-

Bangladeshi Hindus protest over leader's arrest, one dead

Bangladeshi Hindus protest over leader's arrest, one dead

-

Trump tariff vow drives choppy day for markets

-

Celtic fuelled by Dortmund embarrassment: Rodgers

Celtic fuelled by Dortmund embarrassment: Rodgers

-

Pakistan ex-PM Khan calls more protestors to capital after deadly clashes

-

Salah driven not distracted by contract deadlock, says Slot

Salah driven not distracted by contract deadlock, says Slot

-

Algeria holds writer Boualem Sansal on national security charges: lawyer

-

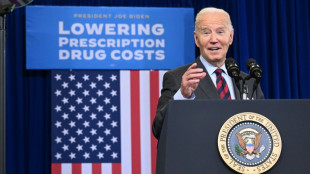

Biden proposes huge expansion of weight loss drug access

Biden proposes huge expansion of weight loss drug access

-

Saudi 2025 budget sees lower deficit on spending trims

-

Pogba's brother, five others, on trial for blackmailing him

Pogba's brother, five others, on trial for blackmailing him

-

Israel pounds Beirut as security cabinet discusses ceasefire plan

-

Prosecutors seek up to 15-year terms for French rape trial defendants

Prosecutors seek up to 15-year terms for French rape trial defendants

-

Emery bids to reverse Villa slump against Juventus

-

Survivors, bodies recovered from capsized Red Sea tourist boat

Survivors, bodies recovered from capsized Red Sea tourist boat

-

Carrefour attempts damage control against Brazil 'boycott'

-

Namibians heads to the polls wanting change

Namibians heads to the polls wanting change

-

Sales of new US homes lowest in around two years: govt

-

Paris mayor Hidalgo says to bow out in 2026

Paris mayor Hidalgo says to bow out in 2026

-

Stocks, dollar mixed on Trump tariff warning

-

ICC to decide fate of Pakistan's Champions Trophy on Friday

ICC to decide fate of Pakistan's Champions Trophy on Friday

-

Man Utd revenue falls as Champions League absence bites

-

Russia vows reply after Ukraine strikes again with US missiles

Russia vows reply after Ukraine strikes again with US missiles

-

Trump threatens trade war on Mexico, Canada, China

-

Motta's injury-hit Juve struggling to fire ahead of Villa trip

Motta's injury-hit Juve struggling to fire ahead of Villa trip

-

Cycling chiefs seek WADA ruling on carbon monoxide use

-

Israel pounds Beirut as security cabinet to discuss ceasefire

Israel pounds Beirut as security cabinet to discuss ceasefire

-

Fewest new HIV cases since late 1980s: UNAIDS report

-

4 security forces killed as ex-PM Khan supporters flood Pakistan capital

4 security forces killed as ex-PM Khan supporters flood Pakistan capital

-

Four bodies, four survivors recovered from Egypt Red Sea sinking: governor

-

Ayub century helps Pakistan crush Zimbabwe, level series

Ayub century helps Pakistan crush Zimbabwe, level series

-

French court cracks down on Corsican language use in local assembly

-

Prosecutors seek up to 14-year terms for French rape trial defendants

Prosecutors seek up to 14-year terms for French rape trial defendants

-

Russia expels UK diplomat accused of espionage

-

Israeli security cabinet to discuss ceasefire as US says deal 'close'

Israeli security cabinet to discuss ceasefire as US says deal 'close'

-

COP29 president blames rich countries for 'imperfect' deal

-

Stocks retreat, dollar mixed on Trump tariff warning

Stocks retreat, dollar mixed on Trump tariff warning

-

No regrets: Merkel looks back at refugee crisis, Russia ties

-

IPL history-maker, 13, who 'came on Earth to play cricket'

IPL history-maker, 13, who 'came on Earth to play cricket'

-

Ukraine says Russia using landmines to carry out 'genocidal activities'

