-

World MotoGP champion Martin to miss US race in new injury setback

World MotoGP champion Martin to miss US race in new injury setback

-

Rays dump plans for new MLB ballpark in St. Petersburg

-

IOC strike $3 bn deal with NBC in US up to 2036 Olympics

IOC strike $3 bn deal with NBC in US up to 2036 Olympics

-

Duterte case seen as a 'gift' for embattled ICC

-

Peru ex-president Castillo hospitalized on Day 4 of hunger strike

Peru ex-president Castillo hospitalized on Day 4 of hunger strike

-

Martinez climbs to Paris-Nice stage win, Jorgenson takes lead

-

Donatella Versace, fashion icon who saved slain brother's brand

Donatella Versace, fashion icon who saved slain brother's brand

-

EU 'open for negotiations' after latest Trump tariff threat

-

End of era as Donatella Versace gives up creative reins of Italian brand

End of era as Donatella Versace gives up creative reins of Italian brand

-

Jockey great Dettori files for bankruptcy after UK tax case

-

Impressive Fact To File gives Mullins' eve of Gold Cup confidence-booster

Impressive Fact To File gives Mullins' eve of Gold Cup confidence-booster

-

Court upholds jail terms for relatives of murdered UK-Pakistani girl

-

Ireland's Easterby laments 'disappointing' Galthie comments after Dupont injury

Ireland's Easterby laments 'disappointing' Galthie comments after Dupont injury

-

Sweden to hold talks on countering soaring food costs

-

Frenchman Martinez climbs to Paris-Nice fifth stage win

Frenchman Martinez climbs to Paris-Nice fifth stage win

-

EU parliament roiled by graft probe linked to China's Huawei

-

UEFA to mull penalty rule rethink after Alvarez controversy

UEFA to mull penalty rule rethink after Alvarez controversy

-

Turkey insists foreign fighters be expelled from Syria: source

-

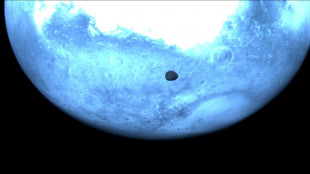

Asteroid probe snaps rare pics of Martian moon

Asteroid probe snaps rare pics of Martian moon

-

White House withdraws vaccine-skeptic nominee to lead US health agency

-

Syria leader signs constitutional declaration, hailing 'new history'

Syria leader signs constitutional declaration, hailing 'new history'

