-

Sergio Perez leaves Red Bull F1 team

Sergio Perez leaves Red Bull F1 team

-

13 dead after Indian navy speedboat rams ferry off Mumbai

-

US Supreme Court agrees to hear TikTok ban case

US Supreme Court agrees to hear TikTok ban case

-

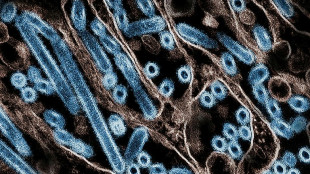

US reports first severe case of bird flu in a human

-

Stocks and dollar edge higher before Fed rate decision

Stocks and dollar edge higher before Fed rate decision

-

UK PM Starmer wants football governance bill passed amid Super League talk

-

France counts cyclone cost as aid reaches Mayotte

France counts cyclone cost as aid reaches Mayotte

-

'Lucky' Shiffrin in doubt for remainder of ski season

-

Notre Dame cathedral unveils controversial new stained glass windows

Notre Dame cathedral unveils controversial new stained glass windows

-

Swiss club Young Boys name new coach in bid to stop slump

-

UniCredit ups pressure on Commerzbank, fuelling German anger

UniCredit ups pressure on Commerzbank, fuelling German anger

-

Melting sea ice in Antarctica causes ocean storms, scientists say

-

Sarkozy must wear electronic tag after losing graft case appeal

Sarkozy must wear electronic tag after losing graft case appeal

-

Maresca insists Chelsea 'trust' Mudryk despite failed drugs test

-

Stock steady, dollar climbs before Fed rate decision

Stock steady, dollar climbs before Fed rate decision

-

Spanish PM's wife denies wrongdoing in graft probe hearing

-

'Ordinary and out of the ordinary': covering France's mass rape trial

'Ordinary and out of the ordinary': covering France's mass rape trial

-

Activist tells Saudi-hosted UN forum of 'silencing' of dissent

-

UK electricity grid set for 'unprecedented' £35 bn investment

UK electricity grid set for 'unprecedented' £35 bn investment

-

Putin-tattooed dancer Polunin says leaving Russia

-

USA star Weah picks up thigh injury: Juventus

USA star Weah picks up thigh injury: Juventus

-

France's Sarkozy must wear electronic tag after losing graft case appeal

-

Olympic champion Hodgkinson's coaches eye 800m world record

Olympic champion Hodgkinson's coaches eye 800m world record

-

Germany criticises UniCredit's 'unfriendly' moves on Commerzbank

-

Serbia's capital Belgrade to make public transport free

Serbia's capital Belgrade to make public transport free

-

Three 'transformations' for nature, according to UN experts

-

Russian oil spill contaminates 50km of Black Sea beaches

Russian oil spill contaminates 50km of Black Sea beaches

-

Climate change made Cyclone Chido stronger: scientists

-

After long delay, French nuclear plant coming on stream

After long delay, French nuclear plant coming on stream

-

Syrians face horror, fearing loved ones may be in mass graves

-

UN calls for 'free and fair' elections in Syria

UN calls for 'free and fair' elections in Syria

-

Dutch authorities fine Netflix 4.75 mn euros over personal data use

-

Further hike in UK inflation hits rate cut chance

Further hike in UK inflation hits rate cut chance

-

UK's Farage says in 'negotiations' with Musk over funding

-

Fiji rules out alcohol poisoning in tourists' mystery illness

Fiji rules out alcohol poisoning in tourists' mystery illness

-

Pokemon is back with a hit new gaming app

-

Flintoff to coach son on England second-string tour of Australia

Flintoff to coach son on England second-string tour of Australia

-

Stock markets, dollar climb before Fed rate decision

-

Spain PM's wife testifies in corruption case

Spain PM's wife testifies in corruption case

-

Belgian cycling legend Rik Van Looy dies aged 90

-

Syria's first flight since Assad's fall takes off

Syria's first flight since Assad's fall takes off

-

Devastated Mayotte battles to recover from cyclone 'steamroller'

