-

Social media firms raise 'serious concerns' over Australian U-16 ban

Social media firms raise 'serious concerns' over Australian U-16 ban

-

Tiger to skip Hero World Challenge after back surgery

-

MLB shifts six 2025 Rays games to avoid weather issues

MLB shifts six 2025 Rays games to avoid weather issues

-

US women's keeper Naeher retiring after Europe matches

-

Dow ends at fresh record as oil prices pull back on ceasefire hopes

Dow ends at fresh record as oil prices pull back on ceasefire hopes

-

West Ham stun Newcastle to ease pressure on Lopetegui

-

Menendez brothers' bid for freedom delayed until January

Menendez brothers' bid for freedom delayed until January

-

Arteta calls on Arsenal to show 'ruthless' streak on Champions League travels

-

Israel bids emotional farewell to rabbi killed in UAE

Israel bids emotional farewell to rabbi killed in UAE

-

Sonar image was rock formation, not Amelia Earhart plane: explorer

-

Tottenham goalkeeper Vicario has ankle surgery

Tottenham goalkeeper Vicario has ankle surgery

-

Prosecutor moves to drop federal cases against Trump

-

Green light for Cadillac to join Formula One grid in 2026

Green light for Cadillac to join Formula One grid in 2026

-

Romania braces for parliamentary vote after far right's poll upset

-

US-Google face off as ad tech antitrust trial comes to close

US-Google face off as ad tech antitrust trial comes to close

-

Special counsel moves to drop federal cases against Trump

-

Israel to decide on ceasefire as US says deal 'close'

Israel to decide on ceasefire as US says deal 'close'

-

California vows to step in if Trump kills US EV tax credit

-

Special counsel asks judge to dismiss subversion case against Trump

Special counsel asks judge to dismiss subversion case against Trump

-

Ronaldo double takes Al Nassr to brink of Asian Champions League quarters

-

Brazil minister says supports meat supplier 'boycott' of Carrefour

Brazil minister says supports meat supplier 'boycott' of Carrefour

-

Egypt says over a dozen missing after Red Sea tourist boat capsizes

-

Steelmaker ArcelorMittal to close two plants in France: unions

Steelmaker ArcelorMittal to close two plants in France: unions

-

Macy's says employee hid up to $154 mn in costs over 3 years

-

Germany fears outside hand in deadly Lithuania jet crash

Germany fears outside hand in deadly Lithuania jet crash

-

EU grocery shoppers 'fooled' by 'maze' of food labels: audit

-

Awaiting Commerzbank, Italy's UniCredit bids for Italian rival

Awaiting Commerzbank, Italy's UniCredit bids for Italian rival

-

Alonso jokes about playing return amid Leverkusen injury woes

-

Stocks push higher on Trump's 'steady hand' for Treasury

Stocks push higher on Trump's 'steady hand' for Treasury

-

G7 ministers discuss ceasefire efforts in Mideast

-

Bayern need to win all remaining Champions League games, says Kane

Bayern need to win all remaining Champions League games, says Kane

-

Indian cricketer, 13, youngest to be sold in IPL history

-

Romania braces for parliament vote after far right's poll upset

Romania braces for parliament vote after far right's poll upset

-

France unveils new measures to combat violence against women

-

Beating Man City eases pressure for Arsenal game: new Sporting coach

Beating Man City eases pressure for Arsenal game: new Sporting coach

-

Argentine court hears bid to end rape case against French rugby players

-

Egypt says 17 missing after Red Sea tourist boat capsizes

Egypt says 17 missing after Red Sea tourist boat capsizes

-

Stocks push higher on hopes for Trump's Treasury pick

-

Dortmund boss calls for member vote on club's arms sponsorship deal

Dortmund boss calls for member vote on club's arms sponsorship deal

-

Chanel family matriarch dies aged 99: company

-

US boss Hayes says Chelsea stress made her 'unwell'

US boss Hayes says Chelsea stress made her 'unwell'

