-

Taiwan's Lai to stop over in Hawaii, Guam during Pacific trip

Taiwan's Lai to stop over in Hawaii, Guam during Pacific trip

-

Namibia extends voting after logistical issues

-

LIV Golf's Herbert in charge at Australian Open, Smith two back

LIV Golf's Herbert in charge at Australian Open, Smith two back

-

Despair in Sweden as gangs recruit kids as contract killers

-

Russia launches massive aerial attack on Ukraine's energy sector

Russia launches massive aerial attack on Ukraine's energy sector

-

Peru scientists unveil crocodile fossil up to 12 million years old

-

At plastic treaty talks, no united front for industry

At plastic treaty talks, no united front for industry

-

Williamson falls for 93 as England fight back in first Test

-

South Korea officials say three dead in heavy snowfall

South Korea officials say three dead in heavy snowfall

-

High-flying Fiorentina face test of Scudetto credentials with Inter visit

-

Verstappen switches focus to re-boot defence of F1 teams' title

Verstappen switches focus to re-boot defence of F1 teams' title

-

UK filmmaker Richard Curtis makes first foray into animation

-

Countrywide air alert in Ukraine due to missile threat

Countrywide air alert in Ukraine due to missile threat

-

China's military corruption crackdown explained

-

Primark boss defends practices as budget fashion brand eyes expansion

Primark boss defends practices as budget fashion brand eyes expansion

-

Williamson eyes ton as New Zealand take control against England

-

Norway faces WWF in court over deep sea mining

Norway faces WWF in court over deep sea mining

-

Trump, Sheinbaum discuss migration in Mexico amid tariff threat

-

Asian markets mixed after subdued pre-holiday shift on Wall St

Asian markets mixed after subdued pre-holiday shift on Wall St

-

Orban's soft power shines as Hungary hosts Israeli match

-

'Retaliate': Trump tariff talk spurs global jitters, preparations

'Retaliate': Trump tariff talk spurs global jitters, preparations

-

'Anti-woke' Americans hail death of DEI as another domino topples

-

Trump hails migration talks with Mexico president

Trump hails migration talks with Mexico president

-

Truckers strike accusing Wagner of driver death in Central African Republic

-

London police say 90 victims identified in new Al-Fayed probe

London police say 90 victims identified in new Al-Fayed probe

-

Air pollution from fires linked to 1.5 million deaths a year

-

Latham falls for 47 as New Zealand 104-2 in first England Test

Latham falls for 47 as New Zealand 104-2 in first England Test

-

US tells Ukraine to lower conscription age to 18

-

Judge denies Sean Combs bail: court order

Judge denies Sean Combs bail: court order

-

Suarez extends Inter Miami stay with new deal

-

Perfect Liverpool on top of Champions League, Dortmund also among winners

Perfect Liverpool on top of Champions League, Dortmund also among winners

-

Liverpool more 'up for it' than beaten Madrid, concedes Bellingham

-

Aston Villa denied late winner against Juventus

Aston Villa denied late winner against Juventus

-

Mexico president hails 'excellent' Trump talks after US tariff threat

-

Leicester set to appoint Van Nistelrooy - reports

Leicester set to appoint Van Nistelrooy - reports

-

Coffee price heats up on tight Brazil crop fears

-

Maeda salvages Celtic draw against Club Brugge

Maeda salvages Celtic draw against Club Brugge

-

Villa denied late winner against Juventus

-

Dortmund beat Zagreb to climb into Champions League top four

Dortmund beat Zagreb to climb into Champions League top four

-

Mbappe misses penalty as Liverpool exact revenge on Real Madrid

-

Brazil's top court takes on regulation of social media

Brazil's top court takes on regulation of social media

-

Thousands still queuing to vote after Namibia polls close

-

Trump taps retired general for key Ukraine conflict role

Trump taps retired general for key Ukraine conflict role

-

Canadian fund drops bid for Spanish pharma firm Grifols

-

Argentine ex-president Fernandez gives statement in corruption case

Argentine ex-president Fernandez gives statement in corruption case

-

Mexico says Trump tariffs would cost 400,000 US jobs

-

Car-centric Saudi to open first part of Riyadh Metro

Car-centric Saudi to open first part of Riyadh Metro

-

Brussels, not Paris, will decide EU-Mercosur trade deal: Lula

-

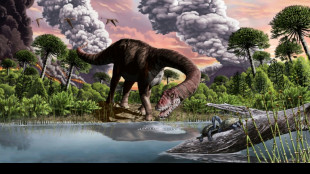

Faeces, vomit offer clues to how dinosaurs rose to rule Earth

Faeces, vomit offer clues to how dinosaurs rose to rule Earth

-

Ruby slippers from 'The Wizard of Oz' up for auction

Industrial slump leaves Germany on brink of recession

German output likely contracted again in the third quarter as an industrial slump drags on, official data is expected to show Wednesday, tipping Europe's largest economy into recession.

Federal statistics agency Destatis will unveil its quarterly GDP estimate at 10am (0900 GMT).

The economy ministry has said it expects "a renewed slight decline" after gross domestic product already shrank by 0.1 percent in the second quarter.

A technical recession is defined as two consecutive quarters of contraction.

"The German economy is unlikely to have emerged from its weak phase in the third quarter," the ministry said in its autumn forecasts this month.

Analysts surveyed by FactSet were narrowly more upbeat, predicting a quarter-on-quarter stagnation.

Other major European economies were also set to publish third-quarter GDP data Wednesday. The figure for the eurozone as a whole will likely be weighed down by Germany's performance.

Traditionally a European growth engine, Germany has been hit hard by elevated energy costs in the wake of Russia's war in Ukraine, sluggish domestic consumption following a period of high inflation and cooling export demand.

The headwinds have taken their toll on the country's crucial industrial sector, which accounts for around 20 percent of German GDP.

"The manufacturing sector is running out of orders," the BDI federation of German industries said in its latest report.

The BDI now sees factory output falling by three percent year-on-year in 2024, noting that this would be "the third consecutive drop".

The downturn has been particularly visible in Germany's flagship auto sector.

Volkswagen is considering closing at least three German plants and axing tens of thousands of jobs, labour leaders told employees this week, as Europe's biggest car manufacturer confronts stiff Chinese competition especially in electric vehicles.

Volkswagen, BMW and Mercedes-Benz all lowered their annual outlook in September, citing falling Chinese demand.

- Government under pressure -

Long-standing structural challenges are adding to Germany's woes, including complex bureaucracy, under-investment in infrastructure, an ageing workforce and a costly green energy transition.

Pressure is mounting on Chancellor Olaf Scholz's government to take action, but the fragile three-party coalition is at odds over how best to turn the economic tide.

Economy Minister Robert Habeck, from the Greens party, last week proposed a multi-billion-euro investment bonanza to help German business.

But the idea was quickly shot down by hawkish Finance Minister Christian Lindner.

Lindner, from the liberal FDP, is a staunch defender of Germany's constitutionally enshrined debt limits and has resisted calls from other coalition members to loosen the rules.

The International Monetary Fund has waded in on the debate, with its European head Alfred Kammer on Tuesday saying Germany needed structural reforms as well as public infrastructure investments.

To achieve this, he told the Sueddeutsche newspaper, "the debt brake can be relaxed".

Germany was the only major advanced economy to shrink in 2023 and the government expects another mild contraction in 2024.

But it sees a recovery starting in 2025, when easing inflation and higher wages are expected to boost consumption.

German inflation slowed to 1.6 percent in September, the lowest level since 2021. October's inflation figure is due later on Wednesday.

L.Janezki--BTB