-

Axing could be end for India's 'Hitman' Rohit in Test cricket

Axing could be end for India's 'Hitman' Rohit in Test cricket

-

10 years after attack, Charlie Hebdo is uncowed and still provoking

-

Iran artist's vision for culture hub enlivens rustic district

Iran artist's vision for culture hub enlivens rustic district

-

'Emilia Perez' heads into Golden Globes as strong favorite

-

'You need to be happy': graffiti encourages Cuban self-reflection

'You need to be happy': graffiti encourages Cuban self-reflection

-

Rohit-less India 57-3 as Australia assert early control in final Test

-

Disaster-hit Chilean park sows seeds of fire resistance

Disaster-hit Chilean park sows seeds of fire resistance

-

South Korea investigators in standoff to arrest President Yoon

-

Philadelphia name South African Carnell as new head coach

Philadelphia name South African Carnell as new head coach

-

Vikings-Lions showdown to end season will decide NFC top seed

-

Vegas Tesla blast suspect's motive unknown as death ruled suicide

Vegas Tesla blast suspect's motive unknown as death ruled suicide

-

Allen and Goff to start NFL Pro Bowl Games as Mahomes snubbed

-

Apple agrees to $95 mn deal to settle Siri eavesdropping suit

Apple agrees to $95 mn deal to settle Siri eavesdropping suit

-

South Korea investigators attempt to arrest President Yoon

-

Tears, tourism on Bourbon Street after US terror nightmare

Tears, tourism on Bourbon Street after US terror nightmare

-

Extradited SKorean crypto 'genius' in court to face US charges

-

Venezuela offers $100,000 reward for exiled opposition candidate

Venezuela offers $100,000 reward for exiled opposition candidate

-

South Korea investigators arrive to attempt to arrest president

-

Giannis and Jokic lead NBA All-Star voting with LeBron well back

Giannis and Jokic lead NBA All-Star voting with LeBron well back

-

Mixed day for global stocks as dollar pushes higher

-

Nick Clegg leaves Meta global policy team

Nick Clegg leaves Meta global policy team

-

Vegas Tesla blast suspect shot himself in head: officials

-

Shiffrin hopes to be back on slopes 'in the next week'

Shiffrin hopes to be back on slopes 'in the next week'

