-

Real Madrid need flawless game against Atletico: Vinicius

Real Madrid need flawless game against Atletico: Vinicius

-

'FIFA owed me this money' says Platini in appeals court

-

French ex-surgeon says 'ready to admit' to some rapes at mass abuse trial

French ex-surgeon says 'ready to admit' to some rapes at mass abuse trial

-

The guilt got him: Dutch robber confesses nine years on

-

Clock ticking down to Trump tariffs on Canada, Mexico, China

Clock ticking down to Trump tariffs on Canada, Mexico, China

-

One dead, several hurt as car hits crowd in German city: police

-

Australia ready for India's spin challenge, says Smith

Australia ready for India's spin challenge, says Smith

-

Nuclear monitor defends Ukraine plant visit via Russia-controlled territory

-

Club Brugge aim to take Aston Villa scalp again in Champions League

Club Brugge aim to take Aston Villa scalp again in Champions League

-

EU chief offers carmakers more time on emission rules to avoid fines

-

Dortmund 'still improving' ahead of Lille clash, says coach Kovac

Dortmund 'still improving' ahead of Lille clash, says coach Kovac

-

Wearable tech has far to go before challenging smartphones

-

Atletico have 'big opportunity' against Real Madrid, says Simeone

Atletico have 'big opportunity' against Real Madrid, says Simeone

-

FA defends ball after Guardiola says it is difficult to control

-

Ski crash almost killed me, says French racer Sarrazin

Ski crash almost killed me, says French racer Sarrazin

-

UK's Royal Society of top scientists debates call to expel Elon Musk

-

Hansen, McCarthy sign new deals with Ireland

Hansen, McCarthy sign new deals with Ireland

-

Rocket set to launch in boost for Europe space ambitions

-

What we know about the health of Pope Francis

What we know about the health of Pope Francis

-

Paris Fashion Week kicks off with big designer debuts expected

-

Eurozone inflation eases slightly in February

Eurozone inflation eases slightly in February

-

Wing Hansen signs new deal with Ireland

-

First deadly attack in Israel since Gaza truce began

First deadly attack in Israel since Gaza truce began

-

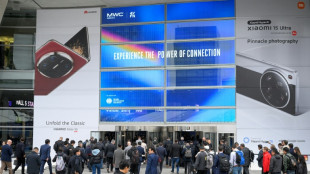

AI, trade tensions mark Barcelona mobile industry meet

-

European defence stocks soar as govts up military spend

European defence stocks soar as govts up military spend

-

France says Ukraine truce would test Russia's commitment to end war

-

Paris imposes car-sharing lane on congested ring road

Paris imposes car-sharing lane on congested ring road

-

One dead in Israel stabbing attack, assailant killed: first responders

-

India brace for 'nervy times' against Australia in semi-final

India brace for 'nervy times' against Australia in semi-final

-

Teen heir to Japanese throne says marriage not on his mind

-

Singapore probes final destination of possible Nvidia chip servers

Singapore probes final destination of possible Nvidia chip servers

-

Asian markets creep up on hopes of China fiscal response to Trump tariffs

-

Police, art sleuth crack case of Brueghel stolen in Poland in 1974

Police, art sleuth crack case of Brueghel stolen in Poland in 1974

-

Hospitalised pope stable, rested overnight: Vatican

-

First Oscar for Brazil adds zest to Rio Carnival extravaganza

First Oscar for Brazil adds zest to Rio Carnival extravaganza

-

Japan deploys 2,000 firefighters to tackle forest blaze

-

7-Eleven to replace CEO in Couche-Tard takeover battle: reports

7-Eleven to replace CEO in Couche-Tard takeover battle: reports

-

Melting ice could slow vital Antarctic ocean current: study

-

AI, trade tensions to mark Barcelona mobile industry meet

AI, trade tensions to mark Barcelona mobile industry meet

-

'Where's the gold?': How the Assads sucked Syria dry

-

Toasts to LA and consolation drinks flow backstage at Oscars

Toasts to LA and consolation drinks flow backstage at Oscars

-

Conan, Gaza and Hackman: top moments from the Oscars

-

Cavs rally to beat Blazers in OT for 10th straight NBA victory

Cavs rally to beat Blazers in OT for 10th straight NBA victory

-

Oz, Bond and Quincy Jones: Oscars a musical ode to film icons

-

Satellite launcher set for blastoff in boost for Europe space ambitions

Satellite launcher set for blastoff in boost for Europe space ambitions

-

'Anora,' a sex worker tragicomedy, wins best picture at Oscars

