-

Thousands march against Angola govt

Thousands march against Angola govt

-

Ireland coast to victory as they run Fiji ragged

-

Atletico make comeback to beat Alaves as Simeone hits milestone

Atletico make comeback to beat Alaves as Simeone hits milestone

-

Aid only 'delaying deaths' as Sudan counts down to famine: agency chief

-

Leipzig lose more ground on Bayern with Hoffenheim loss

Leipzig lose more ground on Bayern with Hoffenheim loss

-

Arsenal back to winning ways, Chelsea up to third in Premier League

-

Sinner powers Davis Cup holders Italy past Australia to final

Sinner powers Davis Cup holders Italy past Australia to final

-

Andy Murray to coach Novak Djokovic

-

Leipzig lose ground on Bayern, Dortmund and Leverkusen win

Leipzig lose ground on Bayern, Dortmund and Leverkusen win

-

Fear in central Beirut district hit by Israeli strikes

-

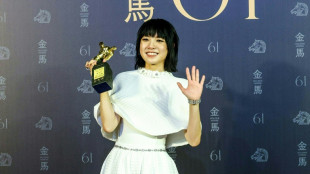

Chinese film about Covid-19 wins Taiwan's top Golden Horse prizes

Chinese film about Covid-19 wins Taiwan's top Golden Horse prizes

-

Tuipulotu puts anger behind him as he captains Scotland against native Australia

-

Inter smash Verona to take Serie A lead

Inter smash Verona to take Serie A lead

-

Mass rape trial sparks demonstrations across France

-

Lebanon says 15 killed in Israeli strike on central Beirut

Lebanon says 15 killed in Israeli strike on central Beirut

-

Eddie Jones will revel in winding up England - Genge

-

Chelsea see off Leicester on Maresca's King Power return

Chelsea see off Leicester on Maresca's King Power return

-

Storms bring chaos to Ireland, France, UK

-

Berrettini gives Italy edge on Australia in Davis Cup semis

Berrettini gives Italy edge on Australia in Davis Cup semis

-

Amber Glenn storms to gold in Cup of China

-

High-flying Chelsea see off Leicester

High-flying Chelsea see off Leicester

-

Climate-threatened nations stage protest at COP29 over contentious deal

-

Families fleeing after 32 killed in new sectarian violence in Pakistan

Families fleeing after 32 killed in new sectarian violence in Pakistan

-

Ancelotti says 'ugly' to speculate about Mbappe mental health

-

Failure haunts UN environment conferences

Failure haunts UN environment conferences

-

Colapinto in doubt for Las Vegas GP after crashing

-

Lebanon says 11 killed in Israeli strike on central Beirut

Lebanon says 11 killed in Israeli strike on central Beirut

-

Three arrested in Spain for racist abuse at Liga Clasico

-

Pope to skip Notre Dame opening for Corsica visit

Pope to skip Notre Dame opening for Corsica visit

-

Tokyo police care for lost umbrellas, keys, flying squirrels

-

Neuville closes in on world title after Rally Japan recovery

Neuville closes in on world title after Rally Japan recovery

-

Jaiswal slams unbeaten 90 as India seize control against Australia

-

'Nice surprise' for Verstappen to edge Norris in Las Vegas GP qualifying

'Nice surprise' for Verstappen to edge Norris in Las Vegas GP qualifying

-

Indian teen admits to 'some nerves' in bid for world chess crown

-

Patrick Reed shoots rare 59 to make Hong Kong Open history

Patrick Reed shoots rare 59 to make Hong Kong Open history

-

Record-breaker Kane hits back after England criticism

-

Cameron Smith jumps into lead at Australian PGA Championship

Cameron Smith jumps into lead at Australian PGA Championship

-

Russell on pole position at Las Vegas GP, Verstappen ahead of Norris

-

Philippine VP made 'active threat' on Marcos' life: palace

Philippine VP made 'active threat' on Marcos' life: palace

-

Celtics labor to win over Wizards, Warriors into Cup quarters

-

Balkans women stage ancient Greek play to condemn women's suffering in war

Balkans women stage ancient Greek play to condemn women's suffering in war

-

Nvidia CEO says will balance compliance and tech advances under Trump

-

Grand Slam ambition dawning for Australia against Scotland

Grand Slam ambition dawning for Australia against Scotland

-

Japan game set to leave England with more questions than answers

-

Amorim's to-do list to make Man Utd great again

Amorim's to-do list to make Man Utd great again

-

What forcing Google to sell Chrome could mean

-

Fears for Gaza hospitals as fuel and aid run low

Fears for Gaza hospitals as fuel and aid run low

