-

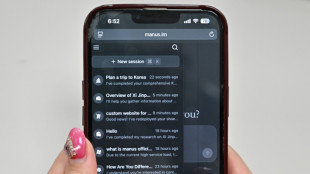

What to know about Manus, China's latest AI assistant

What to know about Manus, China's latest AI assistant

-

Ukraine's Svitolina feels the love in US after Trump-Zelensky dust up

-

US tariffs of 25% on steel, aluminum imports take effect

US tariffs of 25% on steel, aluminum imports take effect

-

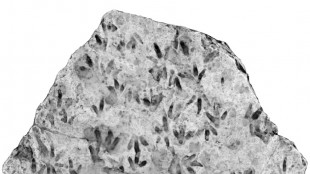

Trove of dinosaur footprints found at Australian school

-

Mongolia's children choke in toxic pollution

Mongolia's children choke in toxic pollution

-

Rubio heads to Canada as Trump wages trade war

-

South Korean pastor vows revolt against Yoon's impeachment

South Korean pastor vows revolt against Yoon's impeachment

-

Pakistan to launch 'full-scale' operation to free train hostages

-

Syria determined to 'prevent unlawful revenge' says fact-finding committee

Syria determined to 'prevent unlawful revenge' says fact-finding committee

-

Most Asian stocks drop as Trump trade policy sows uncertainty

-

Morocco fights measles outbreak amid vaccine misinformation

Morocco fights measles outbreak amid vaccine misinformation

-

Garland stars as comeback Cavs bag 15th straight with defeat of Nets

-

Hamilton eyes dream Ferrari start as F1 revs up in Melbourne

Hamilton eyes dream Ferrari start as F1 revs up in Melbourne

-

Talk of the town: Iconic covers of the New Yorker magazine

-

The New Yorker, a US institution, celebrates 100 years of goings on

The New Yorker, a US institution, celebrates 100 years of goings on

-

Cuban kids resist reggaeton, one verse at a time

-

NASA fires chief scientist, more Trump cuts to come

NASA fires chief scientist, more Trump cuts to come

-

Denmark's Rune ready to break out of tennis doldrums

-

Transformed PSG make statement by ousting Liverpool from Champions League

Transformed PSG make statement by ousting Liverpool from Champions League

-

PSG down Liverpool on penalties in Champions League, Bayern thrash Leverkusen

-

Liverpool 'ran out of luck' against PSG, says Slot

Liverpool 'ran out of luck' against PSG, says Slot

-

Swiatek surges into quarter-finals at rainy Indian Wells, Rune tops Tsitsipas

-

PSG stun Liverpool on penalties to make Champions League quarters

PSG stun Liverpool on penalties to make Champions League quarters

-

PSG beat Liverpool on penalties to reach Champions League quarter-finals

-

Inter cruise into Champions League quarters and titanic Bayern clash

Inter cruise into Champions League quarters and titanic Bayern clash

-

Trump has 'bolstered' PGA-LIV reunification talks: Monahan

-

Kane leads Bayern past Leverkusen into Champions League last eight

Kane leads Bayern past Leverkusen into Champions League last eight

-

Defending champ Swiatek surges into quarter-finals at rainy Indian Wells

-

Piastri signs long-term extension with McLaren

Piastri signs long-term extension with McLaren

-

Trump talks up Tesla in White House show of support for Musk

-

US trades barbs with Canada as steel, aluminum tariffs loom

US trades barbs with Canada as steel, aluminum tariffs loom

-

Oil companies greet Trump return, muted on tariffs

-

Italian defence firm Leonardo to boost capacity amid geopolitical risks

Italian defence firm Leonardo to boost capacity amid geopolitical risks

-

Over 100 hostages freed in deadly Pakistan train siege

-

Ukraine backs 30-day ceasefire as US ends aid freeze

Ukraine backs 30-day ceasefire as US ends aid freeze

-

Swiatek powers into Indian Wells quarter-finals

-

Tiger Woods has surgery for ruptured Achilles tendon

Tiger Woods has surgery for ruptured Achilles tendon

-

Trump burnishes Tesla at White House in show of support for Musk

-

Macron urges allies to plan 'credible security guarantees' for Ukraine

Macron urges allies to plan 'credible security guarantees' for Ukraine

-

Yamal, Raphinha fire Barca past Benfica into Champions League last eight

-

Trump may rethink plans to double Canada steel, aluminum tariffs

Trump may rethink plans to double Canada steel, aluminum tariffs

-

Maradona medical team on trial for 'horror theater' of his death

-

UK makes manslaughter arrest of ship captain over North Sea crash

UK makes manslaughter arrest of ship captain over North Sea crash

-

Ukraine backs US proposal for 30-day ceasefire in war with Russia

-

Mitrovic misses AFC Champions League clash due to irregular heart beat

