-

Icelanders head to the polls after government collapse

Icelanders head to the polls after government collapse

-

England strike twice to have New Zealand in trouble in first Test

-

Researchers analyse DNA from dung to save Laos elephants

Researchers analyse DNA from dung to save Laos elephants

-

North Korea's Kim, Russian minister agree to boost military ties

-

Brook's 171 gives England commanding 151-run lead over New Zealand

Brook's 171 gives England commanding 151-run lead over New Zealand

-

Kamala's coda: What's next for defeated US VP Harris?

-

Chiefs hold off Raiders to clinch NFL playoff berth

Chiefs hold off Raiders to clinch NFL playoff berth

-

Australia's Hazlewood out of 2nd India Test

-

Trudeau in Florida to meet Trump as tariff threats loom

Trudeau in Florida to meet Trump as tariff threats loom

-

Jihadists, allies breach Syria's second city in lightning assault

-

Trudeau in Florida to meet Trump as tariff threats loom: media

Trudeau in Florida to meet Trump as tariff threats loom: media

-

Hunter shines as Hawks top Cavs again

-

Southampton denied shock Brighton win by dubious VAR call

Southampton denied shock Brighton win by dubious VAR call

-

Alarm over high rate of HIV infections among young women, girls

-

Swiss unveil Euro 2025 mascot Maddli

Swiss unveil Euro 2025 mascot Maddli

-

Bears fire coach Eberflus after latest agonizing NFL defeat

-

Rallies mark one month since Spain's catastrophic floods

Rallies mark one month since Spain's catastrophic floods

-

Arnault family's Paris FC takeover completed

-

Georgian police stage new crackdown on pro-EU protestors

Georgian police stage new crackdown on pro-EU protestors

-

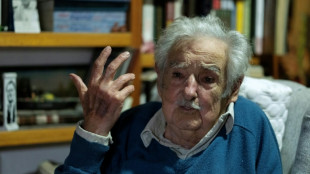

'We're messing up:' Uruguay icon Mujica on strongman rule in Latin America

-

Liverpool dealt Konate injury blow

Liverpool dealt Konate injury blow

-

Van Nistelrooy appointed Leicester manager

-

Verstappen brought back to earth in Doha after F1 title party

Verstappen brought back to earth in Doha after F1 title party

-

Global wine output to hit lowest level since 1961

-

Norris boosts McLaren title hopes with sprint pole

Norris boosts McLaren title hopes with sprint pole

-

Big-hitting Stubbs takes satisfaction from grinding out Test century

-

Romania recounts presidential ballots as parliamentary vote looms

Romania recounts presidential ballots as parliamentary vote looms

-

French skipper Dalin leads as Vendee Globe passes Cape of Good Hope

-

Chelsea not in Premier League title race, says Maresca

Chelsea not in Premier League title race, says Maresca

-

Brazil's Bolsonaro aims to ride Trump wave back to office: WSJ

-

France requests transfer of death row convict held in Indonesia: minister

France requests transfer of death row convict held in Indonesia: minister

-

'Mamie Charge': Migrants find safe haven in Frenchwoman's garage

-

Iconic Uruguayan ex-leader hails country's swing left as 'farewell gift'

Iconic Uruguayan ex-leader hails country's swing left as 'farewell gift'

