-

Brazil's top court takes on regulation of social media

Brazil's top court takes on regulation of social media

-

Thousands still queuing to vote after Namibia polls close

-

Trump taps retired general for key Ukraine conflict role

Trump taps retired general for key Ukraine conflict role

-

Canadian fund drops bid for Spanish pharma firm Grifols

-

Argentine ex-president Fernandez gives statement in corruption case

Argentine ex-president Fernandez gives statement in corruption case

-

Mexico says Trump tariffs would cost 400,000 US jobs

-

Car-centric Saudi to open first part of Riyadh Metro

Car-centric Saudi to open first part of Riyadh Metro

-

Brussels, not Paris, will decide EU-Mercosur trade deal: Lula

-

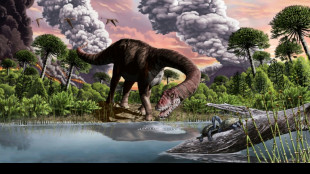

Faeces, vomit offer clues to how dinosaurs rose to rule Earth

Faeces, vomit offer clues to how dinosaurs rose to rule Earth

-

Ruby slippers from 'The Wizard of Oz' up for auction

-

Spain factory explosion kills three, injures seven

Spain factory explosion kills three, injures seven

-

US Fed's favored inflation gauge ticks up in October

-

Defence lawyers plead to judges in French mass rape trial

Defence lawyers plead to judges in French mass rape trial

-

US says China releases three 'wrongfully detained' Americans

-

New clashes in Mozambique as two reported killed

New clashes in Mozambique as two reported killed

-

Romania officials to meet over 'cyber risks' to elections

-

Chelsea visit next stop in Heidenheim's 'unthinkable' rise

Chelsea visit next stop in Heidenheim's 'unthinkable' rise

-

Former England prop Marler announces retirement from rugby

-

Kumara gives Sri Lanka edge on rain-hit day against South Africa

Kumara gives Sri Lanka edge on rain-hit day against South Africa

-

Namibia votes with ruling party facing toughest race yet

-

Spurs goalkeeper Vicario out for 'months' with broken ankle

Spurs goalkeeper Vicario out for 'months' with broken ankle

-

Moscow expels German journalists, Berlin denies closing Russia TV bureau

-

Spain govt defends flood response and offers new aid

Spain govt defends flood response and offers new aid

-

France says Netanyahu has 'immunity' from ICC warrants

-

Nigerian state visit signals shift in France's Africa strategy

Nigerian state visit signals shift in France's Africa strategy

-

Stock markets waver as traders weigh Trump tariffs, inflation

-

Tens of thousands in Lebanon head home as Israel-Hezbollah truce takes hold

Tens of thousands in Lebanon head home as Israel-Hezbollah truce takes hold

-

Opposition candidates killed in Tanzania local election

-

Amorim eyes victory in first Man Utd home game to kickstart new era

Amorim eyes victory in first Man Utd home game to kickstart new era

-

Fresh fury as Mozambique police mow down protester

-

Defeat at Liverpool could end Man City title hopes, says Gundogan

Defeat at Liverpool could end Man City title hopes, says Gundogan

-

Indonesians vote in regional election seen as test for Prabowo

-

Guardiola says no intent to 'make light' of self harm in post-match comments

Guardiola says no intent to 'make light' of self harm in post-match comments

-

New EU commission gets green light to launch defence, economy push

-

Opposition figures killed as Tanzania holds local election

Opposition figures killed as Tanzania holds local election

-

Taiwan Olympic boxing champion quits event after gender questions

-

European stocks drop on Trump trade war worries

European stocks drop on Trump trade war worries

-

Volkswagen to sell operations in China's Xinjiang

-

FA probes referee David Coote over betting claim

FA probes referee David Coote over betting claim

-

Serbia gripped by TV series about murder of prime minister

-

Putin seeks to shore up ties on visit to 'friendly' Kazakhstan

Putin seeks to shore up ties on visit to 'friendly' Kazakhstan

-

New EU commission pushes for defence and economy spending

-

Plastic pollution talks must speed up, chair warns

Plastic pollution talks must speed up, chair warns

-

Pakistan web controls quash dissent and potential

-

1,000 Pakistan protesters arrested in pro-Khan capital march

