-

Allen and Goff to start NFL Pro Bowl Games as Mahomes snubbed

Allen and Goff to start NFL Pro Bowl Games as Mahomes snubbed

-

Apple agrees to $95 mn deal to settle Siri eavesdropping suit

-

South Korea investigators attempt to arrest President Yoon

South Korea investigators attempt to arrest President Yoon

-

Tears, tourism on Bourbon Street after US terror nightmare

-

Extradited SKorean crypto 'genius' in court to face US charges

Extradited SKorean crypto 'genius' in court to face US charges

-

Venezuela offers $100,000 reward for exiled opposition candidate

-

South Korea investigators arrive to attempt to arrest president

South Korea investigators arrive to attempt to arrest president

-

Giannis and Jokic lead NBA All-Star voting with LeBron well back

-

Mixed day for global stocks as dollar pushes higher

Mixed day for global stocks as dollar pushes higher

-

Nick Clegg leaves Meta global policy team

-

Vegas Tesla blast suspect shot himself in head: officials

Vegas Tesla blast suspect shot himself in head: officials

-

Shiffrin hopes to be back on slopes 'in the next week'

-

Dumfries double takes Inter into Italian Super Cup final

Dumfries double takes Inter into Italian Super Cup final

-

Spain's Canary Islands received record 46,843 migrants in 2024: ministry

-

Panama says migrant jungle crossings fell 41% in 2024

Panama says migrant jungle crossings fell 41% in 2024

-

UN experts slam Israel's 'blatant assault' on health rights in Gaza

-

Tesla reports lower 2024 auto deliveries, missing forecast

Tesla reports lower 2024 auto deliveries, missing forecast

-

Meghan Markle's lifestyle show to premiere Jan 15 on Netflix

-

On Bourbon Street, a grim cleanup after deadly nightmare

On Bourbon Street, a grim cleanup after deadly nightmare

-

New Orleans attacker: US Army vet 'inspired' by Islamic State

-

New Orleans killer acted alone, professed loyalty to jihadist group: FBI

New Orleans killer acted alone, professed loyalty to jihadist group: FBI

-

Wall Street lifts spirits after Asia starts year in red

-

UK's biggest dinosaur footprint site uncovered

UK's biggest dinosaur footprint site uncovered

-

Former Australia coach Langer to take charge of London Spirit

-

Most UK doctors suffer from 'compassion fatigue': poll

Most UK doctors suffer from 'compassion fatigue': poll

-

Everton boss Dyche unconcerned by Maupay jibe

-

FBI probes potential accomplices in New Orleans truck ramming

FBI probes potential accomplices in New Orleans truck ramming

-

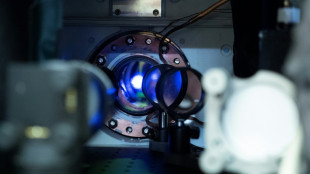

Secret lab developing UK's first quantum clock: defence ministry

-

Premier League chief fears Club World Cup's impact on Man City and Chelsea

Premier League chief fears Club World Cup's impact on Man City and Chelsea

-

US mulls new restrictions on Chinese drones

-

Wall Street dons early green after Asia starts year in red

Wall Street dons early green after Asia starts year in red

-

Rosita Missoni of Italy's eponymous fashion house dies age 93

-

27 sub-Saharan African migrants die off Tunisia in shipwrecks

27 sub-Saharan African migrants die off Tunisia in shipwrecks

-

UK grime star Stormzy banned from driving for nine months

-

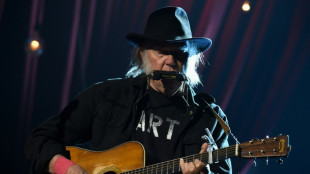

Neil Young dumps Glastonbury alleging 'BBC control'

Neil Young dumps Glastonbury alleging 'BBC control'

