-

Uruguayans vote in tight race for president

Uruguayans vote in tight race for president

-

Thailand's Jeeno wins LPGA Tour Championship

-

'Crucial week': make-or-break plastic pollution treaty talks begin

'Crucial week': make-or-break plastic pollution treaty talks begin

-

Israel, Hezbollah in heavy exchanges of fire despite EU ceasefire call

-

Amorim predicts Man Utd pain as he faces up to huge task

Amorim predicts Man Utd pain as he faces up to huge task

-

Basel backs splashing the cash to host Eurovision

-

Petrol industry embraces plastics while navigating energy shift

Petrol industry embraces plastics while navigating energy shift

-

Italy Davis Cup winner Sinner 'heartbroken' over doping accusations

-

Romania PM fends off far-right challenge in presidential first round

Romania PM fends off far-right challenge in presidential first round

-

Japan coach Jones abused by 'some clown' on Twickenham return

-

Springbok Du Toit named World Player of the Year for second time

Springbok Du Toit named World Player of the Year for second time

-

Iran says will hold nuclear talks with France, Germany, UK on Friday

-

Mbappe on target as Real Madrid cruise to Leganes win

Mbappe on target as Real Madrid cruise to Leganes win

-

Sampaoli beaten on Rennes debut as fans disrupt Nantes loss

-

Israel records 250 launches from Lebanon as Hezbollah targets Tel Aviv, south

Israel records 250 launches from Lebanon as Hezbollah targets Tel Aviv, south

-

Australia coach Schmidt still positive about Lions after Scotland loss

-

Man Utd 'confused' and 'afraid' as Ipswich hold Amorim to debut draw

Man Utd 'confused' and 'afraid' as Ipswich hold Amorim to debut draw

-

Sinner completes year to remember as Italy retain Davis Cup

-

Climate finance's 'new era' shows new political realities

Climate finance's 'new era' shows new political realities

-

Lukaku keeps Napoli top of Serie A with Roma winner

-

Man Utd held by Ipswich in Amorim's first match in charge

Man Utd held by Ipswich in Amorim's first match in charge

-

'Gladiator II', 'Wicked' battle for N. American box office honors

-

England thrash Japan 59-14 to snap five-match losing streak

England thrash Japan 59-14 to snap five-match losing streak

-

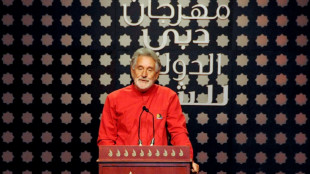

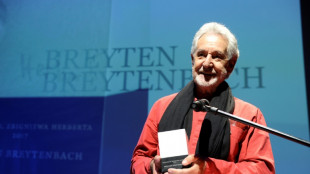

S.Africa's Breyten Breytenbach, writer and anti-apartheid activist

-

Concern as climate talks stalls on fossil fuels pledge

Concern as climate talks stalls on fossil fuels pledge

-

Breyten Breytenbach, writer who challenged apartheid, dies at 85

-

Tuipulotu try helps Scotland end Australia's bid for Grand Slam

Tuipulotu try helps Scotland end Australia's bid for Grand Slam

-

Truce called after 82 killed in Pakistan sectarian clashes

-

Salah wants Liverpool to pile on misery for Man City after sinking Saints

Salah wants Liverpool to pile on misery for Man City after sinking Saints

-

Berrettini takes Italy to brink of Davis Cup defence

-

Lille condemn Sampaoli to defeat on Rennes debut

Lille condemn Sampaoli to defeat on Rennes debut

-

Basel backs splashing the bucks to host Eurovision

-

Leicester sack manager Steve Cooper

Leicester sack manager Steve Cooper

-

IPL auction records tumble as Pant, Iyer break $3 mn mark

-

Salah sends Liverpool eight points clear after Southampton scare

Salah sends Liverpool eight points clear after Southampton scare

-

Key Trump pick calls for end to escalation in Ukraine

-

Tuipulotu try helps Scotland end Australia's bid for a Grand Slam

Tuipulotu try helps Scotland end Australia's bid for a Grand Slam

-

Davis Cup organisers hit back at critics of Nadal retirement ceremony

-

Noel in a 'league of his own' as he wins Gurgl slalom

Noel in a 'league of his own' as he wins Gurgl slalom

-

A dip or deeper decline? Guardiola seeks response to Man City slump

-

Germany goes nuts for viral pistachio chocolate

Germany goes nuts for viral pistachio chocolate

-

EU urges immediate halt to Israel-Hezbollah war

-

Far right targets breakthrough in Romania presidential vote

Far right targets breakthrough in Romania presidential vote

-

Basel votes to stump up bucks to host Eurovision

-

Ukraine shows fragments of new Russian missile after 'Oreshnik' strike

Ukraine shows fragments of new Russian missile after 'Oreshnik' strike

-

IPL auction records tumble as Pant and Iyer snapped up

-

Six face trial in Paris for blackmailing Paul Pogba

