-

Tottenham goalkeeper Vicario has ankle surgery

Tottenham goalkeeper Vicario has ankle surgery

-

Prosecutor moves to drop federal cases against Trump

-

Green light for Cadillac to join Formula One grid in 2026

Green light for Cadillac to join Formula One grid in 2026

-

Romania braces for parliamentary vote after far right's poll upset

-

US-Google face off as ad tech antitrust trial comes to close

US-Google face off as ad tech antitrust trial comes to close

-

Special counsel moves to drop federal cases against Trump

-

Israel to decide on ceasefire as US says deal 'close'

Israel to decide on ceasefire as US says deal 'close'

-

California vows to step in if Trump kills US EV tax credit

-

Special counsel asks judge to dismiss subversion case against Trump

Special counsel asks judge to dismiss subversion case against Trump

-

Ronaldo double takes Al Nassr to brink of Asian Champions League quarters

-

Brazil minister says supports meat supplier 'boycott' of Carrefour

Brazil minister says supports meat supplier 'boycott' of Carrefour

-

Egypt says over a dozen missing after Red Sea tourist boat capsizes

-

Steelmaker ArcelorMittal to close two plants in France: unions

Steelmaker ArcelorMittal to close two plants in France: unions

-

Macy's says employee hid up to $154 mn in costs over 3 years

-

Germany fears outside hand in deadly Lithuania jet crash

Germany fears outside hand in deadly Lithuania jet crash

-

EU grocery shoppers 'fooled' by 'maze' of food labels: audit

-

Awaiting Commerzbank, Italy's UniCredit bids for Italian rival

Awaiting Commerzbank, Italy's UniCredit bids for Italian rival

-

Alonso jokes about playing return amid Leverkusen injury woes

-

Stocks push higher on Trump's 'steady hand' for Treasury

Stocks push higher on Trump's 'steady hand' for Treasury

-

G7 ministers discuss ceasefire efforts in Mideast

-

Bayern need to win all remaining Champions League games, says Kane

Bayern need to win all remaining Champions League games, says Kane

-

Indian cricketer, 13, youngest to be sold in IPL history

-

Romania braces for parliament vote after far right's poll upset

Romania braces for parliament vote after far right's poll upset

-

France unveils new measures to combat violence against women

-

Beating Man City eases pressure for Arsenal game: new Sporting coach

Beating Man City eases pressure for Arsenal game: new Sporting coach

-

Argentine court hears bid to end rape case against French rugby players

-

Egypt says 17 missing after Red Sea tourist boat capsizes

Egypt says 17 missing after Red Sea tourist boat capsizes

-

Stocks push higher on hopes for Trump's Treasury pick

-

Dortmund boss calls for member vote on club's arms sponsorship deal

Dortmund boss calls for member vote on club's arms sponsorship deal

-

Chanel family matriarch dies aged 99: company

-

US boss Hayes says Chelsea stress made her 'unwell'

US boss Hayes says Chelsea stress made her 'unwell'

-

Deadly cargo jet crash in Lithuania amid sabotage probes

-

China's Ding beats 'nervous' Gukesh in world chess opener

China's Ding beats 'nervous' Gukesh in world chess opener

-

Man City can still do 'very good things' despite slump, says Guardiola

-

'After Mazan': France unveils new measures to combat violence against women

'After Mazan': France unveils new measures to combat violence against women

-

Scholz named party's top candidate for German elections

-

Flick says Barca must eliminate mistakes after stumble

Flick says Barca must eliminate mistakes after stumble

-

British business group hits out at Labour's tax hikes

-

German Social Democrats name Scholz as top candidate for snap polls

German Social Democrats name Scholz as top candidate for snap polls

-

Fresh strikes, clashes in Lebanon after ceasefire calls

-

Russia and Ukraine trade aerial attacks amid escalation fears

Russia and Ukraine trade aerial attacks amid escalation fears

-

Georgia parliament convenes amid legitimacy crisis

-

Plastic pollution talks must not fail: UN environment chief

Plastic pollution talks must not fail: UN environment chief

-

Maximum term sought in French mass rape trial for husband who drugged wife

-

Beeches thrive in France's Verdun in flight from climate change

Beeches thrive in France's Verdun in flight from climate change

-

Deep divisions on display at plastic pollution treaty talks

-

UAE names Uzbek suspects in Israeli rabbi's murder

UAE names Uzbek suspects in Israeli rabbi's murder

-

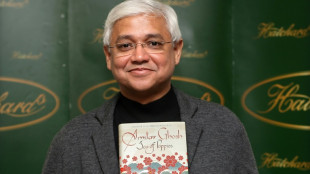

Indian author Ghosh wins top Dutch prize

-

Real Madrid star Vinicius out of Liverpool clash with hamstring injury

Real Madrid star Vinicius out of Liverpool clash with hamstring injury

-

For Ceyda: A Turkish mum's fight for justice for murdered daughter

| RBGPF | -1.6% | 59.24 | $ | |

| CMSC | 0.32% | 24.7516 | $ | |

| RYCEF | -0.15% | 6.79 | $ | |

| VOD | 2.14% | 8.921 | $ | |

| CMSD | 0.41% | 24.561 | $ | |

| SCS | 4.36% | 13.875 | $ | |

| RELX | -0.28% | 46.62 | $ | |

| GSK | 0.69% | 34.195 | $ | |

| RIO | 1.2% | 63.105 | $ | |

| BTI | -0.05% | 37.36 | $ | |

| NGG | 0.06% | 63.15 | $ | |

| BP | -1.31% | 29.335 | $ | |

| AZN | 1.22% | 66.439 | $ | |

| BCC | 6.63% | 153.985 | $ | |

| JRI | 1.12% | 13.36 | $ | |

| BCE | 0.58% | 26.926 | $ |

Asia stocks track US and European surge, oil ticks up

Asian equities rallied Thursday following a strong bounce on Wall Street and a breathtaking surge in Europe sparked by a plunge in oil prices and bargain-buying following a Ukraine-fuelled rout.

