-

US tariffs of 25% on steel, aluminum imports take effect

US tariffs of 25% on steel, aluminum imports take effect

-

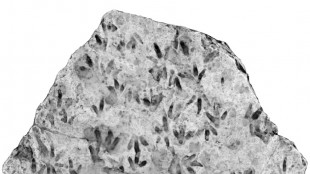

Trove of dinosaur footprints found at Australian school

-

Mongolia's children choke in toxic pollution

Mongolia's children choke in toxic pollution

-

Rubio heads to Canada as Trump wages trade war

-

South Korean pastor vows revolt against Yoon's impeachment

South Korean pastor vows revolt against Yoon's impeachment

-

Pakistan to launch 'full-scale' operation to free train hostages

-

Syria determined to 'prevent unlawful revenge' says fact-finding committee

Syria determined to 'prevent unlawful revenge' says fact-finding committee

-

Most Asian stocks drop as Trump trade policy sows uncertainty

-

Morocco fights measles outbreak amid vaccine misinformation

Morocco fights measles outbreak amid vaccine misinformation

-

Garland stars as comeback Cavs bag 15th straight with defeat of Nets

-

Hamilton eyes dream Ferrari start as F1 revs up in Melbourne

Hamilton eyes dream Ferrari start as F1 revs up in Melbourne

-

Talk of the town: Iconic covers of the New Yorker magazine

-

The New Yorker, a US institution, celebrates 100 years of goings on

The New Yorker, a US institution, celebrates 100 years of goings on

-

Cuban kids resist reggaeton, one verse at a time

-

NASA fires chief scientist, more Trump cuts to come

NASA fires chief scientist, more Trump cuts to come

-

Denmark's Rune ready to break out of tennis doldrums

-

Transformed PSG make statement by ousting Liverpool from Champions League

Transformed PSG make statement by ousting Liverpool from Champions League

-

PSG down Liverpool on penalties in Champions League, Bayern thrash Leverkusen

-

Liverpool 'ran out of luck' against PSG, says Slot

Liverpool 'ran out of luck' against PSG, says Slot

-

Swiatek surges into quarter-finals at rainy Indian Wells, Rune tops Tsitsipas

-

PSG stun Liverpool on penalties to make Champions League quarters

PSG stun Liverpool on penalties to make Champions League quarters

-

PSG beat Liverpool on penalties to reach Champions League quarter-finals

-

Inter cruise into Champions League quarters and titanic Bayern clash

Inter cruise into Champions League quarters and titanic Bayern clash

-

Trump has 'bolstered' PGA-LIV reunification talks: Monahan

-

Kane leads Bayern past Leverkusen into Champions League last eight

Kane leads Bayern past Leverkusen into Champions League last eight

-

Defending champ Swiatek surges into quarter-finals at rainy Indian Wells

-

Piastri signs long-term extension with McLaren

Piastri signs long-term extension with McLaren

-

Trump talks up Tesla in White House show of support for Musk

-

US trades barbs with Canada as steel, aluminum tariffs loom

US trades barbs with Canada as steel, aluminum tariffs loom

-

Oil companies greet Trump return, muted on tariffs

-

Italian defence firm Leonardo to boost capacity amid geopolitical risks

Italian defence firm Leonardo to boost capacity amid geopolitical risks

-

Over 100 hostages freed in deadly Pakistan train siege

-

Ukraine backs 30-day ceasefire as US ends aid freeze

Ukraine backs 30-day ceasefire as US ends aid freeze

-

Swiatek powers into Indian Wells quarter-finals

-

Tiger Woods has surgery for ruptured Achilles tendon

Tiger Woods has surgery for ruptured Achilles tendon

-

Trump burnishes Tesla at White House in show of support for Musk

-

Macron urges allies to plan 'credible security guarantees' for Ukraine

Macron urges allies to plan 'credible security guarantees' for Ukraine

-

Yamal, Raphinha fire Barca past Benfica into Champions League last eight

-

Trump may rethink plans to double Canada steel, aluminum tariffs

Trump may rethink plans to double Canada steel, aluminum tariffs

-

Maradona medical team on trial for 'horror theater' of his death

-

UK makes manslaughter arrest of ship captain over North Sea crash

UK makes manslaughter arrest of ship captain over North Sea crash

-

Ukraine backs US proposal for 30-day ceasefire in war with Russia

-

Mitrovic misses AFC Champions League clash due to irregular heart beat

Mitrovic misses AFC Champions League clash due to irregular heart beat

-

Trump's 'The Apprentice' re-runs hit Amazon

-

Dozens freed, hundreds still held hostage in deadly Pakistan train siege

Dozens freed, hundreds still held hostage in deadly Pakistan train siege

-

Italian defence firm Leonardo to focus on int'l alliances for growth

-

Israel kills senior Hezbollah militant, frees four Lebanese prisoners