-

Dumfries double takes Inter into Italian Super Cup final

-

Spain's Canary Islands received record 46,843 migrants in 2024: ministry

Spain's Canary Islands received record 46,843 migrants in 2024: ministry

-

Panama says migrant jungle crossings fell 41% in 2024

-

UN experts slam Israel's 'blatant assault' on health rights in Gaza

UN experts slam Israel's 'blatant assault' on health rights in Gaza

-

Tesla reports lower 2024 auto deliveries, missing forecast

-

Meghan Markle's lifestyle show to premiere Jan 15 on Netflix

Meghan Markle's lifestyle show to premiere Jan 15 on Netflix

-

On Bourbon Street, a grim cleanup after deadly nightmare

-

New Orleans attacker: US Army vet 'inspired' by Islamic State

New Orleans attacker: US Army vet 'inspired' by Islamic State

-

New Orleans killer acted alone, professed loyalty to jihadist group: FBI

-

Wall Street lifts spirits after Asia starts year in red

Wall Street lifts spirits after Asia starts year in red

-

UK's biggest dinosaur footprint site uncovered

-

Former Australia coach Langer to take charge of London Spirit

Former Australia coach Langer to take charge of London Spirit

-

Most UK doctors suffer from 'compassion fatigue': poll

-

Everton boss Dyche unconcerned by Maupay jibe

Everton boss Dyche unconcerned by Maupay jibe

-

FBI probes potential accomplices in New Orleans truck ramming

-

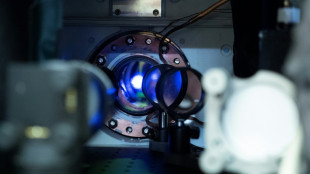

Secret lab developing UK's first quantum clock: defence ministry

Secret lab developing UK's first quantum clock: defence ministry

-

Premier League chief fears Club World Cup's impact on Man City and Chelsea

-

US mulls new restrictions on Chinese drones

US mulls new restrictions on Chinese drones

-

Wall Street dons early green after Asia starts year in red

-

Rosita Missoni of Italy's eponymous fashion house dies age 93

Rosita Missoni of Italy's eponymous fashion house dies age 93

-

27 sub-Saharan African migrants die off Tunisia in shipwrecks

-

UK grime star Stormzy banned from driving for nine months

UK grime star Stormzy banned from driving for nine months

-

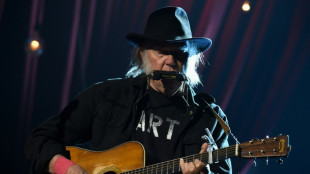

Neil Young dumps Glastonbury alleging 'BBC control'

-

Djokovic, Sabalenka into Brisbane quarters as rising stars impress

Djokovic, Sabalenka into Brisbane quarters as rising stars impress

-

Swiatek battles back to take Poland into United Cup semis

-

Electric cars took 89% of Norway market in 2024

Electric cars took 89% of Norway market in 2024

-

Stock markets begin new year with losses

Asian stocks dip as Santa snubs Wall Street

Asian stocks ended the year in the red on Tuesday after worries about 2025 and profit-taking turned Wall Street's usual holiday-period "Santa Claus rally" into a mini-rout.

The three main US indices all slumped around one percent on Monday, adding to Friday's losses, with Tesla down 3.3 percent and Facebook owner Meta off 1.4 percent.

Volumes were thin but brokers said investors were locking in gains after a bumper 2024, particularly for the "Magnificent Seven" troop of US tech giants.

Concerns about the slow pace of US interest rate cuts by the Federal Reserve and uncertainty about incoming president Donald Trump's tariff plans were also souring the mood.

"In Asia, notably China, tariffs may appear to be a manageable obstacle if they were the only concern," said Stephen Innes at SPI Asset Management.

"However, China's economic difficulties go well beyond simple trade conflicts. The nation is also contending with serious domestic consumption challenges and self-induced setbacks in its technology sector," Innes said.

China's Purchasing Managers' Index (PMI) for manufacturing was 50.1 in December, signalling a third consecutive month of expansion, official data showed on Tuesday.

"Increased policy support towards the end of the year has clearly provided a near-term boost to growth," said Gabriel Ng of Capital Economics.

Tokyo was shut on Tuesday, with the Nikkei 225 posting on Monday its best year-end close since Japan's asset bubble burst in the 1990s.

Elsewhere among major Asian indices, the Hang Seng was the only bright spot, up 0.7 percent by late morning, while stocks in China, South Korea and Australia all dipped.

Rescuers handed over the first bodies from Sunday's crash by a Jeju Air Boeing 737-800 to grieving families on Tuesday, South Korea's deadliest air disaster on its own soil in which 179 people were killed.

Boeing shares fell more than five percent on Wall Street on Monday before recovering.

Jeju Air shares dropped as much as 15 percent on Monday.

On the political front, a South Korean court has issued an arrest warrant for Yoon Suk Yeol, the impeached and suspended president who briefly declared martial law on December 3.

- Key figures around 0400 GMT -

Tokyo - Nikkei 225: closed

Hong Kong - Hang Seng Index: UP 0.7 percent at 20,175.76

Shanghai - Composite: DOWN 0.8 percent at 3,377.45

Euro/dollar: UP at $1.0413 from $1.0401 on Monday

Pound/dollar: UP at $1.2557 from $1.2548

Dollar/yen: DOWN at 156.41 yen from 156.80 yen

Euro/pound: UP at 82.93 pence from 82.89 pence

West Texas Intermediate: UP 0.6 percent at $71.40 per barrel

Brent North Sea Crude: UP 0.5 percent at $74.38 per barrel

burs-stu/pbt

B.Shevchenko--BTB