-

'Puzzle' master Sinner powers champions Italy back into Davis Cup final

'Puzzle' master Sinner powers champions Italy back into Davis Cup final

-

Odegaard inspires Arsenal to reignite title hopes

-

Marseille down Lens to stay in touch with Ligue 1 leaders

Marseille down Lens to stay in touch with Ligue 1 leaders

-

Novak Djokovic: All-conquering, divisive tennis superstar

-

Scott Bessent a credible, safe pick for Treasury: experts

Scott Bessent a credible, safe pick for Treasury: experts

-

World approves UN rules for carbon trading between nations at COP29

-

Putin signs law letting Ukraine fighters write off bad debts

Putin signs law letting Ukraine fighters write off bad debts

-

Thousands march against Angola govt

-

Ireland coast to victory as they run Fiji ragged

Ireland coast to victory as they run Fiji ragged

-

Atletico make comeback to beat Alaves as Simeone hits milestone

-

Aid only 'delaying deaths' as Sudan counts down to famine: agency chief

Aid only 'delaying deaths' as Sudan counts down to famine: agency chief

-

Leipzig lose more ground on Bayern with Hoffenheim loss

-

Arsenal back to winning ways, Chelsea up to third in Premier League

Arsenal back to winning ways, Chelsea up to third in Premier League

-

Sinner powers Davis Cup holders Italy past Australia to final

-

Andy Murray to coach Novak Djokovic

Andy Murray to coach Novak Djokovic

-

Leipzig lose ground on Bayern, Dortmund and Leverkusen win

-

Fear in central Beirut district hit by Israeli strikes

Fear in central Beirut district hit by Israeli strikes

-

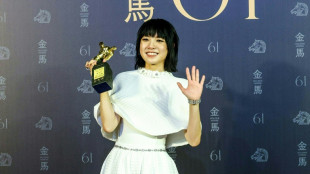

Chinese film about Covid-19 wins Taiwan's top Golden Horse prizes

-

Tuipulotu puts anger behind him as he captains Scotland against native Australia

Tuipulotu puts anger behind him as he captains Scotland against native Australia

-

Inter smash Verona to take Serie A lead

-

Mass rape trial sparks demonstrations across France

Mass rape trial sparks demonstrations across France

-

Lebanon says 15 killed in Israeli strike on central Beirut

-

Eddie Jones will revel in winding up England - Genge

Eddie Jones will revel in winding up England - Genge

-

Chelsea see off Leicester on Maresca's King Power return

-

Storms bring chaos to Ireland, France, UK

Storms bring chaos to Ireland, France, UK

-

Berrettini gives Italy edge on Australia in Davis Cup semis

-

Amber Glenn storms to gold in Cup of China

Amber Glenn storms to gold in Cup of China

-

High-flying Chelsea see off Leicester

-

Climate-threatened nations stage protest at COP29 over contentious deal

Climate-threatened nations stage protest at COP29 over contentious deal

-

Families fleeing after 32 killed in new sectarian violence in Pakistan

-

Ancelotti says 'ugly' to speculate about Mbappe mental health

Ancelotti says 'ugly' to speculate about Mbappe mental health

-

Failure haunts UN environment conferences

-

Colapinto in doubt for Las Vegas GP after crashing

Colapinto in doubt for Las Vegas GP after crashing

-

Lebanon says 11 killed in Israeli strike on central Beirut

-

Three arrested in Spain for racist abuse at Liga Clasico

Three arrested in Spain for racist abuse at Liga Clasico

-

Pope to skip Notre Dame opening for Corsica visit

-

Tokyo police care for lost umbrellas, keys, flying squirrels

Tokyo police care for lost umbrellas, keys, flying squirrels

-

Neuville closes in on world title after Rally Japan recovery

-

Jaiswal slams unbeaten 90 as India seize control against Australia

Jaiswal slams unbeaten 90 as India seize control against Australia

-

'Nice surprise' for Verstappen to edge Norris in Las Vegas GP qualifying

-

Indian teen admits to 'some nerves' in bid for world chess crown

Indian teen admits to 'some nerves' in bid for world chess crown

-

Patrick Reed shoots rare 59 to make Hong Kong Open history

-

Record-breaker Kane hits back after England criticism

Record-breaker Kane hits back after England criticism

-

Cameron Smith jumps into lead at Australian PGA Championship

-

Russell on pole position at Las Vegas GP, Verstappen ahead of Norris

Russell on pole position at Las Vegas GP, Verstappen ahead of Norris

-

Philippine VP made 'active threat' on Marcos' life: palace

-

