-

Hunter shines as Hawks top Cavs again

Hunter shines as Hawks top Cavs again

-

Southampton denied shock Brighton win by dubious VAR call

-

Alarm over high rate of HIV infections among young women, girls

Alarm over high rate of HIV infections among young women, girls

-

Swiss unveil Euro 2025 mascot Maddli

-

Bears fire coach Eberflus after latest agonizing NFL defeat

Bears fire coach Eberflus after latest agonizing NFL defeat

-

Rallies mark one month since Spain's catastrophic floods

-

Arnault family's Paris FC takeover completed

Arnault family's Paris FC takeover completed

-

Georgian police stage new crackdown on pro-EU protestors

-

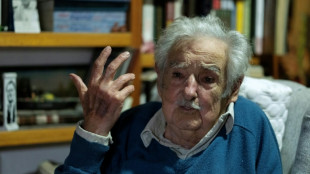

'We're messing up:' Uruguay icon Mujica on strongman rule in Latin America

'We're messing up:' Uruguay icon Mujica on strongman rule in Latin America

-

Liverpool dealt Konate injury blow

-

Van Nistelrooy appointed Leicester manager

Van Nistelrooy appointed Leicester manager

-

Verstappen brought back to earth in Doha after F1 title party

-

Global wine output to hit lowest level since 1961

Global wine output to hit lowest level since 1961

-

Norris boosts McLaren title hopes with sprint pole

-

Big-hitting Stubbs takes satisfaction from grinding out Test century

Big-hitting Stubbs takes satisfaction from grinding out Test century

-

Romania recounts presidential ballots as parliamentary vote looms

-

French skipper Dalin leads as Vendee Globe passes Cape of Good Hope

French skipper Dalin leads as Vendee Globe passes Cape of Good Hope

-

Chelsea not in Premier League title race, says Maresca

-

Brazil's Bolsonaro aims to ride Trump wave back to office: WSJ

Brazil's Bolsonaro aims to ride Trump wave back to office: WSJ

-

France requests transfer of death row convict held in Indonesia: minister

-

'Mamie Charge': Migrants find safe haven in Frenchwoman's garage

'Mamie Charge': Migrants find safe haven in Frenchwoman's garage

-

Iconic Uruguayan ex-leader hails country's swing left as 'farewell gift'

-

Thousands rally in Georgia after violent police crackdown on pro-EU protesters

Thousands rally in Georgia after violent police crackdown on pro-EU protesters

-

Shared experiences make Murray 'perfect coach', says Djokovic

-

Iran, Europeans to keep talking as tensions ratchet up

Iran, Europeans to keep talking as tensions ratchet up

-

Inflation-wary US consumers flock to 'Black Friday' deals

-

France shows off restored Notre Dame after 'impossible' restoration

France shows off restored Notre Dame after 'impossible' restoration

-

South African bowlers strike after Sri Lanka set big target

-

Namibia reopens polls after election chaos in ruling party test

Namibia reopens polls after election chaos in ruling party test

-

Georgia police arrest dozens in clashes with pro-EU protesters

-

US stocks rise on Black Friday

US stocks rise on Black Friday

-

Leclerc on top for Ferrari in Qatar GP practice

-

Jihadists, allies enter Syria's second city in lightning assault

Jihadists, allies enter Syria's second city in lightning assault

-

Amorim puts faith in Mount to turn around Man Utd career

-

Guardiola will not 'run' from Man City rebuild

Guardiola will not 'run' from Man City rebuild

-

Assisted dying campaigners, opponents rally at UK parliament

-

Durable prop Healy set to carve name in Irish rugby history

Durable prop Healy set to carve name in Irish rugby history

-

Macron unveils Notre Dame after 'impossible' restoration

-

Traumatised Spain marks one month since catastrophic floods

Traumatised Spain marks one month since catastrophic floods

-

Yen rallies, euro up on rising inflation data

-

Attack-minded Spurs boss Postecoglou says: 'You'll miss me when I'm gone'

Attack-minded Spurs boss Postecoglou says: 'You'll miss me when I'm gone'

-

Syria jihadists, allies shell major city Aleppo in shock offensive

-

Macron inspects 'sublime' Notre Dame after reconstruction

Macron inspects 'sublime' Notre Dame after reconstruction

-

Arsenal must be near-perfect to catch Liverpool, says Arteta

-

Arrests, intimidation stoke fear in Pakistan's politics

Arrests, intimidation stoke fear in Pakistan's politics

-

Showdown looms on plastic treaty days before deadline

-

Ngozi Okonjo-Iweala: the WTO's trailblazing motivator

Ngozi Okonjo-Iweala: the WTO's trailblazing motivator

-

WTO chief reappointed as Trump threat looms

-

US landmine offer to Ukraine throws treaty into 'crisis': campaign group

US landmine offer to Ukraine throws treaty into 'crisis': campaign group

-

British MPs debate contentious assisted dying law

China tees up fresh spending to boost ailing economy

China said Saturday it would issue special bonds to help its sputtering economy, signalling a spending spree to bolster banks, shore up the property market and ease local government debt as part of one of its biggest support packages in years.

