-

South Korea investigators attempt to arrest President Yoon

South Korea investigators attempt to arrest President Yoon

-

Tears, tourism on Bourbon Street after US terror nightmare

-

Extradited SKorean crypto 'genius' in court to face US charges

Extradited SKorean crypto 'genius' in court to face US charges

-

Venezuela offers $100,000 reward for exiled opposition candidate

-

South Korea investigators arrive to attempt to arrest president

South Korea investigators arrive to attempt to arrest president

-

Giannis and Jokic lead NBA All-Star voting with LeBron well back

-

Mixed day for global stocks as dollar pushes higher

Mixed day for global stocks as dollar pushes higher

-

Nick Clegg leaves Meta global policy team

-

Vegas Tesla blast suspect shot himself in head: officials

Vegas Tesla blast suspect shot himself in head: officials

-

Shiffrin hopes to be back on slopes 'in the next week'

-

Dumfries double takes Inter into Italian Super Cup final

Dumfries double takes Inter into Italian Super Cup final

-

Spain's Canary Islands received record 46,843 migrants in 2024: ministry

-

Panama says migrant jungle crossings fell 41% in 2024

Panama says migrant jungle crossings fell 41% in 2024

-

UN experts slam Israel's 'blatant assault' on health rights in Gaza

-

Tesla reports lower 2024 auto deliveries, missing forecast

Tesla reports lower 2024 auto deliveries, missing forecast

-

Meghan Markle's lifestyle show to premiere Jan 15 on Netflix

-

On Bourbon Street, a grim cleanup after deadly nightmare

On Bourbon Street, a grim cleanup after deadly nightmare

-

New Orleans attacker: US Army vet 'inspired' by Islamic State

-

New Orleans killer acted alone, professed loyalty to jihadist group: FBI

New Orleans killer acted alone, professed loyalty to jihadist group: FBI

-

Wall Street lifts spirits after Asia starts year in red

-

UK's biggest dinosaur footprint site uncovered

UK's biggest dinosaur footprint site uncovered

-

Former Australia coach Langer to take charge of London Spirit

-

Most UK doctors suffer from 'compassion fatigue': poll

Most UK doctors suffer from 'compassion fatigue': poll

-

Everton boss Dyche unconcerned by Maupay jibe

-

FBI probes potential accomplices in New Orleans truck ramming

FBI probes potential accomplices in New Orleans truck ramming

-

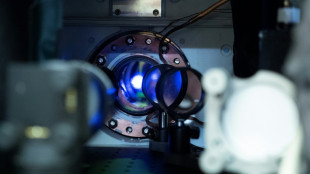

Secret lab developing UK's first quantum clock: defence ministry

-

Premier League chief fears Club World Cup's impact on Man City and Chelsea

Premier League chief fears Club World Cup's impact on Man City and Chelsea

-

US mulls new restrictions on Chinese drones

-

Wall Street dons early green after Asia starts year in red

Wall Street dons early green after Asia starts year in red

-

Rosita Missoni of Italy's eponymous fashion house dies age 93

-

27 sub-Saharan African migrants die off Tunisia in shipwrecks

27 sub-Saharan African migrants die off Tunisia in shipwrecks

-

UK grime star Stormzy banned from driving for nine months

-

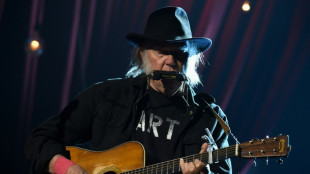

Neil Young dumps Glastonbury alleging 'BBC control'

Neil Young dumps Glastonbury alleging 'BBC control'

