-

Beating Man City eases pressure for Arsenal game: new Sporting coach

Beating Man City eases pressure for Arsenal game: new Sporting coach

-

Argentine court hears bid to end rape case against French rugby players

-

Egypt says 17 missing after Red Sea tourist boat capsizes

Egypt says 17 missing after Red Sea tourist boat capsizes

-

Stocks push higher on hopes for Trump's Treasury pick

-

Dortmund boss calls for member vote on club's arms sponsorship deal

Dortmund boss calls for member vote on club's arms sponsorship deal

-

Chanel family matriarch dies aged 99: company

-

US boss Hayes says Chelsea stress made her 'unwell'

US boss Hayes says Chelsea stress made her 'unwell'

-

Deadly cargo jet crash in Lithuania amid sabotage probes

-

China's Ding beats 'nervous' Gukesh in world chess opener

China's Ding beats 'nervous' Gukesh in world chess opener

-

Man City can still do 'very good things' despite slump, says Guardiola

-

'After Mazan': France unveils new measures to combat violence against women

'After Mazan': France unveils new measures to combat violence against women

-

Scholz named party's top candidate for German elections

-

Flick says Barca must eliminate mistakes after stumble

Flick says Barca must eliminate mistakes after stumble

-

British business group hits out at Labour's tax hikes

-

German Social Democrats name Scholz as top candidate for snap polls

German Social Democrats name Scholz as top candidate for snap polls

-

Fresh strikes, clashes in Lebanon after ceasefire calls

-

Russia and Ukraine trade aerial attacks amid escalation fears

Russia and Ukraine trade aerial attacks amid escalation fears

-

Georgia parliament convenes amid legitimacy crisis

-

Plastic pollution talks must not fail: UN environment chief

Plastic pollution talks must not fail: UN environment chief

-

Maximum term sought in French mass rape trial for husband who drugged wife

-

Beeches thrive in France's Verdun in flight from climate change

Beeches thrive in France's Verdun in flight from climate change

-

Deep divisions on display at plastic pollution treaty talks

-

UAE names Uzbek suspects in Israeli rabbi's murder

UAE names Uzbek suspects in Israeli rabbi's murder

-

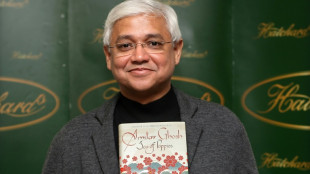

Indian author Ghosh wins top Dutch prize

-

Real Madrid star Vinicius out of Liverpool clash with hamstring injury

Real Madrid star Vinicius out of Liverpool clash with hamstring injury

-

For Ceyda: A Turkish mum's fight for justice for murdered daughter

-

Bestselling 'Woman of Substance' author Barbara Taylor Bradford dies aged 91

Bestselling 'Woman of Substance' author Barbara Taylor Bradford dies aged 91

-

Equity markets mostly on front foot, as bitcoin rally stutters

-

Ukraine drones hit Russian oil energy facility: Kyiv source

Ukraine drones hit Russian oil energy facility: Kyiv source

-

UN chief slams landmine threat after US decision to supply Ukraine

-

Maximum term demanded in French rape trial for husband who drugged wife

Maximum term demanded in French rape trial for husband who drugged wife

-

Salah feels 'more out than in' with no new Liverpool deal on table

-

Pro-Russia candidate leads Romanian polls, PM out of the race

Pro-Russia candidate leads Romanian polls, PM out of the race

-

Taiwan fighter jets to escort winning baseball team home

-

Le Pen threatens to topple French government over budget

Le Pen threatens to topple French government over budget

-

DHL cargo plane crashes in Lithuania, killing one

-

Le Pen meets PM as French government wobbles

Le Pen meets PM as French government wobbles

-

From serious car crash to IPL record for 'remarkable' Pant

-

Equity markets mostly on front foot, bitcoin rally stutters

Equity markets mostly on front foot, bitcoin rally stutters

-

India crush Australia in first Test to silence critics

-

Philippine VP Duterte 'mastermind' of assassination plot: justice department

Philippine VP Duterte 'mastermind' of assassination plot: justice department

-

Asian markets mostly on front foot, bitcoin rally stutters

-

India two wickets away from winning first Australia Test

India two wickets away from winning first Australia Test

-

39 foreigners flee Myanmar scam centre: Thai police

-

As baboons become bolder, Cape Town battles for solutions

As baboons become bolder, Cape Town battles for solutions

-

Uruguay's Orsi: from the classroom to the presidency

-

UN chief slams landmine threat days after US decision to supply Ukraine