Celtics labor to win over Wizards, Warriors into Cup quarters

Celtics labor to win over Wizards, Warriors into Cup quarters

-

Balkans women stage ancient Greek play to condemn women's suffering in war

-

Nvidia CEO says will balance compliance and tech advances under Trump

Nvidia CEO says will balance compliance and tech advances under Trump

-

Grand Slam ambition dawning for Australia against Scotland

Biden urges US regulators to restore tougher rules on midsize banks

US President Joe Biden called on banking regulators Thursday to reinstate tougher rules on midsized banks, saying that doing so would prevent future failures like that of Silicon Valley Bank.

While his predecessor Donald Trump eased rules for banks with between $100 billion and $250 billion in assets, Biden urged regulators to instead consider a set of reforms to "reduce the risk of future banking crises," according to a White House fact sheet.

A White House official called the measures "common-sense steps that can be taken under existing authority" and without congressional approval, in a briefing with journalists.

The announcement comes as regulators, lawmakers and other stakeholders continue to investigate the speedy demise of SVB and two other midsized US banks earlier in March. Those failures spurred fears of widespread financial contagion that have eased somewhat in recent days.

While the largest US banks such as Citigroup and JPMorgan Chase are subjected to the strictest capital and liquidity requirements, midsized banks saw an easing of standards under Trump.

The original Dodd-Frank law passed in the wake of the 2008 financial crisis imposed stricter standards on banks with at least $50 billion in assets.

But a 2018 reform signed into law by Trump removed tougher standards on banks with assets of $50 billion to $100 billion.

For banks with assets between $100 billion and $250 billion, the tougher rules would not automatically be adopted unless regulators imposed them on a case-by-case basis.

Under Thursday's announcement, Biden called for annual stress tests for banks of this size; so-called "living wills" laying out how assets would be wound down in case of failure; and strong capital requirements.

The White House fact sheet did not specifically mention the Federal Reserve or the Federal Deposit Insurance Corporation (FDIC) but was addressed at "federal banking agencies, in consultation with the Treasury Department."

- Deregulation 'may have gone too far' -

In a separate speech, Treasury Secretary Janet Yellen suggested recent banking sector turmoil is a reminder that work on reform remains unfinished, and that there is a need to "consider whether deregulation may have gone too far."

While the failures of SVB and later Signature Bank did not trigger a financial meltdown, the "substantial interventions" required suggests more work needs to be done, Yellen said.

SVB bank was taken over by the FDIC on March 10 following a bank run of depositors after the California lender disclosed losses on assets sold quickly to raise liquidity.

Some of the lender's problems were due to its heavy exposure to a single sector -- technology -- and weak risk management practices that left it exposed to unfavorable interest rate changes.

At congressional hearings this week, the Fed vice chair for supervision Michael Barr called SVB's failure a "textbook case of mismanagement," while also acknowledging deficiencies in oversight.

"I think that any time you have a bank failure like this, bank management clearly failed, supervisors failed and our regulatory system failed," Barr said Wednesday.

Barr also said that Fed examiners called out risk management deficiencies at SVB during the course of banking examination, but that the issues were not addressed in time.

Regulators from the Fed, which oversees the stress tests, and FDIC have told congressional panels they were reviewing oversight of SVB and would address any regulatory failings.

Their reports will be released by May 1.

American Bankers Association President Rob Nichols warned Thursday that with reviews by the Fed and other agencies ongoing, "it is premature to call for rule changes by independent regulatory agencies" before determining the extent to which supervisors failed to fully utilize their tools.

R.Adler--BTB