-

Prosecutors seek up to 12-year terms for French rape trial defendants

Prosecutors seek up to 12-year terms for French rape trial defendants

-

'Record' drone barrage pummels Ukraine as missile tensions seethe

-

Laos hostel staff detained after backpackers' deaths

Laos hostel staff detained after backpackers' deaths

-

Hong Kong LGBTQ advocate wins posthumous legal victory

-

Ukraine says cannot meet landmine destruction pledge due to Russia invasion

Ukraine says cannot meet landmine destruction pledge due to Russia invasion

-

Rod Stewart to play Glastonbury legends slot

-

Winter rains pile misery on war-torn Gaza's displaced

Winter rains pile misery on war-torn Gaza's displaced

-

'Taiwan also has baseball': jubilant fans celebrate historic win

-

Russia pummels Ukraine with 'record' drone barrage

Russia pummels Ukraine with 'record' drone barrage

-

Paul Pogba blackmail trial set to open in Paris

-

China's Huawei unveils 'milestone' smartphone with homegrown OS

China's Huawei unveils 'milestone' smartphone with homegrown OS

-

Landmine victims gather to protest US decision to supply Ukraine

| RBGPF | 1.33% | 61 | $ | |

| RYCEF | 0.44% | 6.8 | $ | |

| RELX | 0.22% | 46.675 | $ | |

| BTI | 0.61% | 37.56 | $ | |

| NGG | -0.88% | 62.71 | $ | |

| GSK | -0.71% | 33.91 | $ | |

| CMSC | -0.65% | 24.57 | $ | |

| BCE | -1.83% | 26.535 | $ | |

| AZN | -0.17% | 66.285 | $ | |

| BP | -1.66% | 28.84 | $ | |

| RIO | -1.81% | 61.86 | $ | |

| VOD | -0.62% | 8.855 | $ | |

| SCS | -1.14% | 13.565 | $ | |

| BCC | -3.06% | 147.965 | $ | |

| JRI | -0.49% | 13.305 | $ | |

| CMSD | -0.71% | 24.407 | $ |

Global stocks rise, digesting US rate stance as oil prices dip

Stock markets made gains and oil prices steadied Tuesday as investors tracked developments in the war in Ukraine and digested the US Federal Reserve chief's warning of more aggressive interest rate hikes.

Crude futures had soared more than seven percent Monday amid supply worries as European leaders debated banning imports from Russia, but retreated modestly on Tuesday.

Despite the economic and political fallout from the Ukraine conflict, Wall Street stocks regained their swagger, finishing solidly higher in the wake of Monday's pullback that came after Federal Reserve Chair Jerome Powell said policymakers may have to raise rates more aggressively to combat inflation.

Main European markets also finished in the green Tuesday, Frankfurt, Paris and Milan all adding one percent while London was half a percent to the good at the close.

The market "seems to be shrugging off the inflation story and hawkish Fed," said Neil Wilson, chief market analyst at Markets.com.

Chris Beauchamp, chief market analyst at online trading platform IGA, said "equities have found the strength to move higher once more ... buoyed by Powell's confident outlook" Monday, when he said the economy has sufficient strength to withstand higher interest rates.

"Of course, if Powell’s optimism is misplaced then the reckoning will be unpleasant, but for now stock markets are still content to move higher," Beauchamp added.

Ukrainian President Volodymyr Zelensky renewed an offer of direct peace talks with Russian counterpart Vladimir Putin late Monday, while US President Joe Biden warned Russia that it will pay a "severe price" if it uses chemical or biological weapons in Ukraine.

"It seems whatever economic weakness that is starting to arise is being shrugged off as hope grows that Russia has lost momentum in the war in Ukraine," Oanda's Edward Moya said.

"The impact from this war is anyone's guess, but what we do know is that the longer it lasts, the greater the stagflation risk will be for the global economy."

In Asia, Hong Kong's main stocks index ended sharply higher, resuming last week's rally sparked by China's pledge to support the country's markets and indicated a tech crackdown was nearing an end.

Back on Wall Street, consumer discretionary stocks led the industrial sectors following results from Nike that topped analyst expectations.

The sporting giant rose 2.2 percent as strong consumer demand and good product pricing offset a hit from lower China sales.

"Nike is a pretty good bellwether for consumer stocks," said Art Hogan, chief strategist at National Securities. "Yesterday was a bit of an overreaction."

- Key figures around 2040 GMT -

New York - DOW: UP 0.7 percent at 34,807.46 (close)

New York - S&P 500: UP 1.1 percent at 4,511.61 (close)

New York - Nasdaq: UP 2.0 percent at 14,108.82 (close)

London - FTSE 100: UP 0.5 percent at 7,476.72 (close)

Frankfurt - DAX: UP 1.0 percent at 14,473.20 (close)

Paris - CAC 40: UP 1.2 percent at 6,659.41 (close)

EURO STOXX 50: UP 1.1 percent at 3,926.12 (close)

Tokyo - Nikkei 225: UP 1.5 percent at 27,224.11 (close)

Hong Kong - Hang Seng Index: UP 3.2 percent at 21,889.28 (close)

Shanghai - Composite: UP 0.2 percent at 3,259.86 (close)

Brent North Sea crude: DOWN 0.1 percent at $115.48 per barrel

West Texas Intermediate: DOWN 0.3 percent at $111.76 per barrel

Euro/dollar: UP at $1.1033 from $1.1016 Monday

Pound/dollar: UP at $1.3260 from $1.3169

Euro/pound: DOWN at 83.16 pence from 83.65 pence

Dollar/yen: UP at 120.82 yen from 119.47 yen

N.Fournier--BTB