-

Teen Konstas to open for Australia in Boxing Day India Test

Teen Konstas to open for Australia in Boxing Day India Test

-

Asian stocks mostly up after US tech rally

-

US panel could not reach consensus on US-Japan steel deal: Nippon

US panel could not reach consensus on US-Japan steel deal: Nippon

-

The real-life violence that inspired South Korea's 'Squid Game'

-

Blogs to Bluesky: social media shifts responses after 2004 tsunami

Blogs to Bluesky: social media shifts responses after 2004 tsunami

-

Tennis power couple de Minaur and Boulter get engaged

-

Supermaxi yachts eye record in gruelling Sydney-Hobart race

Supermaxi yachts eye record in gruelling Sydney-Hobart race

-

Hawaii's Kilauea volcano erupts, spewing columns of lava

-

El Salvador Congress votes to end ban on metal mining

El Salvador Congress votes to end ban on metal mining

-

Five things to know about Panama Canal, in Trump's sights

-

NBA fines Minnesota guard Edwards $75,000 for outburst

NBA fines Minnesota guard Edwards $75,000 for outburst

-

Haitians massacred for practicing voodoo were abducted, hacked to death: UN

-

Inter beat Como to keep in touch with leaders Atalanta

Inter beat Como to keep in touch with leaders Atalanta

-

Mixed day for global stocks as market hopes for 'Santa Claus rally'

-

Man Utd boss Amorim questions 'choices' of Rashford's entourage

Man Utd boss Amorim questions 'choices' of Rashford's entourage

-

Trump's TikTok love raises stakes in battle over app's fate

-

Is he serious? Trump stirs unease with Panama, Greenland ploys

Is he serious? Trump stirs unease with Panama, Greenland ploys

-

England captain Stokes to miss three months with torn hamstring

-

Support grows for Blake Lively over smear campaign claim

Support grows for Blake Lively over smear campaign claim

-

Canada records 50,000 opioid overdose deaths since 2016

-

Jordanian, Qatari envoys hold talks with Syria's new leader

Jordanian, Qatari envoys hold talks with Syria's new leader

-

France's second woman premier makes surprise frontline return

-

France's Macron announces fourth government of the year

France's Macron announces fourth government of the year

-

Netanyahu tells Israel parliament 'some progress' on Gaza hostage deal

-

Guatemalan authorities recover minors taken by sect members

Guatemalan authorities recover minors taken by sect members

-

Germany's far-right AfD holds march after Christmas market attack

-

European, US markets wobble awaiting Santa rally

European, US markets wobble awaiting Santa rally

-

Serie A basement club Monza fire coach Nesta

-

Mozambique top court confirms ruling party disputed win

Mozambique top court confirms ruling party disputed win

-

Biden commutes almost all federal death sentences

-

Syrian medics say were coerced into false chemical attack testimony

Syrian medics say were coerced into false chemical attack testimony

-

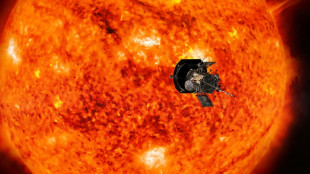

NASA solar probe to make its closest ever pass of Sun

-

France's new government to be announced Monday evening: Elysee

France's new government to be announced Monday evening: Elysee

-

London toy 'shop' window where nothing is for sale

-

Volkswagen boss hails cost-cutting deal but shares fall

Volkswagen boss hails cost-cutting deal but shares fall

-

Accused killer of US insurance CEO pleads not guilty to 'terrorist' murder

-

Global stock markets mostly higher

Global stock markets mostly higher

-

Not for sale. Greenland shrugs off Trump's new push

-

Sweden says China blocked prosecutors' probe of ship linked to cut cables

Sweden says China blocked prosecutors' probe of ship linked to cut cables

-

Acid complicates search after deadly Brazil bridge collapse

-

Norwegian Haugan dazzles in men's World Cup slalom win

Norwegian Haugan dazzles in men's World Cup slalom win

-

Arsenal's Saka out for 'many weeks' with hamstring injury

-

Mali singer Traore child custody case postponed

Mali singer Traore child custody case postponed

-

France mourns Mayotte victims amid uncertainy over government

-

UK economy stagnant in third quarter in fresh setback

UK economy stagnant in third quarter in fresh setback

-

Sweden says China denied request for prosecutors to probe ship linked to cut undersea cables

