-

Axing could be end for India's 'Hitman' Rohit in Test cricket

Axing could be end for India's 'Hitman' Rohit in Test cricket

-

10 years after attack, Charlie Hebdo is uncowed and still provoking

-

Iran artist's vision for culture hub enlivens rustic district

Iran artist's vision for culture hub enlivens rustic district

-

'Emilia Perez' heads into Golden Globes as strong favorite

-

'You need to be happy': graffiti encourages Cuban self-reflection

'You need to be happy': graffiti encourages Cuban self-reflection

-

Rohit-less India 57-3 as Australia assert early control in final Test

-

Disaster-hit Chilean park sows seeds of fire resistance

Disaster-hit Chilean park sows seeds of fire resistance

-

South Korea investigators in standoff to arrest President Yoon

-

Philadelphia name South African Carnell as new head coach

Philadelphia name South African Carnell as new head coach

-

Vikings-Lions showdown to end season will decide NFC top seed

-

Vegas Tesla blast suspect's motive unknown as death ruled suicide

Vegas Tesla blast suspect's motive unknown as death ruled suicide

-

Allen and Goff to start NFL Pro Bowl Games as Mahomes snubbed

-

Apple agrees to $95 mn deal to settle Siri eavesdropping suit

Apple agrees to $95 mn deal to settle Siri eavesdropping suit

-

South Korea investigators attempt to arrest President Yoon

-

Tears, tourism on Bourbon Street after US terror nightmare

Tears, tourism on Bourbon Street after US terror nightmare

-

Extradited SKorean crypto 'genius' in court to face US charges

-

Venezuela offers $100,000 reward for exiled opposition candidate

Venezuela offers $100,000 reward for exiled opposition candidate

-

South Korea investigators arrive to attempt to arrest president

-

Giannis and Jokic lead NBA All-Star voting with LeBron well back

Giannis and Jokic lead NBA All-Star voting with LeBron well back

-

Mixed day for global stocks as dollar pushes higher

-

Nick Clegg leaves Meta global policy team

Nick Clegg leaves Meta global policy team

-

Vegas Tesla blast suspect shot himself in head: officials

-

Shiffrin hopes to be back on slopes 'in the next week'

Shiffrin hopes to be back on slopes 'in the next week'

-

Dumfries double takes Inter into Italian Super Cup final

-

Spain's Canary Islands received record 46,843 migrants in 2024: ministry

Spain's Canary Islands received record 46,843 migrants in 2024: ministry

-

Panama says migrant jungle crossings fell 41% in 2024

-

UN experts slam Israel's 'blatant assault' on health rights in Gaza

UN experts slam Israel's 'blatant assault' on health rights in Gaza

-

Tesla reports lower 2024 auto deliveries, missing forecast

-

Meghan Markle's lifestyle show to premiere Jan 15 on Netflix

Meghan Markle's lifestyle show to premiere Jan 15 on Netflix

-

On Bourbon Street, a grim cleanup after deadly nightmare

-

New Orleans attacker: US Army vet 'inspired' by Islamic State

New Orleans attacker: US Army vet 'inspired' by Islamic State

-

New Orleans killer acted alone, professed loyalty to jihadist group: FBI

-

Wall Street lifts spirits after Asia starts year in red

Wall Street lifts spirits after Asia starts year in red

-

UK's biggest dinosaur footprint site uncovered

-

Former Australia coach Langer to take charge of London Spirit

Former Australia coach Langer to take charge of London Spirit

-

Most UK doctors suffer from 'compassion fatigue': poll

-

Everton boss Dyche unconcerned by Maupay jibe

Everton boss Dyche unconcerned by Maupay jibe

-

FBI probes potential accomplices in New Orleans truck ramming

-

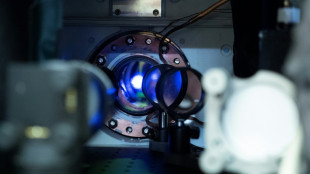

Secret lab developing UK's first quantum clock: defence ministry

Secret lab developing UK's first quantum clock: defence ministry

-

Premier League chief fears Club World Cup's impact on Man City and Chelsea

-

US mulls new restrictions on Chinese drones

US mulls new restrictions on Chinese drones

-

Wall Street dons early green after Asia starts year in red

-

Rosita Missoni of Italy's eponymous fashion house dies age 93

Rosita Missoni of Italy's eponymous fashion house dies age 93

-

27 sub-Saharan African migrants die off Tunisia in shipwrecks

-

UK grime star Stormzy banned from driving for nine months

UK grime star Stormzy banned from driving for nine months

-

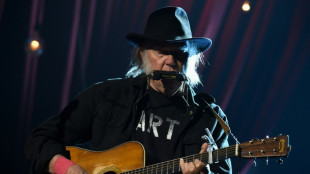

Neil Young dumps Glastonbury alleging 'BBC control'

