-

Medvedev tops Paul to reach quarter-finals at rainy Indian Wells

Medvedev tops Paul to reach quarter-finals at rainy Indian Wells

-

Thailand sacks senior cop over illicit gambling, fraud

-

Pakistan launches 'full-scale' operation to free train hostages

Pakistan launches 'full-scale' operation to free train hostages

-

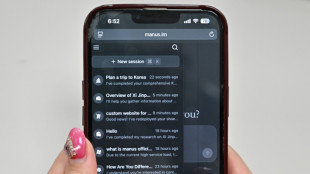

What to know about Manus, China's latest AI assistant

-

Ukraine's Svitolina feels the love in US after Trump-Zelensky dust up

Ukraine's Svitolina feels the love in US after Trump-Zelensky dust up

-

US tariffs of 25% on steel, aluminum imports take effect

-

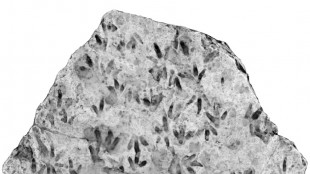

Trove of dinosaur footprints found at Australian school

Trove of dinosaur footprints found at Australian school

-

Mongolia's children choke in toxic pollution

-

Rubio heads to Canada as Trump wages trade war

Rubio heads to Canada as Trump wages trade war

-

South Korean pastor vows revolt against Yoon's impeachment

-

Pakistan to launch 'full-scale' operation to free train hostages

Pakistan to launch 'full-scale' operation to free train hostages

-

Syria determined to 'prevent unlawful revenge' says fact-finding committee

-

Most Asian stocks drop as Trump trade policy sows uncertainty

Most Asian stocks drop as Trump trade policy sows uncertainty

-

Morocco fights measles outbreak amid vaccine misinformation

-

Garland stars as comeback Cavs bag 15th straight with defeat of Nets

Garland stars as comeback Cavs bag 15th straight with defeat of Nets

-

Hamilton eyes dream Ferrari start as F1 revs up in Melbourne

-

Talk of the town: Iconic covers of the New Yorker magazine

Talk of the town: Iconic covers of the New Yorker magazine

-

The New Yorker, a US institution, celebrates 100 years of goings on

-

Cuban kids resist reggaeton, one verse at a time

Cuban kids resist reggaeton, one verse at a time

-

NASA fires chief scientist, more Trump cuts to come

-

Denmark's Rune ready to break out of tennis doldrums

Denmark's Rune ready to break out of tennis doldrums

-

Transformed PSG make statement by ousting Liverpool from Champions League

-

PSG down Liverpool on penalties in Champions League, Bayern thrash Leverkusen

PSG down Liverpool on penalties in Champions League, Bayern thrash Leverkusen

-

Liverpool 'ran out of luck' against PSG, says Slot

-

Swiatek surges into quarter-finals at rainy Indian Wells, Rune tops Tsitsipas

Swiatek surges into quarter-finals at rainy Indian Wells, Rune tops Tsitsipas

-

PSG stun Liverpool on penalties to make Champions League quarters

-

PSG beat Liverpool on penalties to reach Champions League quarter-finals

PSG beat Liverpool on penalties to reach Champions League quarter-finals

-

Inter cruise into Champions League quarters and titanic Bayern clash

-

Trump has 'bolstered' PGA-LIV reunification talks: Monahan

Trump has 'bolstered' PGA-LIV reunification talks: Monahan

-

Kane leads Bayern past Leverkusen into Champions League last eight

-

Defending champ Swiatek surges into quarter-finals at rainy Indian Wells

Defending champ Swiatek surges into quarter-finals at rainy Indian Wells

-

Piastri signs long-term extension with McLaren

-

Trump talks up Tesla in White House show of support for Musk

Trump talks up Tesla in White House show of support for Musk

-

US trades barbs with Canada as steel, aluminum tariffs loom

-

Oil companies greet Trump return, muted on tariffs

Oil companies greet Trump return, muted on tariffs

-

Italian defence firm Leonardo to boost capacity amid geopolitical risks

-

Over 100 hostages freed in deadly Pakistan train siege

Over 100 hostages freed in deadly Pakistan train siege

-

Ukraine backs 30-day ceasefire as US ends aid freeze

-

Swiatek powers into Indian Wells quarter-finals

Swiatek powers into Indian Wells quarter-finals

-

Tiger Woods has surgery for ruptured Achilles tendon

-

Trump burnishes Tesla at White House in show of support for Musk

Trump burnishes Tesla at White House in show of support for Musk

-

Macron urges allies to plan 'credible security guarantees' for Ukraine

-

Yamal, Raphinha fire Barca past Benfica into Champions League last eight

