-

Hunter shines as Hawks top Cavs again

Hunter shines as Hawks top Cavs again

-

Southampton denied shock Brighton win by dubious VAR call

-

Alarm over high rate of HIV infections among young women, girls

Alarm over high rate of HIV infections among young women, girls

-

Swiss unveil Euro 2025 mascot Maddli

-

Bears fire coach Eberflus after latest agonizing NFL defeat

Bears fire coach Eberflus after latest agonizing NFL defeat

-

Rallies mark one month since Spain's catastrophic floods

-

Arnault family's Paris FC takeover completed

Arnault family's Paris FC takeover completed

-

Georgian police stage new crackdown on pro-EU protestors

-

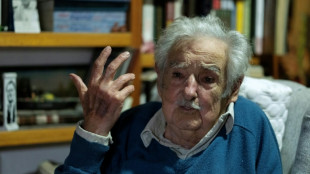

'We're messing up:' Uruguay icon Mujica on strongman rule in Latin America

'We're messing up:' Uruguay icon Mujica on strongman rule in Latin America

-

Liverpool dealt Konate injury blow

-

Van Nistelrooy appointed Leicester manager

Van Nistelrooy appointed Leicester manager

-

Verstappen brought back to earth in Doha after F1 title party

-

Global wine output to hit lowest level since 1961

Global wine output to hit lowest level since 1961

-

Norris boosts McLaren title hopes with sprint pole

-

Big-hitting Stubbs takes satisfaction from grinding out Test century

Big-hitting Stubbs takes satisfaction from grinding out Test century

-

Romania recounts presidential ballots as parliamentary vote looms

-

French skipper Dalin leads as Vendee Globe passes Cape of Good Hope

French skipper Dalin leads as Vendee Globe passes Cape of Good Hope

-

Chelsea not in Premier League title race, says Maresca

-

Brazil's Bolsonaro aims to ride Trump wave back to office: WSJ

Brazil's Bolsonaro aims to ride Trump wave back to office: WSJ

-

France requests transfer of death row convict held in Indonesia: minister

-

'Mamie Charge': Migrants find safe haven in Frenchwoman's garage

'Mamie Charge': Migrants find safe haven in Frenchwoman's garage

-

Iconic Uruguayan ex-leader hails country's swing left as 'farewell gift'

-

Thousands rally in Georgia after violent police crackdown on pro-EU protesters

Thousands rally in Georgia after violent police crackdown on pro-EU protesters

-

Shared experiences make Murray 'perfect coach', says Djokovic

-

Iran, Europeans to keep talking as tensions ratchet up

Iran, Europeans to keep talking as tensions ratchet up

-

Inflation-wary US consumers flock to 'Black Friday' deals

-

France shows off restored Notre Dame after 'impossible' restoration

France shows off restored Notre Dame after 'impossible' restoration

-

South African bowlers strike after Sri Lanka set big target

-

Namibia reopens polls after election chaos in ruling party test

Namibia reopens polls after election chaos in ruling party test

-

Georgia police arrest dozens in clashes with pro-EU protesters

-

US stocks rise on Black Friday

US stocks rise on Black Friday

-

Leclerc on top for Ferrari in Qatar GP practice

-

Jihadists, allies enter Syria's second city in lightning assault

Jihadists, allies enter Syria's second city in lightning assault

-

Amorim puts faith in Mount to turn around Man Utd career

-

Guardiola will not 'run' from Man City rebuild

Guardiola will not 'run' from Man City rebuild

-

Assisted dying campaigners, opponents rally at UK parliament

-

Durable prop Healy set to carve name in Irish rugby history

Durable prop Healy set to carve name in Irish rugby history

-

Macron unveils Notre Dame after 'impossible' restoration

-

Traumatised Spain marks one month since catastrophic floods

Traumatised Spain marks one month since catastrophic floods

-

Yen rallies, euro up on rising inflation data

-

Attack-minded Spurs boss Postecoglou says: 'You'll miss me when I'm gone'

Attack-minded Spurs boss Postecoglou says: 'You'll miss me when I'm gone'

-

Syria jihadists, allies shell major city Aleppo in shock offensive

-

Macron inspects 'sublime' Notre Dame after reconstruction

Macron inspects 'sublime' Notre Dame after reconstruction

-

Arsenal must be near-perfect to catch Liverpool, says Arteta

-

Arrests, intimidation stoke fear in Pakistan's politics

Arrests, intimidation stoke fear in Pakistan's politics

-

Showdown looms on plastic treaty days before deadline

-

Ngozi Okonjo-Iweala: the WTO's trailblazing motivator

Ngozi Okonjo-Iweala: the WTO's trailblazing motivator

-

WTO chief reappointed as Trump threat looms

-

US landmine offer to Ukraine throws treaty into 'crisis': campaign group

US landmine offer to Ukraine throws treaty into 'crisis': campaign group

-

British MPs debate contentious assisted dying law

US, European markets rise before Boeing unveils sweeping job cuts

US and European stock markets rose Friday as traders weighed solid earnings from banking giant JPMorgan Chase, and mulled the outlook for interest rates.