UN chief slams landmine threat days after US decision to supply Ukraine

-

Sporting hope for life after Amorim in Arsenal Champions League clash

-

Head defiant as India sense victory in first Australia Test

Head defiant as India sense victory in first Australia Test

-

Scholz's party to name him as top candidate for snap polls

Asian markets fall and oil extends rally as Ukraine war rages

Asian markets fell further Tuesday, oil prices rallied again and nickel surged to above $100,000 as investors try to assess the impact of the Ukraine war on the world economy.

As Russia's invasion of its neighbour continues, commodity prices have been sent to record or multi-year highs, forcing observers to re-evaluate their outlook for the global recovery with some now warning of a period of soaring inflation and low growth or recession.

Monday's session saw a sea of red across trading floors after the United States said it was considering banning the import of crude from Russia, the world's number three producer, sending the price of Brent to almost $140 for the first time since 2008.

While the black gold eased back slightly from that peak, it remains elevated and continued to rise again on Tuesday.

Europe was not so keen on the US idea, with German Chancellor Olaf Scholz saying Russian oil and gas are of "essential importance" to the continent's economy. Roughly 40 percent of EU gas imports and one quarter of its oil come from Russia.

Meanwhile, Moscow warned that in retaliation for strict sanctions imposed on it for the invasion, it could cut off natural gas supplies to Europe via the Nord Stream 1 pipeline, adding further upward pressure to crude as investors bet on a search for other sources of energy.

European gas prices hit records Monday, while other commodities sourced from Ukraine and Russia also rallied, with wheat at an all-time high and nickel breaking $100,000 a tonne for the first time before easing back.

The crisis comes just as uncertainty was rising owing to surging prices caused by a spike in demand for oil, tight supplies and pandemic-induced supply chain snarls, among other things.

Meanwhile, central banks are starting to wind back the ultra-loose monetary policies put in place at the start of the pandemic as they try to get a grip on runaway prices.

And while analysts have lowered their expectations for how much and how quickly officials will tighten in light of the war, they still see a tougher investing environment down the line.

"It's all about slowing growth and rising inflation," Alifia Doriwala of Rock Creek told Bloomberg Television. "With the sanctions on Russia intensifying, it's hitting all sectors. Then you are going to have some central bank action amidst much uncertain economic growth."

After a rout on US markets, Asia was again well into negative territory.

Tokyo, Hong Kong, Singapore, Seoul, Wellington and Bangkok all lost more than one percent, while Shanghai and Taipei were off more than two percent. Manila sank more than four percent, while Sydney, Jakarta and Mumbai were also in the red.

"Disruptions to energy markets and the possibility of a geopolitical paradigm shift make for a highly unpredictable environment." said Stephen Innes, of SPI Asset Management.

"Given the length of time this has gone on with the possibility of all sides becoming further entrenched in their positions, the geopolitical situation seems likely to get worse before it gets better, although we should reach a point at which equities start to price in a light at the end of the tunnel before it becomes obvious."

And StoneX Financial's Matt Simpson added: "It was the sharp rise in oil which triggered the sell-off in equities as traders priced in stagflation worries once again.

"Should oil prices stabilise then it should remove some selling pressure across equity markets."

- Key figures around 0710 GMT -

Tokyo - Nikkei 225: DOWN 1.7 percent at 25,790.95 (close)

Hong Kong - Hang Seng Index: DOWN 1.6 percent at 20,722.91

Shanghai - Composite: DOWN 2.4 percent at 3,293.53 (close)

Brent North Sea crude: UP 3.1 percent at $127.01 per barrel

West Texas Intermediate: UP 2.5 percent at $122.41 per barrel

Dollar/yen: UP at 115.46 yen from 115.27 yen late Monday

Euro/dollar: DOWN at $1.0852 from $1.0858

Pound/dollar: DOWN at $1.3084 from $1.3109

Euro/pound: UP at 82.94 pence from 82.79 pence

New York - Dow: DOWN 2.4 percent at 32,817.38 (close)

London - FTSE 100: DOWN 0.4 percent at 6,959.48 (close)

J.Fankhauser--BTB