-

Deadly cargo jet crash in Lithuania amid sabotage probes

-

China's Ding beats 'nervous' Gukesh in world chess opener

China's Ding beats 'nervous' Gukesh in world chess opener

-

Man City can still do 'very good things' despite slump, says Guardiola

-

'After Mazan': France unveils new measures to combat violence against women

'After Mazan': France unveils new measures to combat violence against women

-

Scholz named party's top candidate for German elections

-

Flick says Barca must eliminate mistakes after stumble

Flick says Barca must eliminate mistakes after stumble

-

British business group hits out at Labour's tax hikes

-

German Social Democrats name Scholz as top candidate for snap polls

German Social Democrats name Scholz as top candidate for snap polls

-

Fresh strikes, clashes in Lebanon after ceasefire calls

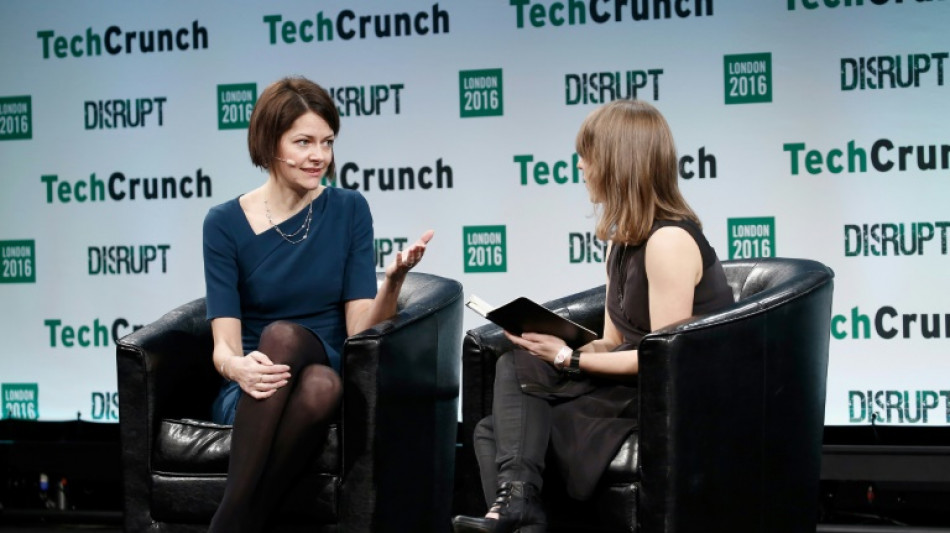

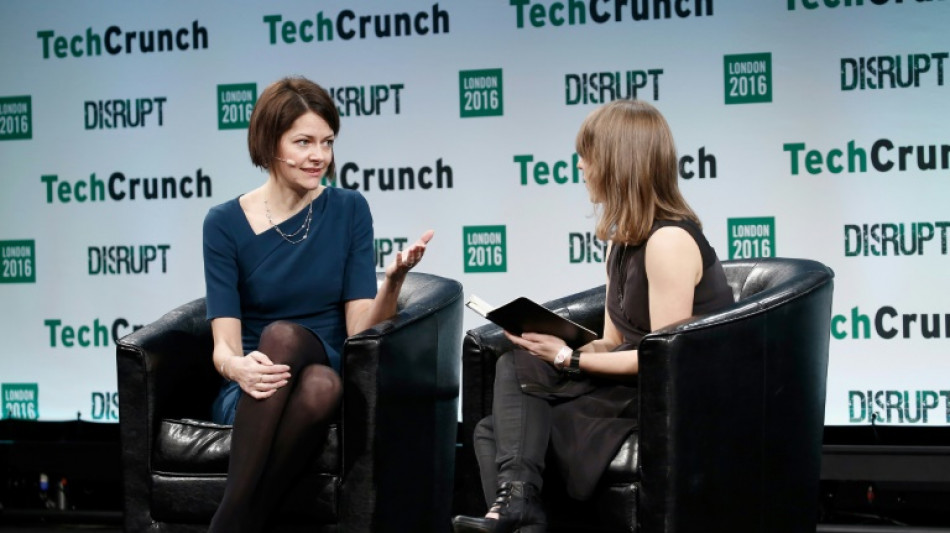

Cybersecurity firm Darktrace accepts $5 bn takeover

Cybersecurity firm Darktrace said Friday it had accepted a $5.3-billion takeover bid from US private equity firm Thoma Bravo, which highlighted the British group's "capability in artificial intelligence".

The cash bid comes after Thoma Bravo expressed takeover interest two years ago.

"Darktrace is at the very cutting edge of cybersecurity technology, and we have long been admirers of its platform and capability in artificial intelligence," Thoma Bravo partner Andrew Almeida said in a statement.

"The pace of innovation in cybersecurity is accelerating in response to cyber threats that are simultaneously complex, global and sophisticated."

Darktrace chief executive Poppy Gustafsson said the group's "technology has never been more relevant in a world increasingly threatened by AI-powered cyberattacks".

Darktrace, headquartered in the university city of Cambridge close to London, floated on the London stock market in 2021.

The cash deal announced Friday is worth $7.75 dollars per Darktrace share -- a 44 percent premium on the group's average share price in the last three months, according to Thoma Bravo.

Following the announcement, the share price surged 18 percent to 612 pence ($7.7).

Created in 2013, Darktrace employs more than 2,300 people around the world.

"The proposed acquisition will provide Darktrace access to a strong financial partner in Thoma Bravo, with deep software sector expertise, who can enhance the company's position as a best-in-class cyber AI business headquartered in the UK," Darktrace chair Gordon Hurst said in the statement.

The pair hope to complete the deal in the second half of the year thanks to shareholder and regulatory approval.

Almeida noted that Thoma Bravo has invested "exclusively in software for over twenty years" which would allow it to bring "operational expertise and deep experience of cybersecurity in supporting Darktrace's growth".

Prior to Friday's announcement, shares in Darktrace has bounced back strongly after the company was cleared by independent auditors EY of having irregularities in its accounts.

Explaining its decision to go private, Darktrace said its "operating and financial achievements have not been reflected commensurately in its valuation with shares trading at a significant discount to its global peer group".

- Takeover boom -

The bid comes at the end of a week in which the London stock market has been gripped by takeover activity, helping the top-tier FTSE 100 index to record highs.

British mining giant Anglo American on Friday rejected a blockbuster $38.8-billion takeover bid from Australian rival BHP, slamming it as "highly unattractive" and "opportunistic".

A battle to buy UK music rights owner Hipgnosis Songs Fund meanwhile took a fresh twist after US rival Concord increased its takeover offer, slightly beating a bid by Blackstone.

Concord on Wednesday offered $1.5 billion for Hipgnosis, whose catalogue includes Justin Bieber, Shakira and Neil Young.

This is more than its original $1.4 billion offer that preceded a higher bid from US asset manager Blackstone.

O.Lorenz--BTB