-

Trump tariff vow drives choppy day for markets

Trump tariff vow drives choppy day for markets

-

Celtic fuelled by Dortmund embarrassment: Rodgers

-

Pakistan ex-PM Khan calls more protestors to capital after deadly clashes

Pakistan ex-PM Khan calls more protestors to capital after deadly clashes

-

Salah driven not distracted by contract deadlock, says Slot

-

Algeria holds writer Boualem Sansal on national security charges: lawyer

Algeria holds writer Boualem Sansal on national security charges: lawyer

-

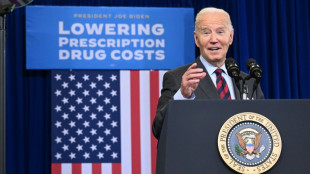

Biden proposes huge expansion of weight loss drug access

-

Saudi 2025 budget sees lower deficit on spending trims

Saudi 2025 budget sees lower deficit on spending trims

-

Pogba's brother, five others, on trial for blackmailing him

-

Israel pounds Beirut as security cabinet discusses ceasefire plan

Israel pounds Beirut as security cabinet discusses ceasefire plan

-

Prosecutors seek up to 15-year terms for French rape trial defendants

-

Emery bids to reverse Villa slump against Juventus

Emery bids to reverse Villa slump against Juventus

-

Survivors, bodies recovered from capsized Red Sea tourist boat

-

Carrefour attempts damage control against Brazil 'boycott'

Carrefour attempts damage control against Brazil 'boycott'

-

Namibians heads to the polls wanting change

-

Sales of new US homes lowest in around two years: govt

Sales of new US homes lowest in around two years: govt

-

Paris mayor Hidalgo says to bow out in 2026

-

Stocks, dollar mixed on Trump tariff warning

Stocks, dollar mixed on Trump tariff warning

-

ICC to decide fate of Pakistan's Champions Trophy on Friday

-

Man Utd revenue falls as Champions League absence bites

Man Utd revenue falls as Champions League absence bites

-

Russia vows reply after Ukraine strikes again with US missiles

-

Trump threatens trade war on Mexico, Canada, China

Trump threatens trade war on Mexico, Canada, China

-

Motta's injury-hit Juve struggling to fire ahead of Villa trip

-

Cycling chiefs seek WADA ruling on carbon monoxide use

Cycling chiefs seek WADA ruling on carbon monoxide use

-

Israel pounds Beirut as security cabinet to discuss ceasefire

-

Fewest new HIV cases since late 1980s: UNAIDS report

Fewest new HIV cases since late 1980s: UNAIDS report

-

4 security forces killed as ex-PM Khan supporters flood Pakistan capital

-

Four bodies, four survivors recovered from Egypt Red Sea sinking: governor

Four bodies, four survivors recovered from Egypt Red Sea sinking: governor

-

Ayub century helps Pakistan crush Zimbabwe, level series

-

French court cracks down on Corsican language use in local assembly

French court cracks down on Corsican language use in local assembly

-

Prosecutors seek up to 14-year terms for French rape trial defendants

-

Russia expels UK diplomat accused of espionage

Russia expels UK diplomat accused of espionage

-

Israeli security cabinet to discuss ceasefire as US says deal 'close'

-

COP29 president blames rich countries for 'imperfect' deal

COP29 president blames rich countries for 'imperfect' deal

-

Stocks retreat, dollar mixed on Trump tariff warning

-

No regrets: Merkel looks back at refugee crisis, Russia ties

No regrets: Merkel looks back at refugee crisis, Russia ties

-

IPL history-maker, 13, who 'came on Earth to play cricket'

-

Ukraine says Russia using landmines to carry out 'genocidal activities'

Ukraine says Russia using landmines to carry out 'genocidal activities'

