-

EU vessels to cease fishing in Senegal after accord expires

EU vessels to cease fishing in Senegal after accord expires

-

Bayer shares hit 20-yr low as problems pile up

-

Russian MPs pass law banning 'propaganda' of childless lifestyles

Russian MPs pass law banning 'propaganda' of childless lifestyles

-

NATO 'must do more than just keep Ukraine in fight', says Rutte

-

EU unity in a 'world on fire': Kallas makes top diplomat pitch

EU unity in a 'world on fire': Kallas makes top diplomat pitch

-

UK vows to cut greenhouse gas emissions by 81% on 1990 levels by 2035

-

Crisis-hit Germany headed for February 23 snap election

Crisis-hit Germany headed for February 23 snap election

-

C.Africa urges lifting of embargo on diamond exports

-

Poland hoping Swiatek can inspire BJK Cup 'revenge' against Spain

Poland hoping Swiatek can inspire BJK Cup 'revenge' against Spain

-

Court challenge begins against UK oil and gas field approvals

-

Stock markets retreat on Trump tariff worries

Stock markets retreat on Trump tariff worries

-

Spain PM accused of 'blackmail' by tying budget to flood aid

-

Lineker to leave Match of the Day after 26 years

Lineker to leave Match of the Day after 26 years

-

New EU chief diplomat backs Ukraine as bloc's top team faces grilling

-

Hong Kong press union head sues WSJ for 'unreasonable dismissal'

Hong Kong press union head sues WSJ for 'unreasonable dismissal'

