-

Icelanders head to the polls after government collapse

Icelanders head to the polls after government collapse

-

England strike twice to have New Zealand in trouble in first Test

-

Researchers analyse DNA from dung to save Laos elephants

Researchers analyse DNA from dung to save Laos elephants

-

North Korea's Kim, Russian minister agree to boost military ties

-

Brook's 171 gives England commanding 151-run lead over New Zealand

Brook's 171 gives England commanding 151-run lead over New Zealand

-

Kamala's coda: What's next for defeated US VP Harris?

-

Chiefs hold off Raiders to clinch NFL playoff berth

Chiefs hold off Raiders to clinch NFL playoff berth

-

Australia's Hazlewood out of 2nd India Test

-

Trudeau in Florida to meet Trump as tariff threats loom

Trudeau in Florida to meet Trump as tariff threats loom

-

Jihadists, allies breach Syria's second city in lightning assault

-

Trudeau in Florida to meet Trump as tariff threats loom: media

Trudeau in Florida to meet Trump as tariff threats loom: media

-

Hunter shines as Hawks top Cavs again

-

Southampton denied shock Brighton win by dubious VAR call

Southampton denied shock Brighton win by dubious VAR call

-

Alarm over high rate of HIV infections among young women, girls

-

Swiss unveil Euro 2025 mascot Maddli

Swiss unveil Euro 2025 mascot Maddli

-

Bears fire coach Eberflus after latest agonizing NFL defeat

-

Rallies mark one month since Spain's catastrophic floods

Rallies mark one month since Spain's catastrophic floods

-

Arnault family's Paris FC takeover completed

-

Georgian police stage new crackdown on pro-EU protestors

Georgian police stage new crackdown on pro-EU protestors

-

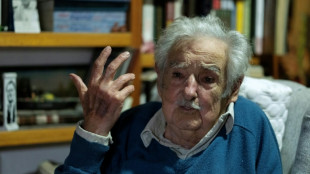

'We're messing up:' Uruguay icon Mujica on strongman rule in Latin America

-

Liverpool dealt Konate injury blow

Liverpool dealt Konate injury blow

-

Van Nistelrooy appointed Leicester manager

-

Verstappen brought back to earth in Doha after F1 title party

Verstappen brought back to earth in Doha after F1 title party

-

Global wine output to hit lowest level since 1961

-

Norris boosts McLaren title hopes with sprint pole

Norris boosts McLaren title hopes with sprint pole

-

Big-hitting Stubbs takes satisfaction from grinding out Test century

-

Romania recounts presidential ballots as parliamentary vote looms

Romania recounts presidential ballots as parliamentary vote looms

-

French skipper Dalin leads as Vendee Globe passes Cape of Good Hope

-

Chelsea not in Premier League title race, says Maresca

Chelsea not in Premier League title race, says Maresca

-

Brazil's Bolsonaro aims to ride Trump wave back to office: WSJ

-

France requests transfer of death row convict held in Indonesia: minister

France requests transfer of death row convict held in Indonesia: minister

-

'Mamie Charge': Migrants find safe haven in Frenchwoman's garage

-

Iconic Uruguayan ex-leader hails country's swing left as 'farewell gift'

Iconic Uruguayan ex-leader hails country's swing left as 'farewell gift'

-

Thousands rally in Georgia after violent police crackdown on pro-EU protesters

-

Shared experiences make Murray 'perfect coach', says Djokovic

Shared experiences make Murray 'perfect coach', says Djokovic

-

Iran, Europeans to keep talking as tensions ratchet up

-

Inflation-wary US consumers flock to 'Black Friday' deals

Inflation-wary US consumers flock to 'Black Friday' deals

-

France shows off restored Notre Dame after 'impossible' restoration

-

South African bowlers strike after Sri Lanka set big target

South African bowlers strike after Sri Lanka set big target

-

Namibia reopens polls after election chaos in ruling party test

-

Georgia police arrest dozens in clashes with pro-EU protesters

Georgia police arrest dozens in clashes with pro-EU protesters

-

US stocks rise on Black Friday

-

Leclerc on top for Ferrari in Qatar GP practice

Leclerc on top for Ferrari in Qatar GP practice

-

Jihadists, allies enter Syria's second city in lightning assault

-

Amorim puts faith in Mount to turn around Man Utd career

Amorim puts faith in Mount to turn around Man Utd career

-

Guardiola will not 'run' from Man City rebuild

-

Assisted dying campaigners, opponents rally at UK parliament

Assisted dying campaigners, opponents rally at UK parliament

-

Durable prop Healy set to carve name in Irish rugby history

-

Macron unveils Notre Dame after 'impossible' restoration

Macron unveils Notre Dame after 'impossible' restoration

-

Traumatised Spain marks one month since catastrophic floods

New French government faces key test with budget plan

New French Prime Minister Michel Barnier faces a major test Thursday as he presents a deficit-slashing budget to his cabinet before submitting it to a largely hostile parliament.

Barnier, who has been in the job only since last month following an inconclusive general election, this week survived a no-confidence vote brought by leftist deputies who feel they should have been appointed to govern by President Emmanuel Macron instead of the conservative Barnier.

But despite handily seeing off the opposition in that vote, Barnier remains hostage to the possibility of left-wing and far-right deputies teaming up in the future to force the government to step down in another no-confidence vote.

France's annual budget plan debate has often triggered no-confidence motions and what is known of Barnier's plan has already sparked vocal opposition.

"This is the most violent austerity plan that this country has ever seen," said Manuel Bompard, a lawmaker for the far-left LFI party. "It will cause French people to suffer."

The government, under pressure from the European Commission to bring France's sprawling deficits and growing debt under control, has already said it will improve its budgetary position by 60 billion euros ($66 billion), 40 billion of which will come from spending cuts and 20 billion from tax increases on high earners and some companies.

The efforts asked would be "fair" and "balanced," Barnier said Thursday.

He has argued that France has little wiggle room left as it risks a downgrade from debt ratings agencies, an excessive deficit procedure by the EU Commission and a risk premium on new debt issuance demanded by investors.

France already pays a higher debt premium than Spain, and is edging closer to high-risk yields demanded of Italy and Greece.

Most of the spending cuts will focus on direct government spending, followed by social security and public healthcare spending.

France's employers association Medef has already complained of looming reductions in state help for companies hiring low-wage workers, saying "hundreds of thousands of jobs" were at risk.

In addition to raising income tax and corporate tax for some, the government is also likely to charge higher levies on owners of polluting vehicles and on the aviation sector.

Barnier has promised, however, to spare "the most vulnerable" from higher taxes, and "those who work".

He is hoping to bring France's public-sector deficit to below five percent of gross domestic product (GDP) next year, from an expected 6.1 percent in 2024.

The government hopes that in 2029 it will drop to below three percent, the EU members' agreed deficit ceiling.

If the opposition parties in parliament come out against the budget draft law, the government has the option of forcing it through without a vote under article 49.3 of the French constitution.

But this would open the door to another vote of no-confidence, putting Barnier at the mercy of the opposition yet again.

burs-jh/as/cw

M.Ouellet--BTB