-

Leipzig lose ground on Bayern, Dortmund and Leverkusen win

Leipzig lose ground on Bayern, Dortmund and Leverkusen win

-

Fear in central Beirut district hit by Israeli strikes

-

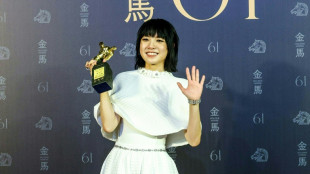

Chinese film about Covid-19 wins Taiwan's top Golden Horse prizes

Chinese film about Covid-19 wins Taiwan's top Golden Horse prizes

-

Tuipulotu puts anger behind him as he captains Scotland against native Australia

-

Inter smash Verona to take Serie A lead

Inter smash Verona to take Serie A lead

-

Mass rape trial sparks demonstrations across France

-

Lebanon says 15 killed in Israeli strike on central Beirut

Lebanon says 15 killed in Israeli strike on central Beirut

-

Eddie Jones will revel in winding up England - Genge

-

Chelsea see off Leicester on Maresca's King Power return

Chelsea see off Leicester on Maresca's King Power return

-

Storms bring chaos to Ireland, France, UK

-

Berrettini gives Italy edge on Australia in Davis Cup semis

Berrettini gives Italy edge on Australia in Davis Cup semis

-

Amber Glenn storms to gold in Cup of China

-

High-flying Chelsea see off Leicester

High-flying Chelsea see off Leicester

-

Climate-threatened nations stage protest at COP29 over contentious deal

-

Families fleeing after 32 killed in new sectarian violence in Pakistan

Families fleeing after 32 killed in new sectarian violence in Pakistan

-

Ancelotti says 'ugly' to speculate about Mbappe mental health

-

Failure haunts UN environment conferences

Failure haunts UN environment conferences

-

Colapinto in doubt for Las Vegas GP after crashing

-

Lebanon says 11 killed in Israeli strike on central Beirut

Lebanon says 11 killed in Israeli strike on central Beirut

-

Three arrested in Spain for racist abuse at Liga Clasico

-

Pope to skip Notre Dame opening for Corsica visit

Pope to skip Notre Dame opening for Corsica visit

-

Tokyo police care for lost umbrellas, keys, flying squirrels

-

Neuville closes in on world title after Rally Japan recovery

Neuville closes in on world title after Rally Japan recovery

-

Jaiswal slams unbeaten 90 as India seize control against Australia

-

'Nice surprise' for Verstappen to edge Norris in Las Vegas GP qualifying

'Nice surprise' for Verstappen to edge Norris in Las Vegas GP qualifying

-

Indian teen admits to 'some nerves' in bid for world chess crown

-

Patrick Reed shoots rare 59 to make Hong Kong Open history

Patrick Reed shoots rare 59 to make Hong Kong Open history

-

Record-breaker Kane hits back after England criticism

-

Cameron Smith jumps into lead at Australian PGA Championship

Cameron Smith jumps into lead at Australian PGA Championship

-

Russell on pole position at Las Vegas GP, Verstappen ahead of Norris

-

Philippine VP made 'active threat' on Marcos' life: palace

Philippine VP made 'active threat' on Marcos' life: palace

-

Celtics labor to win over Wizards, Warriors into Cup quarters

-

Balkans women stage ancient Greek play to condemn women's suffering in war

Balkans women stage ancient Greek play to condemn women's suffering in war

-

Nvidia CEO says will balance compliance and tech advances under Trump

-

Grand Slam ambition dawning for Australia against Scotland

Grand Slam ambition dawning for Australia against Scotland

-

Japan game set to leave England with more questions than answers

-

Amorim's to-do list to make Man Utd great again

Amorim's to-do list to make Man Utd great again

-

What forcing Google to sell Chrome could mean

-

Fears for Gaza hospitals as fuel and aid run low

Fears for Gaza hospitals as fuel and aid run low

-

Anderson to Starc: Five up for grabs in IPL player auction

-

Big money as Saudi makes foray into cricket with IPL auction

Big money as Saudi makes foray into cricket with IPL auction

-

Budget, debt: Trump's Treasury chief faces urgent challenges

-

Trump names hedge fund manager Scott Bessent as Treasury chief

Trump names hedge fund manager Scott Bessent as Treasury chief

-

Putin vows more tests of nuke-capable missile fired at Ukraine

-

Yin avoids penalty to keep lead as Korda charges at LPGA Tour Championship

Yin avoids penalty to keep lead as Korda charges at LPGA Tour Championship

-

With favourites out MLS playoffs promise more upsets

-

Trump to name hedge fund manager Scott Bessent as Treasury chief: US media

Trump to name hedge fund manager Scott Bessent as Treasury chief: US media

-

Guardiola says 75 percent of Premier League clubs want Man City relegated

-

'Unique' Netherlands beat Germany to reach first Davis Cup final

'Unique' Netherlands beat Germany to reach first Davis Cup final

-

Revamped PSG see off Toulouse before Bayern clash

Natural disasters, inflation upped insurers' costs in 2022: Swiss Re

Natural disasters increased insurers' costs in 2022, with inflation pushing up the bill even more, reinsurer Swiss Re said Wednesday, warning of likely further rises in the future due to climate change.

Economic losses caused by natural disasters amounted to $275 billion in 2022, down 5.8 percent compared to the $303 billion in 2021, said the Zurich-based group, which acts as an insurer for insurers.

But of those losses, $125 billion were covered by insurance -- up 3.3 percent on 2021 -- making it the second consecutive year in which insured losses from natural catastrophes topped the $100 billion mark, Swiss Re said.

"The magnitude of losses in 2022 is not a story of exceptional natural hazards, but rather a picture of growing property exposure, accentuated by exceptional inflation," said Martin Bertogg, head of catastrophe perils at Swiss Re.

Inflation drove up compensation costs, particularly for buildings, homes and vehicles damaged by natural disasters.

Rising material costs and labour shortages have also led to higher claims to cover the costs of building repairs. In the United States, the aggregate replacement cost of buildings in 2022 has risen by an estimated 40 percent since the start of 2020.

"While inflation may subside, increasing value concentration in areas vulnerable to natural catastrophes remains a key driver for increasing losses," said Bertogg.

Swiss Re said there had been a five to seven percent uptrend in average annual losses over the last 30 years.

"We expect the trend to continue. The growth has been and will be largely driven by rising loss severity of individual catastrophes... and a backdrop of hazard intensification due to climate change effects," the reinsurance giant said.

- Costly Hurricane Ian -

Hurricane Ian was by far last year's costliest event, resulting in estimated insured losses of $50-65 billion. The storm ranks as the second-costliest natural catastrophe insured loss event after Hurricane Katrina in 2005.

A category-four hurricane, Ian caused more than 150 deaths, almost all in Florida, where it made landfall on September 28.

One of the most powerful storms ever to hit the United States, it flattened whole neighbourhoods and knocked out power for millions of people. Storm surges and immense downpours left even inland neighbourhoods submerged.

Each region of the world suffered a major event, the report said.

In February 2022, storms Eunice, Dudley and Franklin in northwestern Europe triggered combined insured losses of over $4 billion.

France saw its highest ever annual loss ($5 billion) from hailstorms.

Global losses from floods were above average, the main event being flooding in eastern Australia in February-March 2022.

"This resulted in insured losses of $4.3 billion -- the biggest natural catastrophe claims event ever in Australia," Swiss Re said.

In Brazil, monsoon rains were below average, with crop yields, particularly soybean and corn, suffering most, resulting in insured losses of $1 billion.

S.Keller--BTB