-

Beating Man City eases pressure for Arsenal game: new Sporting coach

Beating Man City eases pressure for Arsenal game: new Sporting coach

-

Argentine court hears bid to end rape case against French rugby players

-

Egypt says 17 missing after Red Sea tourist boat capsizes

Egypt says 17 missing after Red Sea tourist boat capsizes

-

Stocks push higher on hopes for Trump's Treasury pick

-

Dortmund boss calls for member vote on club's arms sponsorship deal

Dortmund boss calls for member vote on club's arms sponsorship deal

-

Chanel family matriarch dies aged 99: company

-

US boss Hayes says Chelsea stress made her 'unwell'

US boss Hayes says Chelsea stress made her 'unwell'

-

Deadly cargo jet crash in Lithuania amid sabotage probes

-

China's Ding beats 'nervous' Gukesh in world chess opener

China's Ding beats 'nervous' Gukesh in world chess opener

-

Man City can still do 'very good things' despite slump, says Guardiola

-

'After Mazan': France unveils new measures to combat violence against women

'After Mazan': France unveils new measures to combat violence against women

-

Scholz named party's top candidate for German elections

-

Flick says Barca must eliminate mistakes after stumble

Flick says Barca must eliminate mistakes after stumble

-

British business group hits out at Labour's tax hikes

-

German Social Democrats name Scholz as top candidate for snap polls

German Social Democrats name Scholz as top candidate for snap polls

-

Fresh strikes, clashes in Lebanon after ceasefire calls

-

Russia and Ukraine trade aerial attacks amid escalation fears

Russia and Ukraine trade aerial attacks amid escalation fears

-

Georgia parliament convenes amid legitimacy crisis

-

Plastic pollution talks must not fail: UN environment chief

Plastic pollution talks must not fail: UN environment chief

-

Maximum term sought in French mass rape trial for husband who drugged wife

-

Beeches thrive in France's Verdun in flight from climate change

Beeches thrive in France's Verdun in flight from climate change

-

Deep divisions on display at plastic pollution treaty talks

-

UAE names Uzbek suspects in Israeli rabbi's murder

UAE names Uzbek suspects in Israeli rabbi's murder

-

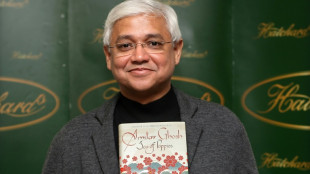

Indian author Ghosh wins top Dutch prize

-

Real Madrid star Vinicius out of Liverpool clash with hamstring injury

Real Madrid star Vinicius out of Liverpool clash with hamstring injury

-

For Ceyda: A Turkish mum's fight for justice for murdered daughter

-

Bestselling 'Woman of Substance' author Barbara Taylor Bradford dies aged 91

Bestselling 'Woman of Substance' author Barbara Taylor Bradford dies aged 91

-

Equity markets mostly on front foot, as bitcoin rally stutters

-

Ukraine drones hit Russian oil energy facility: Kyiv source

Ukraine drones hit Russian oil energy facility: Kyiv source

-

UN chief slams landmine threat after US decision to supply Ukraine

-

Maximum term demanded in French rape trial for husband who drugged wife

Maximum term demanded in French rape trial for husband who drugged wife

-

Salah feels 'more out than in' with no new Liverpool deal on table

-

Pro-Russia candidate leads Romanian polls, PM out of the race

Pro-Russia candidate leads Romanian polls, PM out of the race

-

Taiwan fighter jets to escort winning baseball team home

-

Le Pen threatens to topple French government over budget

Le Pen threatens to topple French government over budget

-

DHL cargo plane crashes in Lithuania, killing one

-

Le Pen meets PM as French government wobbles

Le Pen meets PM as French government wobbles

-

From serious car crash to IPL record for 'remarkable' Pant

-

Equity markets mostly on front foot, bitcoin rally stutters

Equity markets mostly on front foot, bitcoin rally stutters

-

India crush Australia in first Test to silence critics

-

Philippine VP Duterte 'mastermind' of assassination plot: justice department

Philippine VP Duterte 'mastermind' of assassination plot: justice department

-

Asian markets mostly on front foot, bitcoin rally stutters

-

India two wickets away from winning first Australia Test

India two wickets away from winning first Australia Test

-

39 foreigners flee Myanmar scam centre: Thai police

-

As baboons become bolder, Cape Town battles for solutions

As baboons become bolder, Cape Town battles for solutions

-

Uruguay's Orsi: from the classroom to the presidency

-

UN chief slams landmine threat days after US decision to supply Ukraine

UN chief slams landmine threat days after US decision to supply Ukraine

-

Sporting hope for life after Amorim in Arsenal Champions League clash

-

Head defiant as India sense victory in first Australia Test

Head defiant as India sense victory in first Australia Test

-

Scholz's party to name him as top candidate for snap polls

ECB threatens bank climate change laggards with financial penalties

The European Central Bank on Tuesday threatened to impose financial penalties on banks who are slow to minimise climate change-related risks stemming from their activities.

The ECB, which oversees banks operating in the 20-nation eurozone, warned it would impose "penalty payments" should they fail better to address management of climate-related and environmental (C&E) risk, supervisory board vice-chair Frank Elderson said in a Brussels address.

Noting that "we expect banks to manage C&E risks just like any other material risk they are exposed to," Elderson said that the ECB had found banks were generally lagging in this respect "and we have told those banks to remedy the shortcoming by a certain date and, if they don’t comply, they will have to pay a penalty for every day the shortcoming remains unresolved."

The ECB set a deadline of next year having determined there were major gaps in how the banks were assessing their impact on climate change and banks now face a financial penalty which theoretically could be as much as five percent of daily banking income.

The central bank found that many banks had not delivered in meeting an interim deadline of last March.

The ECB published in 2020 a slew of recommendations regarding bank governance in climate risk terms, including listing the percentage of carbon-related assets in each portfolio.

For Elderson, "failing to adequately manage C&E risks is no longer compatible with sound risk management. Such a failure also increasingly calls into question the fitness and propriety of those in charge of establishing and steering banks’ practices. To manage their own risks, banks need to engage with their customers to gain a deep understanding of how they are being affected by the climate and environmental crises and how they will mitigate and adapt to the consequences.

"By failing to complete a proper materiality assessment, these banks are continuing to turn a blind eye to potential risks on their balance sheet."

A fortnight before the COP28 meeting on the environment, Elderson highlighted uncertainty on "whether we will be able to limit global heating to below the two degrees Celsius mark, let alone 1.5 degrees, which is increasingly out of reach."

Indeed, "the threat of a disastrous scenario in which global heating will far surpass two degrees is very real, said Elderson, concluding that what was required was "meaningful, urgent and effective action that builds on the foundations that have been laid in recent years."

M.Odermatt--BTB