-

Van Dijk has 'no idea' over his Liverpool future

Van Dijk has 'no idea' over his Liverpool future

-

US trading partners hit back on steel, aluminum tariffs

-

Dog shoots man in bed, 'paw stuck in trigger'

Dog shoots man in bed, 'paw stuck in trigger'

-

Zelensky expects 'strong' action from US if Russia refuses truce

-

Marcus Smith returns to full-back in England's Six Nations finale with Wales

Marcus Smith returns to full-back in England's Six Nations finale with Wales

-

McIlroy doubts injured Woods will play in 2026, tips comeback

-

S.Africa revised budget gets booed despite smaller tax hike

S.Africa revised budget gets booed despite smaller tax hike

-

Marcus Smith starts at full-back in England's Six Nations finale with Wales

-

Stocks advance on US inflation slowing, Ukraine ceasefire plan

Stocks advance on US inflation slowing, Ukraine ceasefire plan

-

Asani's extra-time stunner knocks Kobe out of AFC Champions League

-

Shares in Zara owner Inditex sink despite record profit

Shares in Zara owner Inditex sink despite record profit

-

US consumer inflation cools slightly as tariff worries flare

-

Captain of cargo ship in North Sea crash is Russian

Captain of cargo ship in North Sea crash is Russian

-

Arrested Filipino ex-president Duterte's lawyers demand his return

-

EU hits back hard at Trump tariffs to force dialogue

EU hits back hard at Trump tariffs to force dialogue

-

Greenland to get new government to lead independence process

-

Former star Eto'o elected to CAF executive by acclamation

Former star Eto'o elected to CAF executive by acclamation

-

'Humiliated': Palestinian victims of Israel sexual abuse testify at UN

-

Stocks diverge over Trump tariffs, Ukraine ceasefire plan

Stocks diverge over Trump tariffs, Ukraine ceasefire plan

-

Ireland prop Porter denies wrongdoing after Dupont Six Nations injury

-

Captain of cargo ship in North Sea crash is Russian: vessel owner

Captain of cargo ship in North Sea crash is Russian: vessel owner

-

West says next step 'up to Putin' on Ukraine ceasefire proposal

-

Battery maker Northvolt files for bankruptcy in Sweden

Battery maker Northvolt files for bankruptcy in Sweden

-

Arrested former Philippine president Duterte's lawyers demand his return

-

Eubank Jr fined £100,000 for hitting boxing rival Benn in face with an egg

Eubank Jr fined £100,000 for hitting boxing rival Benn in face with an egg

-

Snorkel with me to understand climate change, Palau president tells Trump

-

Georgia court extends ex-president Saakashvili's jail term

Georgia court extends ex-president Saakashvili's jail term

-

China, EU vow countermeasures against sweeping US steel tariffs

-

Markets mixed as Trump trade policy sows uncertainty

Markets mixed as Trump trade policy sows uncertainty

-

German arms firm Rheinmetall seizes on European 'era of rearmament'