Israel kills senior Hezbollah militant, frees four Lebanese prisoners

-

Dozens of hostages freed, hundreds still held in Pakistan train seige

-

Far-right Romania politician loses appeal against presidential vote ban

Far-right Romania politician loses appeal against presidential vote ban

-

Facing Trump and Putin, are the EU's defence plans enough?

US bank profits rise as Wall Street hopes for merger boom

Large US banks reported soaring profits Wednesday propelled by strength in trading and financial advisory services as Wall Street eyes a potential merger boom under the incoming Trump administration.

Profits climbed for US financial heavyweights including JPMorgan Chase and Goldman Sachs, in part because of the absence of large costs in 2024's year-ending quarter.

In the equivalent period in 2023, banks set aside large sums to replenish a US rescue program following the collapse of Silicon Vally Bank.

JPMorgan Chase's fourth-quarter profits jumped 50 percent to $14 billion, while Goldman Sachs' more than doubled to $3.9 billion.

In both cases, huge increases in revenues tied to trading were a standout category, reflecting a buoyant environment in a period that included the US presidential election and a heady aftermath on Wall Street.

Citi reported profits of $2.9 billion, compared with a loss of $1.8 billion during the 2023 quarter, while Wells Fargo's profits rose 47 percent to $5.1 billion.

Gains in banking shares helped lift Wall Street stocks Wednesday.

Many financial firms are salivating over the prospects of the shift to the administration of President-elect Donald Trump, who is expected to scale back the confrontational regulatory approach of the outgoing Biden administration.

"There's no question that were in a kind of animal spirits moment right now," said JPMorgan Chief Financial Officer Jeremy Barnum, alluding to an uptick in the "pipeline" of merger and acquisition (M&A) activity.

"All eyes are on the US in a big way," said Citi Chief Financial Officer Mark Mason.

"Generally people are looking at the US with what's likely to be a pro-growth agenda," Mason said on a briefing with reporters. The bank's M&A pipeline is "very strong," he added.

A wave of corporate mergers would translate into increased advisory fees at banks after the Biden administration's broadly skeptical view of dealmaking discouraged some transactions.

The industry also stands poised to benefit from an easing of bank regulation that could free up funds currently required to be held as emergency capital. Instead, banks could lend that money, or return it to shareholders.

- US economy 'resilient' -

At JPMorgan, a successful fourth quarter lifted annual profits to $58.5 billion, up 18 percent.

Profits increased in JPMorgan's commercial and investment bank business, driven by higher advising fees and a surge in fixed income and equity trading. JPMorgan also scored higher asset and wealth management fees.

These areas of strength offset a two percent decline in net interest income, the result of lower interest rates. JPMorgan also experienced higher credit charge offs, while adding net reserves of $267 million in case of bad loans.

Chief Executive Jamie Dimon described the US economy as "resilient," with relatively low unemployment and solid consumer spending.

"Businesses are more optimistic about the economy, and they are encouraged by expectations for a more pro-growth agenda and improved collaboration between government and business," Dimon said.

However, Dimon pointed to the risk that elevated inflation will persist and to geopolitical conditions that remain "the most dangerous and complicated since World War II."

Meanwhile, at Goldman, revenues tied to equity and fixed income, currency and commodity trading rose by double digits, while interest rate products were essentially flat.

Goldman also won higher revenues in equity and debt underwriting. While advisory revenues were lower, Goldman said the investment banking fees backlog rose compared with the prior quarter.

A Goldman powerpoint listed an "improving" regulatory backdrop among the supporting factors for the firm's business.

"With an improving operating backdrop and growing CEO confidence, we are harnessing the power of One Goldman Sachs to continue to serve our clients with excellence and create further value for our shareholders," said Chief Executive David Solomon.

All four banks rose on Wall Street. At mid-morning, JPMorgan was up 0.8 percent, Goldman Sachs 5.9 percent, Citi 6.2 percent and Wells Fargo 5.2 percent.

M.Furrer--BTB