-

Southgate taking year out from coaching

Southgate taking year out from coaching

-

US, Europe stocks fall on US inflation data

-

Zelensky meets Macron in Paris as part of European tour

Zelensky meets Macron in Paris as part of European tour

-

Hurricane Milton shreds Florida stadium roof

-

UN probe accuses Israel of seeking to 'destroy' Gaza healthcare

UN probe accuses Israel of seeking to 'destroy' Gaza healthcare

-

US consumer inflation eases to 2.4% in September

-

England in sight of victory after Brook's triple hundred

England in sight of victory after Brook's triple hundred

-

Juventus readmitted to ECA after failed Super League revolt

-

World number 2 Alcaraz knocked out of Shanghai Masters by Machac

World number 2 Alcaraz knocked out of Shanghai Masters by Machac

-

Leaders of Egypt, Eritrea, Somalia meet amid regional tensions

-

Klopp's Red Bull decision 'ruined life's work' say Dortmund fans

Klopp's Red Bull decision 'ruined life's work' say Dortmund fans

-

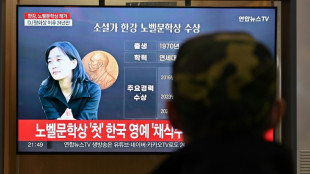

Han Kang wins South Korea's first literature Nobel

-

S. Korea's Nobel winner Han Kang a modest, thought-provoking writer

S. Korea's Nobel winner Han Kang a modest, thought-provoking writer

-

Hurricane Milton tornadoes kill four in Florida amid rescue efforts

-

The almost impossible job: Beating Rafael Nadal at the French Open

The almost impossible job: Beating Rafael Nadal at the French Open

-

New French government faces key test with budget plan

-

Rescuers say Israeli strike on Gaza school kills 28

Rescuers say Israeli strike on Gaza school kills 28

-

Italy's ex-world champion gymnast Ferrari announces retirement

-

Zelensky talks 'victory plan' in meeting with Starmer, Rutte

Zelensky talks 'victory plan' in meeting with Starmer, Rutte

-

South Korea's Han Kang wins literature Nobel

-

Federer lauds retiring Nadal's 'incredible achievements'

Federer lauds retiring Nadal's 'incredible achievements'

-

Ikea posts fall in annual sales after lowering prices

-

Australia beat China 3-1 to resurrect World Cup campaign

Australia beat China 3-1 to resurrect World Cup campaign

-

Stock markets diverge, oil gains after China rebounds

-

Nadal defied injury woes in record-breaking career

Nadal defied injury woes in record-breaking career

-

Nadal v Djokovic, French Open, 2006: Chapter One in epic rivalry

-

World can't 'waste time' trading climate change blame: COP29 hosts

World can't 'waste time' trading climate change blame: COP29 hosts

-

Pakistan at 23-1 after Brook triple hundred takes England to 823-7

-

Zelensky meets Starmer, Rutte on whirlwind tour of Europe

Zelensky meets Starmer, Rutte on whirlwind tour of Europe

-

South Korean same-sex couples make push for marriage equality

-

Rafael Nadal calls time on epic tennis career

Rafael Nadal calls time on epic tennis career

-

Mumbai declares day of mourning for Indian industrialist Ratan Tata

-

Philippines confronts China over South China Sea at ASEAN meet

Philippines confronts China over South China Sea at ASEAN meet

-

Kim Sei-young shoots 62 to take two-stroke lead at LPGA Shanghai

-

The haircuts that help traumatised Ukrainian soldiers heal

The haircuts that help traumatised Ukrainian soldiers heal

-

Sinner crushes Medvedev to set up potential Alcaraz Shanghai semi

-

7-Eleven owner restructures to fight takeover

7-Eleven owner restructures to fight takeover

-

England's Harry Brook blasts triple century against Pakistan

-

Chinese electric car companies cope with European tariffs

Chinese electric car companies cope with European tariffs

-

Zelensky in London for whirlwind tour of Europe ahead of US vote

-

Sri Lanka recovering faster than expected: World Bank

Sri Lanka recovering faster than expected: World Bank

-

Hong Kong, Shanghai rally as most markets track Wall St record

-

Record-breaking Root, Brook both pass 200 as England pile up 658-3

Record-breaking Root, Brook both pass 200 as England pile up 658-3

-

Football mourns Greek defender George Baldock's shock death at 31

-

Uniqlo owner reports record annual earnings

Uniqlo owner reports record annual earnings

-

Hong Kong, Shanghai rally as markets track Wall St record

-

Indonesia biomass drive threatens key forests: report

Indonesia biomass drive threatens key forests: report

-

Home is far away for Madagascar in AFCON qualifying

-

Two months on, Donbas soldiers begin to question Kursk offensive

Two months on, Donbas soldiers begin to question Kursk offensive

-

Rugby Australia to counter-sue in dispute with Melbourne Rebels

Stock markets diverge, oil gains after China rebounds

Chinese stock markets returned to winning ways Thursday, closing with solid gains after China's central bank took action to boost purchases of company shares.

Europe's main equity indices were little changed in midday deals after yet more record-highs Wednesday on Wall Street.

Oil prices jumped around 1.5 percent as volatility continued to dominate the crude market.

The dollar was mixed against its main counterparts before US consumer price inflation data Thursday and after the Federal Reserve revealed a split on last month's bumper cut to US interest rates.

Shanghai's stock market closed 1.3 percent higher Thursday and Hong Kong rose 3.0 percent.

"The China trade made a small comeback, providing a positive tailwind for global markets," said Matt Britzman, senior equity analyst at stockbroker Hargreaves Lansdown.

"All eyes are now on (US) inflation data out later today. While it may not be the Fed's preferred inflation measure, it still has the power to move markets."

Hong Kong and mainland markets whipsawed this week as the euphoria over China's recent moves to boost its economy was dampened by a news conference that failed to unveil more measures or give details on those already announced.

On Thursday, however, investors welcomed news that the People's Bank of China had released details of a "swap facility" that will allow "qualified securities, funds and insurance companies" to access more than $70 billion in liquidity to purchase equities.

The move helped the Shanghai index claw back some of its six-percent plunge Wednesday -- its worst performance in more than four years.

On Wall Street, the Dow and S&P 500 chalked up all-time highs Wednesday thanks to a burst from tech giants including Amazon and Apple.

In London on Thursday, shares in GSK jumped more than five percent after the British pharmaceutical company agreed to pay $2.3 billion in the United States to end lawsuits alleging that its Zantac heartburn drug caused cancer.

- Key figures around 1045 GMT -

Shanghai - Composite: UP 1.3 percent at 3,301.93 points (close)

Hong Kong - Hang Seng Index: UP 3.0 percent at 21,251.98 (close)

London - FTSE 100: DOWN 0.1 percent at 8,237.44 points

Paris - CAC 40: DOWN 0.1 percent at 7,548.84

Frankfurt - DAX: UP 0.1 percent at 19,267.69

Tokyo - Nikkei 225: UP 0.3 percent at 39,380.89 (close)

New York - Dow: UP 1.0 percent at 42,512.00 (close)

Brent North Sea Crude: UP 1.5 percent at $77.73 per barrel

West Texas Intermediate: UP 1.6 percent at $74.39 per barrel

Euro/dollar: DOWN at 1.0935 from $1.0940 on Wednesday

Pound/dollar: UP at $1.3075 from $1.3062

Dollar/yen: DOWN at 148.83 yen from 149.35 yen

Euro/pound: DOWN at 83.62 pence from 83.72 pence

C.Meier--BTB