-

Djokovic, Sabalenka into Brisbane quarters as rising stars impress

-

Swiatek battles back to take Poland into United Cup semis

Swiatek battles back to take Poland into United Cup semis

-

Electric cars took 89% of Norway market in 2024

-

Stock markets begin new year with losses

Stock markets begin new year with losses

-

Rival South Korea camps face off as president holds out

-

French downhill ace Sarrazin out of intensive care

French downhill ace Sarrazin out of intensive care

-

Djokovic cruises past Monfils as rising stars impress in Brisbane

-

Montenegro mourns after gunman kills 12

Montenegro mourns after gunman kills 12

-

Sales surge in 2024 for Chinese EV giant BYD

-

Agnes Keleti, world's oldest Olympic champion, dies at 103

Agnes Keleti, world's oldest Olympic champion, dies at 103

-

Asian stocks begin year on cautious note

-

Andreeva, Mpetshi Perricard showcase Australian Open potential

Andreeva, Mpetshi Perricard showcase Australian Open potential

-

South Korea police raid Jeju Air, airport over fatal crash

-

Perera's 46-ball ton gives Sri Lanka consolation T20 win over New Zealand

Perera's 46-ball ton gives Sri Lanka consolation T20 win over New Zealand

-

Afghan refugees suffer 'like prisoners' in Pakistan crackdown

Stocks slide, oil rebounds as peace talks stall

European and US stocks sank Thursday as key peace talks stalled between Russia and Ukraine, compounded by a worsening inflation and growth outlook.

Ukraine's Foreign Minister Dmytro Kuleba and his Russian counterpart Sergei Lavrov met in Turkey in the first top-level talks since Moscow's invasion two weeks ago, but failed to make any progress on a resolution on a conflict that has sent more than 2.3 people fleeing the country.

"The latest talks between Russia and Ukraine failed to provide breakthrough in ending the war," said ThinkMarkets analyst Fawad Razaqzada.

"Markets have reacted in the way you would expect."

European stocks were down sharply after having surging the previous day on sliding oil prices and a glimmer of hope for an end to the conflict that has seen Western nations slap a range of sanctions on Russia that will result in its economic isolation.

US stocks also opened lower, with the Dow shedding 1.1 percent.

Meanwhile, oil prices rebounded after having fallen by more than 12 percent on Wednesday on hopes oil producing nations will step up production.

European benchmark Brent North Sea oil rose 4.4 percent and New York's WTI gained 3.5 percent, but were still way below the peak of $139 reached earlier this week as investors were spooked about moves by Western nations to ban Russian oil.

Markets have been rocked by extreme volatility in the two weeks since Russia invaded its neighbour, sparking a wave of sanctions against Moscow.

Trading of shares in Russia's steelmaking giant Evraz, whose key shareholders include Roman Abramovich, was suspended in London after the UK slapped an asset freeze on the Russian oligarch over his alleged Kremlin links.

It includes a halt to Abramovich's plan to sell football giant Chelsea.

- Inflation and growth concerns -

The latest economic data provided little comfort to investors, however.

US consumer prices rose at a fresh 40-year high 7.9 percent annually in February,

"Inflation is still terribly high and going higher given the worsening commodity price trends seen this month," said Patrick J. O'Hare at Briefing.com.

"Rising oil prices have been complicating the inflation situation and the Fed's approach for getting inflation under control at a time when the Russia-Ukraine situation has been driving concerns about a slowdown in global growth," he added.

The European Central Bank on Thursday jacked its inflation forecast for this year to 5.1 percent, while cutting the outlook for growth to 3.7 percent.

It also gave itself more flexibility as to when it will start raising interest rates.

"This move appears to open the central banks options with respect to potentially raising rates by the end of this year," said Michael Hewson, chief market analyst at CMC Markets UK.

"EU inflation is already at a record high of 5.8 percent and given the events of the last few weeks, its likely to go even higher in the coming months. Against that backdrop, doing nothing is a luxury the ECB does not have," he warned.

The euro slid against both the dollar and pound.

- Key figures around 1430 GMT -

London - FTSE 100: DOWN 1.3 percent at 7,095.54 points

Frankfurt - DAX: DOWN 3.1 percent at 13,421.05

Paris - CAC 40: DOWN 2.0 percent at 6,197.84

EURO STOXX 50: DOWN 3.1 percent at 3,651.03

New York - Dow: DOWN 1.1 percent at 32,909.66

Brent North Sea crude: UP 4.4 percent at $116.01 per barrel

West Texas Intermediate: UP 3.5 percent at $112.54

Tokyo - Nikkei 225: UP 3.9 percent at 25,690.40 (close)

Hong Kong - Hang Seng Index: UP 1.3 percent at 20,890.26 (close)

Shanghai - Composite: UP 1.2 percent at 3,296.09 (close)

Euro/dollar: DOWN at $1.1033 from $1.1076 Wednesday

Pound/dollar: DOWN at $1.3148 from $1.3181

Euro/pound: DOWN at 83.90 pence from 84.03 pence

Dollar/yen: UP at 116.08 yen from 115.83 yen

burs-rl/ach

I.Meyer--BTB