-

Indonesia deforestation rises for third year running: NGO

Indonesia deforestation rises for third year running: NGO

-

Myanmar junta extends state of emergency by six months

-

Chandimal wages lone battle as Australia tighten grip on first Test

Chandimal wages lone battle as Australia tighten grip on first Test

-

India's Kohli flops on return to domestic cricket

-

Kenya's Ice Lions skate to win on East Africa's only rink

Kenya's Ice Lions skate to win on East Africa's only rink

-

Indonesia deforestation rose again in 2024: NGO

-

Kiwi cricket star Kerr says best yet to come

Kiwi cricket star Kerr says best yet to come

-

Germany's conservatives to seek far right support on immigration

-

US newspaper popularized by 'The Sopranos' to cease printing

US newspaper popularized by 'The Sopranos' to cease printing

-

World awaits Trump tariff deadline on Canada, Mexico and China

-

Japan sinkhole grows to almost Olympic pool length

Japan sinkhole grows to almost Olympic pool length

-

Thousands of protesters call for VP Duterte impeachment

-

Thailand orders stubble burning crackdown as pollution spikes

Thailand orders stubble burning crackdown as pollution spikes

-

Samsung operating profit hit by R&D spending, fight to meet chip demand

-

Japan records biggest jump in foreign workers

Japan records biggest jump in foreign workers

-

Asian markets mostly rise but worries over tariffs, AI linger,

-

Investigators recover plane black boxes from Washington air collision

Investigators recover plane black boxes from Washington air collision

-

'No happiness': Misery for Myanmar exiles four years on from coup

-

Ghosts of past spies haunt London underground tunnels

Ghosts of past spies haunt London underground tunnels

-

Six Nations teams strengths and weaknesses

-

Pressure on Prendergast as Ireland launch Six Nations title defence against England

Pressure on Prendergast as Ireland launch Six Nations title defence against England

-

Scotland eager to avoid Italy slip-up at start of Six Nations

-

Fonseca set for Lyon baptism against Marseille

Fonseca set for Lyon baptism against Marseille

-

Hermoso: Spanish football icon against sexism after forced kiss

-

Mbappe-Vinicius connection next goal for Liga leaders Real Madrid

Mbappe-Vinicius connection next goal for Liga leaders Real Madrid

-

Leverkusen taking confidence from Champions League into Bundesliga title race

-

Man City face Arsenal test as Bournemouth eye Liverpool scalp

Man City face Arsenal test as Bournemouth eye Liverpool scalp

-

Trump's point man for drilling agenda confirmed by Senate

-

Chipmaker Intel beats revenue expectations amidst Q4 loss

Chipmaker Intel beats revenue expectations amidst Q4 loss

-

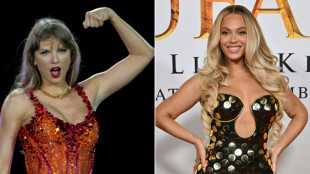

Key nominees for the Grammy Awards

-

Beyonce leads Grammys pack at gala backdropped by fires

Beyonce leads Grammys pack at gala backdropped by fires

-

Samsung Electronics posts 129.85% jump in Q4 operating profit

-

'Shouldn't have happened:' DC air collision stuns experts

'Shouldn't have happened:' DC air collision stuns experts

-

Donald Trump: air crash investigator-in-chief?

-

Nicaragua legislature cements 'absolute power' of president, wife

Nicaragua legislature cements 'absolute power' of president, wife

-

McIlroy launches PGA season debut with hole-in-one

-

Figure skating in shock as athletes, coaches perish in US crash

Figure skating in shock as athletes, coaches perish in US crash

-

Kim opens up four-stroke lead in LPGA's season opener

-

Man Utd progress to Europa last 16 'really important' for Amorim overhaul

Man Utd progress to Europa last 16 'really important' for Amorim overhaul

-

Postecoglou hails Europa League win 'made in Tottenham'

