-

Blinken says Syria's HTS should learn from Taliban isolation

Blinken says Syria's HTS should learn from Taliban isolation

-

Postecoglou says football harder than being Prime Minister

-

Jesus 'back at his best' with Arsenal treble in League Cup

Jesus 'back at his best' with Arsenal treble in League Cup

-

TikTok's rise from fun app to US security concern

-

Amorim tells Rashford to 'speak with the manager' over exit talk

Amorim tells Rashford to 'speak with the manager' over exit talk

-

US Fed signals fewer cuts, sending stocks tumbling

-

Trump opposes deal to avert government shutdown

Trump opposes deal to avert government shutdown

-

US stocks tumble, dollar rallies as Fed signals fewer 2025 rate cuts

-

Ghana's Supreme Court paves way for anti-LGBTQ law

Ghana's Supreme Court paves way for anti-LGBTQ law

-

PSG win thriller in Monaco but lose Donnarumma to facial injury

-

Barca beat Man City to top Women's Champions League group, Arsenal stun Bayern

Barca beat Man City to top Women's Champions League group, Arsenal stun Bayern

-

Holders Liverpool reach League Cup semis, Arsenal advance

-

Fonseca stuns Fils on NextGen opening day

Fonseca stuns Fils on NextGen opening day

-

US Fed cuts key rate a quarter point and signals fewer cuts ahead

-

Spain targets Airbnb in illegal ads probe

Spain targets Airbnb in illegal ads probe

-

Mayotte hospital on life support after cyclone

-

Barca overturn Man City to top Women's Champions League group

Barca overturn Man City to top Women's Champions League group

-

Cute carnivores: Bloodthirsty California squirrels go nuts for vole meat

-

US Fed cuts key rate a quarter point, signals fewer cuts ahead

US Fed cuts key rate a quarter point, signals fewer cuts ahead

-

France races to find survivors in cyclone-hit Mayotte

-

Real Madrid outclass Pachuca to win Intercontinental Cup

Real Madrid outclass Pachuca to win Intercontinental Cup

-

Stone tablet engraved with Ten Commandments sells for $5 million

-

Perez leaves Red Bull after season of struggles

Perez leaves Red Bull after season of struggles

-

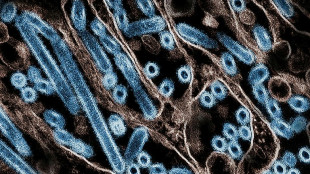

First severe bird flu case in US sparks alarm

-

UN experts urge three 'transformations' for nature

UN experts urge three 'transformations' for nature

-

Sergio Perez leaves Red Bull F1 team

-

13 dead after Indian navy speedboat rams ferry off Mumbai

13 dead after Indian navy speedboat rams ferry off Mumbai

-

US Supreme Court agrees to hear TikTok ban case

-

US reports first severe case of bird flu in a human

US reports first severe case of bird flu in a human

-

Stocks and dollar edge higher before Fed rate decision

-

UK PM Starmer wants football governance bill passed amid Super League talk

UK PM Starmer wants football governance bill passed amid Super League talk

-

France counts cyclone cost as aid reaches Mayotte

-

'Lucky' Shiffrin in doubt for remainder of ski season

'Lucky' Shiffrin in doubt for remainder of ski season

-

Notre Dame cathedral unveils controversial new stained glass windows

-

Swiss club Young Boys name new coach in bid to stop slump

Swiss club Young Boys name new coach in bid to stop slump

-

UniCredit ups pressure on Commerzbank, fuelling German anger

-

Melting sea ice in Antarctica causes ocean storms, scientists say

Melting sea ice in Antarctica causes ocean storms, scientists say

-

Sarkozy must wear electronic tag after losing graft case appeal

-

Maresca insists Chelsea 'trust' Mudryk despite failed drugs test

Maresca insists Chelsea 'trust' Mudryk despite failed drugs test

-

Stock steady, dollar climbs before Fed rate decision

-

Spanish PM's wife denies wrongdoing in graft probe hearing

Spanish PM's wife denies wrongdoing in graft probe hearing

-

'Ordinary and out of the ordinary': covering France's mass rape trial

-

Activist tells Saudi-hosted UN forum of 'silencing' of dissent

Activist tells Saudi-hosted UN forum of 'silencing' of dissent

-

UK electricity grid set for 'unprecedented' £35 bn investment

-

Putin-tattooed dancer Polunin says leaving Russia

Putin-tattooed dancer Polunin says leaving Russia

-

USA star Weah picks up thigh injury: Juventus

-

France's Sarkozy must wear electronic tag after losing graft case appeal

France's Sarkozy must wear electronic tag after losing graft case appeal

-