-

Djokovic, Sabalenka into Brisbane quarters as rising stars impress

Djokovic, Sabalenka into Brisbane quarters as rising stars impress

-

Swiatek battles back to take Poland into United Cup semis

-

Electric cars took 89% of Norway market in 2024

Electric cars took 89% of Norway market in 2024

-

Stock markets begin new year with losses

European stocks rebound sharply on bargain hunting

European equities surged Wednesday on bargain hunting, but analysts warned that the temporary bounce would not last due to fallout from Russia's invasion of Ukraine.

Frankfurt's benchmark DAX index and the Paris CAC 40 each soared about five percent in late morning deals.

Outside the eurozone, London's FTSE 100 jumped 1.5 percent, despite earlier Asian losses.

"European markets rebound as investors fish for bargains," summarised Russ Mould, investment director at AJ Bell.

Brent crude fell but held near $124 per barrel, one day after the United States and Britain moved to ban imports of Russian crude as part of Western sanctions on Moscow.

- 'Dead cat bounce' -

"It's more than likely a dead cat bounce," OANDA analyst Craig Erlam told AFP in reference to surging European stocks.

A "dead cat bounce" is a market term referring to a rebound that briefly interrupts a prolonged downturn.

"We appear to be seeing a temporary corrective move," Erlam said, predicting the rebound would not last as Russia continues to wage war on Ukraine.

"The invasion is still happening, sanctions are still being imposed and oil prices are still high," he noted.

"None of that is conducive with a sustainable stock market recovery."

Major Asian markets declined Wednesday as investors dwelled on Washington's Russian oil and gas ban.

EU nations, which receive roughly 40 percent of their gas imports and one quarter of their oil from Russia, opted to set a goal of cutting their Russian gas imports by two-thirds.

European natural gas prices languished far below this week's record peak, despite fears over the region's reliance on Russian gas.

Europe gas reference Dutch TTF slid 18 percent to 175.75 euros per megawatt hour, having leapt at the start of this week to an all-time high at 345 euros.

Brent had spiked to $139 on Monday -- about $8 short of an all-time record -- in expectation of the US embargo.

Dealers warn of more markets volatility as Russia showed no sign of letting up on its assault on Ukraine.

- $240 oil? -

Prices could rocket further if more nations slap sanctions on Russian crude, according to Bjornar Tonhaugen, head of oil markets at Rystad Energy.

"Oil prices could hit $240 per barrel this summer in the worst-case scenario if Western countries roll out sanctions on Russia's oil exports en masse," Tonhaugen said.

"Market volatility is at an all-time high, with ... the expectation that supply will further tighten due to restrictive sanctions on Russian energy from the West."

The crisis has also fuelled fears that the fragile global recovery from Covid-19 will be replaced by a period of stagflation, in which inflation surges and economies flatline or contract.

Haven investment gold declined Wednesday, one day after hitting a near-record $2,070 per ounce -- the highest since August 2020.

- Key figures around 1125 GMT -

Frankfurt - DAX: UP 5.1 percent at 13,486.53 points

Paris - CAC 40: UP 4.9 percent at 6,256.33

London - FTSE 100: UP 1.8 percent at 7,091.04

EURO STOXX 50: UP 5.1 percent at 3,685.28

Tokyo - Nikkei 225: DOWN 0.3 percent at 24,717.53 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 20,627.71 (close)

Shanghai - Composite: DOWN 1.1 percent at 3,256.39 (close)

New York - Dow: DOWN 0.6 percent at 32,632.64 (close)

Brent North Sea crude: DOWN 3.3 percent at $123.67 per barrel

West Texas Intermediate: DOWN 3.3 percent at $119.65

Euro/dollar: UP at $1.0966 from $1.0899 Tuesday

Pound/dollar: UP at $1.3167 from $1.3104

Euro/pound: UP at 83.29 pence from 83.18 pence

Dollar/yen: UP at 115.87 yen from 115.67 yen

burs-rfj/lth

T.Bondarenko--BTB