-

'Retaliate': Trump tariff talk spurs global jitters, preparations

'Retaliate': Trump tariff talk spurs global jitters, preparations

-

'Anti-woke' Americans hail death of DEI as another domino topples

-

Trump hails migration talks with Mexico president

Trump hails migration talks with Mexico president

-

Truckers strike accusing Wagner of driver death in Central African Republic

-

London police say 90 victims identified in new Al-Fayed probe

London police say 90 victims identified in new Al-Fayed probe

-

Air pollution from fires linked to 1.5 million deaths a year

-

Latham falls for 47 as New Zealand 104-2 in first England Test

Latham falls for 47 as New Zealand 104-2 in first England Test

-

US tells Ukraine to lower conscription age to 18

-

Judge denies Sean Combs bail: court order

Judge denies Sean Combs bail: court order

-

Suarez extends Inter Miami stay with new deal

-

Perfect Liverpool on top of Champions League, Dortmund also among winners

Perfect Liverpool on top of Champions League, Dortmund also among winners

-

Liverpool more 'up for it' than beaten Madrid, concedes Bellingham

-

Aston Villa denied late winner against Juventus

Aston Villa denied late winner against Juventus

-

Mexico president hails 'excellent' Trump talks after US tariff threat

-

Leicester set to appoint Van Nistelrooy - reports

Leicester set to appoint Van Nistelrooy - reports

-

Coffee price heats up on tight Brazil crop fears

-

Maeda salvages Celtic draw against Club Brugge

Maeda salvages Celtic draw against Club Brugge

-

Villa denied late winner against Juventus

-

Dortmund beat Zagreb to climb into Champions League top four

Dortmund beat Zagreb to climb into Champions League top four

-

Mbappe misses penalty as Liverpool exact revenge on Real Madrid

-

Brazil's top court takes on regulation of social media

Brazil's top court takes on regulation of social media

-

Thousands still queuing to vote after Namibia polls close

-

Trump taps retired general for key Ukraine conflict role

Trump taps retired general for key Ukraine conflict role

-

Canadian fund drops bid for Spanish pharma firm Grifols

-

Argentine ex-president Fernandez gives statement in corruption case

Argentine ex-president Fernandez gives statement in corruption case

-

Mexico says Trump tariffs would cost 400,000 US jobs

-

Car-centric Saudi to open first part of Riyadh Metro

Car-centric Saudi to open first part of Riyadh Metro

-

Brussels, not Paris, will decide EU-Mercosur trade deal: Lula

-

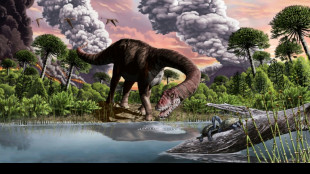

Faeces, vomit offer clues to how dinosaurs rose to rule Earth

Faeces, vomit offer clues to how dinosaurs rose to rule Earth

-

Ruby slippers from 'The Wizard of Oz' up for auction

-

Spain factory explosion kills three, injures seven

Spain factory explosion kills three, injures seven

-

US Fed's favored inflation gauge ticks up in October

-

Defence lawyers plead to judges in French mass rape trial

Defence lawyers plead to judges in French mass rape trial

-

US says China releases three 'wrongfully detained' Americans

-

New clashes in Mozambique as two reported killed

New clashes in Mozambique as two reported killed

-

Romania officials to meet over 'cyber risks' to elections

-

Chelsea visit next stop in Heidenheim's 'unthinkable' rise

Chelsea visit next stop in Heidenheim's 'unthinkable' rise

-

Former England prop Marler announces retirement from rugby

-

Kumara gives Sri Lanka edge on rain-hit day against South Africa

Kumara gives Sri Lanka edge on rain-hit day against South Africa

-

Namibia votes with ruling party facing toughest race yet

-

Spurs goalkeeper Vicario out for 'months' with broken ankle

Spurs goalkeeper Vicario out for 'months' with broken ankle

-

Moscow expels German journalists, Berlin denies closing Russia TV bureau

-

Spain govt defends flood response and offers new aid

Spain govt defends flood response and offers new aid

-

France says Netanyahu has 'immunity' from ICC warrants

-

Nigerian state visit signals shift in France's Africa strategy

Nigerian state visit signals shift in France's Africa strategy

-