Olympic champion Hodgkinson's coaches eye 800m world record

-

Germany criticises UniCredit's 'unfriendly' moves on Commerzbank

Germany criticises UniCredit's 'unfriendly' moves on Commerzbank

-

Serbia's capital Belgrade to make public transport free

| RBGPF | 3.18% | 62.49 | $ | |

| CMSC | -0.83% | 24.12 | $ | |

| JRI | -4.9% | 12.03 | $ | |

| CMSD | -0.72% | 23.76 | $ | |

| NGG | -2.82% | 57.77 | $ | |

| SCS | -4.74% | 12.46 | $ | |

| RYCEF | -1.78% | 7.3 | $ | |

| BCE | -0.77% | 23.4 | $ | |

| RIO | -3.57% | 59.34 | $ | |

| RELX | -1.49% | 46.33 | $ | |

| BCC | -5.13% | 126.62 | $ | |

| GSK | -1.6% | 33.69 | $ | |

| AZN | -3.93% | 64.64 | $ | |

| VOD | -2.62% | 8.41 | $ | |

| BP | -1.89% | 28.54 | $ | |

| BTI | -0.78% | 37 | $ |

US stocks tumble, dollar rallies as Fed signals fewer 2025 rate cuts

Wall Street stocks tumbled and the dollar rallied Wednesday after the Federal Reserve lowered borrowing rates again but projected fewer 2025 interest rate cuts in light of lingering inflation concerns.

US indices lurched lower following the 1900 GMT Fed announcement of the actions but fell further during and after Federal Reserve Chair Jerome Powell's news conference.

All 11 sectors dropped in the S&P 500, which finished three percent lower. Meanwhile the dollar jumped by more than one percent against the euro.

The market is now expecting interest rates will "remain higher for longer," said Briefing.com.

"Seeing the kind of decline we are experiencing right now indicates that the Fed took the market quite by surprise," said CFRA Research's Sam Stovall.

Although stocks often enjoy a late-year bounce referred to as the "Santa Claus rally," Stovall said the depth of Wednesday's drop could spur more selling if traders take profits.

"Maybe Santa is already on vacation," he said.

The US central bank, as expected, moved ahead with a decision to reduce interest rates by a quarter point as Fed Chair Jerome Powell offered an upbeat appraisal of the US economy.

But the announcement was coupled with the altered outlook on 2025 monetary policy.

After the latest interest rate cut, the Fed is now "significantly closer" to the point where no further cuts will be needed, said Powell, who emphasized the central bank still views two percent inflation as a critical long term priority.

In the last couple of months, the Fed's favored inflation measure has ticked higher, moving away from the bank's long-term target of two percent.

Forex Live analyst Adam Button described Powell's tone during the press conference as a shift "back to more emphasis on inflation falling rather than keeping the employment market strong."

Button said the market may also have been reacting to signs of President-elect Donald Trump's opposition to a spending package that seeks to avert a fast-approaching US government shutdown.

Elsewhere, official data Wednesday showed UK inflation had picked up in November, firming expectations that the Bank of England will hold off cutting its key interest rate on Thursday.

Traders were also waiting for the conclusion of the Bank of Japan's policy meeting Thursday.

In the car sector, Nissan shares soared, while Honda fell about three percent. Mitsubishi Motors -- whose top stakeholder is Nissan -- accelerated almost 20 percent.

UniCredit, Italy's second-largest bank, increased its stake in Germany's Commerzbank to around 28 percent amid growing speculation of an attempted buyout.

UniCredit's shares rose by 1.3 percent, while those in Commerzbank climbed 1.6 percent.

- Key figures around 2140 GMT -

New York - Dow: DOWN 2.6 percent at 42,326.87 (close)

New York - S&P 500: DOWN 3.0 percent at 5,872.16 (close)

New York - Nasdaq Composite: DOWN 3.6 percent at 19,392.69 (close)

London - FTSE 100: UP 0.1 percent at 8,199.11 (close)

Paris - CAC 40: UP 0.3 percent at 7,384.62 (close)

Frankfurt - DAX: FLAT at 20,242.57 (close)

Tokyo - Nikkei 225: DOWN 0.7 percent at 39,081.71 (close)

Hong Kong - Hang Seng Index: UP 0.8 percent at 19,864.55 (close)

Shanghai - Composite: UP 0.6 percent at 3,382.21 (close)

Euro/dollar: DOWN at $1.0365 at $1.0491

Pound/dollar: DOWN at $1.2581 from $1.2710

Dollar/yen: UP at 154.73 yen from 153.46 yen

Euro/pound: DOWN at 82.38 pence from 82.54 pence

Brent North Sea Crude: UP 0.3 percent at $73.39 per barrel

West Texas Intermediate: UP 0.7 percent at $70.58 per barrel

burs-jmb/jgc

O.Bulka--BTB