Six face trial in Paris for blackmailing Paul Pogba

-

Olympic champion An wins China crown in style

-

It's party time for Las Vegas victor Russell on 'dream weekend'

It's party time for Las Vegas victor Russell on 'dream weekend'

-

Former Masters champion Reed seals dominant Hong Kong Open win

AI and cloud in spotlight as big tech earnings roll out

US tech giants saw their shares fluctuate this week as investors tried to gauge whether artificial intelligence will fill coffers or drain them.

While it is important to stay on the cutting edge by investing in AI, the market wants financial engines of tech firms going strong to pay for it, according to analysts.

Apple and Amazon on Thursday were the latest titans to see quarterly earnings scrutinized over how their core businesses are doing and whether cloud and AI strategies are paying off.

Amazon said its profit in the recently ended quarter doubled with the help of renewed momentum of its AWS cloud computing business.

Revenue at the AWS cloud computing unit grew, but the e-commerce giant's sales of $148 billion fell just shy of lofty market expectations, and shares dove in after-market trades.

Money taken in by Amazon ads was also shy of expectations.

Retail, ads and cloud computing are considered Amazon's financial pillars.

"While Amazon has multiple levers it can pull, the outlook is becoming tighter," said GlobalData Retail managing director Neil Saunders.

"Amazon will remain very profitable but the pace at which it can add to the bottom line appears to be waning," he said.

Amazon -- like other tech giants investing in AI -- is also spending more money, a factor investors are watching keenly.

"We remain very bullish on the medium to long term impact of AI in every business we know and can imagine," Amazon chief executive Andy Jassy said on an earnings call.

"Generative AI especially is quite iterative and companies have to build muscle around the best way to solve actual customer problems," Jassy said.

- Apple Intelligence -

Apple's quarterly profit rose from a year ago, the company said, besting analyst forecasts and giving its shares a boost in after-hours trading.

Money taken in by Apple's services unit from digital goods and subscriptions hit an all-time high, while the iPhone maker set a new revenue record overall for the June quarter, according to chief executive Tim Cook.

Cook played up the pending public launch of Apple Intelligence -- referring to its suite of AI features.

"Apple Intelligence builds on years of innovation and investment in AI and machine learning," Cook said on an earnings call.

"It will transform how users interact with technology," he added.

Apple has been under pressure to win over doubters on its artificial intelligence strategy after Microsoft and Google rolled out products in swift succession.

"For better or worse, Apple has married its AI efforts to other key parts of its core business, particularly the iPhone," said Emarketer analyst Jacob Bourne.

He added that the effectiveness of its AI investments will likely be measure by sales of Apple hardware and services.

- Seize the moment -

Meta on Wednesday reported profit that beat market expectations and caused its share price to jump.

The impressive profit came even though Meta's Reality Labs unit, devoted to virtual and augmented reality products, lost $4.5 billion, which was more than analysts expected.

"We are in the fortunate position where the strong results that we're seeing in our core products and business give us the opportunity to make deep investments for the future," Meta founder and chief Mark Zuckerberg said on an earnings call.

"I plan to fully seize that opportunity."

- Microsoft and Google -

Microsoft saw its shares slip this week on earnings figures showing its crucial cloud computing unit did not grow as strongly as expected.

Shares of Google parent Alphabet dropped on concerns that ad revenue was slowing while costs were on the rise after its earnings release.

"Meta stands out from other tech firms that have AI ambitions because it already brings in a massive amount of revenue from digital advertising," said Sonata Insights founder and chief analyst Debra Aho Williamson.

"Unlike Google, which is grappling with making changes that will impact its core ad business, most of Meta's AI investments are either aimed at making advertising on its properties work better, or at building new features that could eventually become revenue drivers."

O.Bulka--BTB