Yamal, Raphinha fire Barca past Benfica into Champions League last eight

-

Trump may rethink plans to double Canada steel, aluminum tariffs

-

Maradona medical team on trial for 'horror theater' of his death

Maradona medical team on trial for 'horror theater' of his death

-

UK makes manslaughter arrest of ship captain over North Sea crash

-

Ukraine backs US proposal for 30-day ceasefire in war with Russia

Ukraine backs US proposal for 30-day ceasefire in war with Russia

-

Mitrovic misses AFC Champions League clash due to irregular heart beat

-

Trump's 'The Apprentice' re-runs hit Amazon

Trump's 'The Apprentice' re-runs hit Amazon

-

Dozens freed, hundreds still held hostage in deadly Pakistan train siege

Stocks waver as traders eye US inflation and interest rates

Global stocks wavered Tuesday following a downcast World Bank economic forecast as investors hold their breath ahead of key inflation data and earnings reports.

"Investors are in a wait-and-see mode," said Art Hogan, analyst at B. Riley Financial, alluding to Thursday's United States inflation report and subsequent earnings releases from JPMorgan Chase and other banks on Friday.

Wall Street stocks opened tentatively, tripping into the red early on, but eventually shook off the weakness.

The tech-rich Nasdaq led the market, ending one percent higher on solid gains by Amazon, Facebook parent Meta Platforms and others.

The World Bank's latest economic forecast pointed to a "sharp, long-lasting slowdown" with global growth pegged at 1.7 percent, roughly half the pace it predicted in June, said the bank's latest Global Economic Prospects report.

But the biggest US economic release this week as far as investors will be concerned is Thursday's consumer price index report, expected to show further moderation after big jumps in prices for much of 2022.

The CPI data will be scrutinized for implications on Federal Reserve policy, with the central bank enacting aggressive interest rate hikes to combat inflation.

Fed Chair Jerome Powell avoided tipping his hand on future policy decisions Tuesday in a speech in Sweden, but said the insulation of the Fed from electoral politics allows it to hike interest rates if needed "without considering short-term political factors."

Another US central banker, Fed governor Michelle Bowman, expressed hopes for a soft landing during a separate public appearance.

"Unemployment has remained low as we have tightened monetary policy and made progress in lowering inflation," Bowman said in a prepared speech to an event in Florida.

"I take this as a hopeful sign that we can succeed in lowering inflation without a significant economic downturn," she added.

But she warned that the Fed's policy-setting Federal Open Market Committee will continue raising interest rates as there remains much work to do to lower inflation.

The benchmark lending rate will likely have to remain at a "sufficiently restrictive" level for some time to restore price stability, she said.

After a brutal 2022, equities worldwide have seen a strong start to the new year.

This was thanks in part to Beijing's decision to pivot from restrictive Covid-19 policies, and to an improving economic outlook for Europe due partly to mild weather that has not taxed the energy market.

On Tuesday, European stock markets closed broadly lower.

- Key figures around 2200 GMT -

New York - Dow: UP 0.6 percent at 33,704.10 (close)

New York - S&P 500: UP 0.7 percent at 3,919.25 (close)

New York - Nasdaq: UP 1.0 percent at 10,742.63 (close)

London - FTSE 100: DOWN 0.4 percent at 7,694.49 (close)

Frankfurt - DAX: DOWN 0.1 percent at 14,774.60 (close)

Paris - CAC 40: DOWN 0.6 percent at 6,869.14 (close)

EURO STOXX 50: DOWN 0.3 percent at 4,057.46 (close)

Tokyo - Nikkei 225: UP 0.8 percent at 26,175.56 (close)

Hong Kong - Hang Seng Index: DOWN 0.3 percent at 21,331.46 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,169.51 (close)

Dollar/yen: UP at 132.21 yen from 131.88 yen on Monday

Euro/dollar: UP at $1.0739 from $1.0730

Pound/dollar: DOWN at $1.2153 from $1.2184

Euro/pound: UP at 88.34 pence from 88.07 pence

Brent North Sea crude: UP 0.6 percent at $80.10 a barrel

West Texas Intermediate: UP 0.7 percent at $75.12 a barrel

M.Ouellet--BTB