Mitrovic misses AFC Champions League clash due to irregular heart beat

-

Trump's 'The Apprentice' re-runs hit Amazon

-

Dozens freed, hundreds still held hostage in deadly Pakistan train siege

Dozens freed, hundreds still held hostage in deadly Pakistan train siege

-

Italian defence firm Leonardo to focus on int'l alliances for growth

-

Israel kills senior Hezbollah militant, frees four Lebanese prisoners

Israel kills senior Hezbollah militant, frees four Lebanese prisoners

-

Dozens of hostages freed, hundreds still held in Pakistan train seige

Volkswagen to navigate another tricky year after 2024 profit plunge

Volkswagen said Tuesday its profits nosedived in 2024 amid high costs and fierce Chinese competition as the German carmaker geared up for another tricky year navigating an industry transition and global trade tensions.

At 12.4 billion euros ($13.4 billion) in 2024, net profit for Europe's biggest automaker fell over 30 percent compared with the previous year, even as overall sales grew slightly to reach 324.7 billion euros.

The 10-brand group said its earnings last year were hit by high costs as it faces a stuttering shift to electric vehicles, weak demand in Europe and fierce competition from local rivals in key market China.

The manufacturer, whose models range from Audi to Seat and Skoda, had a particularly difficult 2024 marked by a long dispute with unions that ended with a deal in December to cut 35,000 jobs in Germany by 2030.

The carmaker ultimately decided against closing factories at home for the first time ever, but its problems nevertheless highlighted a broader crisis buffeting Europe's ailing auto industry as it struggles to keep pace with rapid changes.

As it seeks to plot a way forward, finance chief Arno Antlitz vowed Volkswagen would focus on "consistently reducing costs and increasing profitability".

"We need to build more cars with fewer people," he added.

- China troubles -

Highlighting Volkswagen's difficulties, its deliveries last year to China -- its single biggest national market -- fell almost 10 percent, even as they were flat or rose in the rest of the world.

The weakness in China was behind an overall 3.5-percent drop in unit sales, with Volkswagen only shifting around nine million vehicles worldwide last year.

Antlitz nevertheless said he believed that recovery in China, where VW has been losing market share to local rivals like electric carmaker BYD, might be in sight

"We want to fight back in and start gaining market share in China by 2026 at the latest," he said.

For 2025, the group expects revenue to grow by up to five percent and is forecasting a profit margin of between 5.5 and 6.5 percent.

At the upper end, this would be better than the figure for last year, but still below the seven percent it achieved in 2023.

Volkswagen's shares jumped over three percent in Frankfurt immediately after the results were announced, with analyst Pal Skirta of German bank Metzler saying the "optimistic" outlook had pushed them higher.

But in afternoon trade they pulled back and were trading slightly in the red.

- Trump troubles -

The carmaker also warned that 2025 could be marked by challenges arising "from an environment characterised by political uncertainty, increasing trade restrictions and geopolitical tensions".

US President Donald Trump has upended global trade by unleashing a series of tariffs and threats targeting US allies and adversaries.

Volkswagen CEO Oliver Blume told reporters that he hoped the company's footprint in the United States -- where it employs tens of thousands -- could help it make the argument for a "fair compromise" on tariffs levied on Mexico and Canada, where carmakers' source parts.

Trump last week hit all imports from Canada and Mexico with tariffs but then granted an exemption to most auto imports after an outcry from US automakers.

"The US automotive industry has very strong, deep integration in Canada in particular, but also in Mexico," he said.

"We're counting on the strong investment footprint we have in the USA, including future plans," he added.

He also welcomed a proposal last week by the European Commission to give carmakers more time to meet tough emissions reductions targets.

"People have carried out a reality check. The ramp-up of electromobility has not developed as quickly as was assumed years ago," he said.

J.Horn--BTB