-

Markets drop, gold hits record on Fed concern over Trump policies

Markets drop, gold hits record on Fed concern over Trump policies

-

Hamas hands over coffins, in transfer of Bibas family and elderly hostage bodies

-

Airbus profit climbs in 2024, aims to accelerate output

Airbus profit climbs in 2024, aims to accelerate output

-

American conservatives gather to savor Trump's triumph

-

Airbus proft climbs in 2024, aims to accelerate output

Airbus proft climbs in 2024, aims to accelerate output

-

Trump says trade deal with China 'possible'

-

Singapore stays execution of Malaysian for second time

Singapore stays execution of Malaysian for second time

-

Hospitalised Pope had peaceful night, up and eating: Vatican

-

China's sprawling rail projects around Asia

China's sprawling rail projects around Asia

-

Two trials, one president: South Korea's Yoon in the dock

-

Northern Japan snowed under after two-week whiteout

Northern Japan snowed under after two-week whiteout

-

Mercedes-Benz profits plunge as German carmakers reel

-

Hamas set to hand over bodies of four Israeli hostages

Hamas set to hand over bodies of four Israeli hostages

-

Two of a kind: Najin and Fatu, the last northern white rhinos

-

Trump accuses Zelensky of treating US envoy 'rudely'

Trump accuses Zelensky of treating US envoy 'rudely'

-

'We will save them': The quest to rescue nearly extinct rhino

-

Ousted South Korean president sought to stop 'dictatorship', says lawyer

Ousted South Korean president sought to stop 'dictatorship', says lawyer

-

Berlin film festival nurtures portraits of messy motherhood

-

Renault revs up profitability in 2024

Renault revs up profitability in 2024

-

Zelensky to meet US envoy after Trump brands him a 'dictator'

-

Japan's trade minister arranging US trip: reports

Japan's trade minister arranging US trip: reports

-

Eyeing China and US, EU hopes clean tech boost will spark growth

-

Trump considering 'alternatives' to Boeing for Air Force One contract

Trump considering 'alternatives' to Boeing for Air Force One contract

-

'Never lost heart': Japan back-up keeper plays again after nine-year wait

-

Ball, Bridges shine as Hornets sting Lakers

Ball, Bridges shine as Hornets sting Lakers

-

'Parasite' director says new film highlights strength of ordinary people

-

Chinese workers from Myanmar scam centres heading home via Thailand

Chinese workers from Myanmar scam centres heading home via Thailand

-

Iran executed 975 people in 'horrifying' 2024 escalation: rights groups

-

Sri Lanka train derailed after smashing into elephants

Sri Lanka train derailed after smashing into elephants

-

Afghanistan problem 'can be solved': former women's affairs minister

-

G20 foreign ministers meet in South Africa without US on board

G20 foreign ministers meet in South Africa without US on board

-

Trump says Russia has 'the cards' in Ukraine talks

-

Cambodian farmers risk lives for rice as US freezes demining aid

Cambodian farmers risk lives for rice as US freezes demining aid

-

Lights out for Indonesia civil servants as Prabowo cuts budgets

-

London Fashion Week launches with ode to gender fluid designs

London Fashion Week launches with ode to gender fluid designs

-

Messi too hot for Sporting in sub-zero Champions Cup clash

-

Asian markets drop as Fed flags concern over Trump policies

Asian markets drop as Fed flags concern over Trump policies

-

Myanmar returns first batch of Chinese scam workers to Thailand

-

S. Korean president's lawyer says martial law bid sought to stop 'dictatorship'

S. Korean president's lawyer says martial law bid sought to stop 'dictatorship'

-

Heated immigration debate complicates Germany's search for workers

-

Australia seeks to turn failing steel plant into 'green' hub

Australia seeks to turn failing steel plant into 'green' hub

-

Conservative Merz leads Germany's turbulent election race

-

Hamas set to hand over Israel bodies of four Gaza hostages

Hamas set to hand over Israel bodies of four Gaza hostages

-

Fallen white-ball kings England in search of Champions Trophy revival

-

Depleted Australia face uphill battle at Champions Trophy

Depleted Australia face uphill battle at Champions Trophy

-

Delta offers $30,000 each to Toronto plane crash passengers

-

A flight to Oscars glory for Adrian Quesada and 'Like a Bird'?

A flight to Oscars glory for Adrian Quesada and 'Like a Bird'?

-

After rocky road, Havana's 'Cathedral of Ice Cream' back in from the cold

-

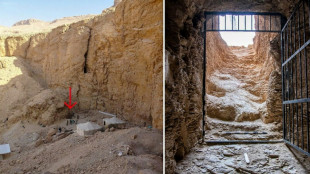

Egypt unveils first ancient royal tomb since Tutankhamun

Egypt unveils first ancient royal tomb since Tutankhamun

-

US-Canadian relations on thin ice ahead of hockey rematch

Italy probing Amazon over 1.2b euros in third-party seller VAT

Italian prosecutors are examining whether online giant Amazon.com evaded 1.2 billion euros in value-added tax (VAT) it should have paid on behalf of certain third-party sellers, sources told AFP Monday.

The total claim against the online retailer, including penalties, could rise to as much as three billion euros ($3.14 billion), a source in Italy's financial crimes police said.

The preliminary investigation, confirmed by a source within the Milan prosecutors' office, involves a three-year period from 2019 to 2021.

An Italian law in 2019 made e-commerce businesses responsible for the VAT owed by its third-party sellers outside the European Union selling goods to customers in Italy.

Previously, these third-party sellers were responsible for paying the tax.

The Italian law came ahead of a reform of EU e-commerce rules, which took effect in July 2021, that sought to simplify how online platforms collect VAT.

A review of transactions from 2019 to 2021 by Italy's financial crime police found "unpaid VAT" by Amazon amounting to 1.2 billion euros, a source at the force told AFP.

"If you add to this sum the penalties... you get up to three billion euros," the source said.

The police investigation, begun in the spring of 2024, wrapped up in December.

Amazon said it would not comment on ongoing investigations, but said it was "committed to complying with all applicable tax laws".

The Seattle-based tech company added that it had paid direct and indirect taxes of 1.4 billion euros to Italy in 2023.

A preliminary investigation by prosecutors does not necessarily lead to charges.

The Italian investigation comes as US President Donald Trump, who has railed against his country's trade deficit with the EU, has threatened the bloc with reciprocal tariffs.

He has said that VAT -- which is not a tariff but a consumption tax irrespective of the origin of the good -- could be subject to a reciprocal levy.

The EU measure that made online platforms liable for the tax obligations of third-part sellers was designed to ensure fair competition for the bloc and recoup lost VAT.

The reform also removed an exemption on collection of the tax on low-value goods.

J.Horn--BTB