-

Icelanders head to the polls after government collapse

Icelanders head to the polls after government collapse

-

England strike twice to have New Zealand in trouble in first Test

-

Researchers analyse DNA from dung to save Laos elephants

Researchers analyse DNA from dung to save Laos elephants

-

North Korea's Kim, Russian minister agree to boost military ties

-

Brook's 171 gives England commanding 151-run lead over New Zealand

Brook's 171 gives England commanding 151-run lead over New Zealand

-

Kamala's coda: What's next for defeated US VP Harris?

-

Chiefs hold off Raiders to clinch NFL playoff berth

Chiefs hold off Raiders to clinch NFL playoff berth

-

Australia's Hazlewood out of 2nd India Test

-

Trudeau in Florida to meet Trump as tariff threats loom

Trudeau in Florida to meet Trump as tariff threats loom

-

Jihadists, allies breach Syria's second city in lightning assault

-

Trudeau in Florida to meet Trump as tariff threats loom: media

Trudeau in Florida to meet Trump as tariff threats loom: media

-

Hunter shines as Hawks top Cavs again

-

Southampton denied shock Brighton win by dubious VAR call

Southampton denied shock Brighton win by dubious VAR call

-

Alarm over high rate of HIV infections among young women, girls

-

Swiss unveil Euro 2025 mascot Maddli

Swiss unveil Euro 2025 mascot Maddli

-

Bears fire coach Eberflus after latest agonizing NFL defeat

-

Rallies mark one month since Spain's catastrophic floods

Rallies mark one month since Spain's catastrophic floods

-

Arnault family's Paris FC takeover completed

-

Georgian police stage new crackdown on pro-EU protestors

Georgian police stage new crackdown on pro-EU protestors

-

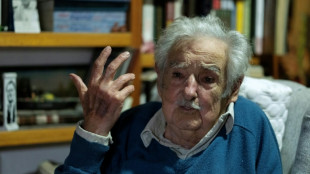

'We're messing up:' Uruguay icon Mujica on strongman rule in Latin America

-

Liverpool dealt Konate injury blow

Liverpool dealt Konate injury blow

-

Van Nistelrooy appointed Leicester manager

-

Verstappen brought back to earth in Doha after F1 title party

Verstappen brought back to earth in Doha after F1 title party

-

Global wine output to hit lowest level since 1961

-

Norris boosts McLaren title hopes with sprint pole

Norris boosts McLaren title hopes with sprint pole

-

Big-hitting Stubbs takes satisfaction from grinding out Test century

-

Romania recounts presidential ballots as parliamentary vote looms

Romania recounts presidential ballots as parliamentary vote looms

-

French skipper Dalin leads as Vendee Globe passes Cape of Good Hope

-

Chelsea not in Premier League title race, says Maresca

Chelsea not in Premier League title race, says Maresca

-

Brazil's Bolsonaro aims to ride Trump wave back to office: WSJ

-

France requests transfer of death row convict held in Indonesia: minister

France requests transfer of death row convict held in Indonesia: minister

-

'Mamie Charge': Migrants find safe haven in Frenchwoman's garage

-

Iconic Uruguayan ex-leader hails country's swing left as 'farewell gift'

Iconic Uruguayan ex-leader hails country's swing left as 'farewell gift'

-

Thousands rally in Georgia after violent police crackdown on pro-EU protesters

-

Shared experiences make Murray 'perfect coach', says Djokovic

Shared experiences make Murray 'perfect coach', says Djokovic

-

Iran, Europeans to keep talking as tensions ratchet up

-

Inflation-wary US consumers flock to 'Black Friday' deals

Inflation-wary US consumers flock to 'Black Friday' deals

-

France shows off restored Notre Dame after 'impossible' restoration

-

South African bowlers strike after Sri Lanka set big target

South African bowlers strike after Sri Lanka set big target

-

Namibia reopens polls after election chaos in ruling party test

-

Georgia police arrest dozens in clashes with pro-EU protesters

Georgia police arrest dozens in clashes with pro-EU protesters

-

US stocks rise on Black Friday

-

Leclerc on top for Ferrari in Qatar GP practice

Leclerc on top for Ferrari in Qatar GP practice

-

Jihadists, allies enter Syria's second city in lightning assault

-

Amorim puts faith in Mount to turn around Man Utd career

Amorim puts faith in Mount to turn around Man Utd career

-

Guardiola will not 'run' from Man City rebuild

-

Assisted dying campaigners, opponents rally at UK parliament

Assisted dying campaigners, opponents rally at UK parliament

-

Durable prop Healy set to carve name in Irish rugby history

-

Macron unveils Notre Dame after 'impossible' restoration

Macron unveils Notre Dame after 'impossible' restoration

-

Traumatised Spain marks one month since catastrophic floods

Credit Suisse to pay $495 mn in US to settle securities case

Credit Suisse said Monday it would pay $495 million to settle a row over mortgage-backed securities dating back to the 2008 financial crisis.

Switzerland's second-biggest bank said it had agreed with New Jersey authorities to make the "one-time payment... to fully resolve claims" for compensation, and said it had already provisioned the amount.

In the claim filed in 2013, Credit Suisse was criticised for not having provided sufficient information on the risks relating to $10 billion of mortgage-backed securities.

Subprime mortgages, credit granted to borrowers often with poor credit histories or insufficient income, were packaged into financial products and sold to investors.

But as borrowers defaulted on many of those mortgages, investors had no way of telling what portion of the loans in the derivatives were bad.

Those products were at the heart of the 2008 financial crisis, which sparked a global recession and brought the international financial system to the brink of collapse.

Credit Suisse said the final settlement with the New Jersey Attorney General allowed it "to resolve the only remaining RMBS (residential mortgage-backed securities) matter involving claims by a regulator and the largest of its remaining exposures on its legacy RMBS docket".

Shares rose after the statement on the SMI, the flagship index of the Swiss Stock Exchange.

Speculation has been growing ahead of an update scheduled by the new chief executive for later this month.

According to the Financial Times, the bank is considering not only disposals in its investment bank but also the sale of some of its domestic activities in Switzerland.

- Financial crisis fines -

In January 2017, US authorities forced Credit Suisse to pay out $5.28 billion over its role in the subprime crisis -- three years after it was fined $2.6 billion for helping Americans avoid taxes.

Last year, Credit Suisse also paid $600 million to financial guarantee insurer MIBA to settle other long-running litigation connected to the US subprime mortgage crisis.

The bank said last January it was increasing the provisions set aside for the MBIA case and others involving mortgage backed securities by $850 million.

Some of the world's biggest banks have also faced legal claims after the 2008 financial crash.

German banking giant Deutsche Bank agreed in December 2016 to pay $7.2 billion to settle a case with the US Department of Justice.

And British banking giant Barclays reached a deal in 2018 to pay a US fine of $2 billion over a fraud case involving subprime mortgage derivatives.

The Bank of America meanwhile agreed to a $17 billion deal with US authorities in 2014 to settle claims it sold risky mortgage securities as safe investments ahead of the 2008 financial crisis.

D.Schneider--BTB