-

Azerbaijan, Armenia say peace deal ready for signing

-

EU, US eye greater energy ties amid Trump frictions

EU, US eye greater energy ties amid Trump frictions

-

Canada rallies against Russian 'aggression' as new US tone splits G7

-

Roberts moves to wing for winless Wales against England in Six Nations

Roberts moves to wing for winless Wales against England in Six Nations

-

NATO's 'Trump whisperer' heads to White House for tough talks

-

UK police extend North Sea crash captain's detention

UK police extend North Sea crash captain's detention

-

US envoy in Moscow to present Ukraine truce plan

-

Donatella Versace to give up creative reins of brand after 28 years

Donatella Versace to give up creative reins of brand after 28 years

-

Trump threatens huge tariffs on European wine, other alcohol

-

Meta tests 'Community Notes' to replace fact-checkers

Meta tests 'Community Notes' to replace fact-checkers

-

Stock markets find little cheer as Trump targets champagne

-

Brazil mine disaster trial ends with claimants hopeful of justice

Brazil mine disaster trial ends with claimants hopeful of justice

-

England fast bowler Wood out for four months after latest injury blow

-

Mbappe returns to France squad as PSG's Doue earns first call-up

Mbappe returns to France squad as PSG's Doue earns first call-up

-

New corruption scandal roils EU parliament

-

Kimmich extends Bayern contract until 2029

Kimmich extends Bayern contract until 2029

-

UK seeks tougher term for father jailed over daughter's murder

-

Israel attack on Gaza IVF clinic a 'genocidal act': UN probe

Israel attack on Gaza IVF clinic a 'genocidal act': UN probe

-

Germany's Merz urges MPs to back spending bonanza in fiery debate

-

Rubio meets Canadian FM as Ukraine, trade war dominate G7

Rubio meets Canadian FM as Ukraine, trade war dominate G7

-

England fast bowler Wood out four months after latest injury blow

-

Trump threatens 200% tariff on wine, champagne from France, other EU countries

Trump threatens 200% tariff on wine, champagne from France, other EU countries

-

Pope marks 12 years in job in hospital and with future uncertain

-

Israel defence minister confirms air strike in Damascus

Israel defence minister confirms air strike in Damascus

-

French lawmakers pressure government to seize Russian assets

-

Trump slammed for using 'Palestinian' as slur against top Democrat

Trump slammed for using 'Palestinian' as slur against top Democrat

-

Crowley starts in one of six changes for Ireland's Six Nations finale with Italy

-

Brignone inches towards World Cup crown at tricky La Thuile super-G

Brignone inches towards World Cup crown at tricky La Thuile super-G

-

Iranian climber who competed without hijab leaves country: family

No home, no insurance: The double hit from Los Angeles fires

As he looks at the ruins of his home razed when deadly fires tore through the Los Angeles area, Sebastian Harrison knows it will never be the same again, because he was not insured.

"I knew it was risky, but I had no choice," he told AFP.

Harrison is one of tens of thousands of Californians forced in recent years to live without a safety net, either because their insurance company dropped them, or because the premiums just got too high.

Some of them are now counting the crippling cost, after enormous blazes ripped through America's second largest city, killing more than two dozen people and levelling 12,000 structures, Harrison's home among them.

His own slice of what he called "paradise" stood on a mountainside overlooking the Pacific Ocean, where Malibu runs into the badly hit Pacific Palisades neighborhood.

The three-acre plot, which contained his home and a few other buildings, was always costly to insure, and in 2010 was already $8,000 a year.

When the bill hit $40,000 in the aftermath of the pandemic, he decided he simply couldn't afford it.

"It's not like I bought myself a fancy car instead of getting insurance," the 59-year-old said.

"It's just that food for myself and my family was more important."

For Harrison, a former actor, the emotional strain of losing the home he had lived in for 14 years is magnified by the knowledge that without a handout from the state or the national government, he has lost everything -- he even still has mortgage payments to make.

"I'm very worried, because this property is everything I had," he said.

- Climate costs -

Insuring property in California has become increasingly difficult.

Well-intentioned legislation that prevents insurance companies from hiking prices unfairly has collided with growing risks from a changing climate in a part of the world that now regularly sees devastating wildfires near populated areas.

Faced with burgeoning claims -- more damage, and higher repair costs because of the soaring price of labor and materials -- insurance companies turned tail and left the state en masse, dropping existing clients and refusing to write new policies.

Even enormous names in the market, like State Farm and Allstate, have pulled back.

Officials in state capital Sacramento have been worried for a while.

Last year Insurance Commissioner Ricardo Lara introduced reforms aimed at encouraging companies to return, including allowing them more leeway to increase their premiums to better match their costs.

But huge and inevitably very expensive fires erupting in what is supposed to be California's rainy season -- it hasn't rained for eight months around Los Angeles -- have reinforced the idea that the state is becoming uninsurable.

"I don't know now, because... my greatest fear was that we were going to have a catastrophe of this nature," Lara told the San Francisco Chronicle at the weekend.

Even the state-mandated insurer of last resort, a scheme designed to provide bare-bones coverage for those locked out of the private sector, could be struggling.

The California FAIR Plan was created in 1968 and is underpinned by every insurance company that operates in the state, as a requirement of their license to operate.

But the number of people now resorting to the scheme means its $200 million reserves are dwarfed by its liabilities. (A reinsurance sector helps to keep it liquid.)

- 'They're going to drop me' -

With the enormous losses expected from the Palisades and Eaton fires set to test the insurance sector even further, California has issued an edict preventing companies from dropping customers or refusing to renew them in certain affected areas, for one year.

That's scant consolation for Gabrielle Gottlieb, whose house in Pacific Palisades survived the flames.

"My insurer dropped a lot of friends of mine... and I'm concerned that they're going to drop me as well eventually," he told AFP.

"They're basically already putting it out there that 'lots of luck after a year!'"

Even in a best case scenario, home insurance looks set to be a lot more expensive in California, as state reforms filter through allowing increased prices in places more susceptible to wildfire.

"Real estate and taxes are already very high in California," said Robert Spoeri, a Pacific Palisades homeowner who was dropped by his insurer last year.

"If the insurance gets even higher, who is going to want to live in this state?"

M.Ouellet--BTB