-

Springbok Du Toit named World Player of the Year for second time

Springbok Du Toit named World Player of the Year for second time

-

Iran says will hold nuclear talks with France, Germany, UK on Friday

-

Mbappe on target as Real Madrid cruise to Leganes win

Mbappe on target as Real Madrid cruise to Leganes win

-

Sampaoli beaten on Rennes debut as fans disrupt Nantes loss

-

Israel records 250 launches from Lebanon as Hezbollah targets Tel Aviv, south

Israel records 250 launches from Lebanon as Hezbollah targets Tel Aviv, south

-

Australia coach Schmidt still positive about Lions after Scotland loss

-

Man Utd 'confused' and 'afraid' as Ipswich hold Amorim to debut draw

Man Utd 'confused' and 'afraid' as Ipswich hold Amorim to debut draw

-

Sinner completes year to remember as Italy retain Davis Cup

-

Climate finance's 'new era' shows new political realities

Climate finance's 'new era' shows new political realities

-

Lukaku keeps Napoli top of Serie A with Roma winner

-

Man Utd held by Ipswich in Amorim's first match in charge

Man Utd held by Ipswich in Amorim's first match in charge

-

'Gladiator II', 'Wicked' battle for N. American box office honors

-

England thrash Japan 59-14 to snap five-match losing streak

England thrash Japan 59-14 to snap five-match losing streak

-

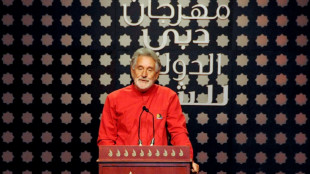

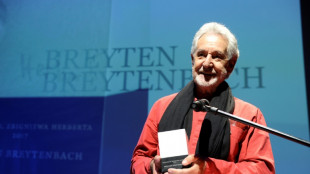

S.Africa's Breyten Breytenbach, writer and anti-apartheid activist

-

Concern as climate talks stalls on fossil fuels pledge

Concern as climate talks stalls on fossil fuels pledge

-

Breyten Breytenbach, writer who challenged apartheid, dies at 85

-

Tuipulotu try helps Scotland end Australia's bid for Grand Slam

Tuipulotu try helps Scotland end Australia's bid for Grand Slam

-

Truce called after 82 killed in Pakistan sectarian clashes

-

Salah wants Liverpool to pile on misery for Man City after sinking Saints

Salah wants Liverpool to pile on misery for Man City after sinking Saints

-

Berrettini takes Italy to brink of Davis Cup defence

-

Lille condemn Sampaoli to defeat on Rennes debut

Lille condemn Sampaoli to defeat on Rennes debut

-

Basel backs splashing the bucks to host Eurovision

-

Leicester sack manager Steve Cooper

Leicester sack manager Steve Cooper

-

IPL auction records tumble as Pant, Iyer break $3 mn mark

-

Salah sends Liverpool eight points clear after Southampton scare

Salah sends Liverpool eight points clear after Southampton scare

-

Key Trump pick calls for end to escalation in Ukraine

-

Tuipulotu try helps Scotland end Australia's bid for a Grand Slam

Tuipulotu try helps Scotland end Australia's bid for a Grand Slam

-

Davis Cup organisers hit back at critics of Nadal retirement ceremony

-

Noel in a 'league of his own' as he wins Gurgl slalom

Noel in a 'league of his own' as he wins Gurgl slalom

-

A dip or deeper decline? Guardiola seeks response to Man City slump

-

Germany goes nuts for viral pistachio chocolate

Germany goes nuts for viral pistachio chocolate

-

EU urges immediate halt to Israel-Hezbollah war

-

Far right targets breakthrough in Romania presidential vote

Far right targets breakthrough in Romania presidential vote

-

Basel votes to stump up bucks to host Eurovision

-

Ukraine shows fragments of new Russian missile after 'Oreshnik' strike

Ukraine shows fragments of new Russian missile after 'Oreshnik' strike

-

IPL auction records tumble as Pant and Iyer snapped up

-

Six face trial in Paris for blackmailing Paul Pogba

Six face trial in Paris for blackmailing Paul Pogba

-

Olympic champion An wins China crown in style

-

It's party time for Las Vegas victor Russell on 'dream weekend'

