-

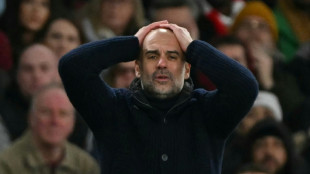

Guardiola relishing 'big fight' for Champions League qualification

Guardiola relishing 'big fight' for Champions League qualification

-

Duterte follows ICC hearing over drug war case via videolink

-

Mark Carney to be sworn in as Canada PM

Mark Carney to be sworn in as Canada PM

-

Chelsea can be flexible, says Maresca

-

UN migration agency laying off around 20% of HQ staff amid US aid cuts: sources

UN migration agency laying off around 20% of HQ staff amid US aid cuts: sources

-

Pique denies Rubiales kickbacks in Spanish Super Cup move to Saudi

-

Tuchel hopes to bring Premier League power to England reign

Tuchel hopes to bring Premier League power to England reign

-

UN chief promises to do "everything" to avoid food cuts to Rohingyas in Bangladesh

-

UniCredit gets ECB nod on Commerzbank stake, but delays merger decision

UniCredit gets ECB nod on Commerzbank stake, but delays merger decision

-

Sri Lanka adjusts train timings to tackle elephant deaths

-

Scotland out to 'disrupt' France's Six Nations title hopes, says Russell

Scotland out to 'disrupt' France's Six Nations title hopes, says Russell

-

BMW expects big hit from tariffs after 2024 profits plunge

-

Bayern's Kim sidelined for 'several weeks' with injury

Bayern's Kim sidelined for 'several weeks' with injury

-

Kremlin says Putin sent 'additional' signals to Trump on ceasefire

-

Funding cuts force WFP to stop food aid to one million in Myanmar

Funding cuts force WFP to stop food aid to one million in Myanmar

-

Thai football body to sue former chief over finances

-

Spain call up Asencio for Nations League quarters

Spain call up Asencio for Nations League quarters

-

Duterte set to face ICC judges in drug war case

-

Gold tops $3,000 for first time on Trump tariff threats

Gold tops $3,000 for first time on Trump tariff threats

-

Canada's Carney to be sworn in as new PM

-

Brignone on verge of World Cup glory with La Thuile super-G triumph

Brignone on verge of World Cup glory with La Thuile super-G triumph

-

UK energy minister heads to China to talk climate

-

Fernandes hits back at Ratcliffe over 'overpaid' jibe

Fernandes hits back at Ratcliffe over 'overpaid' jibe

-

Liverpool's Alexander-Arnold to miss League Cup final in injury blow

-

'God never sleeps': Philippines opponents of Duterte's drug war

'God never sleeps': Philippines opponents of Duterte's drug war

-

Syrian Druze cross armistice line for pilgrimage to Israel

-

Thousands pay to catch glimpse of Ohtani practise in Tokyo

Thousands pay to catch glimpse of Ohtani practise in Tokyo

-

French finance minister calls trade war 'idiotic', plans US trip

-

UN chief in Rohingya refugee camp solidarity visit

UN chief in Rohingya refugee camp solidarity visit

-

Rashford, Henderson recalled in Tuchel's first England squad

-

WFP says funding shortfall forces it to cut food aid to 1 mn people in Myanmar

WFP says funding shortfall forces it to cut food aid to 1 mn people in Myanmar

-

Taiwan tech giant Foxconn's 2024 profit misses forecasts

-

Duterte set to make first ICC appearance

Duterte set to make first ICC appearance

-

Hamilton content after 'completely different' first Ferrari day

-

In a Pakistan desert town, Holi and Ramadan come together

In a Pakistan desert town, Holi and Ramadan come together

-

UK economy unexpectedly shrinks in January in blow to govt

-

UniCredit gets ECB nod for Commerzbank stake

UniCredit gets ECB nod for Commerzbank stake

-

Verstappen blames grip for early Australia struggles

-

WFP to cut food aid to 1 million people in Myanmar

WFP to cut food aid to 1 million people in Myanmar

-

BMW warns on tariffs, China as 2024 profits plunge

-

Driving ban puts brakes on young women in Turkmenistan

Driving ban puts brakes on young women in Turkmenistan

-

East DR Congo mines mint Rwanda-backed M23's fortune

-

Stargazers marvel at 'Blood Moon', rare total lunar eclipse

Stargazers marvel at 'Blood Moon', rare total lunar eclipse

-

US shutdown threat piles pressure on government hit by Trump cuts

-

Peaceful Czechs grapple with youth violence

Peaceful Czechs grapple with youth violence

-

Ivorian painter Aboudia takes teen rebellion to top of the art world

-

Leclerc fastest in second Australian GP practice, Hamilton fifth

Leclerc fastest in second Australian GP practice, Hamilton fifth

-

China urges end to 'illegal' sanctions as it hosts Iran nuclear talks

-

China hosts Iranian, Russian diplomats for nuclear talks