-

France assesses scale of Mayotte 'disaster' as aid arrives

France assesses scale of Mayotte 'disaster' as aid arrives

-

US, Chinese ships at Cambodia bases as Washington navigates diplomatic currents

-

Amorim eager for wantaway Rashford to stay at Manchester United

Amorim eager for wantaway Rashford to stay at Manchester United

-

Warmer winter melts incomes of China's ice cutters

-

Halep, Cruz Hewitt handed wildcards for Australian Open qualifying

Halep, Cruz Hewitt handed wildcards for Australian Open qualifying

-

Xi hails Macau 'success' in visit for 25th anniversary of Chinese rule

-

New Japan coach Nielsen targets Women's World Cup glory

New Japan coach Nielsen targets Women's World Cup glory

-

Ravichandran Ashwin - 'accidental spinner' who became India great

| AZN | -2.05% | 65.831 | $ | |

| GSK | 0.23% | 34.31 | $ | |

| CMSD | 0.08% | 23.95 | $ | |

| SCS | 0.53% | 13.12 | $ | |

| CMSC | 0.07% | 24.336 | $ | |

| BTI | 0.4% | 37.441 | $ | |

| BCC | -0.42% | 132.555 | $ | |

| RBGPF | 3.18% | 62.49 | $ | |

| NGG | -0.68% | 59 | $ | |

| VOD | -1.27% | 8.522 | $ | |

| BCE | -1.55% | 23.22 | $ | |

| BP | 0.46% | 29.215 | $ | |

| RELX | 0.72% | 47.36 | $ | |

| RYCEF | 0.81% | 7.43 | $ | |

| RIO | -1.52% | 60.538 | $ | |

| JRI | -1.11% | 12.481 | $ |

Stock steady, dollar climbs before Fed rate decision

Stock markets moved sideways while the dollar edged higher against main rivals Wednesday with the US Federal Reserve expected to cut interest rates.

Shares in Nissan soared more than 20 percent on reports that the Japanese car titan is in merger talks with rival Honda.

The Fed is widely expected to cut borrowing costs for a third time in a row when it concludes its gathering Wednesday, trimming them by 25 basis points, leaving traders to focus on its statement for clues over the outlook.

"The most important thing from the Fed's meeting will be comments on monetary policy in 2025 as the market is starting to fret about future rate cuts being less frequent," noted Russ Mould, investment director at AJ Bell.

With US inflation coming down, decision-makers have been able to loosen their grip on policy since September.

However, with Donald Trump set to re-enter the White House next month -- pledging tax cuts, deregulation and tariffs on imports from China -- there are fears prices could reignite, forcing the Fed to re-evaluate its rates timetable.

Briefing.com analyst Patrick O'Hare said the market was bracing for Fed chair Jerome Powell to indicate it was unlikely to cut rates again in January.

"The questions are, just how long might any pause last and how might that translate in terms of total rate cuts in 2025," he said.

The Fed is also set to release its latest Summary of Economic Projections, and O'Hare noted that the previous version had suggested rates might come down by 100 basis points in 2025.

Across the Atlantic, official data Wednesday showed UK inflation had picked up in November, firming expectations that the Bank of England will hold off cutting its key interest rate on Thursday.

With annual inflation rising as expected to 2.6 percent, the pound also steadied.

Traders were also waiting for the conclusion of the Bank of Japan's policy meeting Thursday.

Chinese stock markets and oil prices gained on hopes of more stimulus to boost China's flagging economy.

In the car sector, Nissan shares soared, while Honda fell about three percent. Mitsubishi Motors -- whose top stakeholder is Nissan -- accelerated almost 20 percent.

Elsewhere on the corporate front UniCredit, Italy's second-largest bank, increased its stake in Germany's Commerzbank to around 28 percent amid growing speculation of an attempted buyout.

UniCredit's shares rose by 1.4 percent in afternoon trading, while those in Commerzbank climbed 2.3 percent.

- Key figures around 1430 GMT -

New York - Dow: FLAT at 43,465.28 points

New York - S&P 500: FLAT at 6,048.06

New York - Nasdaq Composite: UP less than 0.1 percent at 20,124.11

London - FTSE 100: UP less than 0.1 percent at 8,201.17

Paris - CAC 40: UP less than 0.1 percent at 7,370.91

Frankfurt - DAX: FLAT at 20,252.26

Tokyo - Nikkei 225: DOWN 0.7 percent at 39,081.71 (close)

Hong Kong - Hang Seng Index: UP 0.8 percent at 19,864.55 (close)

Shanghai - Composite: UP 0.6 percent at 3,382.21 (close)

Euro/dollar: DOWN at $1.0490 at $1.0498

Pound/dollar: DOWN at $1.2695 from $1.2707

Dollar/yen: UP at 153.83 yen from 153.41 yen

Euro/pound: UP at 82.62 pence from 82.52 pence

Brent North Sea Crude: UP 0.6 percent at $73.59 per barrel

West Texas Intermediate: UP 0.7 percent at $70.59 per barrel

burs-rl/jj

A.Gasser--BTB