-

Anderson to Starc: Five up for grabs in IPL player auction

-

Big money as Saudi makes foray into cricket with IPL auction

Big money as Saudi makes foray into cricket with IPL auction

-

Budget, debt: Trump's Treasury chief faces urgent challenges

Trucker uprising hits key artery in US-Canada car industry

The Canadian trucker protest has temporarily sidelined a key auto industry transport route, adding stress to a North American car industry already pinched by low inventories and supply chain problems that have sent vehicle price soaring.

Several leading automakers said Thursday they reduced production and cut labor shifts due to the blockade at the Ambassador Bridge, which links Windsor, Canada with the US city of Detroit.

The bridge has been sidelined since Monday night as a two-week, trucker-led uprising against coronavirus restrictions has spread from the Canadian capital.

The route is a crucial gateway for the car industries in the neighboring nations, in a region that is effectively a "giant auto industry cluster," said Jason Miller, a professor of supply chain management at Michigan State University.

Miller said finished goods pass north and south over the bridge, while parts and components may cross the border six or seven times during the manufacturing process, making the country of origin essentially irrelevant for the auto industry.

The bridge is used daily by more than 40,000 commuters and tourists, along with trucks carrying $323 million worth of goods on average.

The car industry has relied on easy and reliable access to the bridge since the 1960s, said Fraser Johnson, a supply chain expert at Ivey Business School at Western University.

In an era of "just in time" inventories, "the plants may have anywhere from just a few hours of inventory to just a few days of inventory," he said.

"So as soon as we get disruptions like this, then that puts the continuous operation of the car plants and their supplier in jeopardy."

- Worsening the 'already bad' situation -

Canadian and American officials and industry groups have warned of significant damage to trade and employment if the disruption is prolonged.

So far, auto companies have described the impact as meaningful but limited.

Ford is running its Canadian plants in Oakville and Windsor at "reduced capacity," a company spokesperson said. "We hope this situation is resolved quickly because it could have widespread impact on all automakers in the US and Canada."

A Toyota spokesperson alluded to existing supply shortages, adding that plants in Canada and the state of Kentucky have been affected by "this most recent challenge."

Toyota expects disruption through the weekend but "we do not anticipate any impact to employment at this time," the official said.

Stellantis said all its North American plants were running Thursday morning, "but a number of US and Canadian plants cut short second shifts Wednesday night, while General Motors canceled its second shift on Wednesday and first shift on Thursday at a Lansing, Michigan plant.

The disruption comes as US retail inventories of new vehicles remain extremely low, and used car prices are still elevated, although the massive increases seen last year have slowed.

Automakers have offered mixed appraisals on the semiconductor picture that has impacted manufacturing. Most companies expect the shortage to ease somewhat in 2022 as long as there are no more semiconductor outages due to Covid-19 restrictions or other unforeseeable reasons. But supply is likely to remain tight through at least mid-year.

"This is piling on to top of an already bad situation -- the microchip shortage, a situation that is not getting solved," said Karl Brauer, analyst at iSeeCars.com.

And Johnson said the disruption at Ambassador Bridge is not easily solved with alternative routes. For example, shifting traffic through Buffalo is problematic because the city's roads lack the infrastructure to handle truck traffic.

Miller said the route also is an important road for other raw materials and goods, such as aluminum exported from Canada to the United States, or plastics shipped in the opposite direction.

"For the auto industry, it's very worrisome," said Miller, who warned the pain will spread to other sectors if the blockade drags on.

J.Bergmann--BTB