-

Ireland prop Porter denies wrongdoing after Dupont Six Nations injury

Ireland prop Porter denies wrongdoing after Dupont Six Nations injury

-

Captain of cargo ship in North Sea crash is Russian: vessel owner

-

West says next step 'up to Putin' on Ukraine ceasefire proposal

West says next step 'up to Putin' on Ukraine ceasefire proposal

-

Battery maker Northvolt files for bankruptcy in Sweden

-

Arrested former Philippine president Duterte's lawyers demand his return

Arrested former Philippine president Duterte's lawyers demand his return

-

Eubank Jr fined £100,000 for hitting boxing rival Benn in face with an egg

-

Snorkel with me to understand climate change, Palau president tells Trump

Snorkel with me to understand climate change, Palau president tells Trump

-

Georgia court extends ex-president Saakashvili's jail term

-

China, EU vow countermeasures against sweeping US steel tariffs

China, EU vow countermeasures against sweeping US steel tariffs

-

Markets mixed as Trump trade policy sows uncertainty

-

German arms firm Rheinmetall seizes on European 'era of rearmament'

German arms firm Rheinmetall seizes on European 'era of rearmament'

-

AI chatbot helps victims of digital sexual violence in Latin America

-

Russian playwright tells story of wounded soldiers

Russian playwright tells story of wounded soldiers

-

'Stranded' astronauts closer to coming home after next ISS launch

-

Medvedev tops Paul to reach quarter-finals at rainy Indian Wells

Medvedev tops Paul to reach quarter-finals at rainy Indian Wells

-

Thailand sacks senior cop over illicit gambling, fraud

-

Pakistan launches 'full-scale' operation to free train hostages

Pakistan launches 'full-scale' operation to free train hostages

-

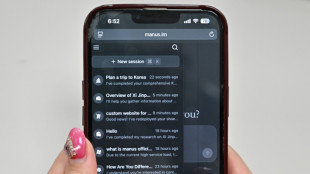

What to know about Manus, China's latest AI assistant

-

Ukraine's Svitolina feels the love in US after Trump-Zelensky dust up

Ukraine's Svitolina feels the love in US after Trump-Zelensky dust up

-

US tariffs of 25% on steel, aluminum imports take effect

-

Trove of dinosaur footprints found at Australian school

Trove of dinosaur footprints found at Australian school

-

Mongolia's children choke in toxic pollution

-

Rubio heads to Canada as Trump wages trade war

Rubio heads to Canada as Trump wages trade war

-

South Korean pastor vows revolt against Yoon's impeachment

-

Pakistan to launch 'full-scale' operation to free train hostages

Pakistan to launch 'full-scale' operation to free train hostages

-

Syria determined to 'prevent unlawful revenge' says fact-finding committee

-

Most Asian stocks drop as Trump trade policy sows uncertainty

Most Asian stocks drop as Trump trade policy sows uncertainty

-

Morocco fights measles outbreak amid vaccine misinformation

-

Garland stars as comeback Cavs bag 15th straight with defeat of Nets

Garland stars as comeback Cavs bag 15th straight with defeat of Nets

-

Hamilton eyes dream Ferrari start as F1 revs up in Melbourne

-

Talk of the town: Iconic covers of the New Yorker magazine

Talk of the town: Iconic covers of the New Yorker magazine

-

The New Yorker, a US institution, celebrates 100 years of goings on

-

Cuban kids resist reggaeton, one verse at a time

Cuban kids resist reggaeton, one verse at a time

-

NASA fires chief scientist, more Trump cuts to come

-

Denmark's Rune ready to break out of tennis doldrums

Denmark's Rune ready to break out of tennis doldrums

-

Transformed PSG make statement by ousting Liverpool from Champions League

-

PSG down Liverpool on penalties in Champions League, Bayern thrash Leverkusen

PSG down Liverpool on penalties in Champions League, Bayern thrash Leverkusen

-

Liverpool 'ran out of luck' against PSG, says Slot

-

Swiatek surges into quarter-finals at rainy Indian Wells, Rune tops Tsitsipas

Swiatek surges into quarter-finals at rainy Indian Wells, Rune tops Tsitsipas

-

PSG stun Liverpool on penalties to make Champions League quarters

-

PSG beat Liverpool on penalties to reach Champions League quarter-finals

PSG beat Liverpool on penalties to reach Champions League quarter-finals

-

Inter cruise into Champions League quarters and titanic Bayern clash

-

Trump has 'bolstered' PGA-LIV reunification talks: Monahan

Trump has 'bolstered' PGA-LIV reunification talks: Monahan

-

Kane leads Bayern past Leverkusen into Champions League last eight

-

Defending champ Swiatek surges into quarter-finals at rainy Indian Wells

Defending champ Swiatek surges into quarter-finals at rainy Indian Wells

-

Piastri signs long-term extension with McLaren

-

Trump talks up Tesla in White House show of support for Musk

Trump talks up Tesla in White House show of support for Musk

-

US trades barbs with Canada as steel, aluminum tariffs loom

-

Oil companies greet Trump return, muted on tariffs

Oil companies greet Trump return, muted on tariffs

-

Italian defence firm Leonardo to boost capacity amid geopolitical risks

Curve Energy Corp. And Lot 49 Capital Corp. Sign Definitive Agreement for Amalgamation and TSX Venture Listing

VANCOUVER, BC / ACCESS Newswire / March 11, 2025 / Curve Energy Corp. (the "Company" or "Curve") and Lot 49 Capital Corp. ("Lot 49") are pleased to announce that they have entered into a definitive agreement (the "Definitive Agreement") to combine the two companies (the "Transaction") which will constitute a reverse takeover transaction ("RTO") of Lot 49. The Transaction is structured to facilitate the listing of the combined entity on the TSX Venture Exchange ("TSXV").

