-

Hunter shines as Hawks top Cavs again

Hunter shines as Hawks top Cavs again

-

Southampton denied shock Brighton win by dubious VAR call

-

Alarm over high rate of HIV infections among young women, girls

Alarm over high rate of HIV infections among young women, girls

-

Swiss unveil Euro 2025 mascot Maddli

-

Bears fire coach Eberflus after latest agonizing NFL defeat

Bears fire coach Eberflus after latest agonizing NFL defeat

-

Rallies mark one month since Spain's catastrophic floods

-

Arnault family's Paris FC takeover completed

Arnault family's Paris FC takeover completed

-

Georgian police stage new crackdown on pro-EU protestors

-

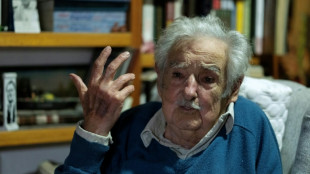

'We're messing up:' Uruguay icon Mujica on strongman rule in Latin America

'We're messing up:' Uruguay icon Mujica on strongman rule in Latin America

-

Liverpool dealt Konate injury blow

-

Van Nistelrooy appointed Leicester manager

Van Nistelrooy appointed Leicester manager

-

Verstappen brought back to earth in Doha after F1 title party

-

Global wine output to hit lowest level since 1961

Global wine output to hit lowest level since 1961

-

Norris boosts McLaren title hopes with sprint pole

-

Big-hitting Stubbs takes satisfaction from grinding out Test century

Big-hitting Stubbs takes satisfaction from grinding out Test century

-

Romania recounts presidential ballots as parliamentary vote looms

-

French skipper Dalin leads as Vendee Globe passes Cape of Good Hope

French skipper Dalin leads as Vendee Globe passes Cape of Good Hope

-

Chelsea not in Premier League title race, says Maresca

-

Brazil's Bolsonaro aims to ride Trump wave back to office: WSJ

Brazil's Bolsonaro aims to ride Trump wave back to office: WSJ

-

France requests transfer of death row convict held in Indonesia: minister

-

'Mamie Charge': Migrants find safe haven in Frenchwoman's garage

'Mamie Charge': Migrants find safe haven in Frenchwoman's garage

-

Iconic Uruguayan ex-leader hails country's swing left as 'farewell gift'

-

Thousands rally in Georgia after violent police crackdown on pro-EU protesters

Thousands rally in Georgia after violent police crackdown on pro-EU protesters

-

Shared experiences make Murray 'perfect coach', says Djokovic

-

Iran, Europeans to keep talking as tensions ratchet up

Iran, Europeans to keep talking as tensions ratchet up

-

Inflation-wary US consumers flock to 'Black Friday' deals

-

France shows off restored Notre Dame after 'impossible' restoration

France shows off restored Notre Dame after 'impossible' restoration

-

South African bowlers strike after Sri Lanka set big target

-

Namibia reopens polls after election chaos in ruling party test

Namibia reopens polls after election chaos in ruling party test

-

Georgia police arrest dozens in clashes with pro-EU protesters

-

US stocks rise on Black Friday

US stocks rise on Black Friday

-

Leclerc on top for Ferrari in Qatar GP practice

-

Jihadists, allies enter Syria's second city in lightning assault

Jihadists, allies enter Syria's second city in lightning assault

-

Amorim puts faith in Mount to turn around Man Utd career

-

Guardiola will not 'run' from Man City rebuild

Guardiola will not 'run' from Man City rebuild

-

Assisted dying campaigners, opponents rally at UK parliament

-

Durable prop Healy set to carve name in Irish rugby history

Durable prop Healy set to carve name in Irish rugby history

-

Macron unveils Notre Dame after 'impossible' restoration

-

Traumatised Spain marks one month since catastrophic floods

Traumatised Spain marks one month since catastrophic floods

-

Yen rallies, euro up on rising inflation data

-

Attack-minded Spurs boss Postecoglou says: 'You'll miss me when I'm gone'

