-

US Fed cuts key rate a quarter point and signals fewer cuts ahead

US Fed cuts key rate a quarter point and signals fewer cuts ahead

-

Spain targets Airbnb in illegal ads probe

-

Mayotte hospital on life support after cyclone

Mayotte hospital on life support after cyclone

-

Barca overturn Man City to top Women's Champions League group

-

Cute carnivores: Bloodthirsty California squirrels go nuts for vole meat

Cute carnivores: Bloodthirsty California squirrels go nuts for vole meat

-

US Fed cuts key rate a quarter point, signals fewer cuts ahead

-

France races to find survivors in cyclone-hit Mayotte

France races to find survivors in cyclone-hit Mayotte

-

Real Madrid outclass Pachuca to win Intercontinental Cup

-

Stone tablet engraved with Ten Commandments sells for $5 million

Stone tablet engraved with Ten Commandments sells for $5 million

-

Perez leaves Red Bull after season of struggles

-

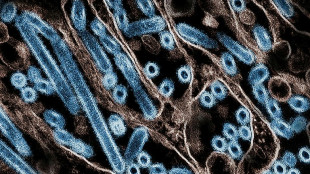

First severe bird flu case in US sparks alarm

First severe bird flu case in US sparks alarm

-

UN experts urge three 'transformations' for nature

-

Sergio Perez leaves Red Bull F1 team

Sergio Perez leaves Red Bull F1 team

-

13 dead after Indian navy speedboat rams ferry off Mumbai

-

US Supreme Court agrees to hear TikTok ban case

US Supreme Court agrees to hear TikTok ban case

-

US reports first severe case of bird flu in a human

-

Stocks and dollar edge higher before Fed rate decision

Stocks and dollar edge higher before Fed rate decision

-

UK PM Starmer wants football governance bill passed amid Super League talk

-

France counts cyclone cost as aid reaches Mayotte

France counts cyclone cost as aid reaches Mayotte

-

'Lucky' Shiffrin in doubt for remainder of ski season

-

Notre Dame cathedral unveils controversial new stained glass windows

Notre Dame cathedral unveils controversial new stained glass windows

-

Swiss club Young Boys name new coach in bid to stop slump

-

UniCredit ups pressure on Commerzbank, fuelling German anger

UniCredit ups pressure on Commerzbank, fuelling German anger

-

Melting sea ice in Antarctica causes ocean storms, scientists say

-

Sarkozy must wear electronic tag after losing graft case appeal

Sarkozy must wear electronic tag after losing graft case appeal

-

Maresca insists Chelsea 'trust' Mudryk despite failed drugs test

-

Stock steady, dollar climbs before Fed rate decision

Stock steady, dollar climbs before Fed rate decision

-

Spanish PM's wife denies wrongdoing in graft probe hearing

-

'Ordinary and out of the ordinary': covering France's mass rape trial

'Ordinary and out of the ordinary': covering France's mass rape trial

-

Activist tells Saudi-hosted UN forum of 'silencing' of dissent

-

UK electricity grid set for 'unprecedented' £35 bn investment

UK electricity grid set for 'unprecedented' £35 bn investment

-

Putin-tattooed dancer Polunin says leaving Russia

-

USA star Weah picks up thigh injury: Juventus

USA star Weah picks up thigh injury: Juventus

-

France's Sarkozy must wear electronic tag after losing graft case appeal

-

Olympic champion Hodgkinson's coaches eye 800m world record

Olympic champion Hodgkinson's coaches eye 800m world record

-

Germany criticises UniCredit's 'unfriendly' moves on Commerzbank

-

Serbia's capital Belgrade to make public transport free

Serbia's capital Belgrade to make public transport free

-

Three 'transformations' for nature, according to UN experts

-

Russian oil spill contaminates 50km of Black Sea beaches

Russian oil spill contaminates 50km of Black Sea beaches

-

Climate change made Cyclone Chido stronger: scientists

-

After long delay, French nuclear plant coming on stream

After long delay, French nuclear plant coming on stream

-

Syrians face horror, fearing loved ones may be in mass graves

-

UN calls for 'free and fair' elections in Syria

UN calls for 'free and fair' elections in Syria

-

Dutch authorities fine Netflix 4.75 mn euros over personal data use

-

Further hike in UK inflation hits rate cut chance

Further hike in UK inflation hits rate cut chance

-

UK's Farage says in 'negotiations' with Musk over funding

-

Fiji rules out alcohol poisoning in tourists' mystery illness

Fiji rules out alcohol poisoning in tourists' mystery illness

