-

Football leagues, unions file EU complaint against FIFA in calendar dispute

Football leagues, unions file EU complaint against FIFA in calendar dispute

-

Nigeria boycott AFCON qualifier in Libya after 'inhumane treatment'

-

India to recall top envoy to Canada: foreign ministry

India to recall top envoy to Canada: foreign ministry

-

Hezbollah, Israeli troops in 'violent clashes' after drone strike

-

China insists won't renounce 'use of force' to take Taiwan as drills end

China insists won't renounce 'use of force' to take Taiwan as drills end

-

Painkiller sale plan to US gives France major headache

-

Italy begins landmark migrant transfers to Albania

Italy begins landmark migrant transfers to Albania

-

Russia jails French researcher for three years

-

'Unsustainable' housing crisis bedevils Spain's socialist govt

'Unsustainable' housing crisis bedevils Spain's socialist govt

-

Stocks shrug off China disappointment but oil slides

-

New Zealand 4-0 up in America's Cup but British show signs of life

New Zealand 4-0 up in America's Cup but British show signs of life

-

Russian prosecutor demands 3 years prison for French researcher

-

'Innocent' British nerve agent victim caught in global murder plot: inquiry

'Innocent' British nerve agent victim caught in global murder plot: inquiry

-

Afghan Taliban vow to implement media ban on images of living things

-

Russian prosecutor demands 3 years, 3 months jail for French researcher

Russian prosecutor demands 3 years, 3 months jail for French researcher

-

England ready for Pakistan's spin assault in second Test

-

New Zealand's Ravindra excited for India Tests with father in crowd

New Zealand's Ravindra excited for India Tests with father in crowd

-

India's capital bans fireworks to curb air pollution

-

Stocks diverge, oil retreats as China disappoints markets

Stocks diverge, oil retreats as China disappoints markets

-

FIFA to open 'global dialogue' on transfer system after Diarra ruling

-

Trio wins economics Nobel for work on wealth inequality

Trio wins economics Nobel for work on wealth inequality

-

Starmer vows to cut red tape as he urges foreign investors to 'back' UK

-

Ex-Stasi officer jailed over 1974 Berlin border killing

Ex-Stasi officer jailed over 1974 Berlin border killing

-

'Not viable': Barcelona turns against surging tourism

-

Hezbollah says targeted Israeli naval base after deadly drone strike

Hezbollah says targeted Israeli naval base after deadly drone strike

-

Rice praises 'unbelievable' England interim boss Carsley despite uncertainty

-

Nepali teenager hailed as hero after climbing world's 8,000m peaks

Nepali teenager hailed as hero after climbing world's 8,000m peaks

-

England captain Stokes back from injury for second Pakistan Test

-

Shanghai stocks gain after stimulus briefing as markets rally

Shanghai stocks gain after stimulus briefing as markets rally

-

Shanghai stocks gain after stimulus briefing as Asian markets rally

-

South Korea military says 'fully ready' as drone flights anger North

South Korea military says 'fully ready' as drone flights anger North

-

Pakistan 'vigilantes' behind rise in online blasphemy cases

-

Nearly 90, but opera legend Kabaivanska is still calling tune

Nearly 90, but opera legend Kabaivanska is still calling tune

-

Smith experiment as Test opener over, Green out of India series

-

With inflation down, ECB eyes faster tempo of rate cuts

With inflation down, ECB eyes faster tempo of rate cuts

-

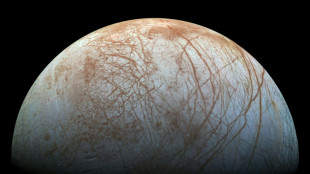

Is life possible on a Jupiter moon? NASA goes to investigate

-

Dodgers crush Mets 9-0 in MLB playoff series opener

Dodgers crush Mets 9-0 in MLB playoff series opener

-

South Korea military says 'fully ready' as drone tensions soar

-

Cummins back, Marsh and Head out of Pakistan ODI series

Cummins back, Marsh and Head out of Pakistan ODI series

-

Shanghai stocks swing after stimulus briefing as most of Asia rises

-

New Zealand's Latham promises 'no fear' as he takes charge for India Tests

New Zealand's Latham promises 'no fear' as he takes charge for India Tests

-

Kyrgios vows to 'shut up' doubters with December comeback

-

Public hearings start into death of Brit by Russian nerve agent

Public hearings start into death of Brit by Russian nerve agent

-

Ex-Stasi officer faces verdict over 1974 Berlin border killing

-

Role of government, poverty research tipped for economics Nobel

Role of government, poverty research tipped for economics Nobel

-

'Stolen satire' feeds US election misinformation

-

Rookie McCarty captures first PGA Tour title in Black Desert Championship

Rookie McCarty captures first PGA Tour title in Black Desert Championship

-

Australia all-rounder Green ruled out of India Test series

-

Seeing double in Nigeria's 'twins capital of the world'

