-

Beating Man City eases pressure for Arsenal game: new Sporting coach

Beating Man City eases pressure for Arsenal game: new Sporting coach

-

Argentine court hears bid to end rape case against French rugby players

-

Egypt says 17 missing after Red Sea tourist boat capsizes

Egypt says 17 missing after Red Sea tourist boat capsizes

-

Stocks push higher on hopes for Trump's Treasury pick

-

Dortmund boss calls for member vote on club's arms sponsorship deal

Dortmund boss calls for member vote on club's arms sponsorship deal

-

Chanel family matriarch dies aged 99: company

-

US boss Hayes says Chelsea stress made her 'unwell'

US boss Hayes says Chelsea stress made her 'unwell'

-

Deadly cargo jet crash in Lithuania amid sabotage probes

-

China's Ding beats 'nervous' Gukesh in world chess opener

China's Ding beats 'nervous' Gukesh in world chess opener

-

Man City can still do 'very good things' despite slump, says Guardiola

-

'After Mazan': France unveils new measures to combat violence against women

'After Mazan': France unveils new measures to combat violence against women

-

Scholz named party's top candidate for German elections

-

Flick says Barca must eliminate mistakes after stumble

Flick says Barca must eliminate mistakes after stumble

-

British business group hits out at Labour's tax hikes

-

German Social Democrats name Scholz as top candidate for snap polls

German Social Democrats name Scholz as top candidate for snap polls

-

Fresh strikes, clashes in Lebanon after ceasefire calls

-

Russia and Ukraine trade aerial attacks amid escalation fears

Russia and Ukraine trade aerial attacks amid escalation fears

-

Georgia parliament convenes amid legitimacy crisis

-

Plastic pollution talks must not fail: UN environment chief

Plastic pollution talks must not fail: UN environment chief

-

Maximum term sought in French mass rape trial for husband who drugged wife

-

Beeches thrive in France's Verdun in flight from climate change

Beeches thrive in France's Verdun in flight from climate change

-

Deep divisions on display at plastic pollution treaty talks

-

UAE names Uzbek suspects in Israeli rabbi's murder

UAE names Uzbek suspects in Israeli rabbi's murder

-

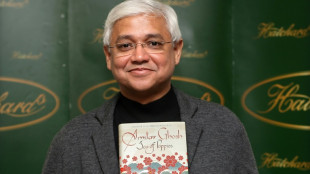

Indian author Ghosh wins top Dutch prize

-

Real Madrid star Vinicius out of Liverpool clash with hamstring injury

Real Madrid star Vinicius out of Liverpool clash with hamstring injury

-

For Ceyda: A Turkish mum's fight for justice for murdered daughter

-

Bestselling 'Woman of Substance' author Barbara Taylor Bradford dies aged 91

Bestselling 'Woman of Substance' author Barbara Taylor Bradford dies aged 91

-

Equity markets mostly on front foot, as bitcoin rally stutters

-

Ukraine drones hit Russian oil energy facility: Kyiv source

Ukraine drones hit Russian oil energy facility: Kyiv source

-

UN chief slams landmine threat after US decision to supply Ukraine

-

Maximum term demanded in French rape trial for husband who drugged wife

Maximum term demanded in French rape trial for husband who drugged wife

-

Salah feels 'more out than in' with no new Liverpool deal on table

-

Pro-Russia candidate leads Romanian polls, PM out of the race

Pro-Russia candidate leads Romanian polls, PM out of the race

-

Taiwan fighter jets to escort winning baseball team home

-

Le Pen threatens to topple French government over budget

Le Pen threatens to topple French government over budget

-

DHL cargo plane crashes in Lithuania, killing one

-

Le Pen meets PM as French government wobbles

Le Pen meets PM as French government wobbles

-

From serious car crash to IPL record for 'remarkable' Pant

-

Equity markets mostly on front foot, bitcoin rally stutters

Equity markets mostly on front foot, bitcoin rally stutters

-

India crush Australia in first Test to silence critics

-

Philippine VP Duterte 'mastermind' of assassination plot: justice department

Philippine VP Duterte 'mastermind' of assassination plot: justice department

-

Asian markets mostly on front foot, bitcoin rally stutters

-

India two wickets away from winning first Australia Test

India two wickets away from winning first Australia Test

-

39 foreigners flee Myanmar scam centre: Thai police

-

As baboons become bolder, Cape Town battles for solutions

As baboons become bolder, Cape Town battles for solutions

-

Uruguay's Orsi: from the classroom to the presidency

-

UN chief slams landmine threat days after US decision to supply Ukraine

UN chief slams landmine threat days after US decision to supply Ukraine

-

Sporting hope for life after Amorim in Arsenal Champions League clash

-

Head defiant as India sense victory in first Australia Test

Head defiant as India sense victory in first Australia Test

-

Scholz's party to name him as top candidate for snap polls

Oil prices surge as US bans Russian oil imports

Crude prices surged Tuesday as the US banned Russian oil imports, while nickel prices rocketed to a record peak on Russian supply fears.