-

Pokemon is back with a hit new gaming app

-

Flintoff to coach son on England second-string tour of Australia

Flintoff to coach son on England second-string tour of Australia

-

Stock markets, dollar climb before Fed rate decision

| RBGPF | 3.18% | 62.49 | $ | |

| CMSC | -0.83% | 24.12 | $ | |

| RELX | -1.49% | 46.33 | $ | |

| SCS | -4.74% | 12.46 | $ | |

| GSK | -1.6% | 33.69 | $ | |

| RIO | -3.57% | 59.34 | $ | |

| BCC | -5.13% | 126.62 | $ | |

| BTI | -0.78% | 37 | $ | |

| NGG | -2.82% | 57.77 | $ | |

| AZN | -3.93% | 64.64 | $ | |

| RYCEF | -1.78% | 7.3 | $ | |

| CMSD | -0.72% | 23.76 | $ | |

| BP | -1.89% | 28.54 | $ | |

| JRI | -4.9% | 12.03 | $ | |

| BCE | -0.77% | 23.4 | $ | |

| VOD | -2.62% | 8.41 | $ |

US Fed cuts key rate a quarter point, signals fewer cuts ahead

The US Federal Reserve cut interest rates by a quarter point Wednesday and signaled a slower pace of cuts ahead, as uncertainty grows over inflation and President-elect Donald Trump's economic plans.

Policymakers voted 11-to-1 to lower the US central bank's key lending rate to between 4.25 percent and 4.50 percent, the Fed announced in a statement.

The sole holdout, who supported keeping rates where they were, was Cleveland Fed President Beth Hammack.

In updated economic forecasts published alongside the decision, members of the Fed's rate-setting committee penciled in just two quarter-point rate cuts in 2025, down from an earlier prediction of four, and hiked their inflation outlook for next year, from 2.1 percent to 2.5 percent.

The Fed has made progress tackling inflation through interest rate hikes in the last two years, and recently began paring back rates to boost demand in the economy and support the labor market.

But in the last couple of months, the Fed's favored inflation measure has ticked higher, moving away from the bank's long-term target of two percent, and raising concerns that the US central bank's battle is not over.

- Trump transition -

This is the final planned interest rate decision before outgoing Democratic President Joe Biden makes way for Republican Donald Trump, whose economic proposals include tariff hikes and the mass deportation of millions of undocumented workers.

These proposals, combined with the recent uptick in inflation data, led some analysts to pare back the number of rate cuts they expect in 2025 ahead of Wednesday's meeting, predicting that interest rates will need to remain higher for longer.

"I'm dubious that another cut is necessary," Citigroup global chief economist Nathan Sheets told AFP ahead of the meeting.

In September, Fed policymakers penciled in four additional quarter-point rate cuts next year.

In updated economic forecasts published on Wednesday, they halved that number to just two.

They also sharply raised the outlook for headline inflation to 2.5 percent, up from 2.1 percent in September, and hiked their growth outlook for this year to 2.5 percent, and then to 2.1 percent in 2025, up slightly from 2.0 percent in September.

- Powell's challenge -

One big challenge Fed chair Jerome Powell will face during the post-decision press conference on Wednesday is how to defend the Fed's decision to make cuts given that the US economy and the labor market are both in relatively good health, while inflation has ticked higher recently.

"We expect Powell will indicate that the Committee believed it was appropriate to continue the re-calibration of its monetary policy stance with another modest reduction," economists at Deutsche Bank wrote in a recent investor note.

"The Chair is likely to emphasize that the current policy stance leaves the Committee well placed to respond to risks in both directions."

Another big task facing the Fed chair is how to deal with the prospect of potentially dramatic economic changes once Trump takes office on January 20.

The Fed has a dual mandate from Congress to act independently to tackle inflation and unemployment. But it still has to deal with the implications of government policies on the broader economy.

"I think it is possible -- conceptually possible -- to have a baseline that's agnostic as to Trump's policies," said Sheets, from Citigroup. "And I think that that is the way that Powell is going to try to sell it."

J.Bergmann--BTB