-

Politics v cricket leaves Champions Trophy up in the air

-

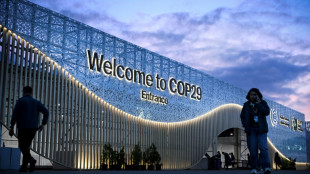

Azerbaijan defends fossil fuels at COP29 as big names skip summit

Azerbaijan defends fossil fuels at COP29 as big names skip summit

-

Tech sector gathers in Lisbon in shadow of Trump victory

-

The women behind Zimbabwe's striking hut painting art

The women behind Zimbabwe's striking hut painting art

-

South Korea prosecutors indict controversial American streamer

-

'Anti-war' comedy directed by Malkovich riles Bulgarian nationalists

'Anti-war' comedy directed by Malkovich riles Bulgarian nationalists

-

Hungary's most vulnerable fall victim to Orban feud with his ex-pastor

-

Asian markets drop as Trump worries kick in after China disappoints

Asian markets drop as Trump worries kick in after China disappoints

-

China, Russia must fight US 'containment': security chief

-

Climate crisis worsening already 'hellish' refugee situation: UN

Climate crisis worsening already 'hellish' refugee situation: UN

-

China planning to cut taxes on home buying: report

-

Dutch court to rule in Shell climate appeal

Dutch court to rule in Shell climate appeal

-

Peru's Juan Diego Florez looks to create a musical legacy

-

Nintendo courts non-gamers in 'about-turn' strategy

Nintendo courts non-gamers in 'about-turn' strategy

-

Toxic towns in Kyrgyzstan battling radioactive danger

-

China's top diplomat holds security talks with Russia's Shoigu

China's top diplomat holds security talks with Russia's Shoigu

-

New Zealand delivers landmark apology to survivors of state abuse

-

Mauritius opposition leader claims sweeping vote win

Mauritius opposition leader claims sweeping vote win

-

Fifth storm in under a month bears down on Philippines

-

Trump makes new appointments, Rubio tipped for secretary of state

Trump makes new appointments, Rubio tipped for secretary of state

-

EU top team heavyweights face parliament test

-

Short cut to feminism: How an assault changed Korean woman's outlook

Short cut to feminism: How an assault changed Korean woman's outlook

-

North Korea ratifies defence treaty with Russia

-

China's largest air show takes off with fighter jets, attack drones

China's largest air show takes off with fighter jets, attack drones

-

Surfboards with bright lights could deter shark attacks - researchers

-

Sri Lanka's leftist president faces first parliament test

Sri Lanka's leftist president faces first parliament test

-

Asian markets stutter with focus on China as Trump picks team

-

Fifth cyclone in under a month bears down on Philippines

Fifth cyclone in under a month bears down on Philippines

-

China's top diplomat to host Russia's Shoigu for security talks

-

Bees help tackle elephant-human conflict in Kenya

Bees help tackle elephant-human conflict in Kenya

-

Australia moves to keep its banks in the Pacific

-

World leaders meet for climate talks, but big names missing

World leaders meet for climate talks, but big names missing

-

Italy and Lufthansa reach deal on ITA Airways stake

-

Fears of Trump trade wars cast pall over Asia-Pacific summit

Fears of Trump trade wars cast pall over Asia-Pacific summit

-

Trump makes new appointments including new 'border czar'

Cryptocurrency platform boss urges tighter regulation

The co-founder of one of the world's most popular cryptocurrencies called for tighter regulation of the sector to guard against the fraud and wild swings that have dogged it, in an interview with AFP.

Jeremy Allaire of Circle recounted the US firm's decision to offer a stabilised cryptocurrency -- and insisted crypto operators owed it to society to submit to safeguards just as other emerging sectors such as AI must.

"We have social objectives that we have to match against the technology," Allaire said during a visit this week to Circle's European headquarters in Paris.

Circle offers a USDC "stablecoin", pegged to the dollar, as well as a euro-pegged variant, EURC.

Currently, $35.5 billion worth of USDC are in circulation.

As with other cryptocurrencies, transactions are recorded on a decentralised ledger, the blockchain, and not by a bank as is the case with traditional currencies.

However, whereas the dollar value of cryptocurrencies such as bitcoin tends to fluctuate, often wildly, the creators of stablecoins actively target a stable value.

In a world propelled by technological development, Allaire said, safeguards are vital for such activities.

"If I'm writing software to control a ballistic missile system, that should be regulated activity," said Allaire.

"If I'm writing a large language model and deploying that, and it has the potential to do very problematic things in society, there need to be rules that need to be assessed. Crypto is the same thing."

- Crypto fraud, ransomware -

Cryptocurrencies have made headlines since their creation, from their extreme volatility to the collapse of several industry giants, foremost among them the FTX exchange platform.

The best-known cyptocurrency, bitcoin, remains the currency of choice for paying on the dark web without leaving any trace.

It is used for extorting funds via ransomware attacks, which block access to victims' computer systems and demand a ransom payment.

According to a recent report by Chainanalysis, the first half of 2024 was marked by a decrease in illicit activities. However, over that period, $460 million was paid out for ransomware, a rise of two percent on a year earlier.

Crypto exhanges operate through open-source software, Allaire noted.

"That helps with transparency, visibility, security, other things."

But some have been "using the technology to do things outside of any kind of supervision", he conceded.

"You've seen fraud, abuse. You've seen people running off with money."

When cryptocurrency emerged, "unregulated intermediaries" sprang up in the sector, he said.

"Of course, the risks they take... in many cases, have led to significant losses," Allaire said.

"But that's not an argument against the technology. That's an argument against humans. And it's an argument for better supervision."

- EU, US crypto regulations -

Regulators across the globe have taken note.

Last year the European Parliament adopted an EU-wide framework for crypto asset markets, "MiCA" -- Markets in Crypto-Assets -- requiring mandatory approval for digital-asset service providers.

In July, Circle announced it was the first "stablecoin" issuer to comply with this new regulation.

Stablecoins are used to facilitate intra-crypto exchanges by investors without having to go through a bank.

But they also give users access to a product pegged to the dollar without having a bank account in the United States, and allow cross-border payments or money transfers.

In the United States too, greater regulation is on the agenda.

US presidential candidate Kamala Harris was quoted as telling Bloomberg last week: "We will encourage innovative technologies like AI and digital assets, while protecting our consumers and investors."

In May the US House of Representatives passed a legal framework designed to regulate the crypto market -- the Financial Innovation and Technology for the 21st Century Act.

Circle is meanwhile preparing to move its headquarters from Boston to New York City - "at the very top of the World Trade Center... the very heart of the dollar international system," says Allaire.

"That's in part symbolic. It's also who we are, what we're doing. We're building, hopefully, the world's leading digital dollar and upgrading to this new internet financial system."

P.Anderson--BTB