-

Tesla rolls out advanced self-driving functions in China

Tesla rolls out advanced self-driving functions in China

-

Milan Fashion week opens as luxury sector struggles

-

Pistons continue playoff push with win over Clippers

Pistons continue playoff push with win over Clippers

-

Thailand's beaming Somkiat set to make MotoGP history

-

'Complete overhaul': what went wrong for Pakistan in Champions Trophy

'Complete overhaul': what went wrong for Pakistan in Champions Trophy

-

What happens next in S. Korea as Yoon's impeachment trial wraps up

-

Asian markets sink as Trump tariffs, China curbs stunt rally

Asian markets sink as Trump tariffs, China curbs stunt rally

-

Trump calls for revival of Keystone XL Pipeline project axed by Biden

-

S. Korea's central bank cuts rate, growth outlook over tariff fears

S. Korea's central bank cuts rate, growth outlook over tariff fears

-

South Korea's Yoon faces last impeachment hearing over martial law

-

Transgender religious order gets rare approval at India Hindu festival

Transgender religious order gets rare approval at India Hindu festival

-

Trump's chip tariff threats raise stakes for Taiwan

-

Stuck in eternal drought, UAE turns to AI to make it rain

Stuck in eternal drought, UAE turns to AI to make it rain

-

Galatasaray accuse Mourinho of 'racist statements' after derby

-

Fears of US public health crises grow amid falling vaccination rates

Fears of US public health crises grow amid falling vaccination rates

-

Latin American classics get the streaming treatment

-

Fires, strikes, pandemic and AI: Hollywood workers can't catch a break

Fires, strikes, pandemic and AI: Hollywood workers can't catch a break

-

Their dreams dashed by Trump, migrants make return journey home

-

Judge declines to immediately grant AP access to White House events

Judge declines to immediately grant AP access to White House events

-

Confusion reigns as US federal workers face Musk job deadline

-

'All eyes on Arctic': Canada boosts its northern force

'All eyes on Arctic': Canada boosts its northern force

-

Bolivia inaugurates steel plant built with Chinese loan

-

Ukraine rupture grows as US sides with Russia at UN

Ukraine rupture grows as US sides with Russia at UN

-

'Assassin's Creed Shadows' leaked ahead of release

-

Spain's Telefonica sells Argentina subsidiary for $1.2 bn

Spain's Telefonica sells Argentina subsidiary for $1.2 bn

-

London Fashion Week: Burberry embraces escape to the countryside

-

NFL could vote on banning Eagles' 'tush push'

NFL could vote on banning Eagles' 'tush push'

-

Macron and Trump rekindle Le Bromance -- with a touch of tension

-

Trump says Canada, Mexico tariffs moving 'forward' on schedule

Trump says Canada, Mexico tariffs moving 'forward' on schedule

-

Macron warns Ukraine peace can't mean 'surrender', after Trump talks

-

US sides with Russia, refusing to support Ukraine at UN

US sides with Russia, refusing to support Ukraine at UN

-

Islamic Jihad says Israeli tanks part of 'plans to annex West Bank by force'

-

DR Congo PM says 'more than 7,000 dead' in war-torn east

DR Congo PM says 'more than 7,000 dead' in war-torn east

-

Anthropic releases its 'smartest' AI model

-

SpaceX targeting Friday for next test of Starship megarocket

SpaceX targeting Friday for next test of Starship megarocket

-

Protesters demand Germany stand by Ukraine on invasion anniversary

-

Kiwi match-winner Ravindra relishes return after freak accident

Kiwi match-winner Ravindra relishes return after freak accident

-

South Carolina to carry out first US firing squad execution since 2010

-

Injured champion Martin to miss MotoGP season opener

Injured champion Martin to miss MotoGP season opener

-

Fiji skipper Nayacalevu joins Wales' Ospreys from England's Sale

-

Macron, Trump vow to work together on Ukraine, despite differences

Macron, Trump vow to work together on Ukraine, despite differences

-

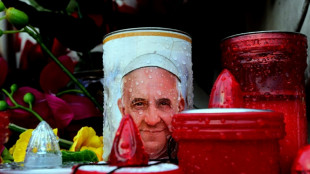

Critically-ill Pope Francis shows 'slight improvement' says Vatican

-

France heavyweight Meafou a doubt for Ireland showdown

France heavyweight Meafou a doubt for Ireland showdown

-

Ravindra ton powers NZ into Champions Trophy semis, hosts Pakistan out

-

£2.8m gold toilet stolen from UK show never found: court

£2.8m gold toilet stolen from UK show never found: court

-

US opposes Ukraine territorial integrity in UN vote

-

Mexico president hopeful of deal this week to avert US tariffs

Mexico president hopeful of deal this week to avert US tariffs

-

Man Utd announce up to 200 fresh job cuts

-

EU vows to enforce digital rules despite Trump tariff warning

EU vows to enforce digital rules despite Trump tariff warning

-

Ravindra ton powers NZ into semis, hosts Pakistan out

S. Korea's central bank cuts rate, growth outlook over tariff fears

South Korea's central bank on Tuesday slashed interest rates and its annual growth forecast as it looks to bolster the economy in the face of US tariffs and the fallout from President Yoon Suk Yeol's brief declaration of martial law last year.

The South Korean economy — Asia's fourth largest — grew less than expected in the final three months of 2024 as Yoon's martial law move hit consumer confidence and domestic demand.

Fears are also growing over US President Donald Trump's hardball trade policies that have seen him impose a broad range of levies on some of his country's biggest economic partners since taking office in January.

An official at the Bank of Korea told AFP it expected gross domestic product to expand 1.5 percent in 2025, down from its initial estimate of 1.9 percent in November.

The benchmark interest rate would also be lowered by a quarter of a percentage point, the official said.

In a statement released after the meeting, the central bank said it projected a "slower recovery in domestic demand and export growth than initially expected".

It blamed "the effects of weakening economic sentiment and the US tariff policy".

"There is a high level of uncertainty regarding the future growth path, including major countries' trade policies, (and) the direction of the US Federal Reserve's monetary policy," it added.

Trump warned last week that he would impose tariffs "in the neighbourhood of 25 percent" on auto imports and a similar amount or higher on semiconductors and pharmaceuticals.

South Korea is home to the world's key chipmakers, Samsung and SK hynix, and was the fourth-largest exporter of steel to the United States last year.

- 'Weak' data -

South Korea's trade ministry last week said it had asked Washington to exclude it from planned US tariffs on steel and aluminium.

The country's steel industry was already facing intense pressure in recent years as it grapples with oversupply — particularly from China — and a decrease in global demand.

The US tariffs are likely to intensify those challenges.

Analysts warn that should cheap Chinese steel barred from the US market begin to flood regions like Southeast Asia and Europe, South Korean steel producers will face deepening price competition.

Seoul's central bank on Tuesday also said employment had continued to slow.

"The data for early 2025 have been weak amid signs the political crisis is weighing on the economy," Gareth Leather, senior Asia economist at Capital Economics, said.

But he said even if the ongoing crisis is resolved soon, South Korea's growth is likely to struggle due to a "downturn in the property sector and tight fiscal policy weigh on demand".

K.Thomson--BTB