-

Overwhelmed? DC crash puts spotlight on US air traffic agency

Overwhelmed? DC crash puts spotlight on US air traffic agency

-

Australia's Marsh out of Champions Trophy with back issue

-

Austrian Straka seizes PGA Pebble Beach lead

Austrian Straka seizes PGA Pebble Beach lead

-

Russian missile attack hits Odesa, wounding seven

-

Neymar signs for Santos

Neymar signs for Santos

-

Alldritt hails team performance as France outclass Wales

-

Argentina down Ruud's Norway in Davis Cup qualifying

Argentina down Ruud's Norway in Davis Cup qualifying

-

US stocks retreat as White House confirms tariffs from Feb. 1

-

France star Dupont marks Six Nations return in style

France star Dupont marks Six Nations return in style

-

Attissogbe, Bielle-Biarrey doubles help France to Wales demolition

-

US charges former Fed official with spying for China

US charges former Fed official with spying for China

-

Kim keeps LPGA lead but Grant and Korda lurk

-

Meta mulling incorporation shift to Texas: report

Meta mulling incorporation shift to Texas: report

-

Norway releases Russian-crewed ship after cable damage

-

Estonia's Petrokina claims 'dream' women's European figure skating gold

Estonia's Petrokina claims 'dream' women's European figure skating gold

-

Oscar-hopeful 'Emilia Perez' star in row over Islam, George Floyd insults

-

Russian missile attack hits Odesa, wounding three

Russian missile attack hits Odesa, wounding three

-

Scientists cast doubt on famous US groundhog's weather forecasts

-

N. Korean troops 'withdrawn' from Kursk front line: Ukraine

N. Korean troops 'withdrawn' from Kursk front line: Ukraine

-

White House says Trump to impose Canada, Mexico, China tariffs at weekend

-

Silicon Valley group buy £145mln stake in Hundred's Lord's franchise - reports

Silicon Valley group buy £145mln stake in Hundred's Lord's franchise - reports

-

Barkley set to be difference maker in Super Bowl rematch

-

Swiss court convicts Trafigura of corruption in Angola

Swiss court convicts Trafigura of corruption in Angola

-

World's longest cargo sail ship launched in Turkey

-

Coe hopeful with IOC vote finishing line in sight

Coe hopeful with IOC vote finishing line in sight

-

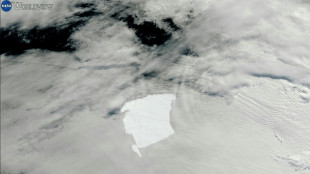

First major chunk breaks off world's biggest iceberg

-

What to make of Trump's Guantanamo plan for migrants

What to make of Trump's Guantanamo plan for migrants

-

UN war crimes investigators say Syria 'rich in evidence'