-

AI chatbot helps victims of digital sexual violence in Latin America

AI chatbot helps victims of digital sexual violence in Latin America

-

Russian playwright tells story of wounded soldiers

-

'Stranded' astronauts closer to coming home after next ISS launch

'Stranded' astronauts closer to coming home after next ISS launch

-

Medvedev tops Paul to reach quarter-finals at rainy Indian Wells

-

Thailand sacks senior cop over illicit gambling, fraud

Thailand sacks senior cop over illicit gambling, fraud

-

Pakistan launches 'full-scale' operation to free train hostages

-

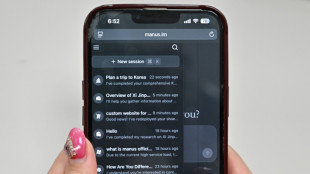

What to know about Manus, China's latest AI assistant

What to know about Manus, China's latest AI assistant

-

Ukraine's Svitolina feels the love in US after Trump-Zelensky dust up

-

US tariffs of 25% on steel, aluminum imports take effect

US tariffs of 25% on steel, aluminum imports take effect

-

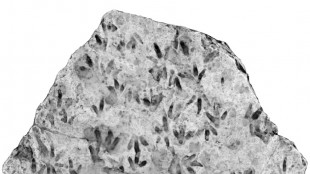

Trove of dinosaur footprints found at Australian school

-

Mongolia's children choke in toxic pollution

Mongolia's children choke in toxic pollution

-

Rubio heads to Canada as Trump wages trade war

-

South Korean pastor vows revolt against Yoon's impeachment

South Korean pastor vows revolt against Yoon's impeachment

-

Pakistan to launch 'full-scale' operation to free train hostages

-

Syria determined to 'prevent unlawful revenge' says fact-finding committee

Syria determined to 'prevent unlawful revenge' says fact-finding committee

-

Most Asian stocks drop as Trump trade policy sows uncertainty

-

Morocco fights measles outbreak amid vaccine misinformation

Morocco fights measles outbreak amid vaccine misinformation

-

Garland stars as comeback Cavs bag 15th straight with defeat of Nets

-

Hamilton eyes dream Ferrari start as F1 revs up in Melbourne

Hamilton eyes dream Ferrari start as F1 revs up in Melbourne

-

Talk of the town: Iconic covers of the New Yorker magazine

European stocks rise tracking big corporate news, China growth

European stock markets climbed on Monday as China's unexpectedly muted growth slowdown and optimism over the impact of the Omicron coronavirus variant boosted investor confidence.

Oil rose modestly on limited supply concerns, while the dollar was up against major rivals as Wall Street was closed for a US public holiday.

The fast-spreading Omicron strain had initially sparked fears for the global economic recovery, but studies indicating that it causes milder illness and government booster vaccine programmes have calmed traders' nerves.

London, Paris and Frankfurt all ended the day higher.

"The relatively lower mortality rates, coupled with ongoing vaccinations efforts, has raised hopes we will transition to endemic and that the economy will recover strongly," said market analyst Fawad Razaqzada of ThinkMarkets.

Britain's benchmark FTSE 100 index climbed to new highs in 2022 after pharma giant GlaxoSmithKline rejected a bid worth £50 billion ($68 billion, 60 billion euros) from Pfizer for a consumer healthcare unit.

GlaxoSmithKline shares rose to the top of the index, while Pfizer's sank to the bottom as the US pharma behemoth said it would press on with a bid for GSK Consumer healthcare.

Concerns over soaring inflation and the US Federal Reserve's stance on hiking interest rates to counter it did not temper investor confidence in European stocks.

The trend was "due to a relatively more dovish central bank and the potential for a strong rebound in economic growth as nations ease travel restrictions amid ongoing booster vaccination efforts", said Razaqzada.

"As we head into 2022, we believe that the post-pandemic bull market remains broadly intact," added Bank of Singapore analyst Eli Lee.

"Historically, bull markets do not end at the beginning of rate hike cycles, and positive trends in global economic growth and earnings continue to be positive fundamental drivers for the market."

China on Monday defied expectations and posted growth figures of 8.1 percent in 2021, although this slowed in the final months amid fresh coronavirus outbreaks, disruptive regulatory crackdowns and property market crises.

Covid infections in the world's second-largest economy climbed to their highest level since March 2020 as Beijing pursues its zero-Covid policy ahead of the Winter Olympics.

But mainland China shares were supported by news that the country's central bank had cut interest rates for the first time since the height of the pandemic last year as officials look to kickstart stuttering growth.

"Rising infections in China just three weeks before the Winter Olympics could lead to widespread economic uncertainty, particularly if the situation is not handled effectively in the short term," said XTB market analyst Walid Koudmani.

Benchmark oil contract Brent North Sea briefly reached the highest level for more than three years at $86.71 per barrel, adding to strong inflation concerns.

"Markets remain focused on the delicate balance between supply and demand which has appeared to impact price fluctuations quite significantly throughout most of the post pandemic economic recovery," said Koudmani.

Credit Suisse fell almost 1.8 percent after the Swiss bank's chairman resigned less than a year after taking the reins following reports he had broken Covid quarantine rules.

Antonio Horta-Osorio's immediate departure adds to the bank's troubles after it was last year rocked by links to the multi-billion-dollar meltdowns at financial firms Greensill and Archegos.

- Key figures around 1630 GMT -

London - FTSE 100: UP 0.9 percent at 7,611.23 points (close)

Frankfurt - DAX: UP 0.3 percent at 15,934.62 (close)

Paris - CAC 40: UP 0.8 percent at 7,201.64 (close)

EURO STOXX 50: UP 0.7 percent at 4,302.11

Tokyo - Nikkei 225: UP 0.7 percent at 28,333.52 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 24,218.03 (close)

Shanghai - Composite: UP 0.6 percent at 3,541.67 (close)

New York - DOW: Closed for a holiday

Euro/dollar: DOWN at $1.1407 from $1.1418 late on Friday

Pound/dollar: DOWN at $1.3652 from $1.3680

Euro/pound: UP at 83.55 pence from 83.43 pence

Dollar/yen: UP at 114.58 yen from 114.25 yen

Brent North Sea crude: UP 0.3 percent at $86.38 per barrel

West Texas Intermediate: UP 0.3 percent at $84.16 per barrel

K.Thomson--BTB