Stock markets waver as traders weigh Trump tariffs, inflation

-

Tens of thousands in Lebanon head home as Israel-Hezbollah truce takes hold

Tens of thousands in Lebanon head home as Israel-Hezbollah truce takes hold

-

Opposition candidates killed in Tanzania local election

-

Amorim eyes victory in first Man Utd home game to kickstart new era

Amorim eyes victory in first Man Utd home game to kickstart new era

-

Fresh fury as Mozambique police mow down protester

US Fed to debate rate cut in shadow of presidential election

The US Federal Reserve is widely expected to cut interest rates again this week, while votes are being counted in one of the closest-fought presidential races in decades.

Opinion polls show Democratic Vice President Kamala Harris and Republican former president Donald Trump in a dead heat ahead of Election Day on Tuesday.

The Fed's two-day rate meeting begins on Wednesday, and is expected to result in a quarter percentage-point rate cut the following day.

The United States has remained a bright spot in the global economy this year, with inflation falling toward the Fed's two percent target, while growth has remained robust and the labor market has remained surprisingly resilient despite recent signs of cooling.

Against this backdrop, futures traders are convinced that the US central bank will announce another rate cut, assigning a probability of more than around 99 percent on Friday that it will move by a quarter percentage-point, according to data from CME Group.

Many analysts agree with the market expectations of a 25 basis point cut, which would lower the Fed's key lending rate to a target range of between 4.50 and 4.75 percent -- three quarters of a percentage-point below its level in early September.

"I think the Fed is probably going to cut interest rates by 25 basis points," Jill Cetina, an executive professor of finance at Texas A&M University and a former vice president of supervision at the Dallas Fed, told AFP.

"We continue to expect the FOMC to lower the fed funds rate by 25bp at its November and December meetings," economists at Goldman Sachs wrote in a note to clients published Friday, referring to the rate-setting Federal Open Market Committee (FOMC).

- Fed independence -

The US central bank has a dual mandate from Congress to act independently to keep inflation at two percent in the long term, and to hold the unemployment rate at the lowest sustainable level.

Under this division of labor, the Fed tackles monetary policy -- primarily by raising and lowering its benchmark interest rate to boost or cut demand in the economy -- while Congress and the White House tackle fiscal matters by adjusting tax-and-spend policies.

On the campaign trail, Trump has repeated his past criticism of Fed Chair Jerome Powell -- whom he first appointed to run the US central bank -- and indicated he would like to have "at least" a say over interest rates.

By contrast, Harris has said she "would never interfere" with the Fed's decisions.

However, given that any changes to the Fed's independence require Congressional approval, it is unlikely that a Trump victory would lead to a significant change to the way the US central bank currently operates.

- Rising borrowing costs -

US government borrowing exploded during the Covid-19 pandemic, and the deficit has remained elevated throughout Joe Biden's four years in office, hitting its third-highest level on record in the 2024 fiscal year, according to Treasury Department figures.

Both Harris and Trump are running on policies that independent analysts expect to push up the deficit, which could force the Fed to keep rates higher than they otherwise would over the longer term to compensate for higher borrowing.

Since the Fed's September decision to cut rates by 50 basis points, there has been a sharp rise in the yield on popular two- and 10-year US Treasury notes, which are heavily affected by interest rate expectations.

That recent rise has pushed up borrowing costs for consumers and businesses, with the average rate on the popular 30-year fixed mortgage inching closer to seven percent in recent weeks, according to data from Freddie Mac.

N.Fournier--BTB