-

New Orleans killer acted alone, professed loyalty to jihadist group: FBI

New Orleans killer acted alone, professed loyalty to jihadist group: FBI

-

Wall Street lifts spirits after Asia starts year in red

-

UK's biggest dinosaur footprint site uncovered

UK's biggest dinosaur footprint site uncovered

-

Former Australia coach Langer to take charge of London Spirit

-

Most UK doctors suffer from 'compassion fatigue': poll

Most UK doctors suffer from 'compassion fatigue': poll

-

Everton boss Dyche unconcerned by Maupay jibe

-

FBI probes potential accomplices in New Orleans truck ramming

FBI probes potential accomplices in New Orleans truck ramming

-

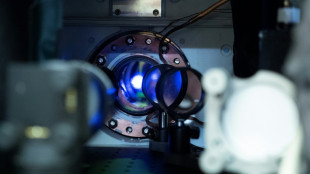

Secret lab developing UK's first quantum clock: defence ministry

-

Premier League chief fears Club World Cup's impact on Man City and Chelsea

Premier League chief fears Club World Cup's impact on Man City and Chelsea

-

US mulls new restrictions on Chinese drones

-

Wall Street dons early green after Asia starts year in red

Wall Street dons early green after Asia starts year in red

-

Rosita Missoni of Italy's eponymous fashion house dies age 93

-

27 sub-Saharan African migrants die off Tunisia in shipwrecks

27 sub-Saharan African migrants die off Tunisia in shipwrecks

-

UK grime star Stormzy banned from driving for nine months

-

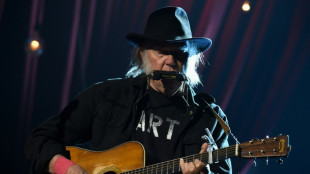

Neil Young dumps Glastonbury alleging 'BBC control'

Neil Young dumps Glastonbury alleging 'BBC control'