The Transaction is expected to be completed by way of a three-cornered amalgamation under the provisions of the Business Corporations Act (British Columbia) whereby a wholly-owned subsidiary of Lot 49 ("SubCo"), will amalgamate with Curve. All of the issued and outstanding common shares of SubCo and Curve following the amalgamation will be immediately exchanged for common shares of Lot 49 ("Lot 49 Shares") on a one-for-one basis.

In connection with closing of the Transaction, Lot 49 intends to settle approximately $138,722 of outstanding debt through the issuance of Lot 49 Shares and complete a subscription receipt financing for gross proceeds of approximately $250,000, with such subscription receipts convertible into Lot 49 Shares on closing of the Transaction. After giving effect to the proposed debt settlement and subscription receipt financing, it is anticipated that approximately 2,954,478 Lot 49 Shares will be outstanding immediately prior to closing of the Transaction. In addition, Curve intends to close a non-brokered private placement for gross proceeds of up to $750,000 prior to closing of the Transaction, such that upon completion of the Transaction, it is anticipated that approximately 124,982,673 Lot 49 Shares will be issued to Curve shareholders, giving Curve shareholders ownership of approximately 97.7% of the resulting issuer.

As part of the Transaction, the current board and management team of Lot 49 will be replaced by Curve's existing leadership, ensuring continuity in Curve's strategic vision and operational execution.

"We are excited to take this next step with Lot 49, positioning Curve Energy for growth and innovation in the fuel and refinery technology sector," said Peter Joyce, CEO of Curve. "Our focus remains on advancing proprietary green chemistry solutions that transform the maritime fuel industry while enhancing sustainability across broader fuel markets."

The completion of the Transaction is subject to satisfaction or waiver of customary closing conditions and receipt of certain necessary regulatory approvals, including acceptance by the TSXV. Further details, including timelines and any required shareholder approvals, will be provided as the Transaction progresses.

About Curve Energy Corp.

Curve Energy Corp. is a technology-driven company pioneering advanced green chemistry solutions for the maritime fuel industry and broader energy markets. The company's patented desulfurization technology upgrades Heavy Fuel Oil (HSFO) by removing sulfur, nitrogen, and vanadium, converting it into Very Low Sulfur Fuel Oil (VLSFO) under near-ambient conditions. Curve's technology eliminates the need for carbon-intensive SMR hydrogen desulfurization, blended fuels, and scrubbers, which operate by spraying exhaust gases with seawater, causing a reaction with sulfur oxides that forms sulfuric acid, which is then discharged into the ocean.

Curve's flagship product, Benchmark VLSFO Curve - SR™ (Curve's Straight Run), is engineered to meet both current and anticipated regulatory standards. As global emissions and fuel quality requirements become increasingly stringent, Curve's scalable and environmentally responsible solution offers an industry-leading yield rate, delivering a high-efficiency, low-carbon alternative for maritime and industrial fuel applications. Additionally, Curve's process enhances profitability by enabling the use of discounted feedstocks that alternative solutions cannot efficiently process, unlocking new economic advantages for refiners and fuel suppliers.

The Company's proprietary process produces IMO 2020-compliant VLSFO and operates within a closed-loop system, maximizing yield efficiency while minimizing environmental impact. Curve's Tank-to-Tank System allows seamless scalability and deployment at ports, terminals, and refineries, requiring minimal infrastructure modifications.

Curve is strategically focused on growth and innovation in refining, industrial fuels, and petrochemicals, with near-term objectives including the development of its first commercial-scale plant. Additionally, the Company is advancing digital refinery optimization, leveraging data-driven solutions to enhance operational efficiency and sustainability.

Looking ahead, Curve is positioned to expand into emerging fuel markets, including alternative fuel development, carbon reduction technologies, and advanced refining solutions. As global energy demand evolves, the Company continues to explore new applications, strategic partnerships, and infrastructure deployment opportunities to accelerate sustainable growth and long-term value creation.

For more information about Curve, visit https://www.curvenrg.com

On behalf of the Board of Directors

Peter Joyce

Chief Executive Officer

Forward Looking Information

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". This information and these statements, referred to herein as "forward‐looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management's expectations and intentions with respect to, among other things: the business plans of Curve and the resulting issuer, the pro forma capital structure of the resulting issuer, the Transaction (including TSXV approval and the closing of the Transaction); completion of the anticipated debt settlement and financings; the efficiency and anticipated applications of the Company's product offerings; and management's beliefs regarding the Company's ability to expand into emerging fuel markets.

These forward‐looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, the risks that: the Company and the resulting issuer will not be able to achieve its business plans; the anticipated pro forma capital structure of the resulting issuer will differ from what is contemplated; the parties may be unable to close the debt settlement and financings; the Company and Lot 49 will be unable to close the Transaction or obtain the requisite third party approvals to close the Transaction; and new laws or regulations could adversely affect the resulting issuer's business and results of operations.

In making the forward looking statements in this news release, the Company has applied several material assumptions, including without limitation, that: the Company and the resulting issuer will be able to carry out its combined business plans as anticipated; the parties will be able to close the debt settlement and financings and will be able to do so on anticipated timelines; and the Company and Lot 49 will receive all necessary third party approvals and will close the Transaction.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws.

CONTACT:

Peter Joyce

[email protected]

SOURCE: Curve Energy

View the original press release on ACCESS Newswire

W.Lapointe--BTB