-

'Not interested': Analysts sceptical about US, Russia nuclear talks

'Not interested': Analysts sceptical about US, Russia nuclear talks

-

Trump to decide on oil tariffs on Canada, Mexico

-

MAHA Moms: Why RFK Jr's health agenda resonates with Americans

MAHA Moms: Why RFK Jr's health agenda resonates with Americans

-

Neymar, eyeing 2026 World Cup, announces return to Brazil's Santos

-

'The region will die': Ukraine's Donbas mines within Russia's grasp

'The region will die': Ukraine's Donbas mines within Russia's grasp

-

'Campaign of terror': Georgia's escalating rights crackdown

-

French luxury billionaire sparks tax debate with threat to leave

French luxury billionaire sparks tax debate with threat to leave

-

Apple profit climbs but sales miss expectations

-

Man Utd, Spurs advance to last 16 in Europa League

Man Utd, Spurs advance to last 16 in Europa League

-

Trump blames deadly Washington air collision on 'diversity'

Samsung operating profit hit by R&D spending, fight to meet chip demand

The operating profit of South Korean tech giant Samsung Electronics sank almost a third in the fourth quarter owing to spending on research, the company said Friday, as analysts said it was struggling to meet demand for chips used in AI servers.

The news comes as industry leaders try to assess the outlook for the sector after Chinese startup DeepSeek unveiled a groundbreaking chatbot that performed as well as artificial intelligence pacesetters -- apparently for a fraction of the cost.

The world's largest memory-chip maker had already acknowledged in October that it was facing a "crisis", and acknowledged questions had arisen about its "fundamental technological competitiveness and the future of the company".

It said operating profit fell to 6.5 trillion won ($4.5 billion) in October-December, from 9.18 trillion won in the previous three months. However, it was up 130 percent on-year.

Sales rose 11.8 percent to 75.78 trillion won and net profit rose 22.2 percent to 7.75 trillion won, topping forecasts according to Yonhap News Agency.

The firm said the fourth-quarter fall-off was down to "soft market conditions especially for IT products, and an increase in expenditures including R&D", as well as the "initial ramp-up costs to secure production capacity for cutting-edge nodes".

It warned that in the first three months of 2025 "overall earnings improvement may be limited due to weakness in the semiconductors business".

- Struggling -

US titan Nvidia, whose semiconductors power the AI industry, has been relying on SK hynix as its main supplier of high-bandwidth memory (HBM) chips for its AI graphics processing units (GPU).

But Samsung, the world's largest memory chip maker, has been struggling to meet the US firm's requirements.

Gloria Tsuen, a Moody's Ratings vice president and senior credit officer, told AFP that its technology leadership "in the semiconductor market has been eroded over the last few years".

"The rapidly increasing demand for AI chips also heightens the technological difficulty in developing new, custom-made chips for customers in a timely manner," she added.

Neil Shah of Counterpoint Research said Samsung's "conservative" moves to focus on costs relative to more challenging customer demands had been "key factors for the headwinds".

Still, Bloomberg reported Friday that Samsung had obtained approval to supply a "version of its fifth-generation high-bandwidth memory (HBM) chips" to Nvidia, citing people familiar with the matter. Samsung declined to comment when asked by AFP about the report.

The earnings figures come as the tech world is shaken by news of DeepSeek new R1 chatbot, which sparked at rout in tech titans -- Nvidia dived 17 percent Monday -- and raised questions about the hundreds of billions of dollars invested in AI in recent years.

The Chinese startup has said it used less-advanced H800 chips -- permitted for export to China until late 2023 -- to power its large learning model.

Worries about the impact of DeepSeek battered stocks in Seoul as the market reopened after an extended break Friday.

Samsung fell more than two percent, while SK hynix plunged almost 12 percent at one point.

Jaejune Kim, executive vice president of Samsung's memory business, said in an earnings call that the company was "monitoring industry trends considering various scenarios", as it also supplies HBM chips used in GPUs to various clients.

"While it is premature to make judgements based on the currently limited information, we anticipate that long-term opportunities and short-term risks will coexist in the market," he said.

He added that Samsung was determined to "actively respond to the rapidly evolving AI market".

While Samsung faces fundamental technology headwinds, DeepSeek's claims have "challenged the fundamental economics and investments for ongoing AI waves", said Counterpoint's Shah.

"This 'frugal innovation' could potentially slow down or stretch the hundreds of billions of dollars in AI infrastructure investments over the years," he said.

"So, this could be a 'blessing in disguise' for Samsung, allowing them to take the time needed to perfect their solution or to lower costs," he added.

O.Krause--BTB