-

EU hits back hard at Trump tariffs to force dialogue

EU hits back hard at Trump tariffs to force dialogue

-

Greenland to get new government to lead independence process

-

Former star Eto'o elected to CAF executive by acclamation

Former star Eto'o elected to CAF executive by acclamation

-

'Humiliated': Palestinian victims of Israel sexual abuse testify at UN

-

Stocks diverge over Trump tariffs, Ukraine ceasefire plan

Stocks diverge over Trump tariffs, Ukraine ceasefire plan

-

Ireland prop Porter denies wrongdoing after Dupont Six Nations injury

-

Captain of cargo ship in North Sea crash is Russian: vessel owner

Captain of cargo ship in North Sea crash is Russian: vessel owner

-

West says next step 'up to Putin' on Ukraine ceasefire proposal

-

Battery maker Northvolt files for bankruptcy in Sweden

Battery maker Northvolt files for bankruptcy in Sweden

-

Arrested former Philippine president Duterte's lawyers demand his return

-

Eubank Jr fined £100,000 for hitting boxing rival Benn in face with an egg

Eubank Jr fined £100,000 for hitting boxing rival Benn in face with an egg

-

Snorkel with me to understand climate change, Palau president tells Trump

-

Georgia court extends ex-president Saakashvili's jail term

Georgia court extends ex-president Saakashvili's jail term

-

China, EU vow countermeasures against sweeping US steel tariffs

-

Markets mixed as Trump trade policy sows uncertainty

Markets mixed as Trump trade policy sows uncertainty

-

German arms firm Rheinmetall seizes on European 'era of rearmament'