-

Negri urges Italy to maintain Six Nations progress

Negri urges Italy to maintain Six Nations progress

-

TikTok king Khaby Lame joins UNICEF as goodwill ambassador

-

White House says Trump will impose Canada, Mexico, China tariffs at weekend

White House says Trump will impose Canada, Mexico, China tariffs at weekend

-

NHL and union agree on three years of salary cap boosts

-

Aston Villa's Duran joins Saudi club Al Nassr for reported £64 mln

Aston Villa's Duran joins Saudi club Al Nassr for reported £64 mln

-

German conservatives bet on far-right support but lose key vote

-

NBA bans Detroit's Stewart one game for repeated flagrant fouls

NBA bans Detroit's Stewart one game for repeated flagrant fouls

-

India clinch T20 series against England amid concussion sub row

-

Postecoglou hopes for end to 'vicious cycle' of Tottenham injuries

Postecoglou hopes for end to 'vicious cycle' of Tottenham injuries

-

Vinicius says wants 'many more years' at Real Madrid

-

India clinch T20 series but concussion sub talking point

India clinch T20 series but concussion sub talking point

-

Stock markets mostly gain at end of turbulent week

-

Italian favourites take ice dancing lead at figure skating European

Italian favourites take ice dancing lead at figure skating European

-

Russell says Scotland have 'mindset' of Six Nations title contenders

-

Pandya, Dube lift India to 181-9 in fourth T20 against England

Pandya, Dube lift India to 181-9 in fourth T20 against England

-

Gavi extends Barcelona contract until 2030

-

Arsenal target Watkins wants to stay at Villa: Emery

Arsenal target Watkins wants to stay at Villa: Emery

-

Stock markets gain at end of turbulent week

-

North Korean troops 'withdrawn' from Kursk front line: Ukraine

North Korean troops 'withdrawn' from Kursk front line: Ukraine

-

Fed's favored inflation gauge accelerates further in December

-

Amorim praises Garnacho revival after Man Utd snub

Amorim praises Garnacho revival after Man Utd snub

-

German election favourite vows to pass migrant bill with far-right help

| RBGPF | 4.18% | 64.91 | $ | |

| CMSC | -0.89% | 23.47 | $ | |

| NGG | -0.55% | 61.4 | $ | |

| SCS | -1.39% | 11.48 | $ | |

| AZN | -0.68% | 70.76 | $ | |

| RELX | -0.92% | 49.89 | $ | |

| RYCEF | 0.53% | 7.49 | $ | |

| BCC | -1.98% | 126.16 | $ | |

| RIO | -0.83% | 60.41 | $ | |

| GSK | -0.26% | 35.27 | $ | |

| BTI | -0.1% | 39.64 | $ | |

| CMSD | -1.59% | 23.84 | $ | |

| BCE | -0.46% | 23.79 | $ | |

| BP | -1.77% | 31.06 | $ | |

| VOD | -0.82% | 8.54 | $ | |

| JRI | -0.32% | 12.53 | $ |

US stocks retreat as White House confirms tariffs from Feb. 1

Wall Street stocks tumbled into negative territory Friday, ending the week on a downcast note after the White House reaffirmed plans to introduce new tariffs against Mexico, Canada and China beginning February 1.

US equities had spent much of the day in the black in a cheery reaction to Apple results and US inflation data that met expectations.

But in a briefing Friday, White House Press Secretary Karoline Leavitt said tariffs against the three US trading partners would be imposed on Saturday, adding: "These are promises made and promises kept by the president."

"The tariff talk in the afternoon injected a new wave of uncertainty," Briefing.com's Patrick O'Hare told AFP.

"We think it just kind of proved to be a bit of a trigger for people to take some money off the table going into the weekend," he said.

Two of the three major US indices finished with weekly losses following a volatile stretch.

AI-related stocks, particularly key chipmaker Nvidia, had plunged early in the week after China's DeepSeek unveiled an artificial intelligence model rivalling those of American tech giants but developed at a fraction of the cost.

Markets later clawed back most of those losses thanks to encouraging earnings and company strategy updates, and as some investors re-evaluated the risks US firms face from Chinese competition.

Financial markets also digested the latest US inflation data, with the Federal Reserve's favourite inflation gauge, the Personal Consumption Expenditures index, accelerating for a third month in a row, reaching 2.6 percent in December as expected.

"While there's still further progress to be made on inflation, investors can breathe a sigh of relief and refocus on the market's more notable fundamentals, like earnings growth and the economy," said Bret Kenwell, US investment analyst at the eToro trading platform.

Earlier, London's benchmark FTSE 100 hit fresh highs, helped by an almost 12 percent surge in the share price of Smiths Group after the British engineering company said it planned to streamline its business and return substantial sums to shareholders.

Paris and Frankfurt ended little changed as early rises fizzled. European stocks had one of their best months in two years in January with Europe-wide indexes rising six percent since the start of 2025.

Data showed German inflation unexpectedly slowed in January, the first decline in months, bolstering the case for further rate cuts by the European Central Bank.

The ECB cut rates on Thursday, its fifth reduction since June.

Concerns over Trump's trade tactics pushed gold to new records above $2,800 an ounce.

"The gold price is proving its haven credentials, as investors choose it to hedge fears about Trump's tariff threats," said Kathleen Brooks, research director at XTB.

- Key figures around 2210 GMT -

New York - Dow: DOWN 0.8 percent at 44,544.66 (close)

New York - S&P 500: DOWN 0.5 percent at 6,040.53 (close)

New York - Nasdaq Composite: DOWN 0.3 percent at 19,627.44 (close)

London - FTSE 100: UP 0.3 percent at 8,673.96 (close)

Paris - CAC 40: UP 0.1 percent at 7,950.17 (close)

Frankfurt - DAX: UNCHANGED at 21,732.05 (close)

Tokyo - Nikkei 225: UP 0.2 percent at 39,572.49 (close)

Hong Kong - Hang Seng Index: Closed for a holiday

Shanghai - Composite: Closed for a holiday

Euro/dollar: DOWN at $1.0363 from $1.0391 on Thursday

Pound/dollar: DOWN at $1.2392 from $1.2419

Dollar/yen: UP at 155.18 yen from 154.28 yen

Euro/pound: DOWN at 83.59 pence from 83.67 pence

West Texas Intermediate: DOWN 0.3 percent at $72.53 per barrel

Brent North Sea Crude: DOWN 0.1 percent at $76.76 per barrel

D.Schneider--BTB