-

China EV giant BYD soars after 5-minute charging platform unveiled

China EV giant BYD soars after 5-minute charging platform unveiled

-

Israel pounds Hamas in Gaza in strikes that rescuers say killed 121

-

Red-hot Forest striker Wood targets New Zealand history at World Cup

Red-hot Forest striker Wood targets New Zealand history at World Cup

-

'We will preserve them': saving Cambodia's crocodiles

-

Japan set to seal World Cup spot as Son aims to forget Spurs woes

Japan set to seal World Cup spot as Son aims to forget Spurs woes

-

Huthis claim new attack on American warships, report new US strikes

-

Asian markets track Wall St gains as tech inspires Hong Kong

Asian markets track Wall St gains as tech inspires Hong Kong

-

Japan victims voice fears 30 years after sarin subway attack

-

Bach's successor needs cool head to guide Olympics through stormy seas: experts

Bach's successor needs cool head to guide Olympics through stormy seas: experts

-

What happens to the human body in deep space?

-

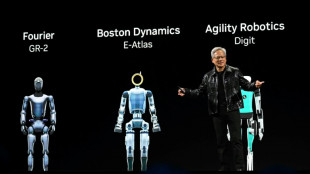

Nvidia showcases AI chips as it shrugs off DeepSeek

Nvidia showcases AI chips as it shrugs off DeepSeek

-

Legalizing magic mushrooms under Trump? Psychedelic fans remain skeptical

-

Fired US federal worker in need of releasing steam? Try the internet

Fired US federal worker in need of releasing steam? Try the internet

-

'No going back': Serbia protests heap pressure on government

-

Trump touts control over famed arts venue

Trump touts control over famed arts venue

-

Trump taps Michelle Bowman to be US Fed vice chair for supervision

-

Jury deliberates US pipeline case with free speech implications

Jury deliberates US pipeline case with free speech implications

-

European star-gazing agency says Chile green power plant will ruin its view

-

Carney says Canada 'too reliant on US' on UK, France trip

Carney says Canada 'too reliant on US' on UK, France trip

-

Starbucks ordered to pay $50m for hot tea spill

-

Talks on divisive deep-sea mining resume in Jamaica

Talks on divisive deep-sea mining resume in Jamaica

-

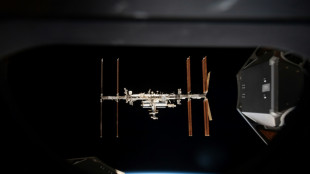

Astronauts finally to return after unexpected 9-month ISS stay

-

Trump veers towards courts clash over migrant flights

Trump veers towards courts clash over migrant flights

-

Donors pledge 5.8 bn euros for Syria, down on last year

-

M23 shuns DR Congo peace talks at 11th hour after sanctions

M23 shuns DR Congo peace talks at 11th hour after sanctions

-

Man Utd defy fan groups with five percent season ticket rise

-

Huthis report new US strikes after major rallies in rebel-held Yemen

Huthis report new US strikes after major rallies in rebel-held Yemen

-

UN chief meets rival Cyprus leaders ahead of talks

-

Messi out injured as Argentina seek to seal World Cup place

Messi out injured as Argentina seek to seal World Cup place

-

New blow to German auto sector as Audi announces job cuts

-

New Canada PM meets King Charles and Macron after Trump threats

New Canada PM meets King Charles and Macron after Trump threats

-

Conan O'Brien tapped to host Oscars again

-

China stimulus hopes help stock markets rise

China stimulus hopes help stock markets rise

-

Hong Kong property tycoon Lee Shau-kee dies aged 97

-

EU vows 2.5 bn euros to help Syrians after Assad ouster

EU vows 2.5 bn euros to help Syrians after Assad ouster

-

'Anti-American'? US questions UN agencies, international aid groups

-

Trump claims Biden pardons of his opponents are void

Trump claims Biden pardons of his opponents are void

-

N.Macedonia mourns 59 killed in nightclub blaze

-

West Ham's Antonio '100 percent' sure he will play again after car crash

West Ham's Antonio '100 percent' sure he will play again after car crash

-

Major rallies in rebel-held Yemen after deadly US strikes

-

Webb telescope directly observes exoplanet CO2 for first time

Webb telescope directly observes exoplanet CO2 for first time

-

Trump to visit top US arts venue after takeover

-

McIlroy wins second Players Championship title in playoff

McIlroy wins second Players Championship title in playoff

-

Stench of death as Sudan army, paramilitaries battle for capital

-

Trump and Zelensky's stormy ties: From impeachment to truce proposal

Trump and Zelensky's stormy ties: From impeachment to truce proposal

-

McIlroy wins Players Championship title in playoff

-

'More and faster': UN calls to shrink buildings' carbon footprint

'More and faster': UN calls to shrink buildings' carbon footprint

-

Plastic pellets spotted in water after North Sea ship crash

-

US retail sales weaker than expected as consumer health under scrutiny

US retail sales weaker than expected as consumer health under scrutiny

-

After ending Man Utd goal drought, Hojlund admits struggles

Court upholds £3 bn lifeline for UK's top water supplier

A UK court on Monday upheld an emergency loan granted to Thames Water, allowing Britain's largest such supplier to keep a financial lifeline as it drowns under massive debt.

The High Court in London last month authorised the £3 billion ($3.9 billion) loan, allowing Thames to stay afloat and stave off a costly public bailout.

However, it was subject to an appeal last week by some of the company's smaller creditors displeased at the terms of the package.

Thames serves 16 million customers, or a quarter of the UK population, in London and surrounding areas.

"We are pleased that the Court of Appeal has today decisively refused the appeals and upheld the strong High Court decision," chief executive Chris Weston said in a statement.

"We remain focused on putting Thames Water onto a more stable financial foundation as we seek a long-term solution to our financial resilience," he added.

The company said it expects to receive the first half of the loan over coming months.

The funds are seen as only a short-term solution for the company, which already had £16 billion of debt, as it looks to attract takeover bids.

Thames is scrambling to find fresh sources of funding, including appealing to the UK water regulator to be allowed to hike bills more than granted.

The company's customers are set to see average annual water bills rise to £588 by 2030 following a decision by British regulator Ofwat -- falling short of the 59-percent hike requested by the troubled group.

Thames and other British water companies, privatised since 1989, are meanwhile under fire for allowing the discharge of large quantities of sewage into rivers and the sea.

This has been blamed on under-investment in a sewage system that dates back largely to the Victorian era.

Y.Bouchard--BTB