-

Djokovic, Sabalenka into Brisbane quarters as rising stars impress

-

Swiatek battles back to take Poland into United Cup semis

Swiatek battles back to take Poland into United Cup semis

-

Electric cars took 89% of Norway market in 2024

-

Stock markets begin new year with losses

Stock markets begin new year with losses

-

Rival South Korea camps face off as president holds out

-

French downhill ace Sarrazin out of intensive care

French downhill ace Sarrazin out of intensive care

-

Djokovic cruises past Monfils as rising stars impress in Brisbane

-

Montenegro mourns after gunman kills 12

Montenegro mourns after gunman kills 12

-

Sales surge in 2024 for Chinese EV giant BYD

-

Agnes Keleti, world's oldest Olympic champion, dies at 103

Agnes Keleti, world's oldest Olympic champion, dies at 103

-

Asian stocks begin year on cautious note

-

Andreeva, Mpetshi Perricard showcase Australian Open potential

Andreeva, Mpetshi Perricard showcase Australian Open potential

-

South Korea police raid Jeju Air, airport over fatal crash

-

Perera's 46-ball ton gives Sri Lanka consolation T20 win over New Zealand

Perera's 46-ball ton gives Sri Lanka consolation T20 win over New Zealand

-

Afghan refugees suffer 'like prisoners' in Pakistan crackdown

-

Coach tight-lipped on whether Rohit will play in final Australia Test

Coach tight-lipped on whether Rohit will play in final Australia Test

-

Blooming hard: Taiwan's persimmon growers struggle

-

South Korea's impeached president resists arrest over martial law bid

South Korea's impeached president resists arrest over martial law bid

-

Knicks roll to ninth straight NBA win, Ivey hurt in Pistons victory

-

'Numb' New Orleans grapples with horror of deadly truck attack

'Numb' New Orleans grapples with horror of deadly truck attack

-

Asia stocks begin year on cautious note

-

FBI probes 'terrorist' links in New Orleans truck-ramming that killed 15

FBI probes 'terrorist' links in New Orleans truck-ramming that killed 15

-

2024 was China's hottest year on record: weather agency

-

Perera smashes 46-ball ton as Sri Lanka pile up 218-5 in 3rd NZ T20

Perera smashes 46-ball ton as Sri Lanka pile up 218-5 in 3rd NZ T20

-

South Korea police raid Muan airport over Jeju Air crash that killed 179

-

South Korea's Yoon resists arrest over martial law bid

South Korea's Yoon resists arrest over martial law bid

-

Sainz set to step out of comfort zone to defend Dakar Rally title

-

New Year's fireworks accidents kill five in Germany

New Year's fireworks accidents kill five in Germany

-

'I'm Still Here': an ode to Brazil resistance

-

New Orleans attack suspect was US-born army veteran

New Orleans attack suspect was US-born army veteran

-

Australia axe Marsh, call-up Webster for fifth India Test

-

Terrorism suspected in New Orleans truck-ramming that killed 15

Terrorism suspected in New Orleans truck-ramming that killed 15

-

At least 10 killed in Montenegro shooting spree

-

Jets quarterback Rodgers ponders NFL future ahead of season finale

Jets quarterback Rodgers ponders NFL future ahead of season finale

-

Eagles' Barkley likely to sit out season finale, ending rushing record bid

| RBGPF | -5.05% | 59.02 | $ | |

| CMSC | 0.93% | 23.145 | $ | |

| AZN | 0.76% | 66.02 | $ | |

| VOD | 0.22% | 8.509 | $ | |

| RYCEF | 2.34% | 7.25 | $ | |

| NGG | 0.46% | 59.696 | $ | |

| GSK | 0.34% | 33.935 | $ | |

| RIO | -0.09% | 58.759 | $ | |

| SCS | -0.17% | 11.8 | $ | |

| RELX | -0.15% | 45.35 | $ | |

| JRI | 0% | 12.13 | $ | |

| BTI | 0.45% | 36.485 | $ | |

| BP | 1.19% | 29.915 | $ | |

| BCC | -0.36% | 118.43 | $ | |

| CMSD | 1.09% | 23.384 | $ | |

| BCE | 0.26% | 23.24 | $ |

US stocks rebound on Amazon results ahead of Fed, election finale

Wall Street stocks rebounded Friday from mixed tech earnings and investor jitters less than a week before a neck-and-neck US presidential election.

After major indices tumbled Thursday following big drops in Microsoft and Meta, buoyant results from Amazon helped boost the market.

Investors also took the bright side of a weak employment report that showed the US economy added just 12,000 jobs last month, far below expectations in a report that was temporarily distorted by major hurricanes and the Boeing strike.

But on the positive side, the report bolstered the chance that the Fed will reduce interest rates again next week. Futures markets overwhelmingly expect a quarter-point cut.

All three major US indices advanced, led by the tech-rich Nasdaq, which climbed 0.8 percent.

The Amazon report "countered some of the negativity that was building yesterday on the mega-cap" stocks, said Briefing.com analyst Patrick O'Hare.

Analysts expect cautious trading early next week ahead of the US presidential election on Tuesday, with the result possibly delayed for several days.

Oil prices gained following reports that Iran was planning a major retaliatory strike on Israel, reviving the market's geopolitical fears.

Expectations of a major rate cut by the Fed, like the bumper 50 basis point cut in September, have receded after data showed strong economic growth in the United States and inflation just above the central bank's long-term two percent target.

But the "lower-than-expected jobs creation could prompt the Fed to follow through with the widely anticipated 25 basis point cut following their next meeting later next week," said Mahmoud Alkudsi, senior market analyst at ADSS brokerage.

eToro US investment analyst Bret Kenwell said the October jobs numbers "should keep a December rate cut on the table, too."

Major European markets closed the day higher.

London gained 0.8 percent despite lingering fears of the consequences of the Labour government's high-tax, high-spending budget unveiled this week.

Britain's 10-year borrowing rate reached its highest level since November 2023 on Thursday, on fears of a resurgence in inflation.

"Worries continue to swirl about the UK Budget stoking inflation and adding to the debt burden," said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

Asian markets closed mixed, with Tokyo down more than two percent as tech shares on the Nikkei were dragged lower following the drop on Wall Street.

Shanghai also ended lower despite a forecast-beating Chinese manufacturing report that boosted hopes for a recovery in the world's second-largest economy.

- Key figures around 2030 GMT -

New York - Dow: UP 0.7 percent at 42,052.19 (close)

New York - S&P 500: UP 0.4 percent at 5,728.80 (close)

New York - Nasdaq Composite: UP 0.8 percent at 18,239.92 (close)

London - FTSE 100: UP 0.8 percent at 8,177.15 (close)

Paris - CAC 40: UP 0.8 percent at 7,409.11 (close)

Frankfurt - DAX: UP 0.9 percent at 19,254.97 (close)

Tokyo - Nikkei 225: DOWN 2.6 percent at 38,053.67 (close)

Hong Kong - Hang Seng Index: UP 0.9 percent at 20,506.43 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,272.01 (close)

Euro/dollar: DOWN at $1.0833 from $1.0884 on Thursday

Pound/dollar: UP at $1.2917 from $1.2899

Dollar/yen: UP at 153.01 yen from 152.03 yen

Euro/pound: DOWN at 83.86 from 84.37 pence

Brent North Sea Crude: UP 0.4 percent at $73.16 per barrel

West Texas Intermediate: UP 0.3 percent at $69.49 per barrel

burs-jmb/jgc

N.Fournier--BTB