-

Thousands rally in Georgia after violent police crackdown on pro-EU protesters

-

Shared experiences make Murray 'perfect coach', says Djokovic

Shared experiences make Murray 'perfect coach', says Djokovic

-

Iran, Europeans to keep talking as tensions ratchet up

-

Inflation-wary US consumers flock to 'Black Friday' deals

Inflation-wary US consumers flock to 'Black Friday' deals

-

France shows off restored Notre Dame after 'impossible' restoration

-

South African bowlers strike after Sri Lanka set big target

South African bowlers strike after Sri Lanka set big target

-

Namibia reopens polls after election chaos in ruling party test

-

Georgia police arrest dozens in clashes with pro-EU protesters

Georgia police arrest dozens in clashes with pro-EU protesters

-

US stocks rise on Black Friday

-

Leclerc on top for Ferrari in Qatar GP practice

Leclerc on top for Ferrari in Qatar GP practice

-

Jihadists, allies enter Syria's second city in lightning assault

-

Amorim puts faith in Mount to turn around Man Utd career

Amorim puts faith in Mount to turn around Man Utd career

-

Guardiola will not 'run' from Man City rebuild

-

Assisted dying campaigners, opponents rally at UK parliament

Assisted dying campaigners, opponents rally at UK parliament

-

Durable prop Healy set to carve name in Irish rugby history

-

Macron unveils Notre Dame after 'impossible' restoration

Macron unveils Notre Dame after 'impossible' restoration

-

Traumatised Spain marks one month since catastrophic floods

Wall Street, Europe rise as Chinese shares tumble

Shares rose on Wall Street and in Europe as investors awaited new signals on interest rates but Chinese stocks tumbled on continued disappointment over a lack of fresh stimulus in the world's second biggest economy.

Oil prices fell for a second day on reports of rising US inventories and as Israel appears to be holding off -- at least for the moment -- from striking Iranian energy installations.

Wall Street has been bumpy in recent days, rallying Monday before giving up most of those gains Tuesday.

Last week's strong jobs report has convinced most investors that the US Federal Reserve will go slow with future interest rate cuts. Fresh clues about the Fed's future path should emerge this week, especially Thursday's inflation report.

The "consumer price index report overshadows almost everything else in coming days and could limit moves on Wall Street as participants position for the data", said Joe Mazzola, a strategist at Charles Schwab.

The minutes from the Fed's September meeting, due later on Wednesday, will also be pored over for insight into the Fed's thinking.

Hurricane Milton's approach towards Florida was also holding back activity as investors waited to see its impact on transport companies, tourism and insurers.

Google parent company Alphabet was down about two percent Wednesday after the US Department of Justice announced Tuesday it would demand that Google make profound changes to how it does business and may even consider a breakup.

Boeing was down more than two percent after it suspended talks with its striking workers late Tuesday over what it said were unreasonable demands.

- China disappointment -

Chinese shares have also been volatile recently, with investors first enthusiastic about a series of steps to kickstart domestic growth and then left deflated Tuesday when a press conference did not provide any further measures.

"When the market's expectations were set sky-high for a 2-3 trillion yuan stimulus package and instead got hit with a big, fat zero, the party was over before it even began," said Stephen Innes, a partner at SPI Asset Management.

Investors are now awaiting a Saturday briefing on fiscal policy by Finance Minister Lan Fo'an for more indications about official plans.

But analysts warned there was unlikely to be the big "bazooka" stimulus akin to the support seen during the global financial crisis.

Shehzad Qazi at China Beige Book said Beijing was "opting for targeting stimulus -- including allocating funds for projects previously announced".

Hong Kong's stock market had soared more than 20 percent between the first batch of announced measures in late September and the start of this week.

The Hang Seng Index collapsed more than nine percent on Tuesday -- its worst day since 2008 -- and shed another one percent Wednesday.

Shanghai ended 6.6-percent lower on Wednesday.

The dollar climbed against its main rivals on expectations that interest rate differentials will continue to favour the US currency.

- Key figures around 1540 GMT -

New York - Dow: UP 0.7 percent at 42,357.32 points

New York - S&P 500: UP 0.5 percent at 5,778.18

New York - Nasdaq Composite: UP 0.4 percent at 18,260.15

London - FTSE 100: UP 0.7 percent at 8,243.74 (close)

Paris - CAC 40: UP 0.5 percent at 7,560.09 (close)

Frankfurt - DAX: UP 1.0 percent at 19,254.93 (close)

Shanghai - Composite: DOWN 6.6 percent at 3,258.86 (close)

Hong Kong - Hang Seng Index: DOWN 1.4 percent at 20,637.24 (close)

Tokyo - Nikkei 225: UP 0.9 percent at 39,277.96 (close)

West Texas Intermediate: DOWN 0.8 percent at $72.95 per barrel

Brent North Sea Crude: DOWN 1.0 percent at $76.45 per barrel

Euro/dollar: DOWN at $1.0957 from $1.0981 on Tuesday

Pound/dollar: DOWN at $1.3087 from $1.3100

Dollar/yen: UP at 149.11 yen from 148.29 yen

Euro/pound: DOWN at 83.74 pence from 83.80 pence

K.Thomson--BTB