A glimmer of hope for peace talks provided some much-needed support to asset markets, which have been in the grip of extreme volatility in the two weeks since Russia invaded its neighbour, sparking a wave of sanctions against Moscow.

However, commentators urged caution in a time of massive uncertainty, with some warning that further losses for stocks were likely and crude will no doubt remain elevated for some time.

But for now, investors are enjoying a rare moment of calm, lapping up cheaper equities after a blockbuster day for their US and European colleagues.

The Dow jumped two percent, the S&P 500 even more and the tech-heavy Nasdaq an impressive 3.6 percent.

Frankfurt rocketed nearly eight percent and Paris more than seven percent, with analysts also crediting the gains to talk of a plan to issue more joint debt to fast-track green energy and renewables, defence and subsidies for spiking energy costs.

But a key driver of the advance was a massive drop in oil prices, which provided some relief to traders worried about already high inflation being sent even higher.

Brent at one point dropped to as low as $105.60, having hit a peak of $139 two days before, on hopes that the huge amounts of Russian oil taken out of the market by sanctions could be largely replaced by sourcing from elsewhere.

The United Arab Emirates said Wednesday it would urge fellow states in the OPEC oil producers' cartel to boost output, while US talks with massive producer Venezuela appeared to be making progress.

At the same time Iraq has said it could lift output and nuclear talks with Iran were also showing signs of bearing fruit.

Both main contracts fluctuated in Asian trade Thursday but with the war in Ukraine still raging and supplies still tight, expectations are for the commodity to maintain its strength.

Meanwhile, the optimists were given a lift after a top foreign policy aide to Ukraine President Volodymyr Zelensky said the country was prepared to talk about Moscow's demand for it to remain neutral in return for security guarantees.

"Surely, we are ready for a diplomatic solution," deputy chief of staff Ihor Zhovkva told Bloomberg Television.

"Our first and foremost pre-condition for having such kind of negotiations is immediate cease-fire and withdrawal of Russian troops."

That came as Russia's foreign ministry said it would be better if its goals in Ukraine were achieved through talks.

Investors will be keeping a close eye on a meeting between the countries' foreign ministers in Turkey on Thursday, marking the first high-level contact between Kyiv and Moscow since the invasion.

"If you see a resolution of the war in Ukraine -- and we are getting some reports that Russia and Ukraine might be moving closer to the negotiation stage -- that could help shift sentiment," said Nadia Lovell of UBS Global Wealth Management.

But she said she saw further choppiness ahead.

On equity markets, Tokyo bolted almost four percent higher -- its best one-day gain in 21 months -- while Seoul, Mumbai and Taipei gained more than two percent. Shanghai, Sydney, Singapore, Manila and Wellington were up more than one percent while Hong Kong, Jakarta and Bangkok were also in positive territory.

Gold, a safe haven asset in times of turmoil, fell back below $2,000, having almost hit a record on Wednesday, and other commodities that have hit all-time highs -- including wheat and nickel -- also retreated.

However, equity markets remain well down on the year and Stephen Innes at SPI Asset Management said: "It has been a harrowing week for investors; keep in mind these are financial-crises-type markets where everybody is trading headlines and chasing the same momentum intraday.

"But this should prove to be a reminder that systematic flow can move markets both ways, especially when the active investor base sits on the sidelines."

Investors will be closely watching US inflation data later in the day as it could play a part in the Federal Reserve's thinking ahead of an expected interest rate hike this month.

That comes as the European Central Bank holds its own policy meeting, with some commentators suggesting it could step back from tightening measures as it looks to support the economy, despite soaring prices in the eurozone.

- Key figures around 0710 GMT -

Tokyo - Nikkei 225: UP 3.9 percent at 25,690.40 (close)

Hong Kong - Hang Seng Index: UP 0.6 percent at 20,751.25

Shanghai - Composite: UP 1.2 percent at 3,296.09 (close)

Brent North Sea crude: 1.9 percent at $113.29 per barrel

West Texas Intermediate: UP 1.1 percent at $109.87

Euro/dollar: DOWN at $1.1056 from $1.1067 late Wednesday

Pound/dollar: DOWN at $1.3181 from $1.3181

Euro/pound: DOWN at 83.88 pence from 83.94 pence

Dollar/yen: UP at 116.05 yen from 115.86 yen

New York - Dow: UP 2.0 percent at 33,286.25 (close)

London - FTSE 100: UP 3.3 percent at 7,190.72 (close)

M.Odermatt--BTB