-

World MotoGP champion Martin to miss US race in new injury setback

World MotoGP champion Martin to miss US race in new injury setback

-

Rays dump plans for new MLB ballpark in St. Petersburg

-

IOC strike $3 bn deal with NBC in US up to 2036 Olympics

IOC strike $3 bn deal with NBC in US up to 2036 Olympics

-

Duterte case seen as a 'gift' for embattled ICC

-

Peru ex-president Castillo hospitalized on Day 4 of hunger strike

Peru ex-president Castillo hospitalized on Day 4 of hunger strike

-

Martinez climbs to Paris-Nice stage win, Jorgenson takes lead

-

Donatella Versace, fashion icon who saved slain brother's brand

Donatella Versace, fashion icon who saved slain brother's brand

-

EU 'open for negotiations' after latest Trump tariff threat

-

End of era as Donatella Versace gives up creative reins of Italian brand

End of era as Donatella Versace gives up creative reins of Italian brand

-

Jockey great Dettori files for bankruptcy after UK tax case

-

Impressive Fact To File gives Mullins' eve of Gold Cup confidence-booster

Impressive Fact To File gives Mullins' eve of Gold Cup confidence-booster

-

Court upholds jail terms for relatives of murdered UK-Pakistani girl

-

Ireland's Easterby laments 'disappointing' Galthie comments after Dupont injury

Ireland's Easterby laments 'disappointing' Galthie comments after Dupont injury

-

Sweden to hold talks on countering soaring food costs

-

Frenchman Martinez climbs to Paris-Nice fifth stage win

Frenchman Martinez climbs to Paris-Nice fifth stage win

-

EU parliament roiled by graft probe linked to China's Huawei

-

UEFA to mull penalty rule rethink after Alvarez controversy

UEFA to mull penalty rule rethink after Alvarez controversy

-

Turkey insists foreign fighters be expelled from Syria: source

-

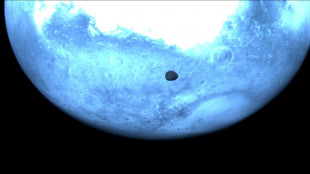

Asteroid probe snaps rare pics of Martian moon

Asteroid probe snaps rare pics of Martian moon

-

White House withdraws vaccine-skeptic nominee to lead US health agency

-

Syria leader signs constitutional declaration, hailing 'new history'

Syria leader signs constitutional declaration, hailing 'new history'