1,000 Pakistan protesters arrested in pro-Khan capital march

-

ICC prosecutor seeks arrest warrant for Myanmar junta chief

-

Philippine VP's bodyguards swapped out amid investigation

Philippine VP's bodyguards swapped out amid investigation

-

EasyJet annual profit rises 40% on package holidays

-

Ukraine sees influx of Western war tourists

Ukraine sees influx of Western war tourists

-

Greeks finally get Thessaloniki metro after two-decade wait

Stock markets rise, dollar pressured as US votes

Major stock markets rose and the dollar remained under pressure Tuesday as the United States votes in a knife-edge presidential election.

Equities in Shanghai and Hong Kong won strong support from hopes over China's economy, while European indices grew slightly as investors await interest-rate decisions from the US Federal Reserve and Bank of England on Thursday.

"A contested election result could cause volatility on the markets," noted Russ Mould, investment director at AJ Bell.

"Equally, a clear winner quickly after voting ends could provide some relief to investors."

A win for Republican Donald Trump is expected to boost the dollar, restoke inflation, and send Treasury yields higher owing to his pledges to slash taxes and impose tariffs on imports.

Analysts see less upheaval from a win by Democratic Vice President Kamala Harris.

"A pro-tariff Trump presidency could see the dollar strengthen amid concerns higher inflation will prompt the Fed to keep interest rates higher," predicted Matt Britzman, senior equity analyst at Hargreaves Lansdown.

"There is likely to a period of volatility particularly if the result is contested, but investors should keep their eyes on long-term horizons as historically financial markets have risen over the course of both Democratic and Republican presidencies."

Wall Street's three main indices ended in the red Monday.

Hong Kong and Shanghai each closed up by more than two percent Tuesday after data showed China's services sector expanded last month at its fastest pace since July.

The news came as traders await the end of a Chinese government meeting this week to hammer out an economic stimulus.

Officials are expected to give the go-ahead to about $140 billion in extra budget spending, mostly for indebted local governments, and a similar one-off payment for banks.

Adding to the risk-on mood were comments by Chinese Premier Li Qiang, who said he was "fully confident" that China's economy would hit its growth targets this year and indicated that there was room to do more.

Oil prices gained less sharply having surged almost three percent Monday after top producers agreed to extend output cuts through to the end of December and on worries about the Middle East crisis.

On the corporate front, striking workers at Boeing approved a contract proposal late Monday, ending more than seven weeks of stoppages that underscored discontent within the workforce of the beleaguered US aviation giant.

Shares in Vodafone gained 1.5 percent in London after UK regulators moved closer to approving the mobile phone group's multi-billion-pound proposed merger of its British operations with those of Hong Kong-based CK Hutchison.

The Competition and Markets Authority indicated that it could seal the deal between Vodafone and Three should the pair commit to investing in the UK's mobile phone infrastructure and take steps to protect consumers over pricing.

- Key figures around 1030 GMT -

London - FTSE 100: UP 0.3 percent at 8,204.82 points

Paris - CAC 40: UP 0.1 percent at 7,377.88

Frankfurt - DAX: UP 0.1 percent at 19,170.66

Tokyo - Nikkei 225: UP 1.1 percent at 38,474.90 (close)

Hong Kong - Hang Seng Index: UP 2.1 percent at 21,006.97 (close)

Shanghai - Composite: UP 2.3 percent at 3,386.99 (close)

New York - Dow: DOWN 0.6 percent at 41,794.60 (close)

Euro/dollar: UP at $1.0894 from $1.0878 on Monday

Pound/dollar: UP at $1.2985 from $1.2954

Dollar/yen: UP at 152.20 yen from 152.17 yen

Euro/pound: DOWN at 83.89 from 83.94 pence

Brent North Sea Crude: UP 0.5 percent at $75.48 per barrel

West Texas Intermediate: UP 0.6 percent at $71.86 per barrel

S.Keller--BTB