-

ECB to cut rates again as debate heats up on pause

ECB to cut rates again as debate heats up on pause

-

Zelensky says 'will not be simple' to replace him as Ukraine leader

-

Asian markets climb on hopes of China fiscal response to Trump tariffs

Asian markets climb on hopes of China fiscal response to Trump tariffs

-

Small-budget sex worker romp 'Anora' triumphs at Oscars

ECB to cut rates again as debate heats up on pause

The European Central Bank is expected to cut interest rates again this week in a bid to boost the floundering eurozone economy, even as debate heats up about when to hit pause.

It will mark the central bank's sixth reduction since June last year, with its focus having shifted from tackling inflation to relieving pressure on the 20 nations that use the euro.

With "growth stuttering", a quarter-point cut at Thursday's meeting "is a near certainty", HSBC bank analysts said.

A reduction by a quarter percentage point would bring the bank's benchmark deposit rate to 2.50 percent.

The rate reached a record of four percent in late 2023 after the ECB launched an unprecedented hiking cycle to tame energy and food costs that surged after Russia's invasion of Ukraine.

But investors will be keeping an eye out for signals from ECB President Christine Lagarde that a pause might be on the horizon, after some officials said it was time to start discussing the matter.

Markets have indicated they expect the ECB to bring the deposit rate steadily down to two percent by the end of the year to support a eurozone economy that has showed increasing signs of weakness.

- Rate debate -

Some policymakers are starting to ask how the central bank should continue on the path downward.

Isabel Schnabel, an influential member of the ECB's board, told The Financial Times last month that policymakers were getting "closer to the point where we may have to pause or halt our rate cuts".

"We can no longer say with confidence that our monetary policy is still restrictive," she said.

Meanwhile Pierre Wunsch, a member of the ECB's rate-setting governing council and Belgium's central bank chief, also warned against "sleepwalking" into making too many reductions.

Uncertainty about the potential impact of US President Donald Trump's policies is also clouding the outlook.

Some are fearful that eurozone growth could be hit if he goes ahead with levying tariffs on EU goods, while others worry that a broad, disruptive trade war could reignite inflation.

Eurozone inflation has already ticked up in recent months, hitting 2.5 percent in January, though ECB officials have voiced confidence it will settle around the central bank's two-percent target later this year.

In the United States, where the economy is in more robust health than in the eurozone, the Federal Reserve paused rate cuts recently after inflation rose and amid uncertainty about the future direction of Trump's policy.

But ING bank analyst Carsten Brzeski pointed out that, while some ECB members were starting to push back against too much easing, there remained others with a "dovish" bias who were "still calling for continued rate cuts".

And most observers do not expect Lagarde, who says the central bank will continue to make decisions "meeting-by-meeting", to give any clear signals about a potential pause.

- Poor outlook -

The ECB will also publish updated economic forecasts on Thursday.

While inflation predictions are expected to remain stable, the central bank might further lower its growth projections for the coming years, according to economists.

The eurozone has eked out meagre growth in the past two years amid a poor performance in its biggest economies, Germany and France, leaving the single currency area lagging behind the United States and China.

While France still faces political instability, there are hopes the recent German election could lead to the formation of a more stable governing coalition that could enact economic reforms.

Despite the debate on a potential pause in rate cuts, Brzeski said the poor outlook might leave the ECB with little choice but to further ease borrowing costs.

"There is still a high risk that the eurozone economy underperforms over the coming months," he said.

This "will force the ECB to bring rates down to at least two percent -- whether they like it or not."

E.Schubert--BTB