Seeing double in Nigeria's 'twins capital of the world'

-

UK FM to attend EU foreign affairs talks for first time in 2 years

Stocks shrug off China disappointment but oil slides

Major stock markets shrugged off weak data from China on Monday following a pledge by the country's finance minister to boost the world's second-biggest economy, but oil prices fell.

One of the week's key events, meanwhile, occurs Thursday when the European Central Bank is expected to lower interest rates again as anxiety about inflation in the eurozone fades and concerns over sluggish growth mount.

The euro traded lower against the dollar and pound Monday.

Wall Street opened mixed after setting more record highs Friday on strong US company earnings that added to positive sentiment over the world's biggest economy ahead of the country's presidential election next month.

The blue-chip Dow dipped 0.2 percent.

Shares in Boeing fell 1.5 percent after its announcement Friday after the market closed that it will cut 10 percent of its workforce and projected a large third-quarter loss amid a machinist strike in the Seattle region.

Without corporate earnings or data releases on Monday there was little driving trading, according to Briefing.com analyst Patrick O'Hare.

"It's like participants are choosing what is thought to be the safest trade, not wanting to be out of the stock market but not wanting to chase it either without a clear-cut catalyst to bolster their conviction," he said.

Still, the S&P 500 moved higher into record territory ahead of the next big batch of corporate earnings reports on Tuesday, when Goldman Sachs, Citi and Bank of America release their third quarter figures.

In Europe, London and Frankfurt stocks moved higher in afternoon trading while Paris was flat.

Oil prices slid as concerns about the outlook for China's economy offset fears of escalating conflict in the crude-rich Middle East, analysts said.

"The devil is always in the detail and once again China has glossed over how it intends to accelerate economic growth," noted AJ Bell investment director Russ Mould.

China's finance minister Lan Fo'an on Saturday said the country would issue special bonds to bolster banks, signalling an impending spending spree to shore up the property market and ease local government debt.

Harry Murphy Cruise, an economist at Moody's Analytics, said the announcement "ticked most of the right boxes, but it lacked detail on the scale and scope of new spending", adding that "we expect more supports to be announced through the remainder of the year".

Authorities have been seeking to boost domestic activity and shore up China's ailing property sector.

In recent weeks, Chinese policymakers have unveiled a string of measures to stimulate activity and spur household consumption.

Following the latest announcement, official data Sunday showed China's consumer inflation rate slowed in September, in a sign that demand remains fragile.

Separate figures Monday revealed that China's export growth slowed sharply in September while imports remained sluggish.

Investors are eyeing key Chinese data later in the week, including on retail sales, trade and economic growth.

"While the full effects of the recent economic measures may not be immediately evident in the upcoming data releases, these figures will provide more insight into how China's economy is faring and whether additional actions may be necessary," said Tony Sycamore, analyst at IG trading group.

- Key figures around 1330 GMT -

New York - Dow: DOWN 0.2 percent at 42,790.34 points

New York - S&P 500: UP 0.3 percent at 5,830.42

New York - Nasdaq Composite: UP 0.5 percent at 18,430.82

London - FTSE 100: UP 0.1 percent at 8,262.16

Paris - CAC 40: FLAT at 7,577.19

Frankfurt - DAX: UP 0.5 percent at 19,451.36

Shanghai - Composite: UP 2.1 percent at 3,284.32 (close)

Hong Kong - Hang Seng Index: DOWN 0.8 percent at 21,092.87 (close)

Tokyo - Nikkei 225: Closed for a holiday

Euro/dollar: DOWN at $1.0912 from $1.0941 on Friday

Pound/dollar: DOWN at $1.3033 from $1.3068

Dollar/yen: UP at 149.86 yen from 149.09 yen

Euro/pound: UP at 83.72 pence from 83.70 pence

West Texas Intermediate: DOWN 1.9 percent at $74.11 per barrel

Brent North Sea Crude: DOWN 1.8 percent at $77.64 per barrel

burs-rl/lth

S.Keller--BTB