-

Scientists observe 'negative time' in quantum experiments

Scientists observe 'negative time' in quantum experiments

-

US approves first drug treatment for sleep apnea

-

US drops bounty for Syria's new leader after Damascus meeting

US drops bounty for Syria's new leader after Damascus meeting

-

Saudi man arrested after deadly car attack on German Christmas market

-

'Torn from my side': horror of German Christmas market attack

'Torn from my side': horror of German Christmas market attack

-

US House passes bill to avert shutdown, Senate vote to follow

-

Bayern Munich rout Leipzig on sombre night in Germany

Bayern Munich rout Leipzig on sombre night in Germany

-

Tiger in family golf event but has 'long way' before PGA return

-

Wall Street climbs as markets brace for possible govt shutdown

Wall Street climbs as markets brace for possible govt shutdown

-

Pogba wants to 'turn page' after brother sentenced in extortion case

-

Court rules against El Salvador in controversial abortion case

Court rules against El Salvador in controversial abortion case

-

Reggaeton star Daddy Yankee, wife resolve business dispute

-

French court hands down heavy sentences in teacher beheading trial

French court hands down heavy sentences in teacher beheading trial

-

Israel army says troops shot Syrian protester in leg

-

Tien sets-up all-American NextGen semi-final duel

Tien sets-up all-American NextGen semi-final duel

-

Bulked-up Fury promises 'war' in Usyk rematch

-

Major reshuffle as Trudeau faces party pressure, Trump taunts

Major reshuffle as Trudeau faces party pressure, Trump taunts

-

Reggaeton star Daddy Yankee in court, says wife embezzled $100 mn

-

Injured Eze out of Palace's clash with Arsenal

Injured Eze out of Palace's clash with Arsenal

-

Norway's Deila named coach of MLS Atlanta United

-

In Damascus meeting, US drops reward for arrest of Syria's new leader

In Damascus meeting, US drops reward for arrest of Syria's new leader

-

Inter-American Court rules Colombia drilling violated native rights

-

Amazon expects no disruptions as US strike goes into 2nd day

Amazon expects no disruptions as US strike goes into 2nd day

-

Man Utd 'more in control' under Amorim says Iraola

-

Emery insists Guardiola 'still the best' despite Man City slump

Emery insists Guardiola 'still the best' despite Man City slump

-

US confirms billions in chips funds to Samsung, Texas Instruments

-

English Rugby Football Union chairman quits amid pay row

English Rugby Football Union chairman quits amid pay row

-

Wall Street rebounds despite US inflation ticking higher

-

Major reshuffle as Trudeau faces party pressure, Trump attacks

Major reshuffle as Trudeau faces party pressure, Trump attacks

-

Serbia schools to shut amid new protests over station collapse

-

Serbia schools shut amid new protests over station collapse

Serbia schools shut amid new protests over station collapse

-

Gatland remains as Wales boss but must 'change fortunes on the pitch'