Attack-minded Spurs boss Postecoglou says: 'You'll miss me when I'm gone'

-

Syria jihadists, allies shell major city Aleppo in shock offensive

-

Macron inspects 'sublime' Notre Dame after reconstruction

Macron inspects 'sublime' Notre Dame after reconstruction

-

Arsenal must be near-perfect to catch Liverpool, says Arteta

-

Arrests, intimidation stoke fear in Pakistan's politics

Arrests, intimidation stoke fear in Pakistan's politics

-

Showdown looms on plastic treaty days before deadline

-

Ngozi Okonjo-Iweala: the WTO's trailblazing motivator

Ngozi Okonjo-Iweala: the WTO's trailblazing motivator

-

WTO chief reappointed as Trump threat looms

-

US landmine offer to Ukraine throws treaty into 'crisis': campaign group

US landmine offer to Ukraine throws treaty into 'crisis': campaign group

-

British MPs debate contentious assisted dying law

UK housing market hit by budget fallout

Britain's housing market has been rocked by the UK government's costly budget, as retail banks pull mortgage rates in anticipation of more costly products, sparking fears of tumbling home prices.

Homebuyers are gripped by panic after the Bank of England declared it would not hesitate to lift its main interest rate in response to the government's anticipated borrowing splurge that many see as further fuelling sky-high inflation.

- 'Torrid week' -

"It has been a torrid week for the mortgage market," Sarah Coles, personal finance analyst at broker Hargreaves Lansdown, told AFP.

Home-loan providers, which offer mortgages based on the central bank's rate, have scrapped about 40 percent of available products since the budget on September 23, according to data provider Moneyfacts.

That equates to more than 1,600 mortgage rates offered for a fixed period of time.

Coles said "the market struggled to function normally" as the pound struck a record-low against the dollar following the economic plan announced by the government of new Prime Minister Liz Truss.

The central bank reacted by launching emergency purchases of long-dated UK government bonds as soaring yields put pension funds at risk of collapse.

"Lenders withdrew (mortgage) rates for new customers while they waited for the dust to settle," said Coles.

"Once things feel more functional, they will be back but at a higher rate."

Major UK bank Barclays said that "due to high demand" it "withdrew a small number of mortgage products from sale for new customers".

For some time, the average mortgage rate has hovered around two percent for a fix lasting between two and five years, according to Moneyfacts.

However, those same mortgage deals are now approaching five percent, more than doubling monthly repayment costs.

- Added costs -

Tom Bill, head of UK residential research at Knight Frank, told AFP that mortgage holders could find themselves paying an additional "hundreds of pounds per month, that they're going to have to find", adding to the cost-of-living crisis.

The removal of mortgage deals "is a bitter pill to swallow for those who want to move and those with fixed terms due to end", said Tim Bannister, a director at online property firm Rightmove.

"And it will impact buyers' budgets, especially those who were already stretching themselves."

Richard Donell, executive director of online property group Zoopla, said rising mortgage rates "have been brewing for some time".

The Bank of England has in less than a year hiked its interest rate to 2.25 percent from a record-low 0.1 percent in a bid to cool decades-high inflation.

Experts are predicting the BoE's rate will peak close to six percent in the first half of next year. Before the budget, the market consensus forecast had been for a four-percent pinnacle.

- House prices to slump? -

Analysts are meanwhile predicting that British house prices are heading for a protracted slump after soaring in recent times as demand outpaces supply.

The average British home price surged 9.5 percent in September from a year earlier, home loans provider Nationwide revealed on Friday.

However prices were flat last month compared with August.

"The stall in house prices in September was little surprise given the growing downward pressure on demand from rising mortgage rates," said Capital Economics analyst Andrew Wishart.

"This marks the beginning of the most significant correction in house prices since 2007", when the global financial crisis began to emerge.

In his budget, finance minister Kwasi Kwarteng lifted the point at which tax is levied on purchases of residential properties -- a benefit that has seemingly been wiped out by the shake up of mortgage rates.

C.Meier--BTB