The plan is part of a series of actions undertaken by Beijing to draw a line under a years-long property sector crisis and chronically low consumption that has plagued the world's second biggest economy.

Beijing's planned special bonds are aimed at boosting the capital available to banks -- part of a push to get them lending in the hopes of firing up sluggish consumer spending.

China is also preparing to allow local governments to borrow more to fund the acquisition of unused land for development, aimed at pulling the property market out of a prolonged slump.

No figures were provided on the planned special bonds announced at a highly anticipated press conference by Finance Minister Lan Fo'an and other officials, following a series of steps launched in recent weeks that have included interest rate cuts and liquidity for banks.

But Lan said China still has room "to issue debts and increase the deficit" to fund the new measures.

Officials have been battling to reverse China's slowdown and achieve a growth target of five percent this year -- enviable for many Western countries but a far cry from the double-digit expansion that for years boosted the Asian giant.

On Saturday, Lan said Beijing was "accelerating the use of additional treasury bonds, and ultra-long-term special treasury bonds are also being issued for use".

"In the next three months, a total of 2.3 trillion yuan of special bond funds can be arranged for use in various places," he added.

On top of that, Beijing also plans to "issue special government bonds to support large state-owned commercial banks," Lan said, although he did not say how much.

Chinese authorities have been urging commercial banks to lend more and lower mortgage rates -- measures that would put more cash into the pockets of consumers.

Beijing's bonds would therefore offer banks help to shore up their capital, giving them greater leeway to lend more.

- Bonds for buildings -

And local governments will be issued special bonds enabling them to acquire unused and idle land for development, Vice Finance Minister Liao Min said, in action that could prop up the housing market.

The move would "help ease liquidity and debt pressures on local governments and real estate companies," he explained.

Beijing will also encourage the acquisition of existing commercial properties to be used as affordable housing.

However, analysts expressed frustration that Beijing had refrained from putting a number on further fiscal stimulus.

"The key messages are that... the central government has the capacity to issue more bonds and raise fiscal deficit, and... the central government plans to issue more bonds to help local governments to pay their debt," Zhiwei Zhang, president and chief economist at Pinpoint Asset Management, said.

Beijing was likely "still working on the minute details of the fiscal stimulus," Heron Lim at Moody's Analytics told AFP.

"In the meantime, investors might be taking a step back until they are absolutely certain of the direction fiscal policy is taking."

- 'Lack of forward guidance' -

China's economic uncertainty is also fuelling a vicious cycle that has kept consumption stubbornly low.

Julian Evans-Pritchard, head of China economics at Capital Economics, said that "notably absent was any mention of large-scale handouts to consumers" on Saturday.

"The lack of forward guidance on the scale of next year's budget deficit means it is still difficult to judge how large and long-lasting the fiscal boost will be," he pointed out.

Chinese policymakers have in the last weeks unveiled a string of stimulus measures including a suite of rate cuts and a loosening of rules on buying homes, but economists said that more action is needed to pull the economy out of its slump for good.

Earlier on Saturday, China's top banks said they would cut lower interest rates on existing mortgages from October 25, state media said, following a government call for the action.

"Except for second mortgages in Beijing, Shanghai, Shenzhen and some other regions, the interest rates on other eligible mortgages will be adjusted" to no less than 30 basis points below the prime lending rate, the central bank's benchmark rate for mortgages, state broadcaster CCTV said.

CCTV reported that major banks, including the Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China and China Construction Bank had announced that they would make the adjustments "in batches".

The People's Bank of China last month requested that commercial banks lower such rates by October 31.

Beijing also last month slashed interest on one-year loans to financial institutions, cut the amount of cash lenders must keep on hand and pushed to lower rates on existing mortgages.

And the central bank this week boosted support for markets by opening up tens of billions of dollars in liquidity for firms to buy stocks.

F.Pavlenko--BTB