-

AI chatbot helps victims of digital sexual violence in Latin America

AI chatbot helps victims of digital sexual violence in Latin America

-

Russian playwright tells story of wounded soldiers

-

'Stranded' astronauts closer to coming home after next ISS launch

'Stranded' astronauts closer to coming home after next ISS launch

-

Medvedev tops Paul to reach quarter-finals at rainy Indian Wells

-

Thailand sacks senior cop over illicit gambling, fraud

Thailand sacks senior cop over illicit gambling, fraud

-

Pakistan launches 'full-scale' operation to free train hostages

-

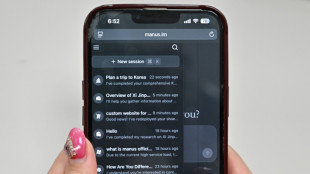

What to know about Manus, China's latest AI assistant

What to know about Manus, China's latest AI assistant

-

Ukraine's Svitolina feels the love in US after Trump-Zelensky dust up

-

US tariffs of 25% on steel, aluminum imports take effect

US tariffs of 25% on steel, aluminum imports take effect

-

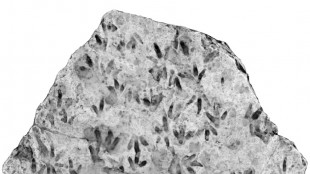

Trove of dinosaur footprints found at Australian school

-

Mongolia's children choke in toxic pollution

Mongolia's children choke in toxic pollution

-

Rubio heads to Canada as Trump wages trade war

-

South Korean pastor vows revolt against Yoon's impeachment

South Korean pastor vows revolt against Yoon's impeachment

-

Pakistan to launch 'full-scale' operation to free train hostages

-

Syria determined to 'prevent unlawful revenge' says fact-finding committee

Syria determined to 'prevent unlawful revenge' says fact-finding committee

-

Most Asian stocks drop as Trump trade policy sows uncertainty

-

Morocco fights measles outbreak amid vaccine misinformation

Morocco fights measles outbreak amid vaccine misinformation

-

Garland stars as comeback Cavs bag 15th straight with defeat of Nets

-

Hamilton eyes dream Ferrari start as F1 revs up in Melbourne

Hamilton eyes dream Ferrari start as F1 revs up in Melbourne

-

Talk of the town: Iconic covers of the New Yorker magazine

-

The New Yorker, a US institution, celebrates 100 years of goings on

The New Yorker, a US institution, celebrates 100 years of goings on

-

Cuban kids resist reggaeton, one verse at a time

-

NASA fires chief scientist, more Trump cuts to come

NASA fires chief scientist, more Trump cuts to come

-

Denmark's Rune ready to break out of tennis doldrums

-

Transformed PSG make statement by ousting Liverpool from Champions League

Transformed PSG make statement by ousting Liverpool from Champions League

-

PSG down Liverpool on penalties in Champions League, Bayern thrash Leverkusen

-

Liverpool 'ran out of luck' against PSG, says Slot

Liverpool 'ran out of luck' against PSG, says Slot

-

Swiatek surges into quarter-finals at rainy Indian Wells, Rune tops Tsitsipas

-

PSG stun Liverpool on penalties to make Champions League quarters

PSG stun Liverpool on penalties to make Champions League quarters

-

PSG beat Liverpool on penalties to reach Champions League quarter-finals

-

Inter cruise into Champions League quarters and titanic Bayern clash

Inter cruise into Champions League quarters and titanic Bayern clash

-

Trump has 'bolstered' PGA-LIV reunification talks: Monahan

-

Kane leads Bayern past Leverkusen into Champions League last eight

Kane leads Bayern past Leverkusen into Champions League last eight

-

Defending champ Swiatek surges into quarter-finals at rainy Indian Wells

Stocks mostly rise as US inflation falls

Global stock markets mostly rose Thursday as investors digested highly anticipated data showing another softening of US consumer inflation, potentially giving the Federal Reserve room to slow its interest rate hikes.

Equities also found support on growing optimism over China's economic reopening.

Europe's main bourses were higher in mid-afternoon trading.

In Paris, the CAC 40 rose past 7,000 points for the first time since a few days before Russia's invasion of Ukraine.

On Wall Street, shares were down however after the S&P 500 and Nasdaq soared Wednesday thanks to demand for recently beaten-down tech firms.

After inflation soared to decades-high levels in the last year, investors had been keenly awaiting the latest US consumer price index (CPI) reading for indications about the Fed's next move.

It showed that consumer inflation slipped in December to the lowest level in over a year -- rising 6.5 percent from a year ago, the smallest increase since October 2021, according to the Labor Department.

The annual figure was also down from November's 7.1 percent spike.

Between November and December, CPI dipped 0.1 percent, the first time in around two years it logged a month-on-month contraction.

Although generally positive, the report showed that services inflation remained above the Fed's target rate.

"From a headline standpoint, the Consumer Price Index was pretty much on the mark with the market's hopeful expectations," said Patrick J. O'Hare from Briefing.com.

Srijan Katyal, global head of strategy and trading services at the brokerage ADSS, said the retreat from a 40-year high above nine percent was "certainly welcome news for both the markets and consumers".

"The annual CPI decreasing for a second consecutive month to reach 6.5 percent shows that the Fed's aggressive monetary policy continues to slow inflation."

The Fed has raised interest rates seven times in the past year to try to cool demand and rein in surging prices.

- Fed pivot coming? -

Stock market gains were also helped by comments from Fed official Susan Collins backing a quarter-point US rate hike at the bank's next policy decision on February 1.

Collins, who is head of the Boston Fed, told The New York Times that slowing the pace of increases would give policymakers a chance to see how their efforts to rein in inflation were working.

Investors are also keeping tabs on developments in China as it emerges from years of strict zero-Covid containment measures.

While the long-term outlook remains positive, soaring infections across the country are leading to worries about the effect on economic activity.

World oil prices also jumped on expectations of rebounding Chinese energy demand.

"Energy traders should get used to seeing oil prices head higher," said Oanda analyst Edward Moya. "Oil demand is coming back and expectations are high that China's demand is about to skyrocket."

Several oil experts have tipped prices to hit $100 a barrel this year, with top hedge fund manager Pierre Andurand predicting last week that it could pass $140.

- Key figures around 1445 GMT -

London - FTSE 100: UP 0.5 percent at 7,760.15 points

Frankfurt - DAX: UP 0.2 percent at 14,975.29

Paris - CAC 40: UP 0.5 percent at 6,957.95

EURO STOXX 50: UP 0.2 percent at 4,110.45

New York - Dow: DOWN 0.4 percent at 33,848.41

Tokyo - Nikkei 225: FLAT at 26,449.82 (close)

Hong Kong - Hang Seng Index: UP 0.4 percent at 21,514.10 (close)

Shanghai - Composite: UP 0.1 percent at 3,163.45 (close)

Euro/dollar: UP at $1.0776 from $1.0757 on Wednesday

Dollar/yen: DOWN at 130.67 yen from 132.45 yen

Pound/dollar: DOWN at $1.2106 from $1.2146

Euro/pound: UP at 88.93 pence from 88.56 pence

Brent North Sea crude: UP 1.8 percent at $84.17 a barrel

West Texas Intermediate: UP 1.3 percent at $78.73 a barrel

C.Kovalenko--BTB