While remaining below Monday's peak of $139.13 per barrel, the main international oil contract, Brent, jumped 6.8 percent to $131.63.

The main US contract, WTI, rose by 6.7 percent to $127.44 per barrel.

President Joe Biden announced a ban on US imports of Russian oil while Britain said it will phase them out by the end of the year.

EU nations, which receive roughly 40 percent of their gas imports and one quarter of their oil from Russia, instead opted to set a goal of cutting their Russian gas imports by two-thirds.

Meanwhile, Moscow warned earlier that in retaliation for sanctions imposed on it for the invasion, it could cut off natural gas supplies to Europe via the Nord Stream 1 pipeline.

While the US does not import large amounts of Russian oil, analysts said the move was nevertheless important.

Market analyst Fawad Razaqzada at ThinkMarkets called it the "launch of an an all-out economic war against Russia" by the United States.

"There will be consequences: high gas prices, even more inflation and retaliation from Russia."

Craig Erlam at OANDA said: "It's another step towards the West turning its back on Russia and leaving it isolated in the world."

The rise in oil prices pulled the rug out from under a rebound in European and US equity prices.

While London managed to squeak out a gain of 0.1 percent, Frankfurt ended the day flat and Paris shed 0.3 percent.

Meanwhile on Wall Street, the Dow was down 0.6 percent in late morning trading.

Commodity prices also felt the effects of the growing isolation of Russia.

The London Metal Exchange suspended trade in nickel after the base metal spiked to a record $101,365 per tonne as Russian supply concerns sparked sharp volatility.

Nickel is used to make stainless steel and batteries for electric vehicles.

"Russia is one of the leading global exporters of this commodity and with the potential of incoming sanctions directed towards western countries, the market could see a significant supply shock in the short term which could lead to even further price increases until the situation is stabilised," said Walid Koudmani, chief market analyst at xtb online trading platform.

Nickel prices have risen from around $20,000 per tonne in January, he noted, putting huge pressure on manufacturers.

Gold rose as high as $2,069.25, a level unseen since August 2020.

- Stagflation -

The Ukraine crisis comes just as uncertainty was rising owing to surging prices caused by a spike in demand for oil, tight supplies and pandemic-induced supply chain snarls, among other things.

Markets remain fearful of stagflation -- a vicious mixture of low economic growth and elevated inflation.

"There are fears we are heading for a period of stagflation in the eurozone given the energy crunch and the region's exposure to Russia," noted ThinkMarkets' Razaqzada.

Europe gas reference Dutch TTF fell 6.5 percent to 212.35 euros per megawatt hour on Tuesday, one day after striking a record 345 euros.

- Key figures around 1330 GMT -

Brent North Sea crude: UP 6.8 percent at $131.63 per barrel

West Texas Intermediate: UP 6.7 percent at $127.44

New York - Dow: DOWN 0.6 percent at 32,622.95 points

EURO STOXX 50: DOWN 0.2 percent at 3,505.29

London - FTSE 100: UP 0.1 percent at 6,964.11 (close)

Frankfurt - DAX: FLAT at 12,831.51 (close)

Paris - CAC 40: DOWN 0.3 percent at 5,962.96 (close)

Tokyo - Nikkei 225: DOWN 1.7 percent at 25,790.95 (close)

Hong Kong - Hang Seng Index: DOWN 1.4 percent at 20,765.87 (close)

Shanghai - Composite: DOWN 2.4 percent at 3,293.53 (close)

Euro/dollar: UP at $1.0885 from $1.0854 Monday

Pound/dollar: DOWN at $1.3091 from $1.3104

Euro/pound: UP at 83.11 pence from 82.83 pence

Dollar/yen: UP at 115.71 yen from 115.32 yen

burs-rl/ach

M.Odermatt--BTB