-

Argentina's dollar craze cools under greenback-loving Milei

Argentina's dollar craze cools under greenback-loving Milei

-

Medici secret passageway in Florence reopens after refit

-

Anger after Musk backs German far right

Anger after Musk backs German far right

-

Arteta says 'best is yet to come' as he marks five years at Arsenal

-

Pereira happy to achieve Premier League 'target' with Wolves

Pereira happy to achieve Premier League 'target' with Wolves

-

'Dark lull' in German energy transition sparks political debate

-

Russian skaters allowed to compete as neutrals in 2026 Winter Olympics

Russian skaters allowed to compete as neutrals in 2026 Winter Olympics

-

Russian missile barrage on Kyiv kills one, damages embassies

-

No longer Assad's mouthpiece, Syrian media face uncertainty

No longer Assad's mouthpiece, Syrian media face uncertainty

-

US diplomats meet with Syria's new ruler

-

EU, Swiss hail 'historic' new deal resetting relations

EU, Swiss hail 'historic' new deal resetting relations

-

Stocks retreat as US inflation ticks higher

-

Two dead after Lapland tourist bus crash in Finland

Two dead after Lapland tourist bus crash in Finland

-

Fed's favored inflation gauge edges higher in November

-

Ex-IMF chief Rato gets four-year jail term in Spain for tax crimes

Ex-IMF chief Rato gets four-year jail term in Spain for tax crimes

-

Spain orders 25 more Eurofighter jets from Airbus

-

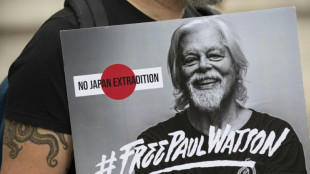

Anti-whaling campaigner Paul Watson arrives in France

Anti-whaling campaigner Paul Watson arrives in France

-

Fed's favored inflation gauge rises again in November

Wall Street climbs as markets brace for possible govt shutdown

Wall Street stocks bounced higher Friday following a pullback in US Treasury yields as markets braced for a looming US government shutdown.

Data showed the personal consumption expenditures (PCE) price index rose 2.4 percent in the 12 months to November, up from 2.3 percent in October, the Commerce Department said in a statement.

But the reading came in lower than expected, prompting a pullback in US Treasury bond yields that had risen after Federal Reserve policy makers signaled earlier this week they expect fewer interest rate cuts in 2025.

Stocks fell sharply on Wednesday after the Fed decision.

But on Friday, the broad-based S&P 500 finished at 5,930.85, up 1.1 percent for the day but down about two percent for the week.

"We have seen a nice rebound from what was, in our view, an overreaction to the Fed's outlook on Wednesday," said Angelo Kourkafas of Edward Jones, pointing to Friday's inflation data as a supportive factor for equities.

Treasury yields pulled back following comments from Federal Reserve Bank of Chicago President Austan Goolsbee, who expressed confidence that the PCE data showed that inflation was returning to the Fed's target of two percent.

"Over the next 12 to 18 months, rates can still go down a fair amount," Goolsbee told CNBC.

Investors were also keeping watch on developments in Capitol Hill.

US lawmakers raced to stave off a government shutdown set to bite within hours after Donald Trump and Elon Musk sabotaged a bipartisan agreement that would have averted a shutdown.

If no deal is struck, the government will cease to be funded at midnight, and non-essential operations will start to grind to halt, with up to 875,000 workers furloughed and 1.4 million more required to work without pay.

European stocks finished the day lower although they cut their losses as Wall Street rebounded, with data showing tepid retail sales in the UK in the runup to Christmas dampening sentiment.

Among individual companies, Nike dipped 0.2 percent as it reported lower earnings while new CEO Elliott Hill outlined steps to get the slumping sports giant back on track. Analysts pointed to Nike's near-term outlook, which suggests a turnaround will not be quick.

Carnival jumped 6.4 percent following an upbeat 2025 forecast that included a 20 percent rise in profits to $2.3 billion.

- Key figures around 2150 GMT -

New York - Dow: UP 1.2 percent at 42,840.26 (close)

New York - S&P 500: UP 1.1 percent at 5,930.85 (close)

New York - Nasdaq Composite: UP 1.0 percent at 19,572.60 (close)

London - FTSE 100: DOWN 0.3 percent at 8,084.61 (close)

Paris - CAC 40: DOWN 0.3 percent at 7,274.48 (close)

Frankfurt - DAX: DOWN 0.4 percent at 19,884.75 (close)

Tokyo - Nikkei 225: DOWN 0.3 percent at 38,701.90 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 19,720.70 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,368.07 (close)

Euro/dollar: UP at $1.0431 from $1.0363 on Thursday

Pound/dollar: UP at $1.2567 from $1.2502

Dollar/yen: DOWN at 156.45 yen from 157.44 yen

Euro/pound: DOWN at 82.98 pence from 82.28 pence

West Texas Intermediate: UP 0.1 percent at $69.46 per barrel

Brent North Sea Crude: UP 0.1 percent at $72.94 per barrel

burs-jmb/bgs

R.Adler--BTB