It's party time for Las Vegas victor Russell on 'dream weekend'

-

Former Masters champion Reed seals dominant Hong Kong Open win

-

Norris applauds 'deserved' champion Verstappen

Norris applauds 'deserved' champion Verstappen

-

Jaiswal and Kohli slam centuries as Australia stare at defeat

-

Kohli blasts century as India declare against Australia

Kohli blasts century as India declare against Australia

-

Verstappen 'never thought' he'd win four world titles

-

Former Masters champion Reed wins Hong Kong Open

Former Masters champion Reed wins Hong Kong Open

-

Awesome foursomes: Formula One's exclusive club of four-time world champions

-

Smylie beats 'idol' Cameron Smith to win Australian PGA Championship

Smylie beats 'idol' Cameron Smith to win Australian PGA Championship

-

Five key races in Max Verstappen's 2024 title season

-

Max Verstappen: Young, gifted and single-minded four-time F1 champion

Max Verstappen: Young, gifted and single-minded four-time F1 champion

-

'Star is born': From homeless to Test hero for India's Jaiswal

Elon Musk's move to buy Twitter faces roadblocks

Even for the richest person on the planet, buying Twitter was always going to be a challenge –- a highly complex financial transaction now made even trickier by a defensive "poison pill" move from the platform's board.

Musk's $43 billion offer lays out the myriad potential pitfalls: possible government approvals, legal as well as regulatory due diligence, negotiations of a final agreement and, of course, how to pay for it all.

Then Twitter's board on Friday showed it won't go quietly, saying any acquisition of over 15 percent of the firm's stock without its OK would trigger a plan to flood the market with shares and thus make a buyout much harder.

"Your move @elonmusk," tweeted Silicon Valley journalist Kara Swisher.

The offer itself, which Musk said was final, values Twitter at $54.20 per share -- above the closing price ahead of his bid, but below a high of $77.06 hit in February of last year.

Even with a moderate and inflexible proposal, which could help the board argue for rejection, it's a fraught moment that could end in lawsuits from just about everyone involved.

To succeed in repelling Musk's offer, the Twitter board will need to be on solid ground making an argument that the company is worth more, said Wharton School finance professor Kevin Kaiser.

Shareholders who feel that the board is rejecting a profitable deal will be free to file lawsuits against Twitter.

- Sidestep the board? -

Musk has the option of sidestepping the board and trying to buy shares directly from shareholders on the market, but that could lead to tedious negotiations with some stock owners holding out for more money.

"The Twitter board has limited ability under Delaware law to stop a tender offer made directly to the shareholders, which Elon Musk hasn't done, but which he could do if he chose to," Kaiser said.

"If he does this, and if the shareholders elect to tender their shares, then he can succeed without needing board support or approval."

While the serial entrepreneur's net worth is estimated at $265 billion by Forbes, his fortune is not sitting in a bank account waiting to be spent.

Musk said at a TED Conference that he had "sufficient funds" to consummate the deal, but financial analysts describe the situation as more complicated.

Much of Musk's wealth comes from shares of electric car maker Tesla, which he runs.

Musk would need to turn a chunk of his Tesla holding into cash, either by selling shares or taking out loans with stock as collateral.

"The specifics of how Musk would finance the deal will determine the ramifications for Twitter," Moody's said in a note to investors.

Moody's estimated it would cost Musk $39 billion to buy all the outstanding Twitter shares, and that there would be "a strong chance" he would have to repay or refinance the San Francisco-based company's billions of dollars of existing debt.

That was before the poison pill move by Twitter that ramps up the cost for Musk.

Musk tweeted a poll that hinted he might be thinking of taking his bid directly to shareholders.

He asked whether taking the company private for his offered price should be up to shareholders and not the board.

As the poll neared its close on Friday, more than 2.7 million votes had been cast with nearly 84 percent of them in favor of the idea.

Selling a massive amount of shares in Tesla to buy Twitter would come with a large tax bill based on capital gains, and could cause shares in the electric car company to sink as the market is flooded with stock for sale.

Musk could keep hold of his shares and get a loan, absorbing the interest payments. Or he could team up with a deep-pocketed partner, but that could come with the strong-willed executive having someone to answer to regarding his decisions at Twitter.

O.Lorenz--BTB