China hosts Iranian, Russian diplomats for nuclear talks

-

Ireland eye unlikely Six Nations title against uncertain Italy

| RIO | 1.73% | 62.28 | $ | |

| BCC | 2.44% | 98.79 | $ | |

| CMSC | 0.3% | 23.24 | $ | |

| NGG | 0.97% | 62.93 | $ | |

| SCS | 1.04% | 10.903 | $ | |

| BCE | -1.01% | 23.432 | $ | |

| RELX | 2.23% | 48.9 | $ | |

| JRI | 0.78% | 12.8966 | $ | |

| RYCEF | 4.02% | 10.19 | $ | |

| RBGPF | -0.35% | 66.2 | $ | |

| BP | 2.37% | 33.155 | $ | |

| CMSD | 0.49% | 23.315 | $ | |

| VOD | 0.31% | 9.53 | $ | |

| GSK | 0.23% | 39.32 | $ | |

| AZN | 1.09% | 77.355 | $ | |

| BTI | -0.77% | 41.065 | $ |

Gold tops $3,000 for first time on Trump tariff threats

Safe-haven gold surpassed $3,000 for the first time Friday, boosted by uncertainty over US President Donald Trump's tariffs, while stock markets gained on hopes US lawmakers will avert a government shutdown.

"Markets hate uncertainty, and Trump's second tenure in the White House has served to provide huge instability over expectations for trade, jobs, inflation, and government spending," said Joshua Mahony, chief market analyst at Scope Markets.

However, Asian equities managed to end the week on a positive note while European markets were also up in midday deals.

Stocks gained support from "hopes that the US government would avoid a shutdown of non-essential services", said Derren Nathan, head of equity research at Hargreaves Lansdown.

With just hours until a deadline to push a Republican spending bill through, Senate Democratic leader Chuck Schumer dropped his threat to block it.

The package would keep the lights on through September, but Democrats have come under pressure from their grassroots to defy the plan, which they say is full of harmful spending cuts.

London's FTSE 100 index rose as the pound dropped against the dollar, after data showed the UK economy unexpectedly shrank in January.

In the eurozone, Paris and Frankfurt both rebounded after losses the previous day on US tariff threats.

In the latest salvo, Trump threatened to impose 200 percent tariffs on wine, champagne and other alcoholic beverages from European Union countries in retaliation against the bloc's planned levies on American-made whiskey and other products.

The EU's tariffs were announced in retaliation to Trump's levies on steel and aluminium.

The president said he would not row back on the metals duties, nor plans for sweeping reciprocal tariffs on countries worldwide that are due to kick in as soon as April 2.

Observers have warned that markets are being wracked by uncertainty amid fears the increasing trade war between major global economies could reignite inflation.

Wall Street has been hammered, with the S&P 500 slipping into a correction Thursday, having fallen more than 10 percent from its recent peak -- a record high touched just last month.

In Asia, markets benefitted from news that Chinese officials would hold a news conference Monday on measures to boost consumption, with Hong Kong rising over two percent and Shanghai jumping 1.8 percent on Friday.

Tokyo also advanced.

In company news, shares in Gucci-owner Kering slumped more than 10 percent in Paris as the group appointed a new creative director to helm its struggling flagship brand.

Shares in BMW dropped over two percent as the German premium carmaker reported a plunge in profits last year and warned of challenges for the year ahead from trade tensions and weak demand in China.

Meanwhile, major conglomerate CK Hutchison Holdings -- owned by tycoon Li Ka-shing -- tumbled in Hong Kong after Chinese officials in the city reposted an newspaper opinion piece attacking the firm over its sale of a controlling stake in Panama ports under pressure from Trump.

It had surged as much as 25 percent after the sale last week.

- Key figures around 1040 GMT -

London - FTSE 100: UP 0.5 percent at 8,585.92 points

Paris - CAC 40: UP 0.7 percent at 7,995.07

Frankfurt - DAX: UP 0.9 percent at 22,779.07

Tokyo - Nikkei 225: UP 0.7 percent at 37,053.10 (close)

Hong Kong - Hang Seng Index: UP 2.1 percent at 23,959.98 (close)

Shanghai - Composite: UP 1.8 percent at 3,419.56 (close)

New York - Dow: DOWN 1.3 percent at 40,813.57 (close)

Euro/dollar: UP at $1.0889 from $1.0849 on Thursday

Pound/dollar: DOWN at $1.2942 from $1.2948

Dollar/yen: UP at 148.66 yen from 147.75 yen

Euro/pound: UP at 84.08 pence from 83.75 pence

Brent North Sea Crude: UP 0.9 percent at $70.52 per barrel

West Texas Intermediate: UP 1.0 percent at $67.22 per barrel

I.Meyer--BTB