-

Prosecutors seek up to 12-year terms for French rape trial defendants

-

'Record' drone barrage pummels Ukraine as missile tensions seethe

'Record' drone barrage pummels Ukraine as missile tensions seethe

-

Laos hostel staff detained after backpackers' deaths

-

Hong Kong LGBTQ advocate wins posthumous legal victory

Hong Kong LGBTQ advocate wins posthumous legal victory

-

Ukraine says cannot meet landmine destruction pledge due to Russia invasion

-

Rod Stewart to play Glastonbury legends slot

Rod Stewart to play Glastonbury legends slot

-

Winter rains pile misery on war-torn Gaza's displaced

-

'Taiwan also has baseball': jubilant fans celebrate historic win

'Taiwan also has baseball': jubilant fans celebrate historic win

-

Russia pummels Ukraine with 'record' drone barrage

-

Paul Pogba blackmail trial set to open in Paris

Paul Pogba blackmail trial set to open in Paris

-

China's Huawei unveils 'milestone' smartphone with homegrown OS

-

Landmine victims gather to protest US decision to supply Ukraine

Landmine victims gather to protest US decision to supply Ukraine

-

Indian rival royal factions clash outside palace

| CMSC | -0.65% | 24.57 | $ | |

| RBGPF | 1.33% | 61 | $ | |

| BCC | -3.08% | 147.94 | $ | |

| GSK | -0.69% | 33.915 | $ | |

| SCS | -1.22% | 13.555 | $ | |

| AZN | -0.36% | 66.16 | $ | |

| BTI | 0.56% | 37.54 | $ | |

| BCE | -2.06% | 26.475 | $ | |

| RIO | -1.86% | 61.83 | $ | |

| RELX | 0.26% | 46.69 | $ | |

| JRI | -0.5% | 13.303 | $ | |

| NGG | -0.81% | 62.75 | $ | |

| RYCEF | 0.44% | 6.8 | $ | |

| CMSD | -0.33% | 24.498 | $ | |

| VOD | -0.62% | 8.855 | $ | |

| BP | -1.77% | 28.81 | $ |

Stocks climb as investors track US rate stance, Ukraine war

Stock markets rose while oil prices steadied Tuesday as investors tracked developments in the war in Ukraine and digested the US Federal Reserve chief's warning of a possible sharp interest rate hike.

Crude futures had soared more than seven percent Monday on supply worries as European leaders debated banning imports from Russia, but they were more or less flat in Tuesday trading.

Wall Street advanced around 0.8 percent in early deals, mirroring similar rises on main European markets.

Some EU states want to ramp up pressure on Russian President Vladimir Putin with energy sanctions, though others, including Germany -- hugely reliant on Moscow's fuel -- have been reluctant to target the key sector.

Adding to the price pressure, Saudi Arabia warned that Yemeni rebel attacks on its oil facilities pse a "direct threat" to global supplies, after Red Sea facilities belonging to giant Saudi Aramco were targeted.

"Despite some optimism seen across markets resulting from the potential of peace talks between Russia and Ukraine, the oil market remains one of the most volatile," noted Walid Koudmani, chief market analyst at XTB.

Soaring oil prices have been a driver of turmoil on world markets in recent weeks as demand surges also as economies reopen from pandemic lockdowns.

That, along with a spike in the cost of other key commodities, such as metals and wheat on the Ukraine conflict, has sent global inflation rocketing and caused central banks to hike interest rates.

There is a growing fear that the global economy could endure a period of stagflation whereby prices soar but growth stalls.

- Rising rate -

Federal Reserve chair Jerome Powell on Monday indicated the US central bank could lift borrowing costs faster than market expectations to keep a leash on inflation.

The yield on the 10-year US Treasury note -- a proxy for interest rate expectations -- jumped further above two percent as traders bet on aggressive Fed rate hikes in the coming months.

"The battle of rate-hike expectations will be waged all year," said Briefing.com analyst Patrick O'Hare.

"Thus far, it has been the root of volatility in the capital markets as participants have been attempting to assess the ultimate impact of the Fed removing its policy accommodation on the path of the economy, inflation, and earnings," he said.

Regarding the Ukraine war, the Kremlin on Tuesday said it would like negotiations with Kyiv aimed at ending Russia's military action to have more substance.

The two sides are holding negotiations remotely after several rounds of talks between delegations meeting on the border between Belarus and Ukraine.

So far, the talks have yielded little progress, with both sides blaming the other, and none has been at the presidential level.

Ukrainian President Volodymyr Zelensky renewed an offer of direct peace talks with Putin late Monday.

In Asia, Hong Kong's main stocks index ended sharply higher, resuming last week's rally sparked by China's pledge to support the country's markets and indicated a tech crackdown was nearing an end.

- Key figures around 1345 GMT -

New York - DOW: UP 0.8 percent at 34,827.63 points

London - FTSE 100: UP 0.5 percent at 7,478.30

Frankfurt - DAX: UP 0.8 percent at 14,437.32

Paris - CAC 40: UP 0.8 percent at 6,638.58

EURO STOXX 50: UP 0.9 percent at 3,915.42

Brent North Sea crude: FLAT at $115.54 per barrel

West Texas Intermediate: DOWN 1.0 percent at $119.91 per barrel

Tokyo - Nikkei 225: UP 1.5 percent at 27,224.11 (close)

Hong Kong - Hang Seng Index: UP 3.2 percent at 21,889.28 (close)

Shanghai - Composite: UP 0.2 percent at 3,259.86 (close)

Euro/dollar: UP at $1.1032 from $1.1013 Monday

Pound/dollar: UP at $1.3259 from $1.3156

Euro/pound: DOWN at 83.22 pence from 83.67 pence

Dollar/yen: UP at 120.62 yen from 119.47 yen

K.Brown--BTB