On Wall Street, the Dow and S&P 500 rallied to fresh records, while the tech-rich Nasdaq also finished higher.

Shares in JPMorgan Chase jumped more than five percent after the bank reported lower profits which nevertheless topped estimates, with executives saying the economy was poised to avoid a recession.

"The bank earnings were an excuse to rally, not necessarily a reason to rally," said Steve Sosnick of Interactive Brokers. "Right now the market mentality is to rally, and it's going to do that... unless it has a reason not to, and there was no reason not to today."

EV maker Tesla's shares fell almost eight percent as investors were apparently disappointed by Elon Musk's presentation of a much-hyped Robotaxi without steering wheels or pedals, which was short on financial and technical details.

After the closing bell sounded in New York, the US aviation giant Boeing announced it was cutting 10 percent of its workforce as it projected a large third-quarter loss in the wake of a machinist strike in the Seattle region.

Chief executive Kelly Ortberg said the company must "reset our workforce levels to align with our financial reality," adding that the cuts "will include executives, managers and employees."

The firm's share price slipped in after-hours trading.

- European markets close higher -

The Paris and Frankfurt stock markets closed higher ahead of expectations that the European Central Bank (ECB) would plow ahead with its third interest rate cut of the year next week.

Fawad Razaqzada, market analyst at City Index and Forex.com, said the ECB is likely to reduce rates by 25 basis points -- half the size of the Fed's first rate cut in four years last month.

"Holding the ECB from being more aggressive in its rate-cutting is the still-strong wage growth in Eurozone, and the fact that the Fed has signaled it won't cut rates aggressively again following its initial 50 basis point rate cut," he said.

"Middle East tensions add another layer of uncertainty for Eurozone given that its largest member states are all net energy importers," he added.

London's FTSE 100 index rose as data showed the UK economy rebounded in August after stagnating for two months, giving a boost to the new Labour government weeks before its maiden budget.

In Asia, the Shanghai stock market closed more than 2.5 percent lower after a week dominated by concerns over a lack of detail on the scale of China's recent batch of stimulus measures.

The country's Finance Minister, Lan Fo'an, is expected to announce additional details during a fiscal policy briefing on Saturday.

"The stakes are high," Julian Evans-Pritchard, head of China economics at Capital Economics, wrote in an investor note. "Most observers agree that recent stimulus announcements won't amount to much unless backed up by fiscal support."

"Three factors will be key in determining the impact of stimulus: its scale, where it's channelled, and how soon it's deployed," he added.

Elsewhere, oil steadied after having surged more than three percent Thursday following the Israeli defense minister's vow that his country would strike Iran in retaliation for last week's missile attack.

- Key figures around 2100 GMT -

New York - Dow: UP 1.0 percent at 42,863.86 points (close)

New York - S&P 500: UP 0.6 percent at 5,815.03 (close)

New York - Nasdaq: UP 0.3 percent at 18,342.94 (close)

London - FTSE 100: UP 0.2 percent at 8,253.65 (close)

Paris - CAC 40: UP 0.5 percent at 7,577.89 (close)

Frankfurt - DAX: UP 0.9 percent at 19,373.83 (close)

Tokyo - Nikkei 225: UP 0.6 percent at 39,605.80 (close)

Shanghai - Composite: DOWN 2.6 percent at 3,217.74 (close)

Hong Kong - Hang Seng Index: Closed for holiday

Euro/dollar: UP at $1.0941 from $1.0935 on Thursday

Pound/dollar: UP at $1.3068 from $1.3058

Dollar/yen: UP at 149.09 yen from 148.58 yen

Euro/pound: DOWN at 83.70 pence from 83.73 pence

West Texas Intermediate: DOWN 0.4 percent at $75.56 per barrel

Brent North Sea Crude: DOWN 0.5 percent at $79.04 per barrel

M.Furrer--BTB