-

African players in Europe: Salah leads Golden Boot race after brace

African players in Europe: Salah leads Golden Boot race after brace

-

Global stock markets edge higher as US inflation eases rate fears

-

German far-right AfD to march in city hit by Christmas market attack

German far-right AfD to march in city hit by Christmas market attack

-

Ireland centre Henshaw signs IRFU contract extension

Markets struggle at end of tough week

Asian markets stuttered Friday as data showing a pick-up in Chinese consumption was offset by concerns about US interest rates after Fed boss Jerome Powell indicated a slower pace of cuts.

The uncertain performance came at the end of a painful week fuelled by worries about another disruptive China-US trade war.

The dollar dipped against its peers after rallying since Trump's election win last week.

China's retail sales expanded 4.8 percent on-year in October, data showed Friday, speeding up from September and far better than expected, lifting hopes for the world's number two economy. It is also the best performance since February.

The figures provided some much-needed optimism that the country's consumers are becoming more confident and follows a slew of measures out of Beijing in recent weeks aimed at kickstarting growth.

"The economy stabilised in October because of the policy shift in late September," Zhang Zhiwei, president and chief economist of Pinpoint Asset Management, said.

But he warned that the "property sector has not turned around".

And Erin Xin and Taylor Wang at HSBC Global Research said: "With external uncertainty looming, policymakers will need to continue to provide decisive support to sustain the momentum."

The reading came after the US Federal Reserve boss dampened rate cut hopes.

In a speech Thursday, Powell played up the performance of the world's top economy and policymakers' progress in bringing inflation down towards their two percent target.

That had allowed officials to start lowering borrowing costs in September, with a follow-up last week.

However, while the bank is expected to cut again next month, Powell warned that the path "is not preset", adding that "the economy is not sending any signals that we need to be in a hurry to lower rates".

The remarks followed warnings of caution from other decision-makers this week, with investors already worried that tax cuts and tariffs planned by US President-elect Donald Trump could reignite inflation.

Investors are now scaling back their bets on how many cuts will be made next year.

Figures Thursday showed an uptick in wholesale price inflation, a day after news that consumer prices rose in line with forecasts. The readings further weighed on cut hopes.

The prospect of rates staying higher than previously thought has added to downward pressure on stocks.

Hong Kong, Sydney, Singapore, Taipei and Manila all rose, though Shanghai, Seoul, Jakarta, Bangkok and Wellington slipped.

Tokyo rose even as data showed a slowdown in Japanese economic growth.

London fell as data showed the UK economy grew less than expected in the third quarter. Paris and Frankfurt also fell.

"The (Trump) administration's renewed focus on tariffs could weigh heavily on currencies of trade-exposed economies, particularly those in Asia and the eurozone," said Charu Chanana, chief investment strategist at Saxo Markets.

"The appointment of China hawks to the cabinet is spelling a clear near-term focus on trade and tariff policy, which is dollar-positive."

She added that "rising yields, particularly in the US, increase the relative appeal of the dollar against lower-yielding currencies, further boosting demand for the dollar".

Bitcoin sat around $87,900 after striking a record of $93,462 on Wednesday.

However, observers have predicted the unit could soon break the $100,000 mark after Trump's pro-crypto comments during his election campaign.

- Key figures around 0815 GMT -

Tokyo - Nikkei 225: UP 0.3 percent at 38,642.91 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 19,426.34 (close)

Shanghai - Composite: DOWN 1.5 percent at 3,330. 73 (close)

London - FTSE 100: DOWN 0.4 percent at 8,037.68

Dollar/yen: DOWN at 155.80 yen from 156.28 yen on Thursday

Euro/dollar: UP at $1.0558 from $1.0524

Pound/dollar: UP at $1.2671 from $1.2662

Euro/pound: UP at 83.33 pence from 83.11 pence

West Texas Intermediate: DOWN 1.6 percent at $67.58 per barrel

Brent North Sea Crude: DOWN 1.6 percent at $71.41 per barrel

New York - Dow: DOWN 0.5 percent at 43,750.86 (close)

J.Fankhauser--BTB