-

Djokovic, Sabalenka into Brisbane quarters as rising stars impress

-

Swiatek battles back to take Poland into United Cup semis

Swiatek battles back to take Poland into United Cup semis

-

Electric cars took 89% of Norway market in 2024

-

Stock markets begin new year with losses

Stock markets begin new year with losses

-

Rival South Korea camps face off as president holds out

-

French downhill ace Sarrazin out of intensive care

French downhill ace Sarrazin out of intensive care

-

Djokovic cruises past Monfils as rising stars impress in Brisbane

-

Montenegro mourns after gunman kills 12

Montenegro mourns after gunman kills 12

-

Sales surge in 2024 for Chinese EV giant BYD

-

Agnes Keleti, world's oldest Olympic champion, dies at 103

Agnes Keleti, world's oldest Olympic champion, dies at 103

-

Asian stocks begin year on cautious note

-

Andreeva, Mpetshi Perricard showcase Australian Open potential

Andreeva, Mpetshi Perricard showcase Australian Open potential

-

South Korea police raid Jeju Air, airport over fatal crash

-

Perera's 46-ball ton gives Sri Lanka consolation T20 win over New Zealand

Perera's 46-ball ton gives Sri Lanka consolation T20 win over New Zealand

-

Afghan refugees suffer 'like prisoners' in Pakistan crackdown

-

Coach tight-lipped on whether Rohit will play in final Australia Test

Coach tight-lipped on whether Rohit will play in final Australia Test

-

Blooming hard: Taiwan's persimmon growers struggle

Oil soars, stocks fall on Russia crude ban talk

Stock markets fell, metals prices hit record highs and oil surged on Monday after the United States raised the prospect of an embargo on Russian crude.

European markets seesawed in afternoon trading, paring back some losses after sharp drops earlier in the day following a four percent fall in Hong Kong.

Wall Street was lower in early trading.

"The catalyst for the overnight fallout were reports that the US and Western allies are considering a ban on Russian oil imports," said Briefing.com analyst Patrick O'Hare.

US Secretary of State Antony Blinken said Sunday that the White House and allies were in talks about banning oil imports from Russia following its invasion of Ukraine.

But German Chancellor Ola Scholz on Monday cautioned against banning Russian oil and gas, saying doing so could put Europe's energy security at risk.

The benchmark Brent North Sea crude oil contract soared to a near 14-year high as it reached $139.13 before cooling to $121.54.

The record high stands at $147.50, achieved in 2008 during the global financial crisis.

European gas prices, meanwhile, struck record peaks on energy supply fears.

Russia is one of the world's biggest crude producers and is also a leading supplier of natural gas.

"As the dust has settled, fear of European bans on Russian oil -- and potential retaliation or follow-up moves in gas or other commodities -- has subsided," said OANDA analyst Craig Erlam.

Commodities have been red hot since Russia's assault on its neighbour, with gold rising above $2,000 an ounce thanks to the metal's status as a haven investment, before falling back to $1,986.

Aluminium, copper and palladium prices kicked off the week with record highs and nickel rocketed by more than 25 percent in value.

"Commodity and energy prices have inevitably been under upward pressure, with escalating sanctions against Russia and the shuttering of some Ukrainian ports driving the search for replacement supplies of crops, metals and energy," noted Richard Hunter, head of markets at Interactive Investor.

Ukraine, one of the world's top wheat producers, has set export restrictions on the crop and other agricultural products, the Interfax Ukraine news agency reported.

The conflict has pushed wheat prices higher as Russia is the world's top exporter of the cereal and Ukraine is the fourth according to US official estimates.

- Stagflation worries -

The surge in prices is handing a headache to central banks, which have already begun removing pandemic-era cash stimulus and are raising interest rates to bring down inflation that stood at the highest levels in decades even before the invasion.

"The current backdrop is also stoking stagflation concerns, with rising inflationary pressure unlikely to be offset by sufficient global economic growth to prevent a stagnant environment," Hunter added.

The International Monetary Fund warned at the weekend that the war and sanctions on Russia would have a "severe impact" on the global economy.

In foreign exchange Monday, the euro sank to the lowest level for almost two years against the dollar, pummelled by fears of sanctions on Russian energy that would hit the eurozone's economic recovery, traders said.

The euro slid 1.1 percent to $1.0806 before recovering slightly later in the day, while the ruble hit a record-low 142.18 against the dollar.

- Key figures around 1445 GMT -

New York - Dow: DOWN 0.4 percent at 33,482.86 points

London - FTSE 100: DOWN 0.1 percent at 6,981.67

Frankfurt - DAX: DOWN 0.5 percent at 13,027.36

Paris - CAC 40: DOWN 0.1 percent at 6,052.90

EURO STOXX 50: UP 0.1 percent at 3,558.09

Tokyo - Nikkei 225: DOWN 2.9 percent at 25,221.41 (close)

Hong Kong - Hang Seng Index: DOWN 3.9 percent at 21,045.21 (close)

Shanghai - Composite: DOWN 2.2 percent at 3,372.86 (close)

Brent North Sea crude: UP 2.9 percent at $121.54 per barrel

West Texas Intermediate: UP 1.2 percent at $117.06 per barrel

Euro/dollar: UP at $1.0891 from $1.0850 Friday

Pound/dollar: DOWN at $1.3159 from $1.3200

Euro/pound: UP at 82.77 pence from 82.18 pence

Dollar/yen: UP at 115.34 yen from 114.78 yen

burs-bcp-lth/cdw

R.Adler--BTB