-

Swiss unveil Euro 2025 mascot Maddli

Swiss unveil Euro 2025 mascot Maddli

-

Bears fire coach Eberflus after latest agonizing NFL defeat

-

Rallies mark one month since Spain's catastrophic floods

Rallies mark one month since Spain's catastrophic floods

-

Arnault family's Paris FC takeover completed

-

Georgian police stage new crackdown on pro-EU protestors

Georgian police stage new crackdown on pro-EU protestors

-

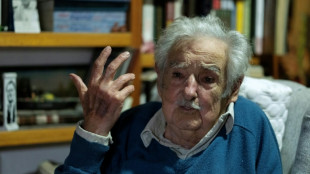

'We're messing up:' Uruguay icon Mujica on strongman rule in Latin America

-

Liverpool dealt Konate injury blow

Liverpool dealt Konate injury blow

-

Van Nistelrooy appointed Leicester manager

-

Verstappen brought back to earth in Doha after F1 title party

Verstappen brought back to earth in Doha after F1 title party

-

Global wine output to hit lowest level since 1961

-

Norris boosts McLaren title hopes with sprint pole

Norris boosts McLaren title hopes with sprint pole

-

Big-hitting Stubbs takes satisfaction from grinding out Test century

-

Romania recounts presidential ballots as parliamentary vote looms

Romania recounts presidential ballots as parliamentary vote looms

-

French skipper Dalin leads as Vendee Globe passes Cape of Good Hope

-

Chelsea not in Premier League title race, says Maresca

Chelsea not in Premier League title race, says Maresca

-

Brazil's Bolsonaro aims to ride Trump wave back to office: WSJ

-

France requests transfer of death row convict held in Indonesia: minister

France requests transfer of death row convict held in Indonesia: minister

-

'Mamie Charge': Migrants find safe haven in Frenchwoman's garage

-

Iconic Uruguayan ex-leader hails country's swing left as 'farewell gift'

Iconic Uruguayan ex-leader hails country's swing left as 'farewell gift'

-

Thousands rally in Georgia after violent police crackdown on pro-EU protesters

-

Shared experiences make Murray 'perfect coach', says Djokovic

Shared experiences make Murray 'perfect coach', says Djokovic

-

Iran, Europeans to keep talking as tensions ratchet up

-

Inflation-wary US consumers flock to 'Black Friday' deals

Inflation-wary US consumers flock to 'Black Friday' deals

-

France shows off restored Notre Dame after 'impossible' restoration

-

South African bowlers strike after Sri Lanka set big target

South African bowlers strike after Sri Lanka set big target

-

Namibia reopens polls after election chaos in ruling party test

-

Georgia police arrest dozens in clashes with pro-EU protesters

Georgia police arrest dozens in clashes with pro-EU protesters

-

US stocks rise on Black Friday

-

Leclerc on top for Ferrari in Qatar GP practice

Leclerc on top for Ferrari in Qatar GP practice

-

Jihadists, allies enter Syria's second city in lightning assault

-

Amorim puts faith in Mount to turn around Man Utd career

Amorim puts faith in Mount to turn around Man Utd career

-

Guardiola will not 'run' from Man City rebuild

-

Assisted dying campaigners, opponents rally at UK parliament

Assisted dying campaigners, opponents rally at UK parliament

-

Durable prop Healy set to carve name in Irish rugby history

-

Macron unveils Notre Dame after 'impossible' restoration

Macron unveils Notre Dame after 'impossible' restoration

-

Traumatised Spain marks one month since catastrophic floods

-

Yen rallies, euro up on rising inflation data

Yen rallies, euro up on rising inflation data

-

Attack-minded Spurs boss Postecoglou says: 'You'll miss me when I'm gone'

-

Syria jihadists, allies shell major city Aleppo in shock offensive

Syria jihadists, allies shell major city Aleppo in shock offensive

-

Macron inspects 'sublime' Notre Dame after reconstruction

-

Arsenal must be near-perfect to catch Liverpool, says Arteta

Arsenal must be near-perfect to catch Liverpool, says Arteta

-

Arrests, intimidation stoke fear in Pakistan's politics

-

Showdown looms on plastic treaty days before deadline

Showdown looms on plastic treaty days before deadline

-

Ngozi Okonjo-Iweala: the WTO's trailblazing motivator

-

WTO chief reappointed as Trump threat looms

WTO chief reappointed as Trump threat looms

-

US landmine offer to Ukraine throws treaty into 'crisis': campaign group

-

British MPs debate contentious assisted dying law

British MPs debate contentious assisted dying law

-

Macron offers first glimpse of post-fire Notre Dame

-

Syria jihadists, allies shell Aleppo in shock offensive

Syria jihadists, allies shell Aleppo in shock offensive

-

Japan government approves $92 bn extra budget

Swiss franc's surge against the euro a boon for business

The Swiss franc is breaking records against the euro, giving the Swiss economy a temporary boost as central banks battle inflation -- although experts remain cautious about the months ahead.

Seen as a safe haven, the Swiss currency briefly hit a high of 0.94 francs to the euro on Monday following the Italian general election.

While it has since eased back a little, it is nevertheless at the highest levels since the launch of the single currency more than 20 years ago, outside a brief flash crash in 2015.

"It's more about the weakness of the euro than the strength of the Swiss franc," Credit Suisse economist Maxime Botteron told AFP, citing the franc's steadier performance against the US dollar.

"European growth is showing signs of running out of steam, even recession," he said, noting that "these indicators come in a context where the Swiss National Bank (SNB) has changed its monetary policy".

Switzerland's central bank has abandoned the negative rate it has imposed since 2015 to combat the overvaluation of its currency.

Like other central banks, the SNB seeks to prevent inflation from taking root. But in the midst of soaring energy prices, the franc's rise is providing it with welcome help in curbing price increases.

"In Switzerland, two-thirds of inflation is due to imports. An appreciation of the Swiss franc therefore reduces the rise of these goods a little," said Botteron, adding that the SNB "therefore has less need to tighten monetary policy" than other central banks.

In August, inflation rose to 3.5 percent, its highest level in 29 years, but far behind the 9.1 percent recorded last month in the eurozone.

- Tourism boost -

"There is a very clear strategy to shield Switzerland the against the rising inflation coming from the eurozone, the US and other trading partners," said Thomas Flury, UBS bank's global head of currency strategy.

The franc's rise has not triggered panic, unlike in 2015 when exporters feared their production costs and export prices would explode.

"High inflation in the eurozone makes the real appreciation much less dramatic than in the past," said Flury.

"Acceptance is coming because companies in Switzerland would rather have a stronger Swiss franc than discussions on wage rises that French or German companies will have to do, as well the cost pressures from imports."

If this rise in the franc eases somewhat the pressure on their imports, Swiss companies, with well-filled order books, also have some leeway to increase their prices, said Botteron.

In tourism, another sector sensitive to the exchange rate, the franc's rise has enabled Swiss hoteliers to increase their prices to a lesser degree than in neighbouring countries given the lower inflation, a spokesman for the Hotellerie Suisse hotel industry body told AFP.

"For hoteliers, this means that they should become even more competitive against foreign countries," he explained.

As Switzerland nevertheless remains an expensive destination, the group remains cautious, fearing that "consumer budgets will tighten".

However, this boost to the Swiss economy may only be short-lived.

"We'll have to see how this develops over the winter," said Flury.

Even if it is too early to guess how the exchange rate might develop, recession or weak growth in the European economy would hamper Swiss companies and the franc's value may become a much more sensitive subject.

L.Dubois--BTB