-

Azerbaijan, Armenia say peace deal ready for signing

-

EU, US eye greater energy ties amid Trump frictions

EU, US eye greater energy ties amid Trump frictions

-

Canada rallies against Russian 'aggression' as new US tone splits G7

-

Roberts moves to wing for winless Wales against England in Six Nations

Roberts moves to wing for winless Wales against England in Six Nations

-

NATO's 'Trump whisperer' heads to White House for tough talks

-

UK police extend North Sea crash captain's detention

UK police extend North Sea crash captain's detention

-

US envoy in Moscow to present Ukraine truce plan

-

Donatella Versace to give up creative reins of brand after 28 years

Donatella Versace to give up creative reins of brand after 28 years

-

Trump threatens huge tariffs on European wine, other alcohol

-

Meta tests 'Community Notes' to replace fact-checkers

Meta tests 'Community Notes' to replace fact-checkers

-

Stock markets find little cheer as Trump targets champagne

-

Brazil mine disaster trial ends with claimants hopeful of justice

Brazil mine disaster trial ends with claimants hopeful of justice

-

England fast bowler Wood out for four months after latest injury blow

-

Mbappe returns to France squad as PSG's Doue earns first call-up

Mbappe returns to France squad as PSG's Doue earns first call-up

-

New corruption scandal roils EU parliament

-

Kimmich extends Bayern contract until 2029

Kimmich extends Bayern contract until 2029

-

UK seeks tougher term for father jailed over daughter's murder

-

Israel attack on Gaza IVF clinic a 'genocidal act': UN probe

Israel attack on Gaza IVF clinic a 'genocidal act': UN probe

-

Germany's Merz urges MPs to back spending bonanza in fiery debate

-

Rubio meets Canadian FM as Ukraine, trade war dominate G7

Rubio meets Canadian FM as Ukraine, trade war dominate G7

-

England fast bowler Wood out four months after latest injury blow

-

Trump threatens 200% tariff on wine, champagne from France, other EU countries

Trump threatens 200% tariff on wine, champagne from France, other EU countries

-

Pope marks 12 years in job in hospital and with future uncertain

-

Israel defence minister confirms air strike in Damascus

Israel defence minister confirms air strike in Damascus

-

French lawmakers pressure government to seize Russian assets

-

Trump slammed for using 'Palestinian' as slur against top Democrat

Trump slammed for using 'Palestinian' as slur against top Democrat

-

Crowley starts in one of six changes for Ireland's Six Nations finale with Italy

-

Brignone inches towards World Cup crown at tricky La Thuile super-G

Brignone inches towards World Cup crown at tricky La Thuile super-G

-

Iranian climber who competed without hijab leaves country: family

Stock markets get boost from bank earnings, inflation data

Stock markets surged on Wednesday, buoyed by robust US bank earnings and encouraging inflation data from the United States and Britain.

Wall Street's three main indexes jumped after US financial titans Goldman Sachs, JPMorgan Chase, BlackRock and others posted stellar quarterly results.

Shares in Goldman Sachs, Citigroup and BlackRock surged almost five percent, though JPMorgan saw a more modest gain of 0.5 percent.

European stock markets were also firmly in the green in afternoon deals while Asia finished on a mixed note.

US inflation rose for a third straight month in December, reaching 2.9 percent, in line with expectations from economists.

But "core" inflation, which excludes volatile food and energy costs, came in at a lower-than-expected 3.2 percent, a slight decline from the month earlier.

"The key takeaway from the report for a market worried about inflation heating up again is that these results were better than feared," said Briefing.com analyst Patrick O'Hare.

Kathleen Brooks, research director at trading platform XTB, noted that the US Federal Reserve closely looks at core inflation to make decisions on interest rates.

"Digging deeper into this report, although headline inflation was higher, this was down to food prices and a sharp rise in monthly gas prices," Brooks said.

"The Fed could choose to look through price increases for volatile commodities that they cannot control. Instead, the Fed may focus on core inflation," she added.

Analysts have pared back their expectations on the number of Fed rate cuts for this year and believe policymakers will hold borrowing costs steady at the next decision-making meeting later this month as inflation remains above its two-percent target.

In Britain, official figures showed that inflation unexpectedly fell to 2.5 percent in December, easing some pressure on the Labour government as it struggles with growing the economy.

The pound rose versus the dollar, with analysts forecasting that the Bank of England would likely cut its key interest rate next month as the rate of price increases cools.

Separate official data showed Europe's biggest economy Germany contracted for a second straight year in 2024, with little hope of a strong recovery ahead of national elections next month.

- Nintendo jump -

In Asia, Tokyo's stock market ended down, though games giant Nintendo piled on more than two percent and briefly hit a record high as traders anticipate it will soon release its much-anticipated Switch 2 console.

The Nikkei 225's drop also came as the yen strengthened, with traders weighing the chances of a rate hike by the Bank of Japan this month.

Also in focus this week is the release of Chinese 2024 growth data, with expectations that it could come in below the previous year and be among the slowest in more than three decades.

Leaders have unveiled a string of measures to reignite the economy, with a particular emphasis on consumers and the troubled property sector, though there are fears the return of President-elect Donald Trump could see another painful China-US trade war.

Trump has warned he will impose tariffs of as much as 60 percent on imports from China, and observers say Beijing has likely kept its powder dry with regards stimulus as it prepares for the next four years.

- Key figures around 1445 GMT -

New York - Dow: UP 1.6 percent at 43,198.12 points

New York - S&P: UP 1.6 percent at 5,937.28

New York - Nasdaq Composite: UP 2.0 19,418.76

London - FTSE 100: UP 0.9 percent at 8,277.79

Paris - CAC 40: UP 0.9 percent at 7,491.39

Frankfurt - DAX: UP 1.5 percent at 20,575.66

Tokyo - Nikkei 225: DOWN 0.1 percent at 38,444.58 (close)

Hong Kong - Hang Seng Index: UP 0.3 percent at 19,286.07 (close)

Shanghai - Composite: DOWN 0.4 percent at 3,227.12 (close)

Euro/dollar: UP at $1.0335 from $1.0310 on Tuesday

Pound/dollar: UP at $1.2283 from $1.2211

Dollar/yen: DOWN at 156.24 yen from 157.98 yen

Euro/pound: DOWN at 84.13 pence from 84.40 pence

Brent North Sea Crude: UP 1.0 at $80.75 per barrel

West Texas Intermediate: UP 1.4 percent at $77.41 per barrel

J.Bergmann--BTB